Linn County Limited Power of Attorney for the Sale of Real Property Form

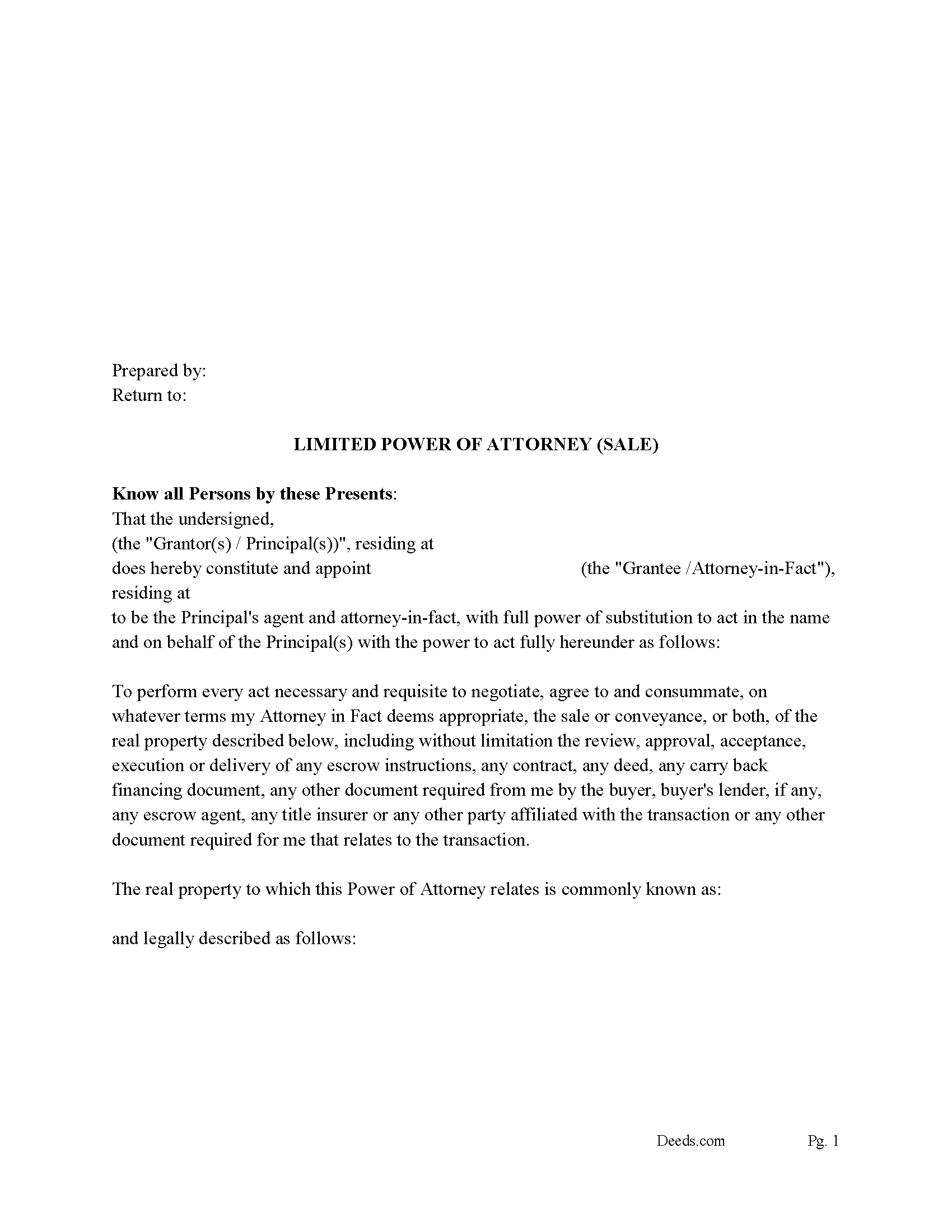

Linn County Limited Power of Attorney Form

Fill in the blank form formatted to comply with all recording and content requirements.

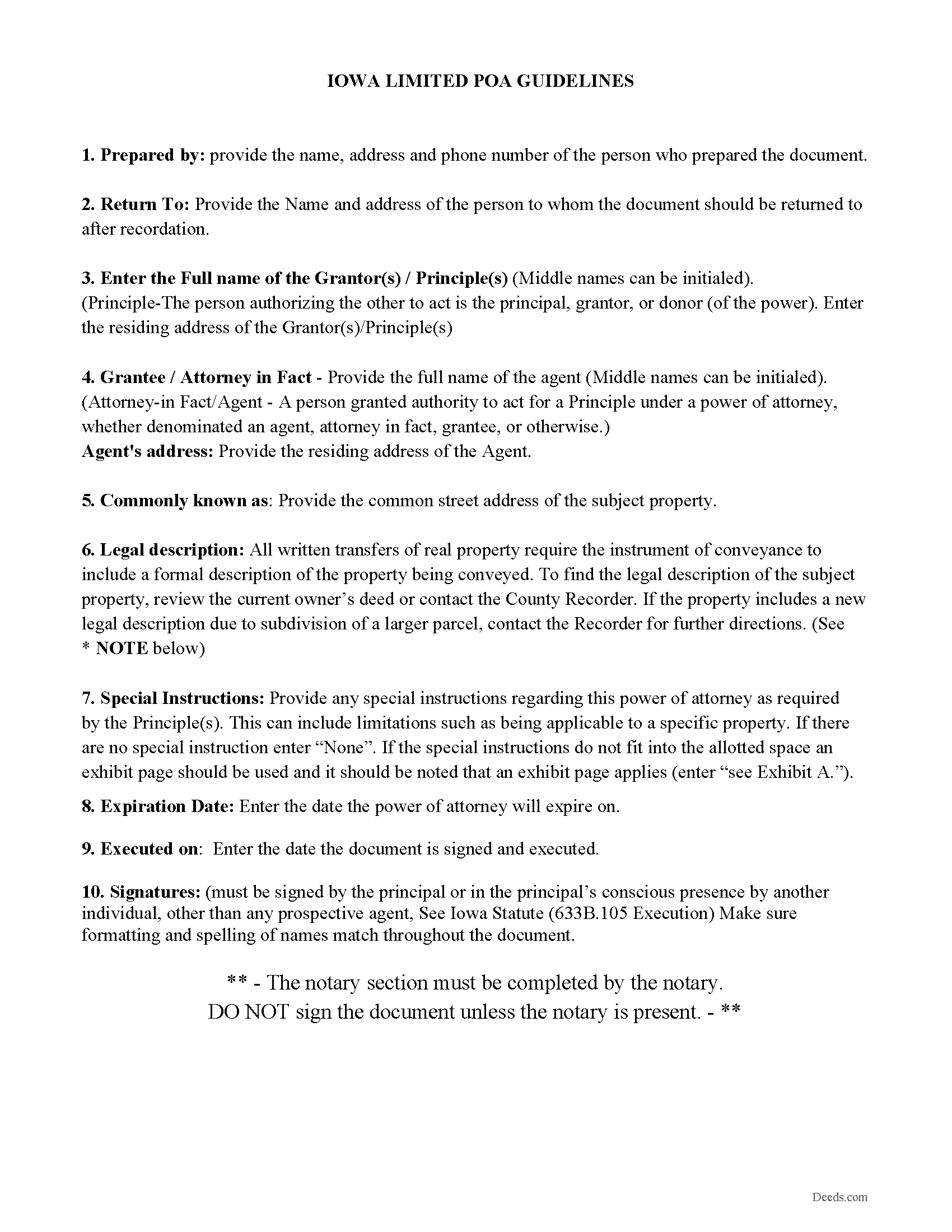

Linn County Limited Power of Attorney Guidelines

Line by line guide explaining every blank on the form.

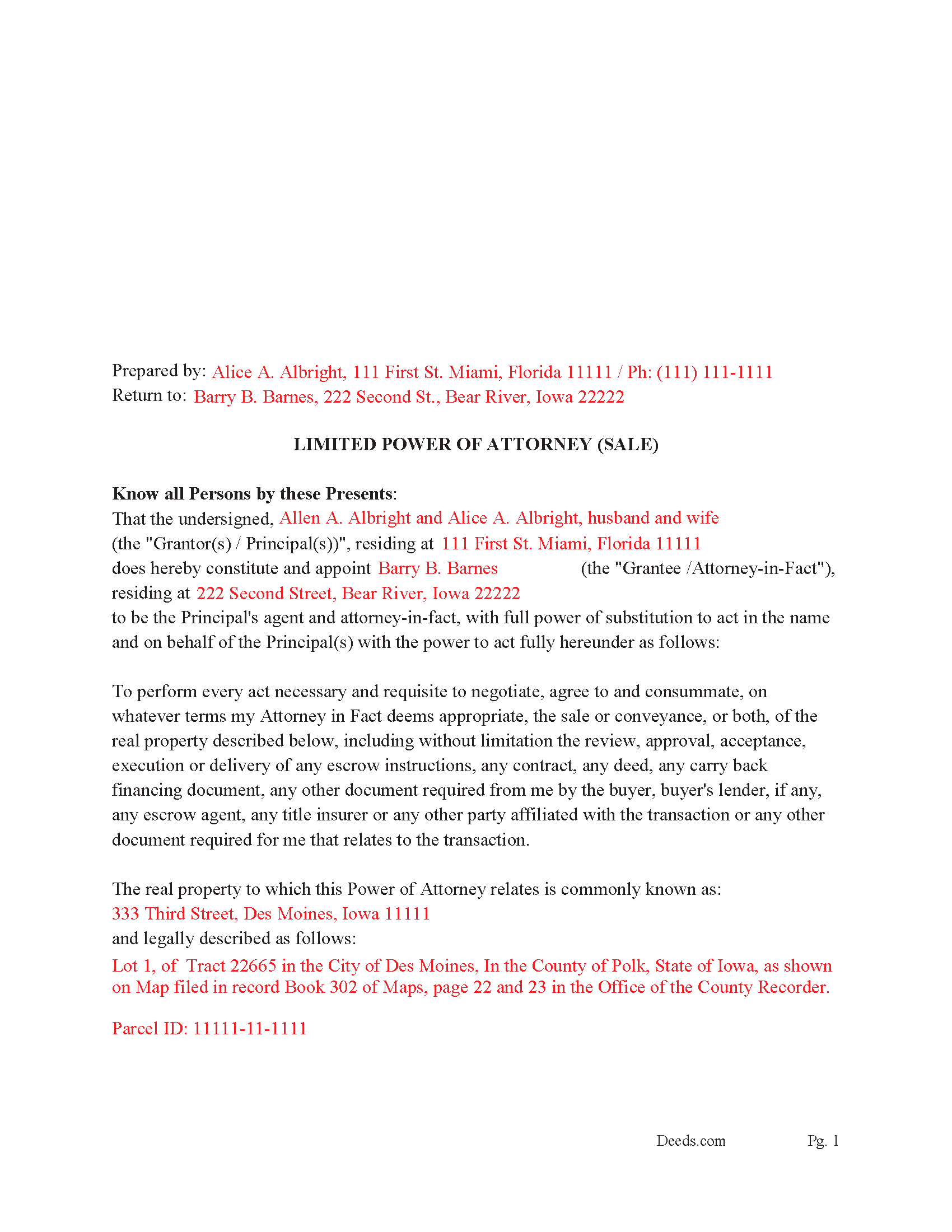

Linn County Completed Example of the Limited Power of Attorney Document

Example of a properly completed form for reference.

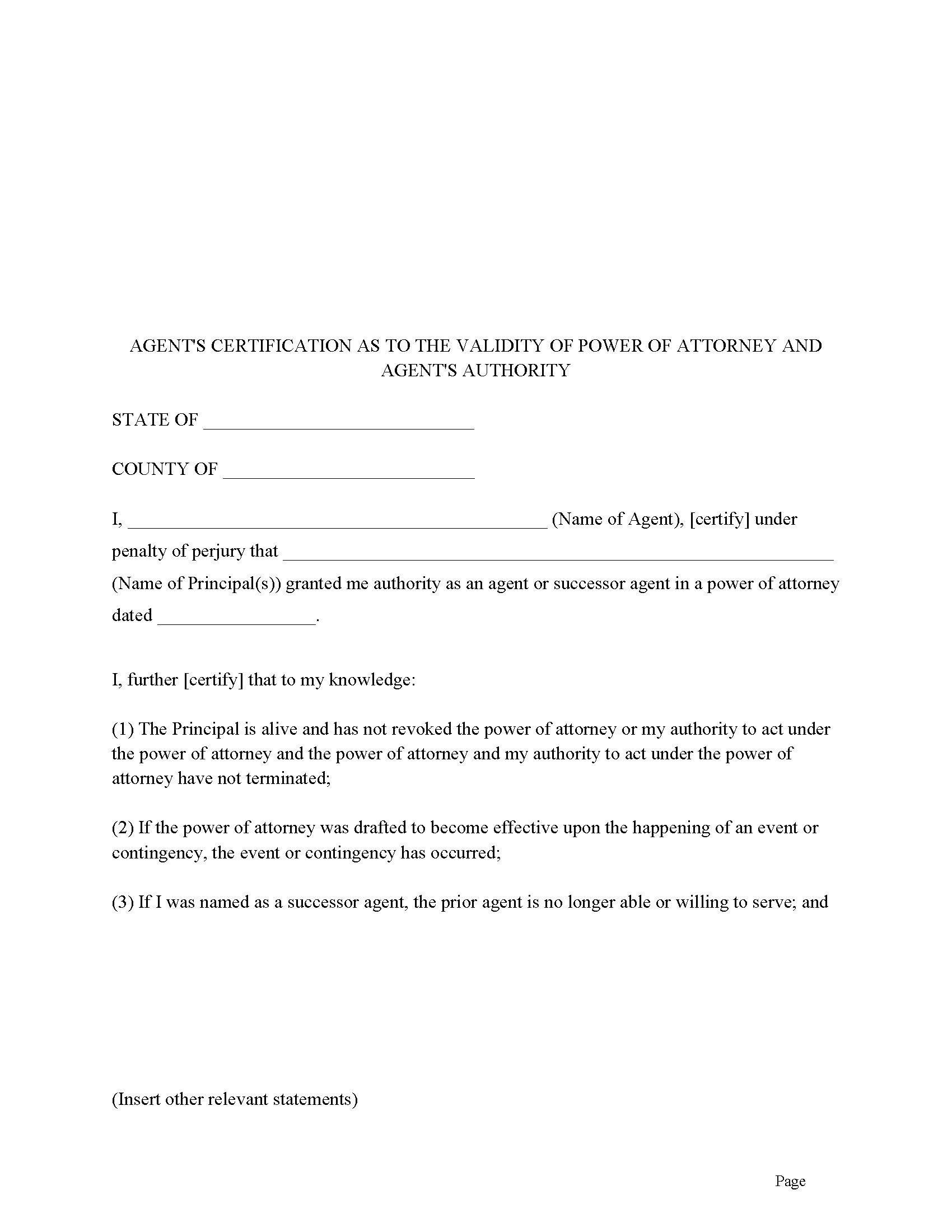

Linn County Agents Certification Form

Fill in the blank Limited Power of Attorney for the Sale of Real Property form formatted to comply with all Iowa recording and content requirements.

All 4 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Iowa and Linn County documents included at no extra charge:

Where to Record Your Documents

Linn County Recorder

Cedar Rapids, Iowa 52404

Hours: 8:00am to 5:00pm Monday through Friday

Phone: (319) 892-5420

Recording Tips for Linn County:

- White-out or correction fluid may cause rejection

- Double-check legal descriptions match your existing deed

- Avoid the last business day of the month when possible

- Recording fees may differ from what's posted online - verify current rates

Cities and Jurisdictions in Linn County

Properties in any of these areas use Linn County forms:

- Alburnett

- Cedar Rapids

- Center Point

- Central City

- Coggon

- Ely

- Fairfax

- Hiawatha

- Lisbon

- Marion

- Mount Vernon

- Palo

- Prairieburg

- Robins

- Springville

- Toddville

- Troy Mills

- Viola

- Walker

Hours, fees, requirements, and more for Linn County

How do I get my forms?

Forms are available for immediate download after payment. The Linn County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Linn County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Linn County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Linn County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Linn County?

Recording fees in Linn County vary. Contact the recorder's office at (319) 892-5420 for current fees.

Questions answered? Let's get started!

Use this Limited Power of Attorney to appoint an Agent to sell a specific property. In the form the principal empowers the agent to perform every act necessary and requisite to negotiate, agree to and consummate, on whatever terms your Attorney in Fact deems appropriate, the sale or conveyance, or both, of the real property described, including without limitation the review, approval, acceptance, execution or delivery of any escrow instructions, any contract, any deed, any carry back financing document, any other document required from you by the buyer, buyer's lender, if any, any escrow agent, any title insurer or any other party affiliated with the transaction or any other document required for you that relates to the transaction.

This power of attorney is not affected by any subsequent disability or incapacity of the principal and shall be considered a "Durable Power of Attorney." (ii) shall be governed, as to its validity, terms and enforcement, by those laws of the State of Iowa that apply to instruments negotiated, executed, delivered and performed solely within the State of Iowa.

Once completed this Limited Power of Attorney is recorded in the County where the subject property is located and (must be signed by the principal or in the principal's conscious presence by another individual, other than any prospective agent, directed by the principal to sign the principal's name on the power of attorney. A power of attorney must be acknowledged before a notary public or other individual authorized by law to take acknowledgments. An agent named in the power of attorney shall not notarize the principal's signature. An acknowledged signature on a power of attorney is presumed to be genuine.) (633B.105 Execution)

(Iowa Limited POA-Sale Package includes form, guidelines, and completed example)

Important: Your property must be located in Linn County to use these forms. Documents should be recorded at the office below.

This Limited Power of Attorney for the Sale of Real Property meets all recording requirements specific to Linn County.

Our Promise

The documents you receive here will meet, or exceed, the Linn County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Linn County Limited Power of Attorney for the Sale of Real Property form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4588 Reviews )

Cheryl W.

August 10th, 2019

Have yet to use. Appears over whelming, we will see.

Thank you for your feedback. We really appreciate it. Have a great day!

chris a.

February 17th, 2021

It was easy to complete the deed but on the third page I only need one signature in stead of 3 I need to delete 2 or put n//a in those blocks I will continue to use your services and have recommended it to others

Thank you for your feedback. We really appreciate it. Have a great day!

Janet R.

January 7th, 2019

Disappointed. Description of Lien discharge form does not indicate it is specific to Mechanic liens. I'm inexperienced with liens & should have contacted someone before I ordered.

Sorry to hear that, it does look like our product description was lacking clarity. We have updated the description to better reflect the documents. We have also canceled your order and refunded the payment. Hope you have a great day.

Carolyn A.

October 18th, 2019

Easy to use!!

Thank you!

Lynn S.

July 22nd, 2020

Great service. I did not have to put much thought into the process!!! Worth the $15.00 extra!!

Thank you for your feedback. We really appreciate it. Have a great day!

Pamela P.

April 10th, 2021

Access to all the necessary forms was easy. The detailed guide very helpful for ensuring a customer can fill out the documents accurately.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Heather A.

January 8th, 2019

quick response to e-mail. the forms are easy to use, fully explained.

Thank you for your feedback Heather, glad we could help.

Michael L.

April 6th, 2022

Thumbs up. Very pleased with service. Easy process.

Thank you!

Samantha B.

December 9th, 2020

Awesome service! This took care of my needs 10x faster than I thought possible. I even bought an extra service that wasn't needed to accomplish my end goal and they refunded me without me even asking. Highly recommend!

Thank you for your feedback. We really appreciate it. Have a great day!

Thomas J.

March 3rd, 2021

I'm pleased with the service

Thank you!

Nicholas B.

October 24th, 2020

A lot of information to read over but downloading process was great and ill definitely use the service again. Showed me my country and city that my forms would be valid in and the information is step by step with examples and that is great

Thank you for your feedback. We really appreciate it. Have a great day!

Maurice M.

January 29th, 2019

It was very convenient to be able to purchase the forms that I needed and save an extra trip downtown. I really appreciated the instructions that came with the forms.

Thank you Maurice. Have a great day!

Michael W.

February 7th, 2025

Excellent product. I am so happy I found Deeds.com!

Thank you for your feedback. We really appreciate it. Have a great day!

Sheryl L.

December 1st, 2021

EZ to use program....was able to print all forms ordered. I expect to go back to to use recording ability. Instructions are easily followed...would be nice to have confirmation included but they are available to purchase. Hope for successful recording of TOD affidavit. Pretty good value...attorney quoted well over the price I paid for package.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Shane T.

March 7th, 2020

The Transfer on Death Deed form package was very good. But like anything, could use some improvements. There is not enough space to fill more than one beneficiary with any level of additional detail like "as his sole and separate property" The area for the legal description could be a bit bigger and potentially fit many legal descriptions. Or it could be made to simply say "See Exhibit A" as is likely necessary for most anyway. The guide should indicate what "homestead property" means so the user doesn't have to research the legal definition. (which turns out to be obvious, at least in my state, if you live there, it's your homestead.) It would be helpful if an "Affidavit of Death" form were included in the package for instances where the current deed hasn't been updated to reflect a widowed owner as the sole owner before recording with only the one signature.

Thank you for your feedback. We really appreciate it. Have a great day!