Cook County Mineral Deed with Quitclaim Covenants Form

Cook County Mineral Deed with Quitclaim Covenants Form

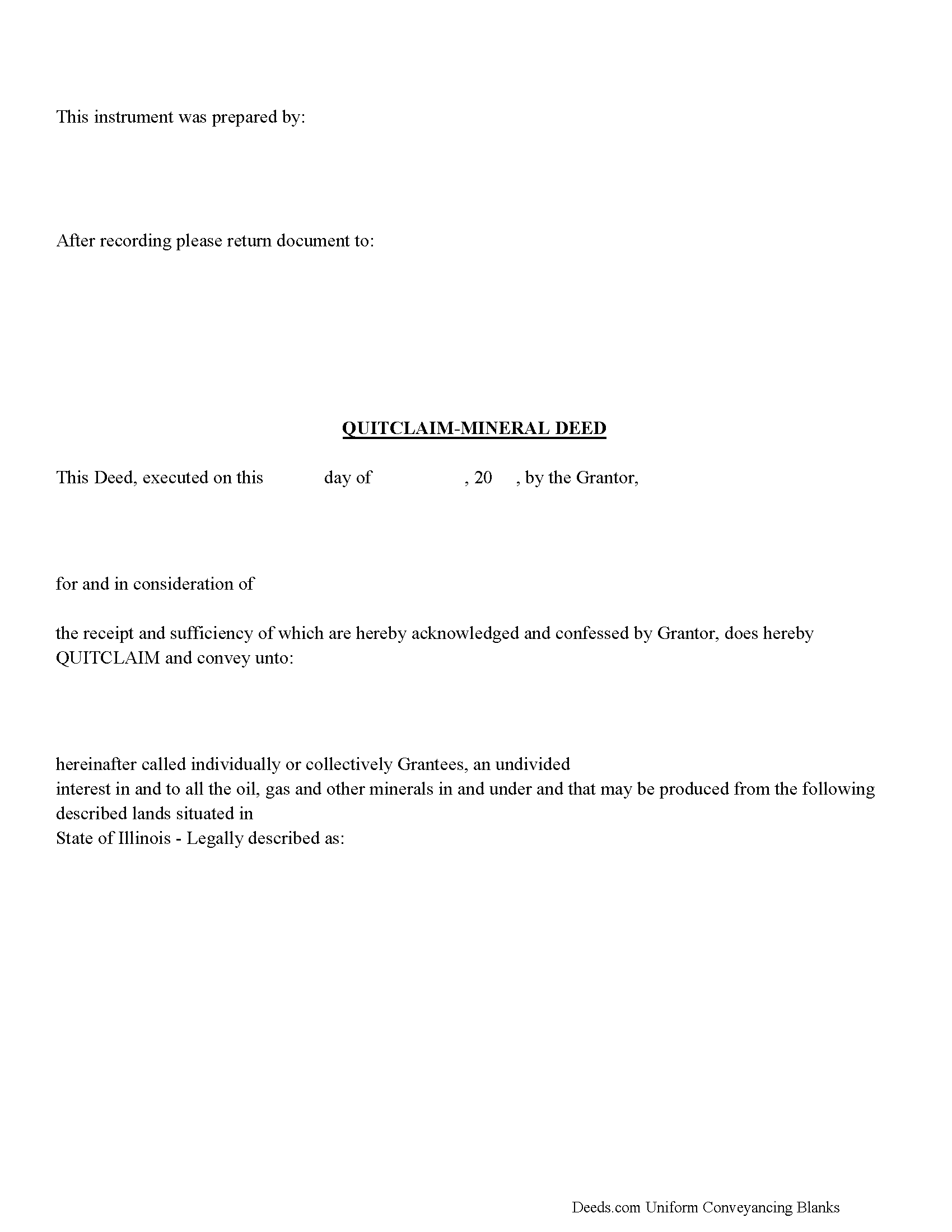

Fill in the blank Mineral Deed with Quitclaim Covenants form formatted to comply with all Illinois recording and content requirements.

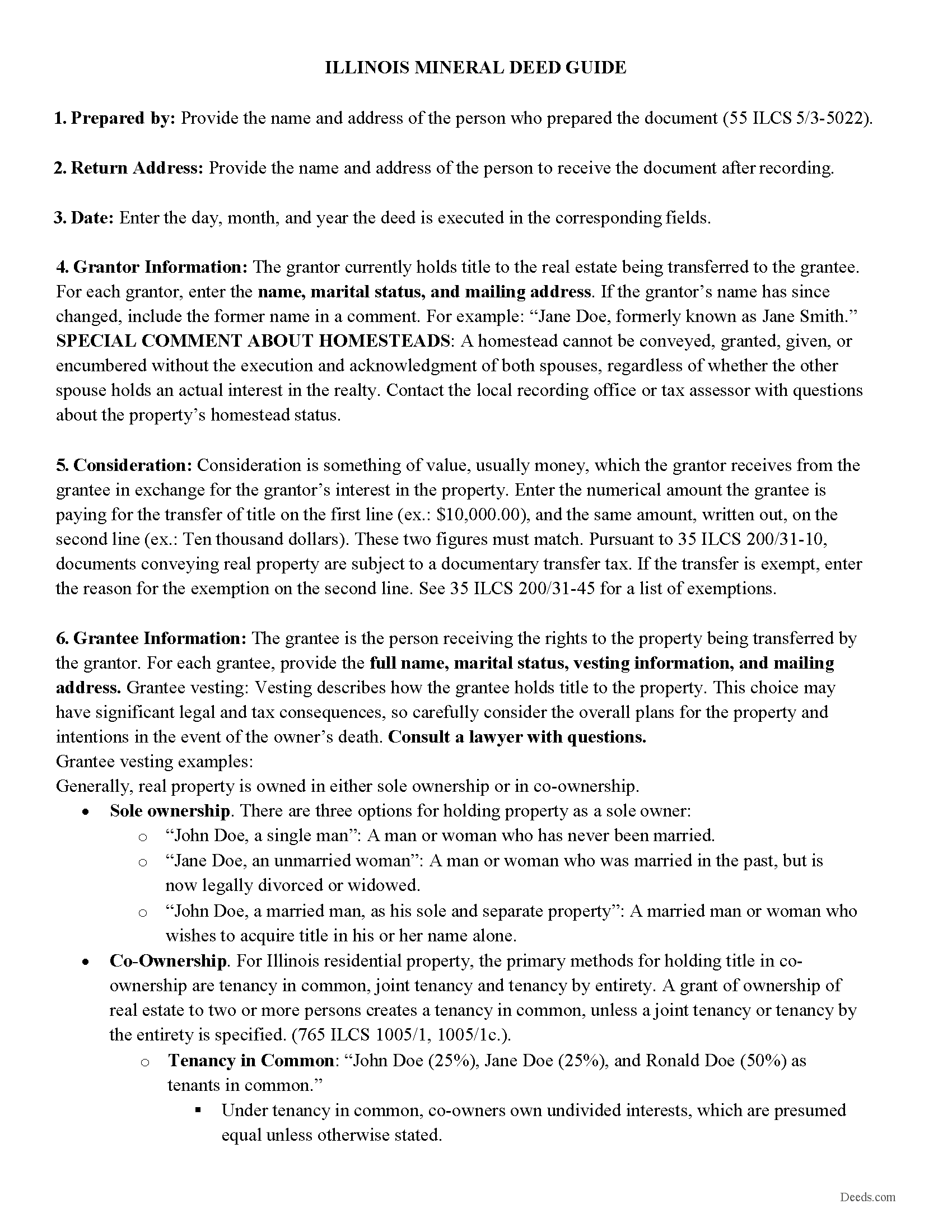

Cook County Mineral Deed with Quitclaim Covenants Guide

Line by line guide explaining every blank on the Mineral Deed with Quitclaim Covenants form.

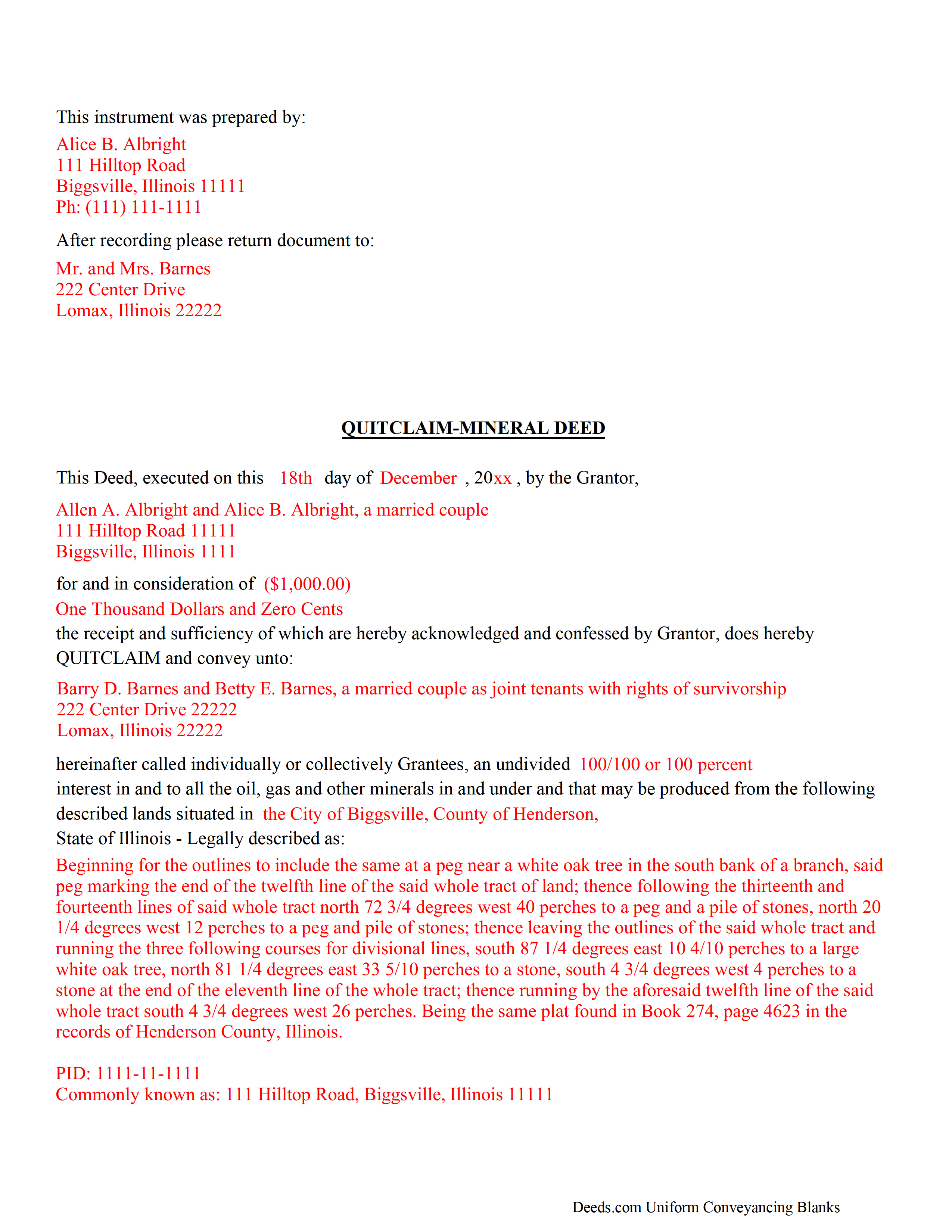

Cook County Completed Example of the Mineral Deed with Quitclaim Covenants Document

Example of a properly completed Illinois Mineral Deed with Quitclaim Covenants document for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Illinois and Cook County documents included at no extra charge:

Where to Record Your Documents

Downtown Office Chicago Court Building

Chicago, Illinois 60602

Hours: 9:00 a.m. - 5:00 p.m. M-F

Phone: (312) 603-5050

Markham Court Building

Markham, Illinois 60426

Hours: 8:30 a.m. - 4:30 p.m. M-F (Note: ALL DOCUMENTS must be recorded at the Clerk's downtown office)

Phone: (708) 210-4448

Rolling Meadows Court Building

Rolling Meadows, Illinois 60008

Hours: 8:30 a.m. - 4:30 p.m. M-F (Note: ALL DOCUMENTS must be recorded at the Clerk's downtown office)

Phone: (847) 818-2070

Bridgeview Court Building

Bridgeview, Illinois 60455

Hours: 8:30 a.m. - 4:30 p.m. M-F (Note: ALL DOCUMENTS must be recorded at the Clerk's downtown office)

Phone: (708) 974-6397

Recording Tips for Cook County:

- Double-check legal descriptions match your existing deed

- Make copies of your documents before recording - keep originals safe

- Bring extra funds - fees can vary by document type and page count

- Mornings typically have shorter wait times than afternoons

Cities and Jurisdictions in Cook County

Properties in any of these areas use Cook County forms:

- Alsip

- Arlington Heights

- Bedford Park

- Bellwood

- Berkeley

- Berwyn

- Blue Island

- Bridgeview

- Broadview

- Brookfield

- Burbank

- Calumet City

- Chicago

- Chicago Heights

- Chicago Ridge

- Cicero

- Country Club Hills

- Des Plaines

- Dolton

- Elk Grove Village

- Elmwood Park

- Evanston

- Evergreen Park

- Flossmoor

- Forest Park

- Franklin Park

- Glencoe

- Glenview

- Glenwood

- Golf

- Hanover Park

- Harvey

- Harwood Heights

- Hazel Crest

- Hickory Hills

- Hillside

- Hines

- Hoffman Estates

- Hometown

- Homewood

- Justice

- Kenilworth

- La Grange

- La Grange Park

- Lansing

- Lemont

- Lincolnwood

- Lyons

- Markham

- Matteson

- Maywood

- Melrose Park

- Midlothian

- Morton Grove

- Mount Prospect

- Niles

- Northbrook

- Oak Forest

- Oak Lawn

- Oak Park

- Olympia Fields

- Orland Park

- Palatine

- Palos Heights

- Palos Hills

- Palos Park

- Park Forest

- Park Ridge

- Posen

- Prospect Heights

- Richton Park

- River Forest

- River Grove

- Riverdale

- Riverside

- Robbins

- Rolling Meadows

- Schaumburg

- Schiller Park

- Skokie

- South Holland

- Steger

- Stone Park

- Streamwood

- Summit Argo

- Techny

- Thornton

- Tinley Park

- Westchester

- Western Springs

- Wheeling

- Willow Springs

- Wilmette

- Winnetka

- Worth

Hours, fees, requirements, and more for Cook County

How do I get my forms?

Forms are available for immediate download after payment. The Cook County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Cook County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Cook County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Cook County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Cook County?

Recording fees in Cook County vary. Contact the recorder's office at (312) 603-5050 for current fees.

Questions answered? Let's get started!

The General Mineral Deed in Illinois Quitclaims oil, gas, and mineral rights from the grantor to the grantee. THIS IS NOT A LEASE. There are no Exceptions or Reservations included.

The transfer includes the oil, gas and other minerals of every kind and nature. The Grantor can stipulate the percentage of Mineral Rights the Grantee will receive.

This general mineral deed gives the grantee the right to access, for the purpose of mining, drilling, exploring, operating and developing said lands for oil, gas, and other minerals, and storing handling, transporting and marketing of such.

The seller, or grantor Quitclaims the mineral rights and does NOT accept responsibility to any discrepancy of title (This assignment is without warranty of title, either express or implied)

Uses: Mineral deeds with quitclaim are often used in situations where the grantor wants to quickly release any interest they might have in mineral rights, such as in settling estates, resolving disputes, clearing up uncertainties about ownership in a title's history or when mineral rights have previously been severed or fragmented from surface rights and cloud a title, making it difficult to transfer property. Resolution often involves the holder(s) of the mineral rights, quit-claiming any rights he/she/they have or might have in the subject property.

Use of this document can have a permanent effect on your rights to the property, if you are not completely sure of what you are executing seek the advice of a legal professional.

(Illinois Mineral Deed with Quitclaim Package includes form, guidelines, and completed example)

Important: Your property must be located in Cook County to use these forms. Documents should be recorded at the office below.

This Mineral Deed with Quitclaim Covenants meets all recording requirements specific to Cook County.

Our Promise

The documents you receive here will meet, or exceed, the Cook County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Cook County Mineral Deed with Quitclaim Covenants form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4585 Reviews )

Trina P.

February 22nd, 2023

Deeds.com is a quick and effective way at finding property deeds. I had the results I needed in a couple hours without having to miss work to get to the clerks office, which is well worth the price of the service.

Thank you for your feedback. We really appreciate it. Have a great day!

Carolyn D.

March 18th, 2022

The sight provided exactly what I needed and was easy to use. I was able to download the type of Deed I used and was completely satisfied with the website.

Thank you for your feedback. We really appreciate it. Have a great day!

John W.

September 30th, 2020

You charge too much for a form. Your business model is shortsighted. I would not try to use your service again. You got $20 from me this once, but I would try very hard to not use your service again. Your model does not encourage serial or professional usage.

Thank you for your feedback John. We do wish that you had decided our product was too expensive prior to purchasing and using so that there was no remorse. Have a wonderful day.

Donna O.

March 6th, 2020

Quick and easy to use. I was able to download the Transfer on Death Deed form to my computer so that I can read through and fill them out at a later time. That made it convenient and "no pressure". The complimentary guide and completed example that came with the form was also very helpful.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Debbie M.

July 3rd, 2020

The forms and instructions were easy to follow and get complete. It was very nice to be able to just find them, pay for them, and download them so that they were printed just within a matter of 30 minutes. Thank you

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Cynthia E.

October 12th, 2024

Disappointed that you were not able to provide me with the information requested. They did issue a refund but I don’t think it’s come through yet.

We are grateful for your engagement and feedback, which help us to serve you better. Thank you for being an integral part of our community.

Faye C.

June 13th, 2021

Product was ok; except in divorce cases there are usually two grantors - your form had only one signature and notary line for a grantor on the Quitclaim deed.

Thank you for your feedback. We really appreciate it. Have a great day!

Fred A.

April 15th, 2019

Very nice forms offer, very thoughtful to include other related forms that may be necessary. The site was easy to use, and very fast. Thank You.

Thank you!

davidjrhall e.

March 13th, 2023

So far its been good. The David Jr Hall Estate Trust is a Business Blind Trust and we are looking forward to working with your platform and seeing how far we can go.

Thank you!

Chrisona S.

October 27th, 2022

Received the forms as promised. Very satisfied.

Thank you!

Mary G.

March 7th, 2021

Deeds.com was a fast and easy site to use the staff answered my questions online efficiently

Thank you!

Wayne T.

February 2nd, 2021

I was skeptical when I first came upon this website. Not sure why I had such a negative feeling, but after I received the printed deed I felt relieved and completely satisfied. This is a great website for everyone who wouldn't want to retrieve their deed in person and worth the reasonable fee.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Sherri S.

March 30th, 2021

Easy to access forms, and reasonably priced. I'll definitely use again in the future.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Greg S.

August 19th, 2022

The Beneficiary Deed is easy to fill out, expecially with the examples/explanations provided. The only recommendation I would make is to state that the Parcel ID and the Assessor's ID are one in the same. I looked everywhere for something that mentions "Assessor's ID" in my paperwork to no avail. Upon calling the Maricopa Assessor's number in Maricopa I was told that they are the same.

Thank you for your feedback. We really appreciate it. Have a great day!

JACK G.

December 27th, 2019

Worked out good can the forms be filled out on the computer and printed off.

Thank you for your feedback. We really appreciate it. Have a great day!