Linn County Unconditional Waiver upon Progress Payment Form

Linn County Unconditional Waiver upon Progress Payment Form

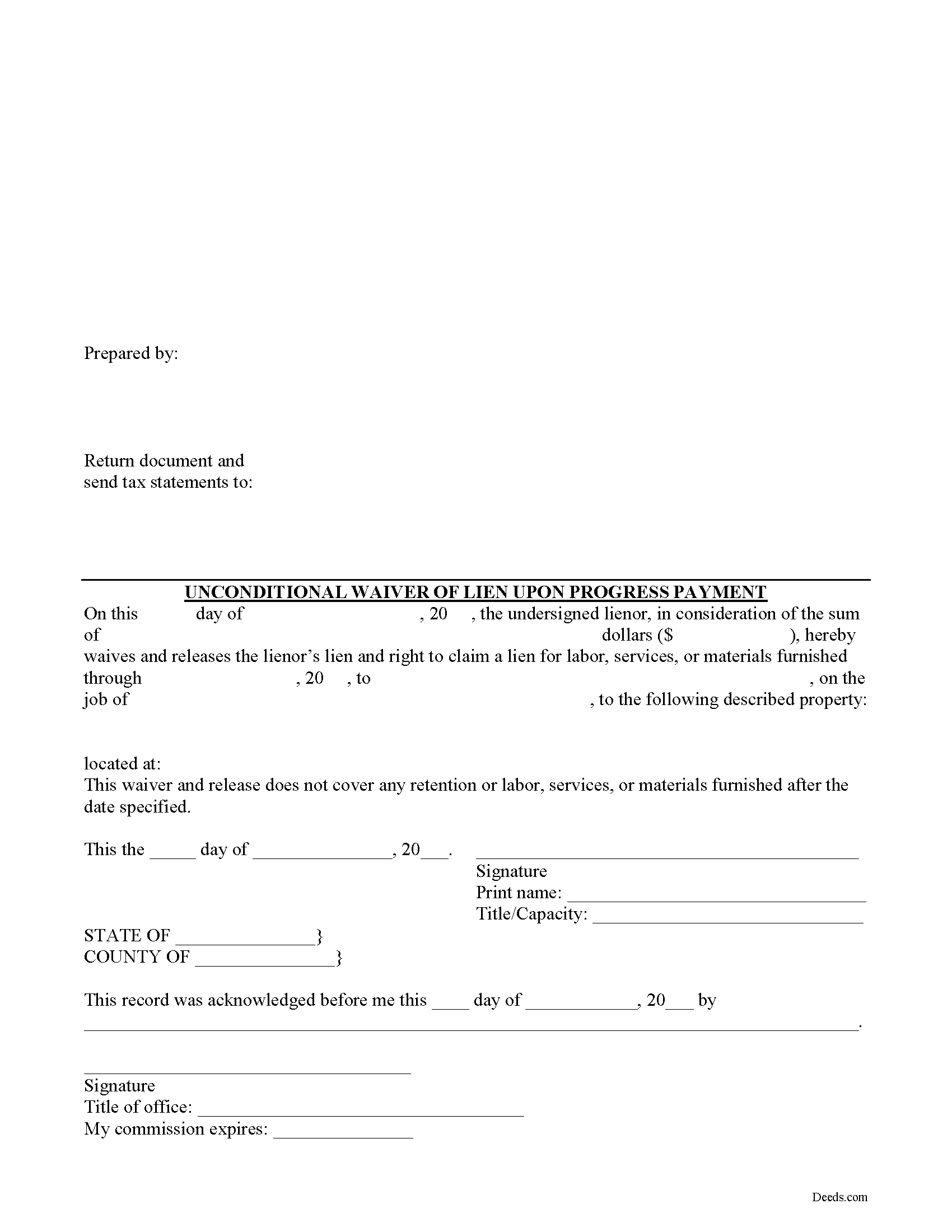

Fill in the blank Unconditional Waiver upon Progress Payment form formatted to comply with all Iowa recording and content requirements.

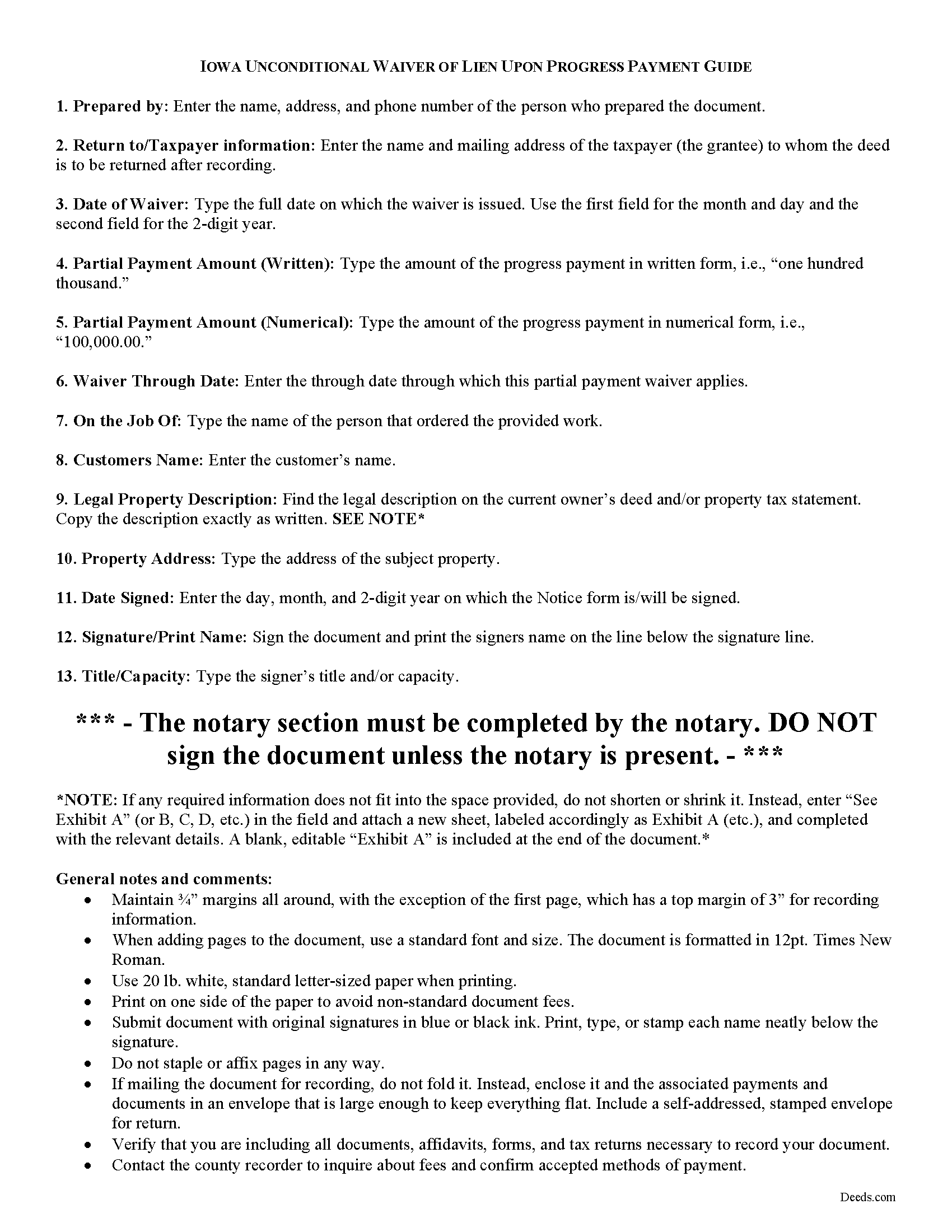

Linn County Unconditional Waiver upon Progress Payment Guide

Line by line guide explaining every blank on the Unconditional Waiver upon Progress Payment form.

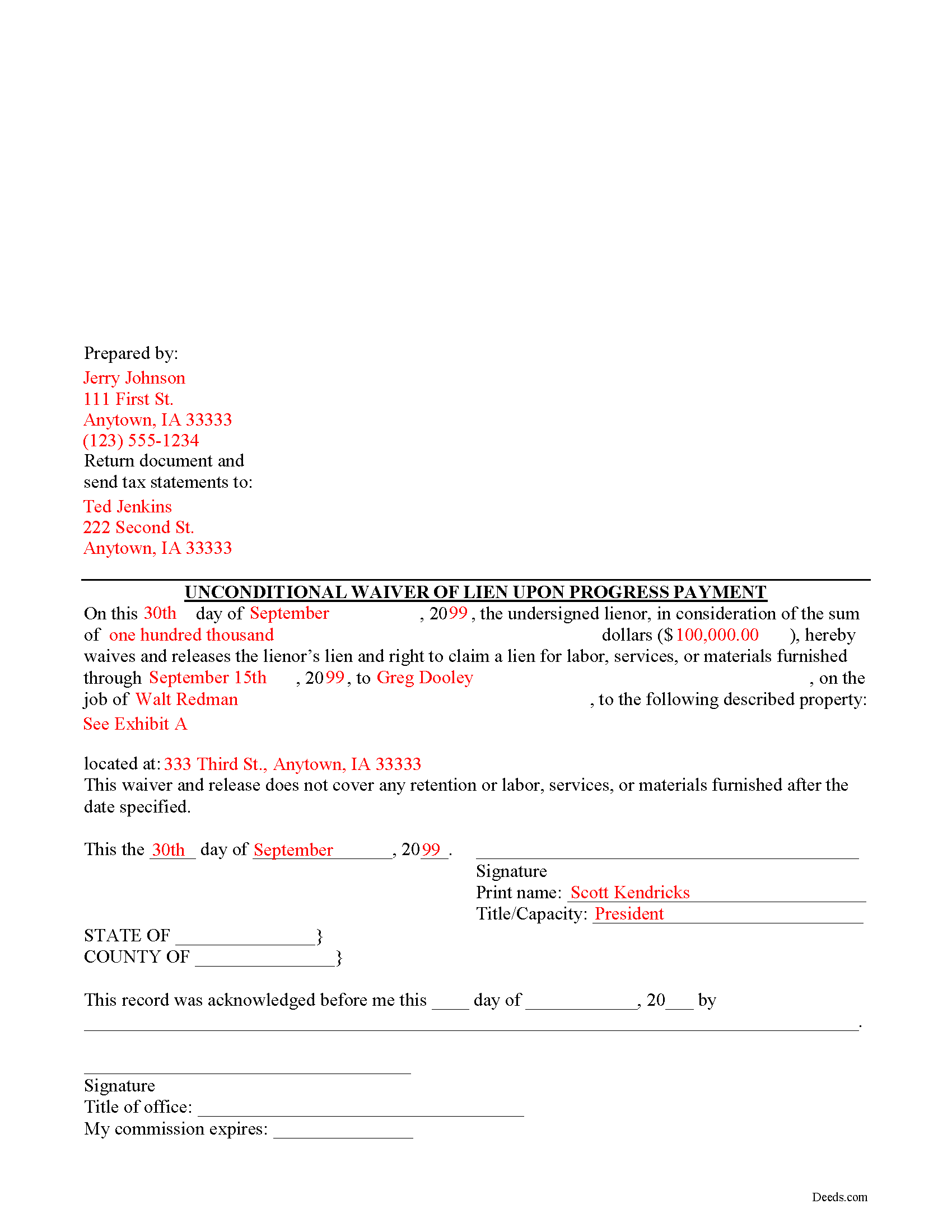

Linn County Completed Example of the Unconditional Waiver upon Progress Payment Document

Example of a properly completed Iowa Unconditional Waiver upon Progress Payment document for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Iowa and Linn County documents included at no extra charge:

Where to Record Your Documents

Linn County Recorder

Cedar Rapids, Iowa 52404

Hours: 8:00am to 5:00pm Monday through Friday

Phone: (319) 892-5420

Recording Tips for Linn County:

- Documents must be on 8.5 x 11 inch white paper

- White-out or correction fluid may cause rejection

- Ask for certified copies if you need them for other transactions

Cities and Jurisdictions in Linn County

Properties in any of these areas use Linn County forms:

- Alburnett

- Cedar Rapids

- Center Point

- Central City

- Coggon

- Ely

- Fairfax

- Hiawatha

- Lisbon

- Marion

- Mount Vernon

- Palo

- Prairieburg

- Robins

- Springville

- Toddville

- Troy Mills

- Viola

- Walker

Hours, fees, requirements, and more for Linn County

How do I get my forms?

Forms are available for immediate download after payment. The Linn County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Linn County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Linn County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Linn County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Linn County?

Recording fees in Linn County vary. Contact the recorder's office at (319) 892-5420 for current fees.

Questions answered? Let's get started!

Mechanic's liens are governed under Chapter 572 of Iowa Code. A waiver is a conscious relinquishment of a right. In this case, the person granting the waiver is relinquishing the right to seek a mechanic's lien for all or part of the amount due. This assurance is usually enough to get the other party to pay. In Iowa, there are no statutory forms for waivers although according to the principles of contract law, the parties may agree to such modifications in writing.

Generally, waivers come in four varieties: conditional or unconditional, and based on a partial/progress or final payment. Conditional waivers only become effective after the responsible party's check clears the bank on which it was drawn, and provide more protection for the claimants. Unconditional waivers go into effect immediately, tend to favor the owners' interests, and should only be used after payment is confirmed. Waiving lien rights after a partial payment allows the claimant to retain some lien rights, but to release others based on the amount paid on the overall balance due. Waivers upon final payments remove the claimant's eligibility to place a lien because they state that the account is paid in full.

Regardless of the nature, waivers must identify the parties, the location of the project, relevant dates, and payments.

An unconditional waiver is effective when signed and given to the property owner, and waives part of the lien amount representing the partial payment made. Unconditional waivers are effective regardless if payment is actually made. So if accepting a payment via check, only use an unconditional waiver if there are no doubts about whether the check will clear the bank.

This article is provided for informational purposes only and should not be relied upon as a substitute for the advice from a legal professional. Please contact an Iowa attorney with any questions about sending notice to property owners or anything else with regard to mechanic's liens.

Important: Your property must be located in Linn County to use these forms. Documents should be recorded at the office below.

This Unconditional Waiver upon Progress Payment meets all recording requirements specific to Linn County.

Our Promise

The documents you receive here will meet, or exceed, the Linn County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Linn County Unconditional Waiver upon Progress Payment form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4580 Reviews )

Mary P.

February 11th, 2019

Excellent easy to follow instructions.

Great to hear Mary, Have a wonderful day!

Van S.

March 25th, 2022

Easy to use...very informative...ttook care of exactly what I was looking for.

Thank you for your feedback. We really appreciate it. Have a great day!

Brian H.

May 1st, 2019

Forms are good. But need to be able to fill in information and blanks so these can be filed. Disappointed.

Thank you for your feedback. The forms are fill in the blank, Adobe PDFs. As is noted on the site, make sure you download the documents to your computer and open them with Adobe. Sounds like you may be trying to complete them online in your browser.

Monica M.

September 15th, 2020

I was very impressed with the quick responses I received from my questions. Usually when forced to communicate via email, responses aren't received right away. Thank you for being on top of things.

Thank you!

Nancy C.

August 2nd, 2019

So easy and documents downloaded in a flash. Highly recommended. Just gotta fill out and submit done. Thank You

Thank you!

Elma Jean B.

June 11th, 2023

My experience was great! Thank you, ejb

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Maribel I.

September 15th, 2022

It would be helpful to be able to edit verbiage on the form. I was preparing a Deed of Distribution; therefore, there was no consideration paid. I had to type the language into a Word document instead.

Thank you for your feedback. We really appreciate it. Have a great day!

DON O.

December 16th, 2020

needs to be more user friendly

Thank you for your feedback. We really appreciate it. Have a great day!

Joan E S.

June 10th, 2022

appreciate the ease of finding a group of forms without the need for a lawyer--the time and expense--for a basic transfer of joint tenancy following a death.

Thank you!

Nancy E.

April 25th, 2023

Easy to complete. I would suggest, since it is 2 pages, make a bigger space for land descriptions & sources.

Thank you for your feedback. We really appreciate it. Have a great day!

Justine John S.

February 17th, 2022

Splendid! I will definitely and absolutely recommend you guys and this company to my co-investors !

Thank you!

franklin m.

October 14th, 2020

good format, helpful instructions

Thank you!

Elango R.

November 9th, 2020

It was so easy to use the site and got recording done in a day. Very happy with experience.

Thank you!

Catherine R.

August 7th, 2019

What a great way to put my mind at ease. It was easy to fill out and printed out nicely.

Thank you for your feedback. We really appreciate it. Have a great day!

brenda S.

March 1st, 2019

Excellent instructions very easy to follow!

Thank you!