Norfolk County Estate Tax Affidavit Form

Norfolk County Estate Tax Affidavit Form

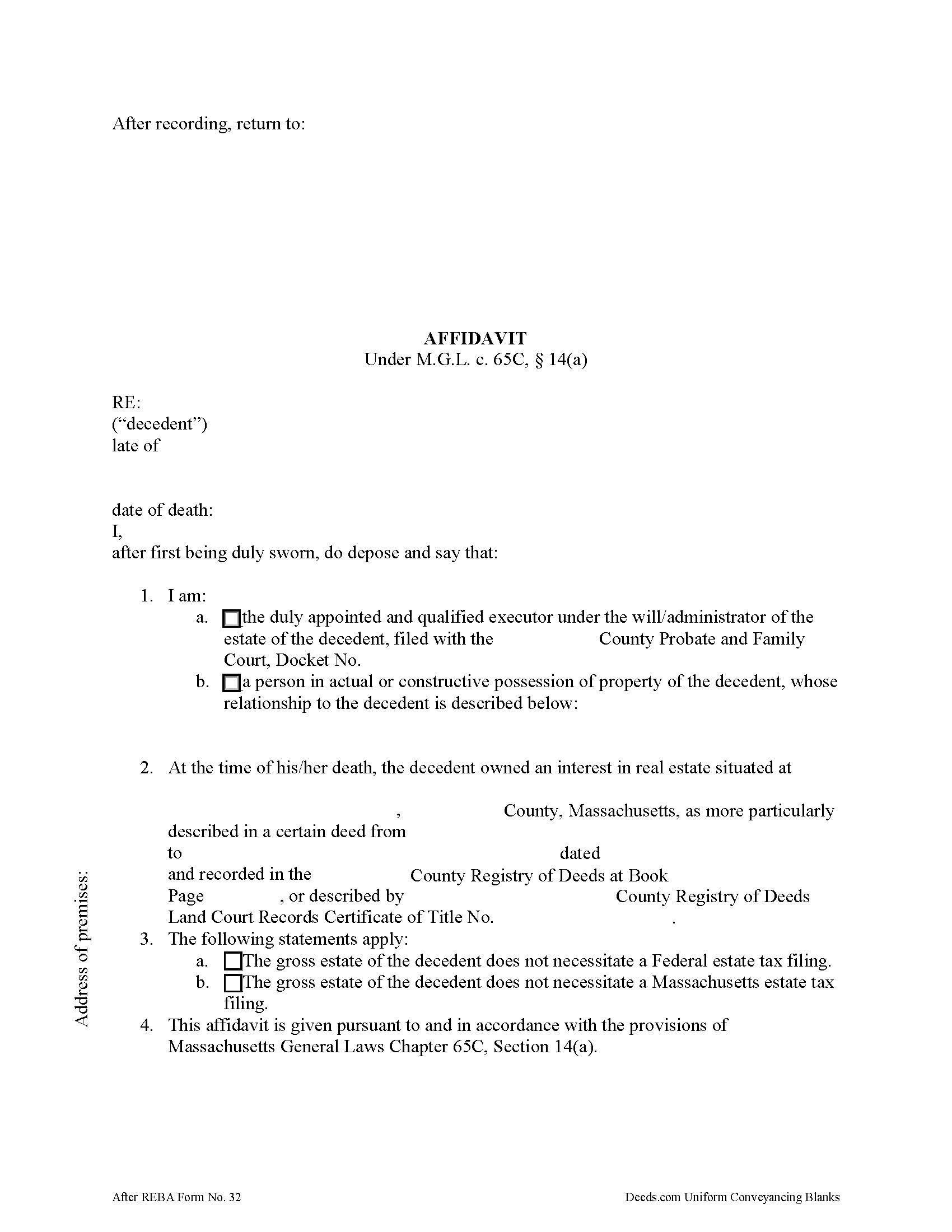

Fill in the blank form formatted to comply with all recording and content requirements.

Norfolk County Estate Tax Affidavit Guide

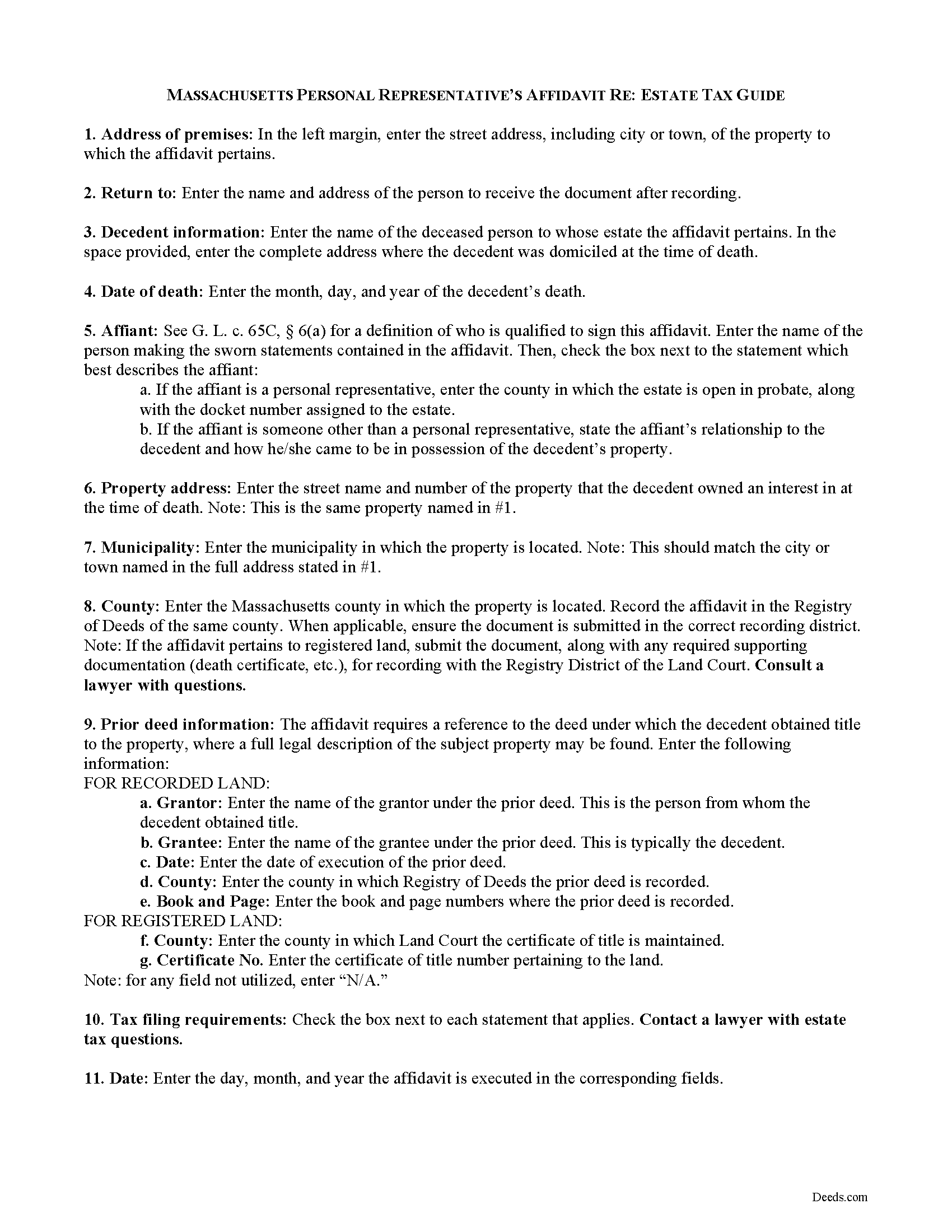

Line by line guide explaining every blank on the form.

Norfolk County Completed Example of the Estate Tax Affidavit Document

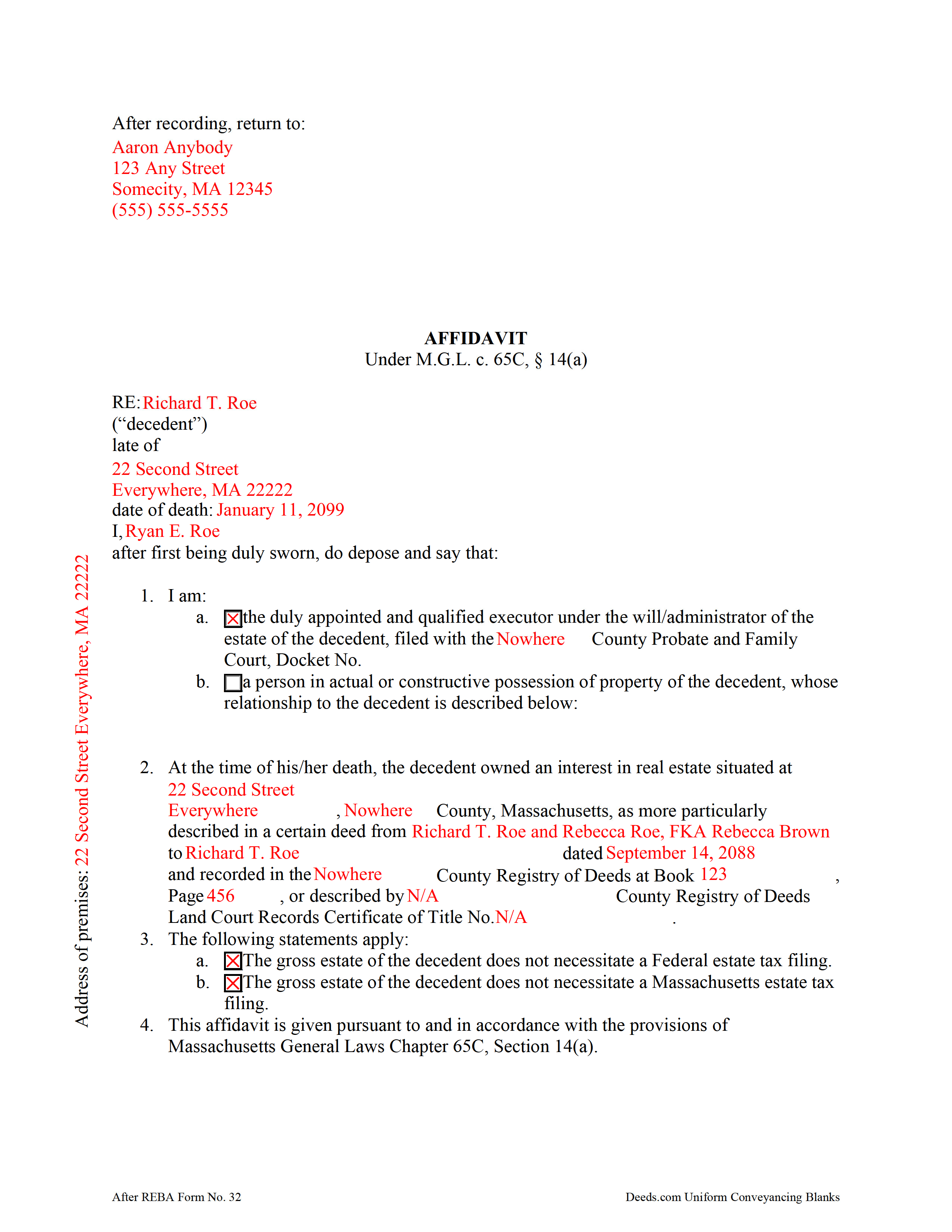

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Massachusetts and Norfolk County documents included at no extra charge:

Where to Record Your Documents

Norfolk County Registry of Deeds

Dedham, Massachusetts 02026-0069

Hours: 8:30 to 4:30 M-F / Recording: 9:00 to 4:00

Phone: (781) 461-6101

Recording Tips for Norfolk County:

- Bring your driver's license or state-issued photo ID

- Recorded documents become public record - avoid including SSNs

- Recording early in the week helps ensure same-week processing

Cities and Jurisdictions in Norfolk County

Properties in any of these areas use Norfolk County forms:

- Avon

- Babson Park

- Bellingham

- Braintree

- Brookline

- Brookline Village

- Canton

- Cohasset

- Dedham

- Dover

- East Walpole

- East Weymouth

- Foxboro

- Franklin

- Holbrook

- Medfield

- Medway

- Millis

- Milton

- Milton Village

- Needham

- Needham Heights

- Norfolk

- North Weymouth

- Norwood

- Plainville

- Quincy

- Randolph

- Sharon

- Sheldonville

- South Walpole

- South Weymouth

- Stoughton

- Walpole

- Wellesley

- Wellesley Hills

- Westwood

- Weymouth

- Wrentham

Hours, fees, requirements, and more for Norfolk County

How do I get my forms?

Forms are available for immediate download after payment. The Norfolk County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Norfolk County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Norfolk County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Norfolk County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Norfolk County?

Recording fees in Norfolk County vary. Contact the recorder's office at (781) 461-6101 for current fees.

Questions answered? Let's get started!

In Massachusetts, upon death, a lien attaches to a decedent's real property for ten years, or until the estate tax is paid, or an affidavit showing that the decedent's gross estate does not require an estate tax filing is recorded by a personal representative (or other qualified person under G. L. c. 65C, 6(a)) in the Registry of Deeds.

Use the affidavit of estate tax under M.G.L. c. 65C, 14(a) to release the lien on the decedent's property. The affidavit should include the name, address, and date of death of the decedent. The affiant shall indicate whether he/she is the personal representative of the decedent's probated estate, or, if the property is not subject to probate, then the affiant's relationship to the decedent.

The document's recitals also include the address of the premises affected and the prior instrument containing a legal description of the property. All statements contained within the affidavit are made by the affiant on penalty of perjury and sworn to before a notary public.

Contact a lawyer with questions about the Massachusetts estate tax and affidavits relating to decedents' estates in the Commonwealth of Massachusetts.

(Massachusetts ETA Package includes form, guidelines, and completed example)

Important: Your property must be located in Norfolk County to use these forms. Documents should be recorded at the office below.

This Estate Tax Affidavit meets all recording requirements specific to Norfolk County.

Our Promise

The documents you receive here will meet, or exceed, the Norfolk County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Norfolk County Estate Tax Affidavit form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

John S.

June 29th, 2021

Your service is refreshingly clear, simple, and free of superfluous claims or unnecessary marketing. And, more affordable than other online legal document providers I've looked at. So nice! I forgot I had used it some years ago for another deed so glad you are still around for this time.

Thank you for the kind words John. Have a fantastic day!

RAUL G.

October 14th, 2019

Very pleased with the service, easy to download and print

Thank you for your feedback. We really appreciate it. Have a great day!

Sophia G.

February 11th, 2022

Hassle free service , and don't have to wait in line

Thank you for your feedback. We really appreciate it. Have a great day!

Margaret S.

March 16th, 2020

Great experience, quick and easy, thank you!

Thank you for your feedback. We really appreciate it. Have a great day!

RONALD F.

July 24th, 2020

Great service. Very reasonable cost. All necessary detailed information provided.

Thank you for your feedback. We really appreciate it. Have a great day!

Sam A.

September 26th, 2022

User friendly website and deeds are very easy to maneuver. I'm very happy with everything Deeds.com has to offer. It truly helped me with the business that I had to take care of.

Thank you!

Darrell W.

November 10th, 2021

Fast and easy to use. Nice to have available online.

Thank you for your feedback. We really appreciate it. Have a great day!

Patricia C.

December 29th, 2021

Deeds.com saved me time and research by offering a beneficiary deed and full instructions for filling it out. My home will now pass directly to my only son without probate. This form and other complimentary forms was an excellent value.

Thank you for your feedback. We really appreciate it. Have a great day!

Karen W.

October 18th, 2021

Great experience. Easy.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Donna M.

November 22nd, 2021

Appreciated the ability to not only download the form but the instruction's AND a sample.

Thank you for your feedback. We really appreciate it. Have a great day!

Marcia D.

March 16th, 2023

Excellent... This website was awesome. Exactly what I was looking for.

Thank you!

Roger A.

November 2nd, 2023

Easy peasy to use! It's great to have the guide for completing the form and an example of a completed form.

It was a pleasure serving you. Thank you for the positive feedback!

james B.

May 10th, 2021

Downloaded quickly and saved to hard drive easily. I then opened in Adobe Acrobat Reader DC then was able to enter and save data in appropriate blanks. Yes, worth $22.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Elizabeth K.

November 25th, 2023

I found what I needed easily.

We are delighted to have been of service. Thank you for the positive review!

Mary H.

January 31st, 2019

Your site was very informative and I was able to instantly and easily download the documents that I needed. I could not be happier with your service. Thank You Mary Harju

Thank you Mary, we really appreciate your feedback.