Cook County Mortgage Secured by Promissory Note Form

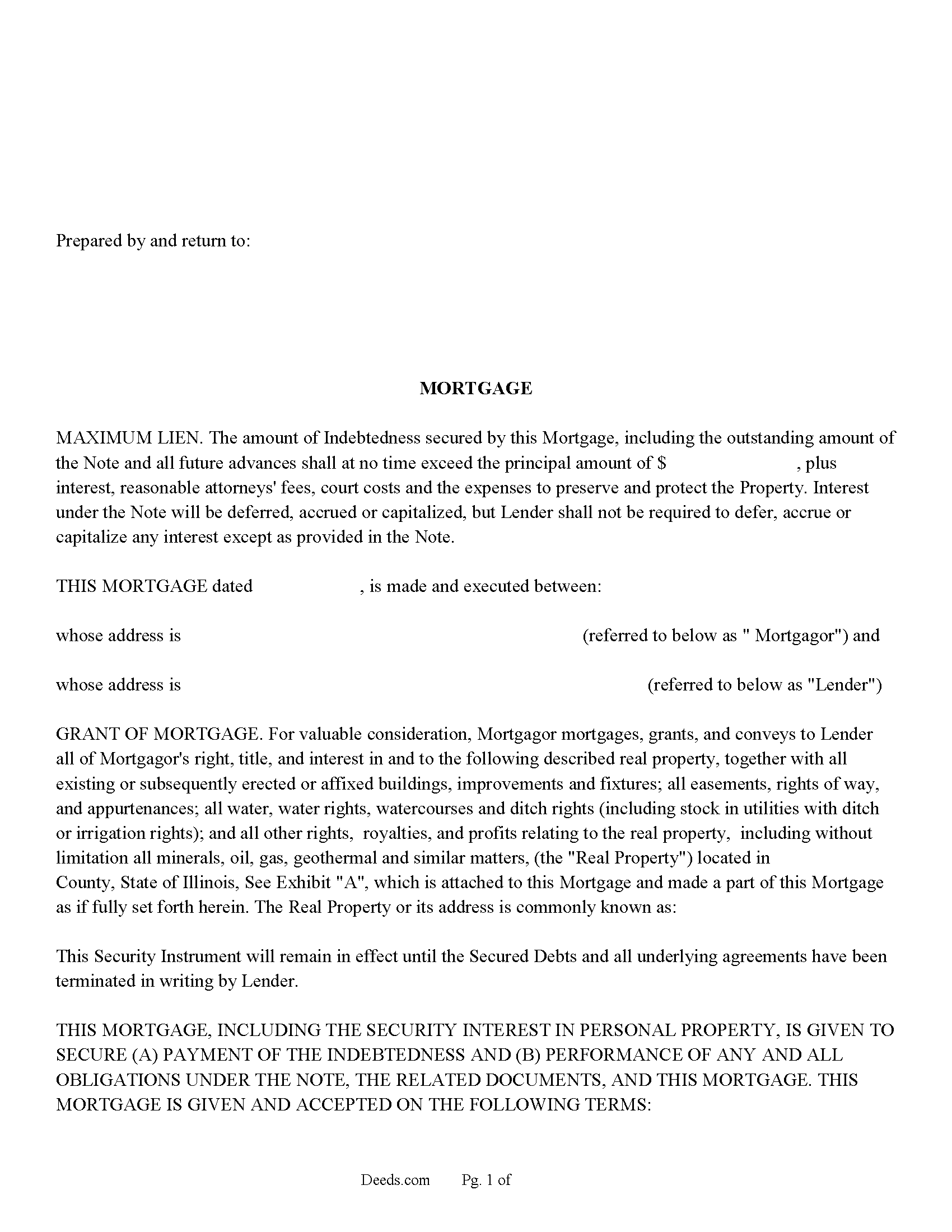

Cook County Mortgage Form

Fill in the blank form formatted to comply with all recording and content requirements.

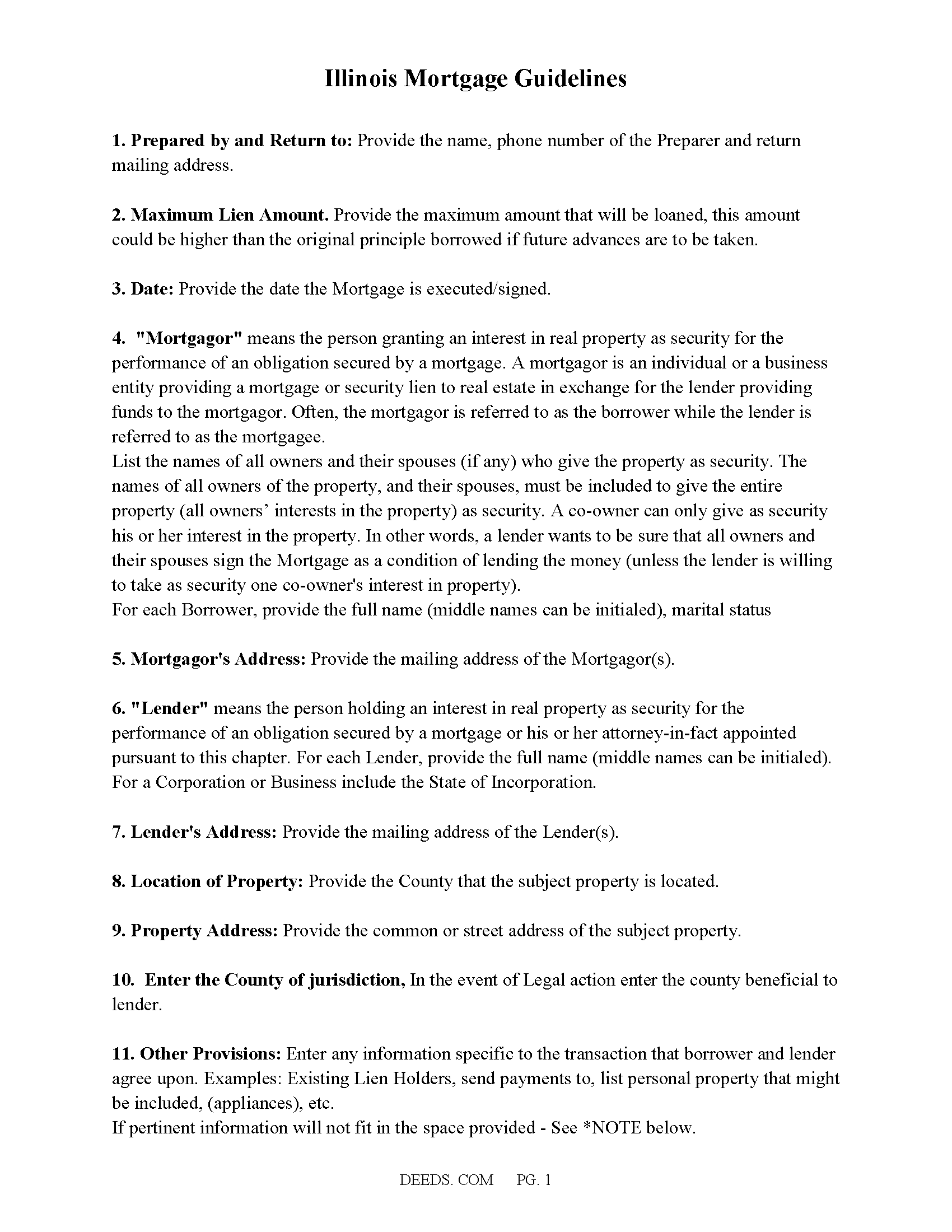

Cook County Mortgage Guide

Fill in the blank form formatted to comply with all recording and content requirements.

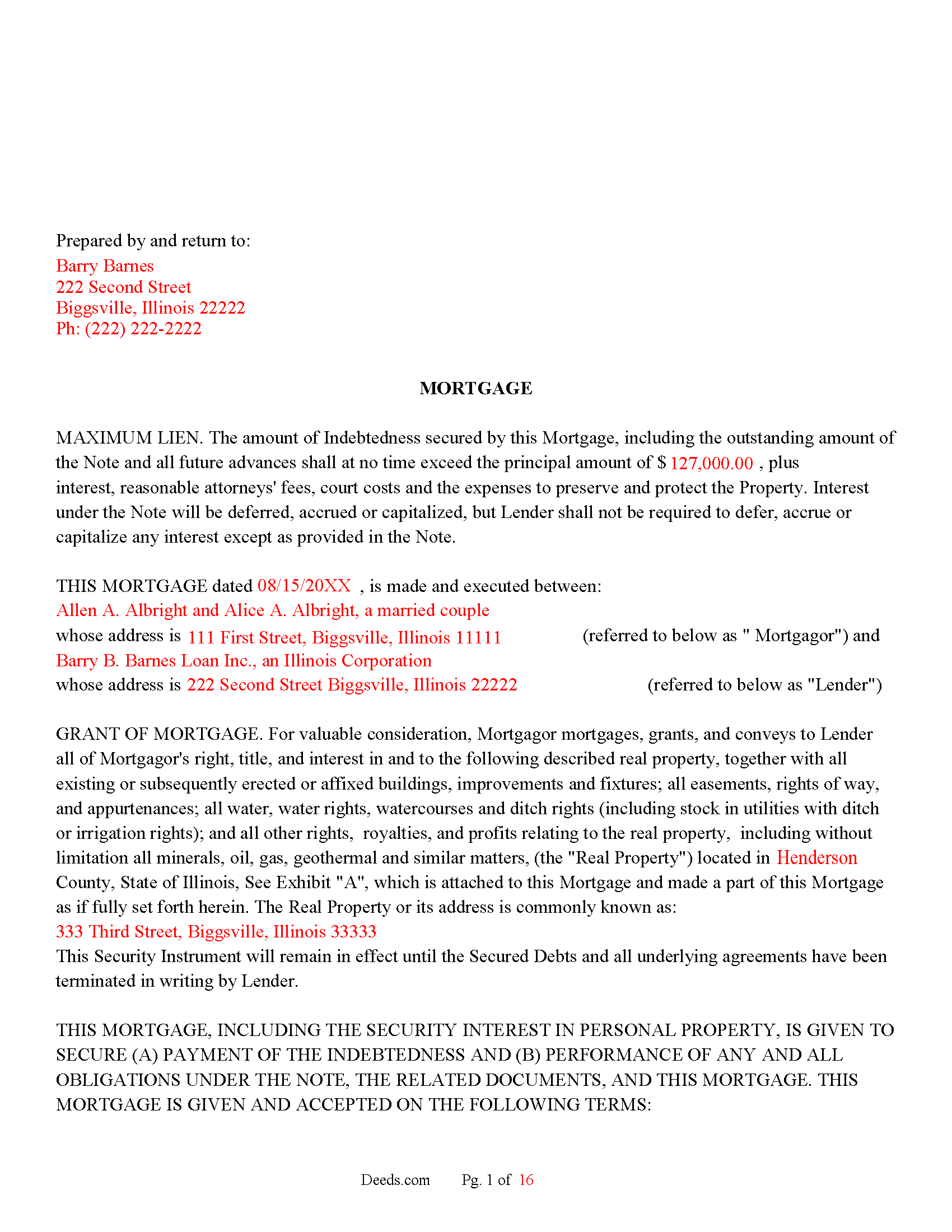

Cook County Completed Example of the Mortgage Secured by Promissory Note Document

Example of a properly completed Illinois Mortgage Secured by Promissory Note document for reference.

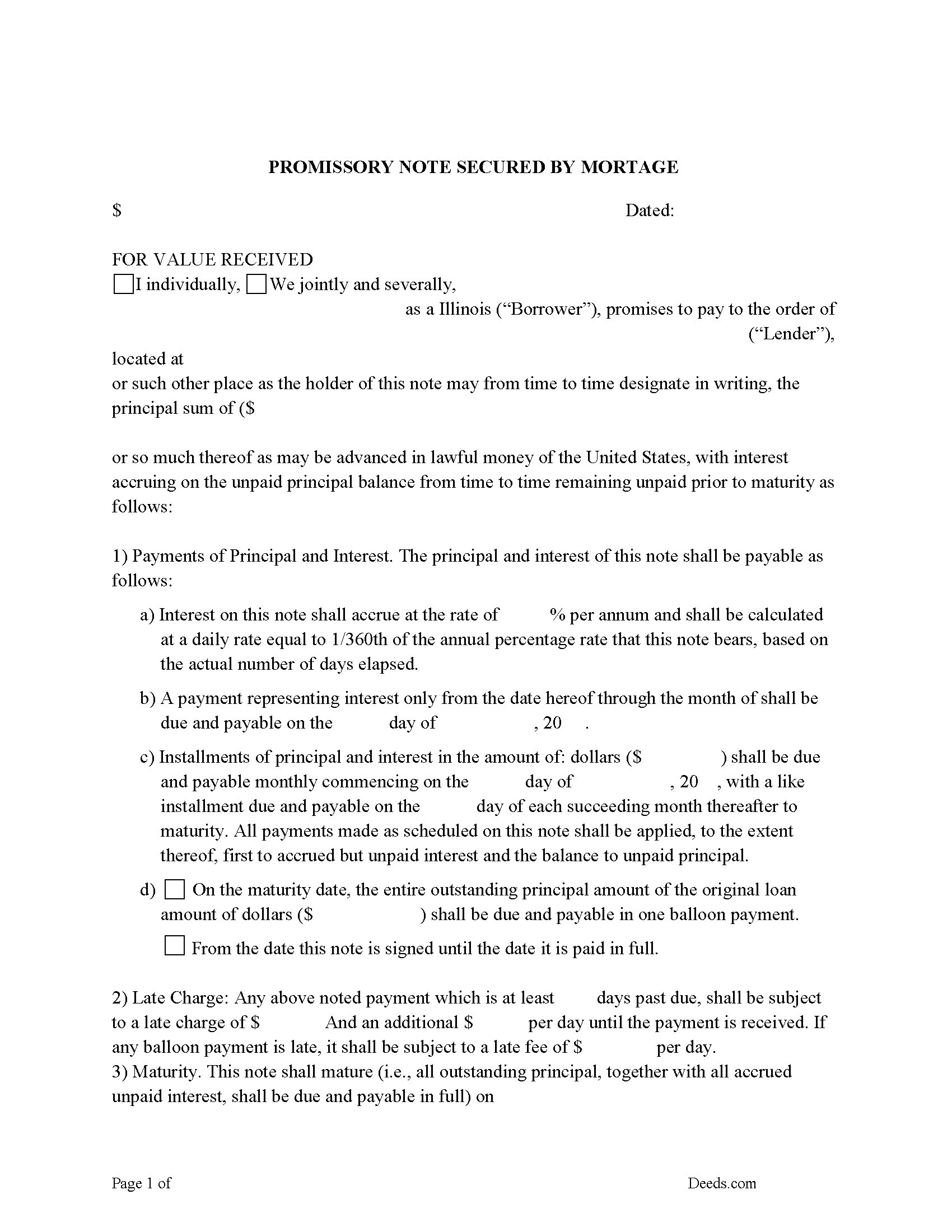

Cook County Promissory Note Form

Fill in the Blank Promissory Note secured by Mortgage

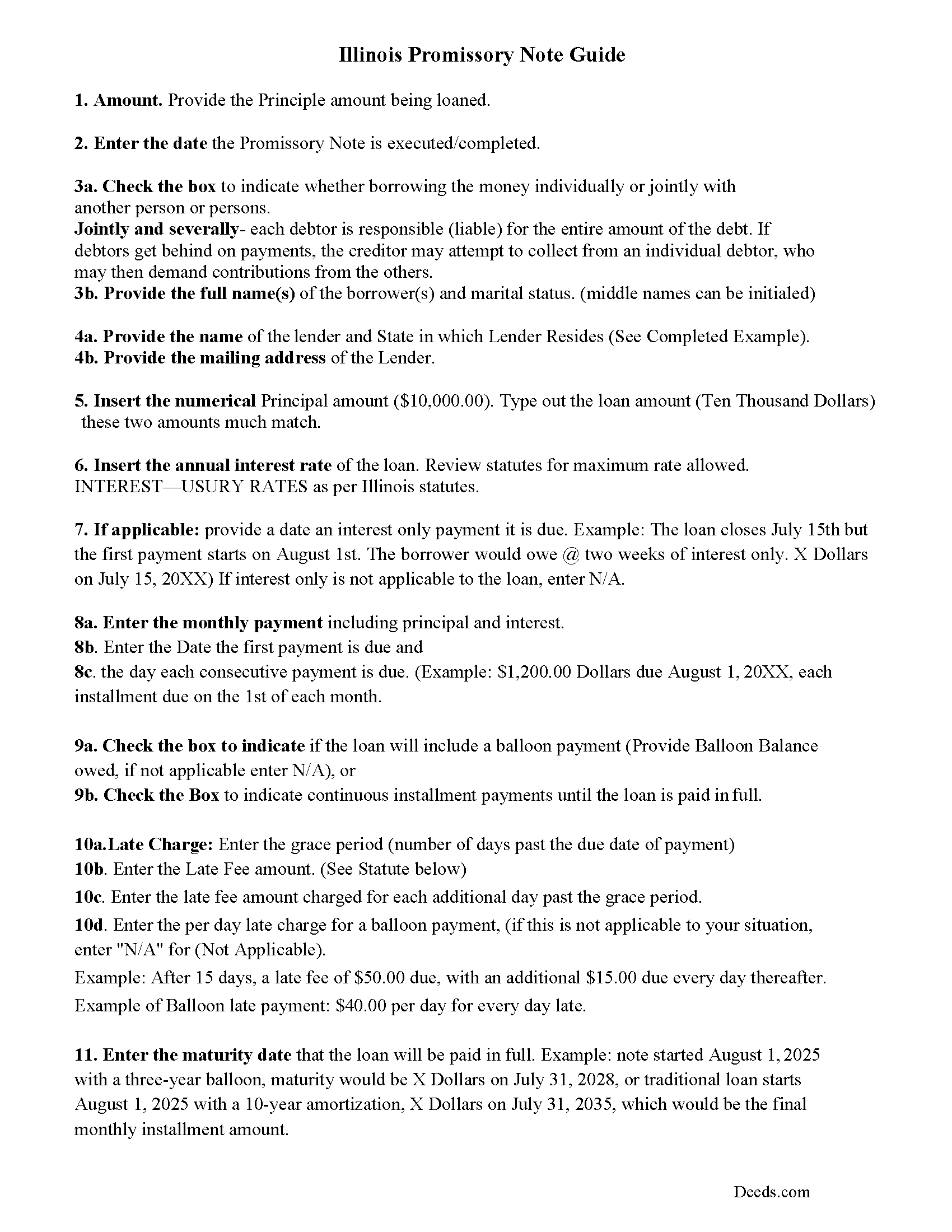

Cook County Promissory Note Guidelines

Line by line guide explaining every blank on the form.

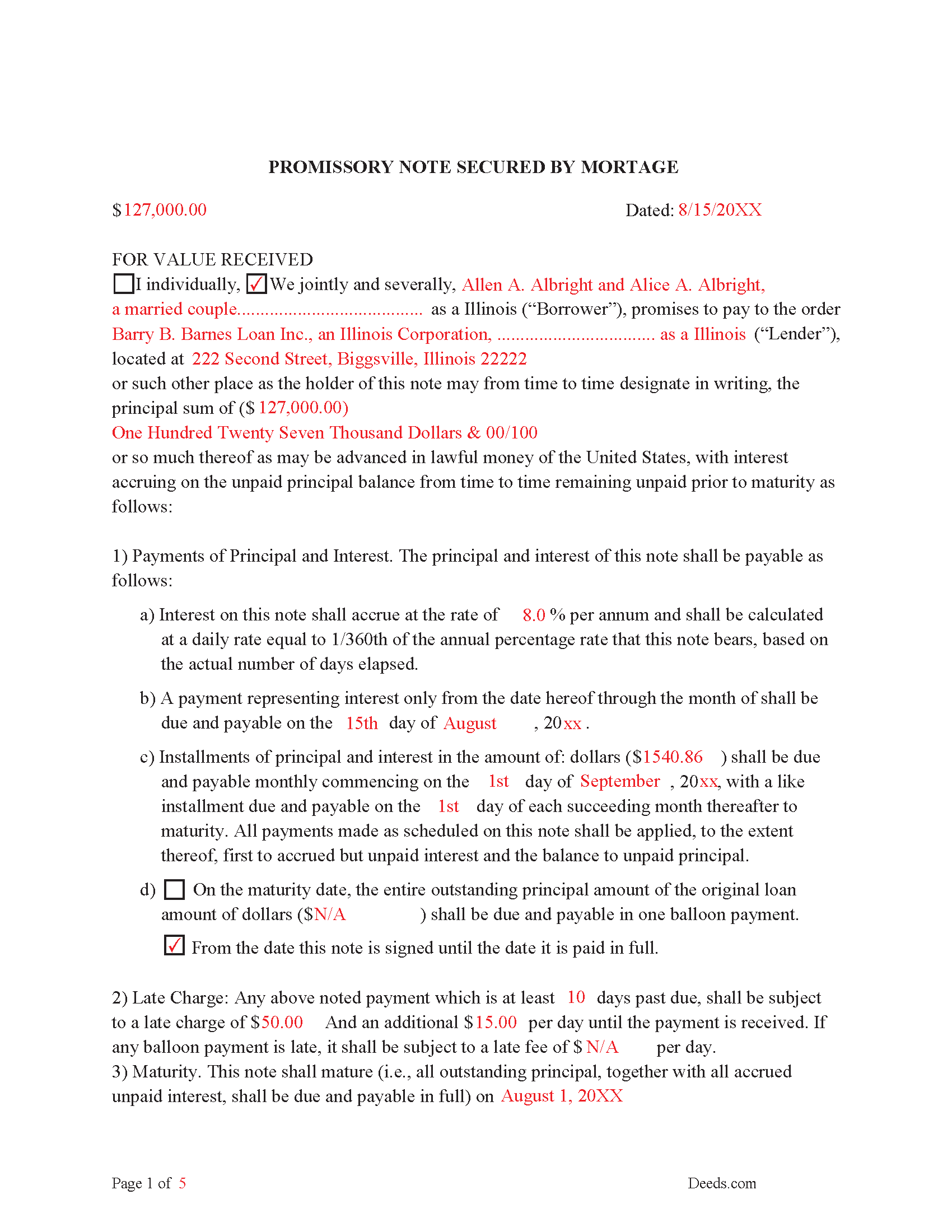

Cook County Completed Example of the Promissory Note Document

Line by line guide explaining every blank on the form.

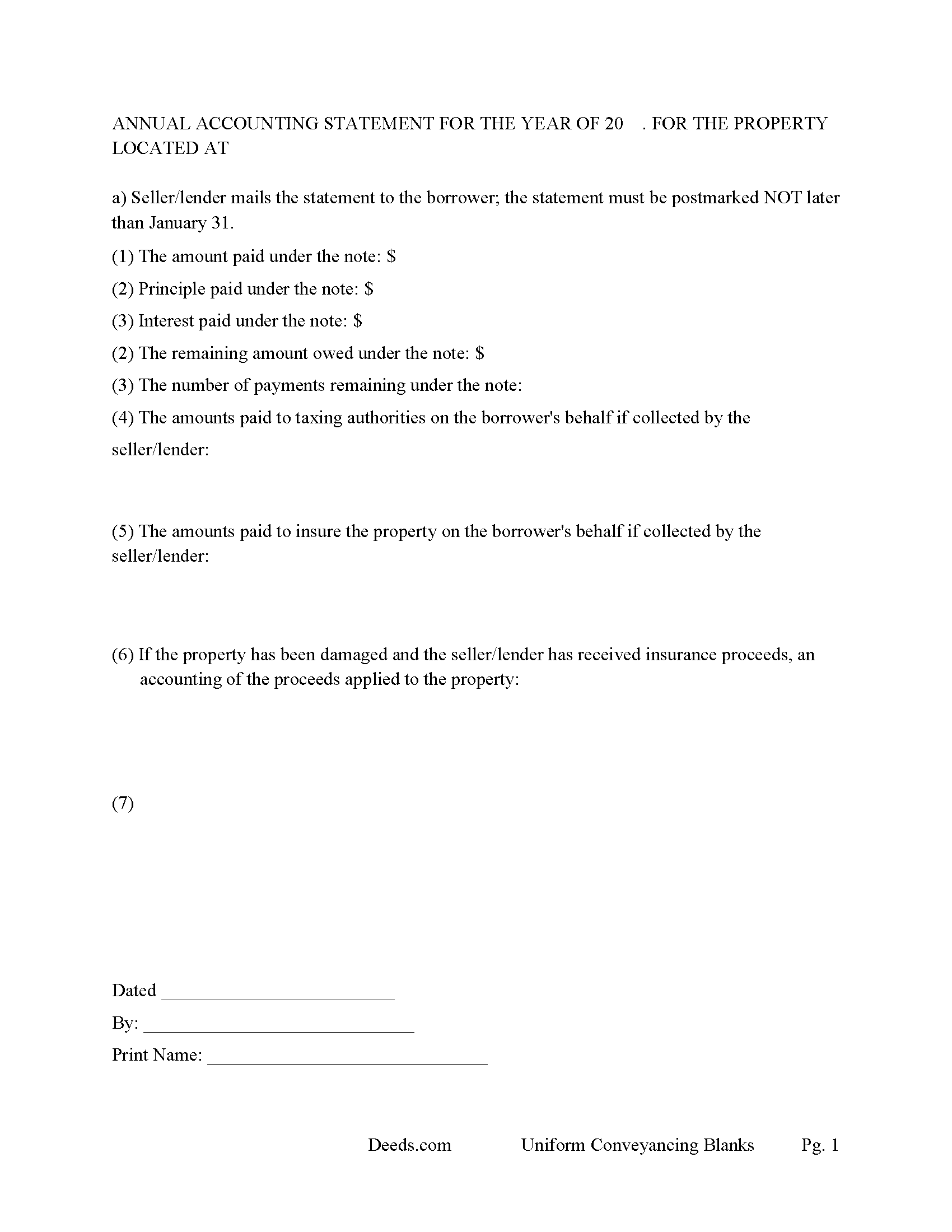

Cook County Annual Accounting Statement Form

Mail to borrower for fiscal year reporting.

All 7 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Illinois and Cook County documents included at no extra charge:

Where to Record Your Documents

Downtown Office Chicago Court Building

Chicago, Illinois 60602

Hours: 9:00 a.m. - 5:00 p.m. M-F

Phone: (312) 603-5050

Markham Court Building

Markham, Illinois 60426

Hours: 8:30 a.m. - 4:30 p.m. M-F (Note: ALL DOCUMENTS must be recorded at the Clerk's downtown office)

Phone: (708) 210-4448

Rolling Meadows Court Building

Rolling Meadows, Illinois 60008

Hours: 8:30 a.m. - 4:30 p.m. M-F (Note: ALL DOCUMENTS must be recorded at the Clerk's downtown office)

Phone: (847) 818-2070

Bridgeview Court Building

Bridgeview, Illinois 60455

Hours: 8:30 a.m. - 4:30 p.m. M-F (Note: ALL DOCUMENTS must be recorded at the Clerk's downtown office)

Phone: (708) 974-6397

Recording Tips for Cook County:

- Check margin requirements - usually 1-2 inches at top

- Request a receipt showing your recording numbers

- Ask for certified copies if you need them for other transactions

Cities and Jurisdictions in Cook County

Properties in any of these areas use Cook County forms:

- Alsip

- Arlington Heights

- Bedford Park

- Bellwood

- Berkeley

- Berwyn

- Blue Island

- Bridgeview

- Broadview

- Brookfield

- Burbank

- Calumet City

- Chicago

- Chicago Heights

- Chicago Ridge

- Cicero

- Country Club Hills

- Des Plaines

- Dolton

- Elk Grove Village

- Elmwood Park

- Evanston

- Evergreen Park

- Flossmoor

- Forest Park

- Franklin Park

- Glencoe

- Glenview

- Glenwood

- Golf

- Hanover Park

- Harvey

- Harwood Heights

- Hazel Crest

- Hickory Hills

- Hillside

- Hines

- Hoffman Estates

- Hometown

- Homewood

- Justice

- Kenilworth

- La Grange

- La Grange Park

- Lansing

- Lemont

- Lincolnwood

- Lyons

- Markham

- Matteson

- Maywood

- Melrose Park

- Midlothian

- Morton Grove

- Mount Prospect

- Niles

- Northbrook

- Oak Forest

- Oak Lawn

- Oak Park

- Olympia Fields

- Orland Park

- Palatine

- Palos Heights

- Palos Hills

- Palos Park

- Park Forest

- Park Ridge

- Posen

- Prospect Heights

- Richton Park

- River Forest

- River Grove

- Riverdale

- Riverside

- Robbins

- Rolling Meadows

- Schaumburg

- Schiller Park

- Skokie

- South Holland

- Steger

- Stone Park

- Streamwood

- Summit Argo

- Techny

- Thornton

- Tinley Park

- Westchester

- Western Springs

- Wheeling

- Willow Springs

- Wilmette

- Winnetka

- Worth

Hours, fees, requirements, and more for Cook County

How do I get my forms?

Forms are available for immediate download after payment. The Cook County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Cook County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Cook County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Cook County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Cook County?

Recording fees in Cook County vary. Contact the recorder's office at (312) 603-5050 for current fees.

Questions answered? Let's get started!

This Mortgage has stringent default provisions that is typically suited for a private Lender with financing of residential property, small business property, Rental units (up to 4 units), Condominiums, planned unit development and vacant land.

EVENTS OF DEFAULT. Each of the following, at Lender's option, shall constitute an Event of Default under this Mortgage:

Payment Default. Mortgagor fails to make any payment when due under the Indebtedness.

Default on Other Payments.

Other Defaults.

Default in Favor of Third Parties.

False Statements.

Defective Collateralization.

Death or Insolvency.

Creditor or Forfeiture Proceedings.

Events Affecting Guarantor.

Adverse Change.

RIGHTS AND REMEDIES ON DEFAULT. Upon the occurrence of an Event of Default and at any time thereafter, Lender, at Lender's option, may exercise any one or more of the following rights and remedies, in addition to any other rights or remedies provided by law:

Accelerate Indebtedness.

UCC Remedies.

Appoint Receiver.

Judicial Foreclosure.

Nonjudicial Sale.

Deficiency Judgment.

Tenancy at Sufferance.

Other Remedies - Lender shall have all other rights and remedies provided in this Mortgage or the Note or available at law or in equity.

Sale of the Property.

Notice of Sale.

Election of Remedies

Attorneys' Fees; Expenses.

Promissory Note can be used for installment or balloon payments.

Includes default rates (interest rate that occurs when borrower is in default)

In addition to any other remedies available to Lender if this Note is not paid in full at the Maturity Date, Borrowers shall pay to Lender an Overdue Loan Fee, which fee shall be due at the time this Note is otherwise paid in full. The "Overdue Loan Fee" shall be determined based upon the outstanding principal balance of this Note as of the Maturity Date and shall be:

(a)one percent (1.0%) Of such principal balance if the Note is paid in full on or after thirty(30)days after the Maturity Date but less than sixty (60) days after the Maturity Date, or

(b)two percent (2.0%) of such principal balance if the Note is paid in full on or after sixty(60)days after the Maturity Date.

Late Payment Fees. Any payment which is at least ___ days past due, shall be subject to a late charge of $___ And an additional $___ per day until the payment is received. If any balloon payment is late, it shall be subject to a late fee of $___ per day.

(Illinois Mortgage Package includes forms, guidelines, and completed examples) For Use in Illinois Only.

Important: Your property must be located in Cook County to use these forms. Documents should be recorded at the office below.

This Mortgage Secured by Promissory Note meets all recording requirements specific to Cook County.

Our Promise

The documents you receive here will meet, or exceed, the Cook County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Cook County Mortgage Secured by Promissory Note form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4585 Reviews )

JOHN B.

December 14th, 2020

Process of acquiring an account and submitting a document was VERY easy. Failure was on the Recorders office, for not accepting the survey. Cheers.

Thank you!

William S C.

June 11th, 2021

The Lady Bird Deed appears to be fine with me as are the instructions. However, there apparently are no specific laws in Texas addressing them other than they are OK. The problem is that lenders are surely going to use them as triggers for their due on sale clauses, especially as the current small mortgage rates begin to increase. The solution to that seems to be to sign and have them notarized, but not to record them unless the holder needs to enforce the provisions. It seems to me that you should consider your solution to that problem in your instructions.

Thank you for your feedback. We really appreciate it. Have a great day!

Suzy I.

June 5th, 2019

I was overwhelmed with information about what forms I needed to complete the probate process, and this site was very helpful! Everything was in one place to download. Thanks!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Susann T.

November 4th, 2020

I have been very happy with the prompt assistance that I have received from deeds.com! How refreshing this is when so often good customer service seems rare these days!

Thank you for your feedback. We really appreciate it. Have a great day!

GAYNELL G.

August 9th, 2022

THANKS

Thank you!

Donald C.

August 7th, 2020

As promised, my forms were immediately ready for download. The forms were exactly what i wanted. I couldnt be happier and i cant even guess how much money i saved. They were even formatted to the exact font, spacing and margin used by my county. It is obvious a lot of time and effort was put into the preparation of these documents. They are absolutely perfect. Check it out, you wont be disappointed and the price is much less than i expected. Don caldwell

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Tressa P.

November 17th, 2020

This online service was very easy to use. I highly recommend Deeds.com. The quick response from the representative upon submitting your document is quick. If something needed to be adjusted they will send you message and you can in turn respond right away with a message. The pricing of this service is very reasonable.

Thank you!

Tammy L.

August 20th, 2025

Very Poor and useles, a scam, don't waste your money, those templates are useless and do Not give you Any valid,proper, meeningful wording to use, did Not Help me, nothing more than what a 5th grader can come up with as far as wording or example..I feel I was riped off and this is a total scam... nothing useful

We appreciate all feedback, even when it’s critical. Thousands of customers have successfully used our documents, but they are not for everyone. These are reviewed, fill-in-the-blank templates that provide the wording and structure required by law. Some situations call for more personalized guidance or hand-holding than templates alone can provide, and in those cases an attorney may be the better option.

Muhamed H.

February 3rd, 2022

Nice!

Thank you!

Lahoma G.

February 3rd, 2021

Got it very fast !! Thanks

Thank you for your feedback. We really appreciate it. Have a great day!

John W.

September 30th, 2020

You charge too much for a form. Your business model is shortsighted. I would not try to use your service again. You got $20 from me this once, but I would try very hard to not use your service again. Your model does not encourage serial or professional usage.

Thank you for your feedback John. We do wish that you had decided our product was too expensive prior to purchasing and using so that there was no remorse. Have a wonderful day.

Donald S.

July 7th, 2020

Good

Thank you!

Jennifer H.

October 12th, 2020

Deeds.com is amazing. It made finding out how to file legal documents worry free and easily understood. Thank You

Thank you for your feedback. We really appreciate it. Have a great day!

Nick V.

July 21st, 2020

Turn time was great. Highly recommend.

Thank you!

Victoria S.

March 13th, 2021

Deed.com is AMAZING! I only had about 2 weeks to get my quit claim deed recorded by my county office before my refinace due date approached. When I uploaded my quit claim to Deed.com I got it electronically recored by county register's office in "24 hours"!!! Deed.com is quick and efficient and I will dedinitely be using Deed.com again if I ever need a document recorded again.

Thank you for your feedback. We really appreciate it. Have a great day!