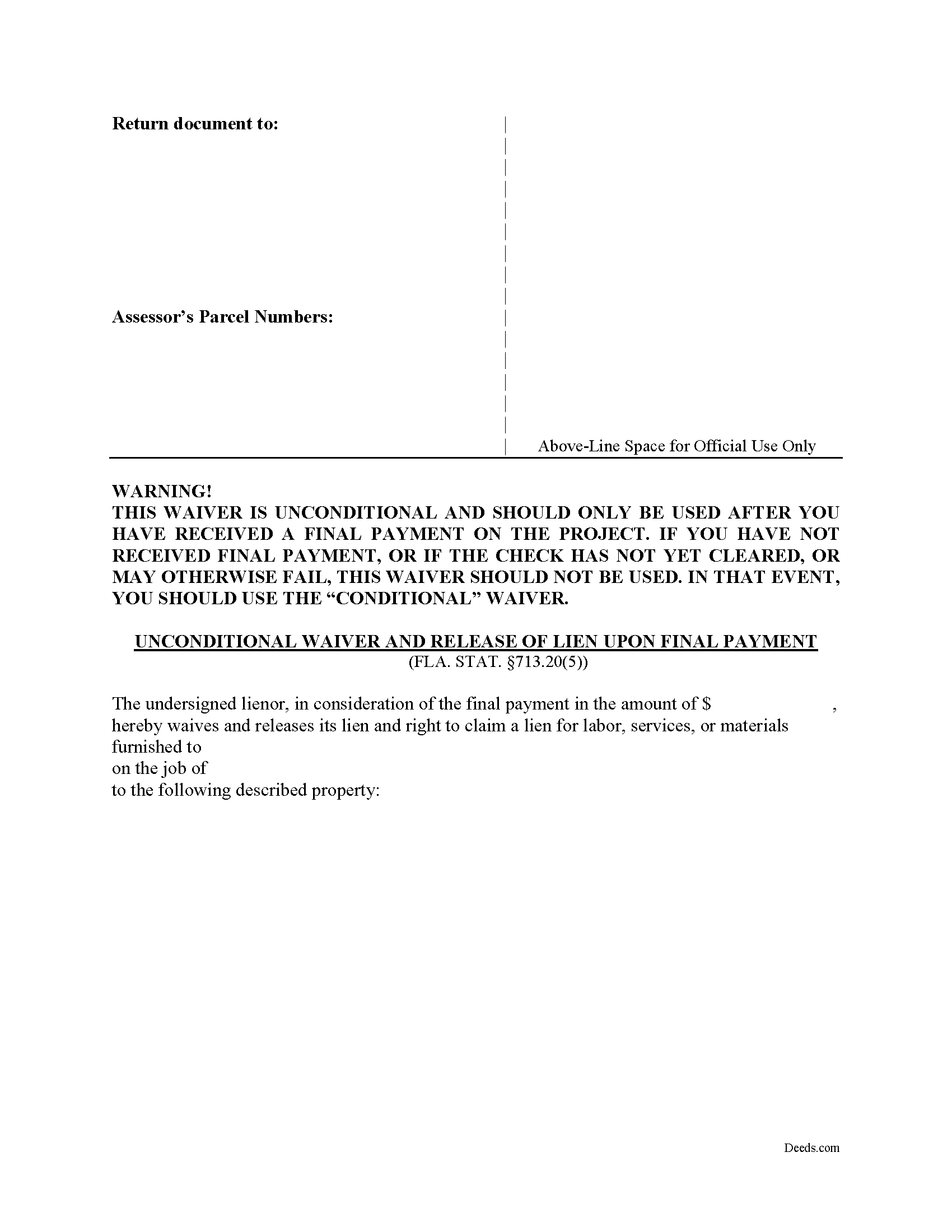

Indian River County Unconditional Waiver upon Final Payment Form

Indian River County Unconditional Waiver upon Final Payment Form

Fill in the blank form formatted to comply with all recording and content requirements.

Indian River County Unconditional Waiver upon Final Payment Guide

Line by line guide explaining every blank on the form.

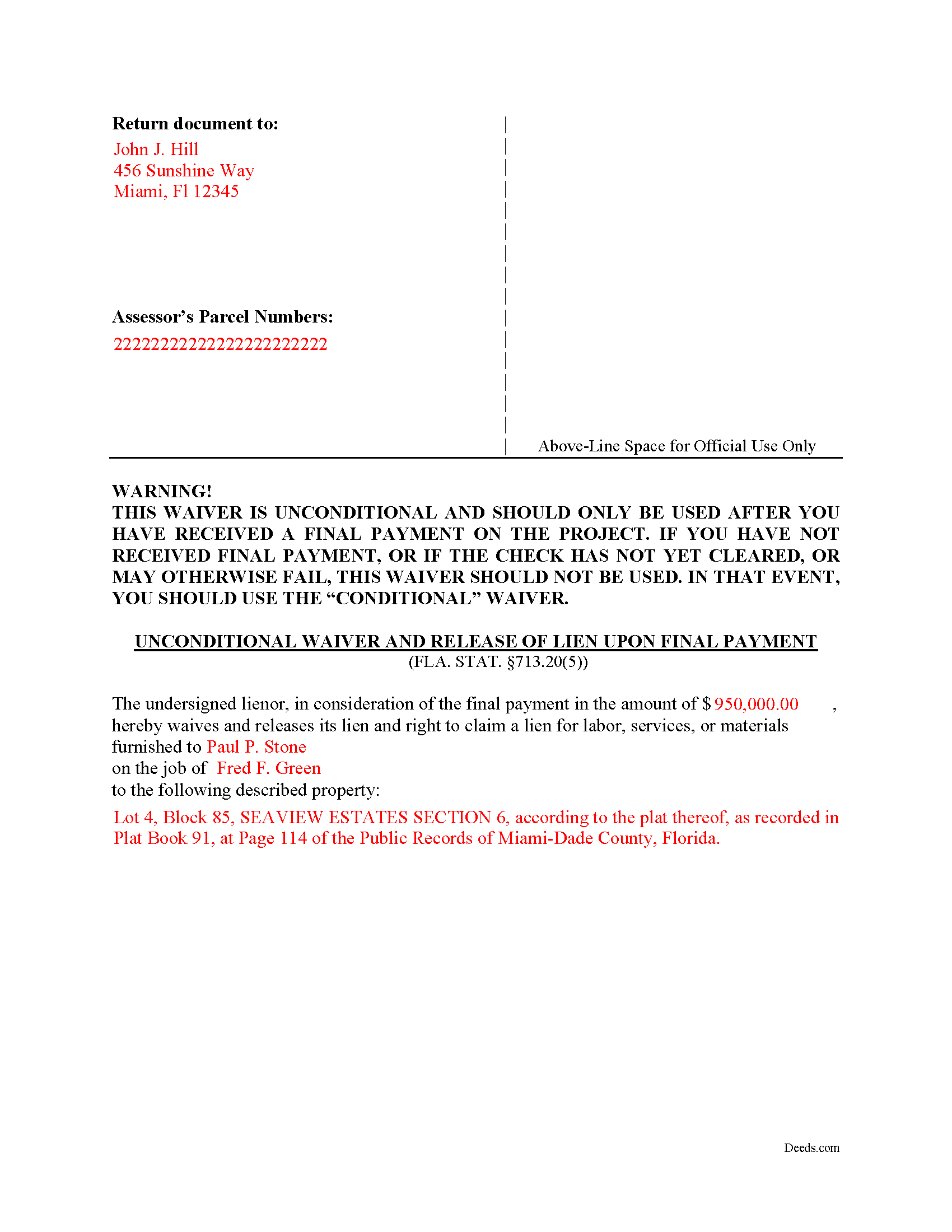

Indian River County Completed Example of the Unconditional Waiver upon Final Payment Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Florida and Indian River County documents included at no extra charge:

Where to Record Your Documents

Recording - County Courthouse

Vero Beach, Florida 32960

Hours: 8:30am to 4:30pm M-F

Phone: (772) 770-5185, Ext 3175 and 3135

Recording Tips for Indian River County:

- Double-check legal descriptions match your existing deed

- Documents must be on 8.5 x 11 inch white paper

- Check margin requirements - usually 1-2 inches at top

Cities and Jurisdictions in Indian River County

Properties in any of these areas use Indian River County forms:

- Fellsmere

- Roseland

- Sebastian

- Vero Beach

- Wabasso

- Winter Beach

Hours, fees, requirements, and more for Indian River County

How do I get my forms?

Forms are available for immediate download after payment. The Indian River County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Indian River County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Indian River County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Indian River County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Indian River County?

Recording fees in Indian River County vary. Contact the recorder's office at (772) 770-5185, Ext 3175 and 3135 for current fees.

Questions answered? Let's get started!

Florida recognizes four types of lien waivers, as set forth in FLA. STAT. 713.20. There are two categories of waivers: conditional and unconditional. Both categories include full or partial releases. A full lien release waives the entire lien amount while a partial waiver relinquishes the right to a lien for the amount represented by a progress payment.

Lienors use the unconditional waiver upon final payment to confirm receipt of the final balance due, and to remove the lien against the property. The waiver must include the names of the lienor, the contractor, and the property owner, the legal description of the property where the work or improvement took place, and the amount paid.

The lienor signs and dates the form in front of a notary, then files it in the records of the same county where the original lien was recorded.

Each case is unique, so contact an attorney with questions about the Unconditional Waiver upon Final Payment or anything else related to Florida's Construction Lien Law.

Important: Your property must be located in Indian River County to use these forms. Documents should be recorded at the office below.

This Unconditional Waiver upon Final Payment meets all recording requirements specific to Indian River County.

Our Promise

The documents you receive here will meet, or exceed, the Indian River County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Indian River County Unconditional Waiver upon Final Payment form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4577 Reviews )

Ruth R.

January 31st, 2020

Very pleased with the service, solved an immediate problem for me and at good price.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Robin G.

February 1st, 2024

Very user friendly. I was totally amazed. Thank you so much.

We are delighted to have been of service. Thank you for the positive review!

Kimberly G.

April 5th, 2021

It would be helpful if there were a specific example of putting a deed into a trust. Also, the limitation of characters on the description of the property was not enough.

Thank you for your feedback. We really appreciate it. Have a great day!

Maria F.

June 26th, 2020

Easy forms to follow. Thank you for this service. You can even file them through e-filing. Great service. Thanks. Maria F.

Thank you!

Thomas G.

November 21st, 2024

Wasn’t what I expected

Sorry to hear that your expectations were missed. Your order has been canceled. We do hope that you find something more suitable to your expectations elsewhere. Do keep in mind that purchasing legal forms should not be an exploratory endeavor.

Karen L.

June 14th, 2022

Form is easy to complete but has a crowded look upon printing. I would put more returns between paragraphs to make it easier to read.

Thank you for your feedback. We really appreciate it. Have a great day!

R Rodney H.

January 29th, 2019

Excellent service--I got just the information I needed quickly and reasonably priced. I am glad to know of this service for future needs, as an individual, in this sector. Cheers, RRH

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Karen H.

April 6th, 2024

Saves a trip to the Recorders Office!

It was a pleasure serving you. Thank you for the positive feedback!

Becky O.

February 11th, 2022

Super easy and quick. Love the service-

Thank you!

Jules S.

May 6th, 2020

I can't believe I haven't been using this service since inception. The only thing I would recommend is to allow us to delete an erroneous upload. I accidentally uploaded the same document twice but I saw no way for me to correct my mistake other than to send an email.

Thank you for your feedback. We really appreciate it. Have a great day!

LeRoy E.

June 20th, 2022

So thankful I found this. I was feeling stressed out and reluctant about doing this on my own.

Thank you!

SHARON D.

December 23rd, 2018

This is one of the easiest sites to purchase and download needed forms. I would highly recommend this site.

Thank you Sharon. We really appreciate you. Enjoy your holidays.

JOHN B.

December 14th, 2020

Process of acquiring an account and submitting a document was VERY easy. Failure was on the Recorders office, for not accepting the survey. Cheers.

Thank you!

Elliot B.

January 31st, 2022

Outstanding forms and the recording service made a short day of what I needed to do. Will be back for the next one, thanks!

Thank you for your feedback. We really appreciate it. Have a great day!

John H.

September 16th, 2022

Response was timely, even though unsuccessful in locating a requested deed. Deeds very courteously and professionally cancelled my order and cancelled its charge to my credit card.

Thank you for your feedback. We really appreciate it. Have a great day!