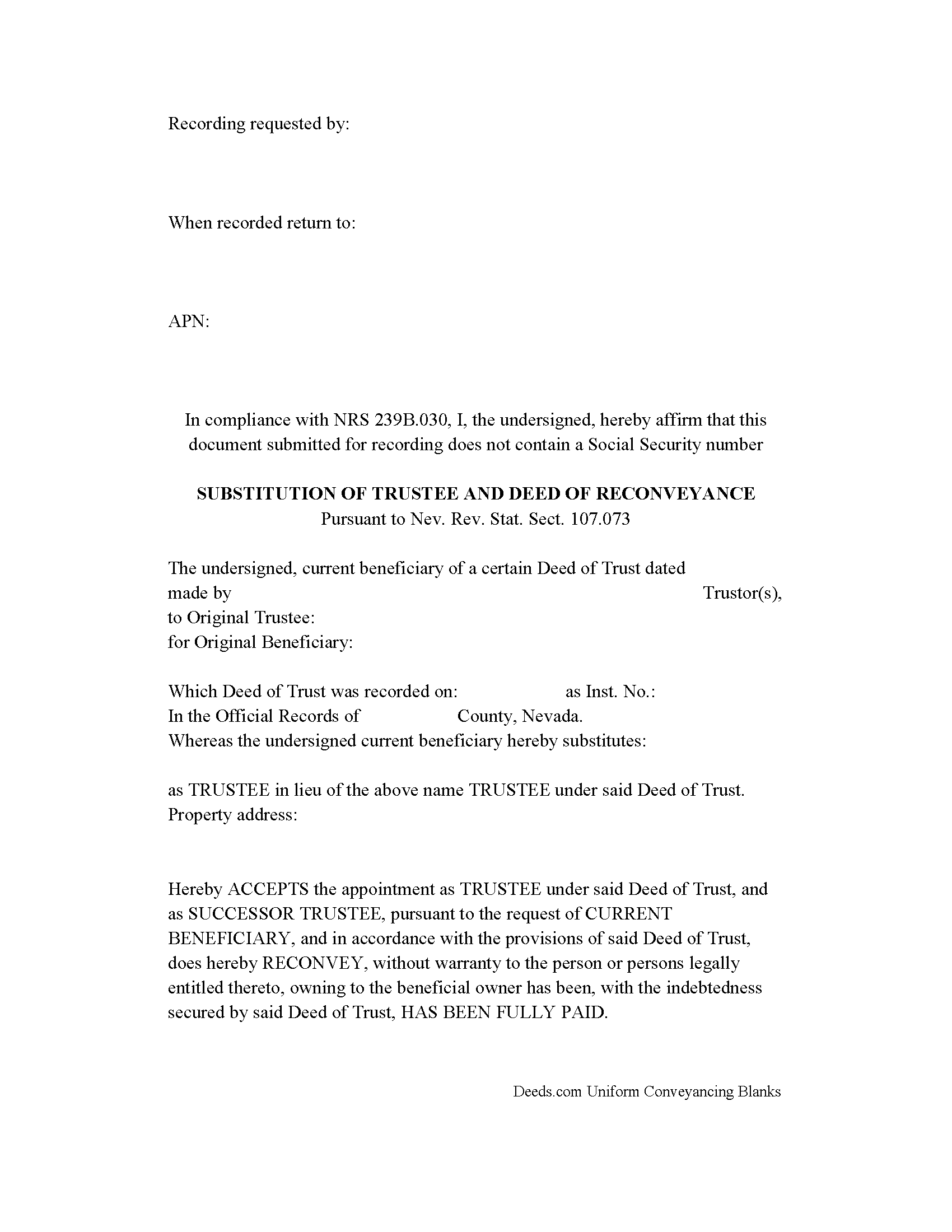

Elko County Substitution of Trustee and Deed of Reconveyance (For Deed of Trust) Form

Elko County Substitution of Trustee and Deed of Full Reconveyance Form

Fill in the blank form formatted to comply with all recording and content requirements.

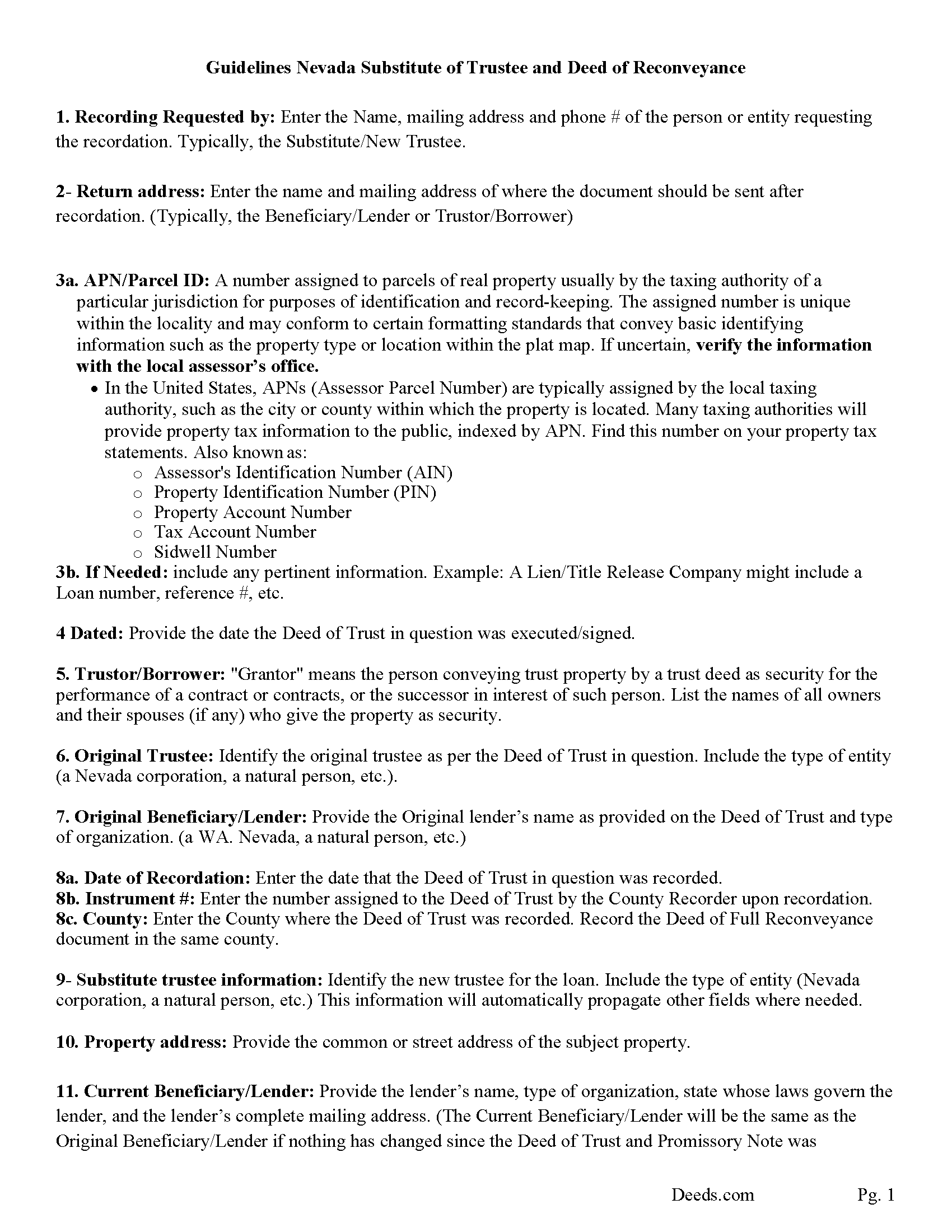

Elko County Substitution of Trustee and Deed of Reconveyance Guide

Line by line guide explaining every blank on the form.

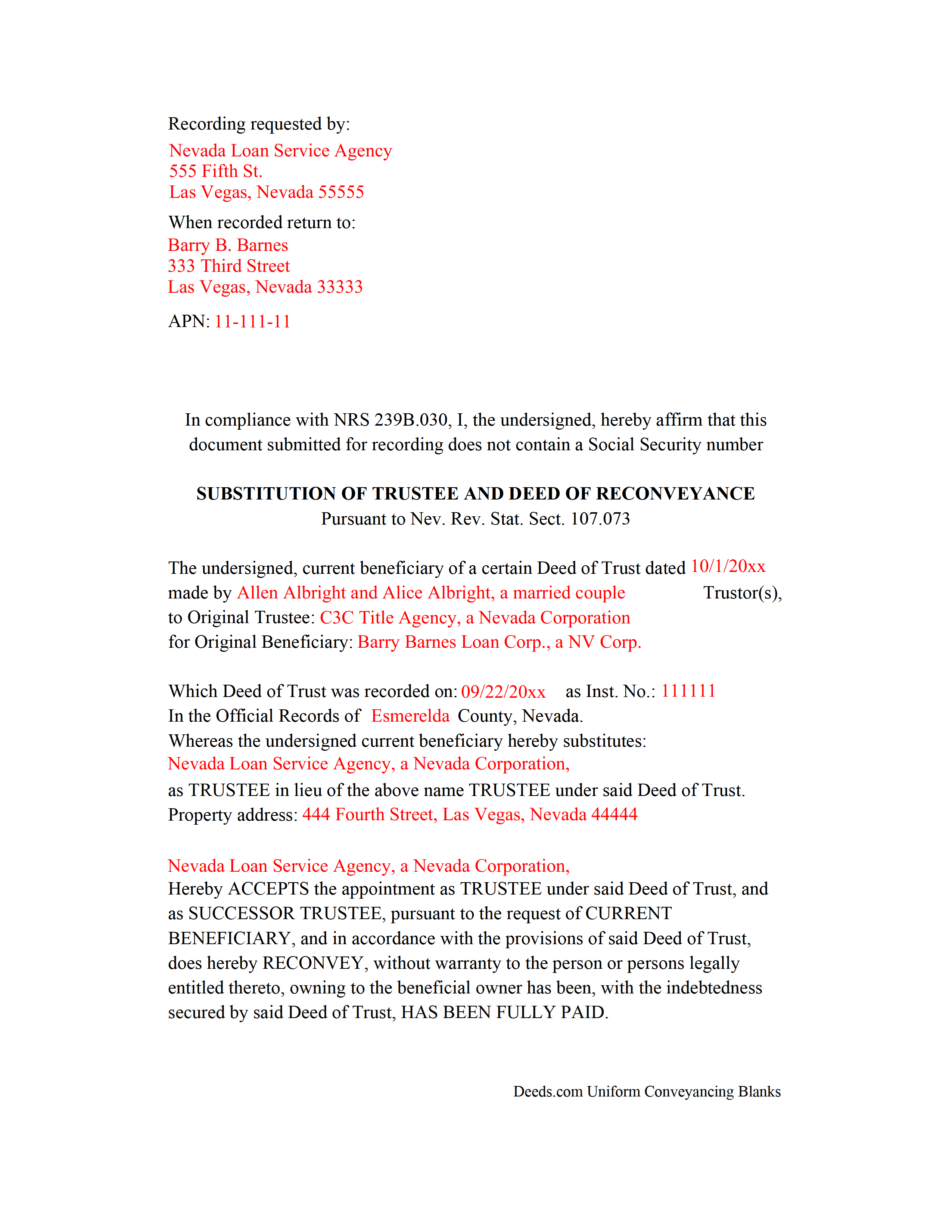

Elko County Completed Example of the Substitute and Reconveyance

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Nevada and Elko County documents included at no extra charge:

Where to Record Your Documents

Elko County Recorder

Elko, Nevada 89801

Hours: 8:00 to 5:00 M-F

Phone: (775) 738-6526

Recording Tips for Elko County:

- Double-check legal descriptions match your existing deed

- Check margin requirements - usually 1-2 inches at top

- Leave recording info boxes blank - the office fills these

- Recorded documents become public record - avoid including SSNs

- Both spouses typically need to sign if property is jointly owned

Cities and Jurisdictions in Elko County

Properties in any of these areas use Elko County forms:

- Carlin

- Deeth

- Elko

- Halleck

- Jackpot

- Jarbidge

- Lamoille

- Montello

- Mountain City

- Owyhee

- Ruby Valley

- Spring Creek

- Tuscarora

- Wells

- West Wendover

Hours, fees, requirements, and more for Elko County

How do I get my forms?

Forms are available for immediate download after payment. The Elko County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Elko County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Elko County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Elko County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Elko County?

Recording fees in Elko County vary. Contact the recorder's office at (775) 738-6526 for current fees.

Questions answered? Let's get started!

When a promissory note secured by a Deed of Trust is paid off, the beneficiary/lender contacts the trustee and notifies him/her to reconvey title to the Trustor/borrower. If the original Trustee is unavailable or can't act, a substitute trustee is typically chosen. This form allows the lender to choose a new trustee and authorizes the new trustee to reconvey title by recording the form. This form can be exercised by the original beneficiary/lender or a secondary beneficiary/lender who may have purchased/inherited the promissory note.

Use this document when the subject "Deed of Trust" has been recorded formatted Pursuant to Nev. Rev. Stat. Sect. 107.073 (If the deed of trust has been recorded by a microfilm or other photographic process, a marginal release may not be used and an acknowledged reconveyance of the deed of trust must be recorded.) (NRS 107.073(2))

Typically, within 21 day after satisfaction of debt, the lender delivers to the (trustee or trustor/) borrower (the original note and deed of trust), (if the beneficiary)/lender (is in possession of those documents). The lender will also (execute a request to reconvey the estate in real property conveyed to the trustee by the grantor)/trustor/borrower. (NRS107.077(1))

If the Promissory Note secured, (by a Deed of Trust is made on or after October 1, 1991), (is paid or otherwise satisfied or discharged, and a properly executed request to reconvey is received by the trustee, the trustee shall cause to be recorded a reconveyance of the deed of trust.). This is required (within 45 days.) (NRS107.077(2))

(If the beneficiary fails to deliver to the trustee a properly executed request to reconvey pursuant to subsection 1, or if the trustee fails to cause to be recorded a reconveyance of the deed of trust pursuant to subsection 2, the beneficiary or the trustee, as the case may be, is liable in a civil action to the grantor, his or her heirs or assigns in the sum of $1,000, plus reasonable attorney's fees and the costs of bringing the action, and the beneficiary or the trustee is liable in a civil action to any party to the deed of trust for any actual damages caused by the failure to comply with the provisions of this section and for reasonable attorney's fees and the costs of bringing the action.) (NRS107.077(3))

(Nevada SOT and DOR Package includes form, guidelines, and completed example) For use in Nevada only.

Important: Your property must be located in Elko County to use these forms. Documents should be recorded at the office below.

This Substitution of Trustee and Deed of Reconveyance (For Deed of Trust) meets all recording requirements specific to Elko County.

Our Promise

The documents you receive here will meet, or exceed, the Elko County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Elko County Substitution of Trustee and Deed of Reconveyance (For Deed of Trust) form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4578 Reviews )

THOMAS C.

September 16th, 2020

Thank you for the fine, easy to implement service.

Thank you for your feedback. We really appreciate it. Have a great day!

samantha b.

February 18th, 2019

excellent instructions and the examples made completing the forms so very simple. thanks so much.

Thank you Samantha.

Mark B.

March 8th, 2021

I had to download forms one by one: would be more convenient to have a single download for all.

Thank you for your feedback. We really appreciate it. Have a great day!

Diana M.

June 25th, 2020

First time user - process went very smooth and fast. It took me a little to find my messages. At first I didn't know you process documents other than deeds so maybe you should consider putting on your home page that it's not only for deeds - it's for any document that needs recording. :)

Thank you for your feedback. We really appreciate it. Have a great day!

Kimberly B.

September 22nd, 2020

Absolutely recommend Deeds.com! The process to recording your document is explained step by step. If you have any questions, you just send a message and almost instantly a staff member will reply. Super quick processing. I uploaded my document late Friday afternoon, it was reviewed by Deeds.com staff and sent to the county for recording on Monday. By Tuesday, my document was successfully recorded by the County Recorder's Office and a copy of my recorded document was available for me, as well!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Susan M.

March 15th, 2022

Loved my experience with deeds.com! Easy and simple to fill in the form, plus the extra instructions were helpful! I will use them again!

Thank you for your feedback. We really appreciate it. Have a great day!

Lauren W.

October 30th, 2019

I took a chance and downloaded the Beneficiary Deed form -- would have liked to have been able to see the form before I paid, but I took a chance as everywhere else I looked online wanted me to fill out form online and then pay $30+ for each deed. I'm doing several, so I was glad to be able to just download the blank form that appears to be one I can directly type into on my computer. Yay! Would use your site again if needed. Thanks!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Anita C.

November 3rd, 2021

I found this site when looking for help filing a quitclaim deed to change my property deed to my married name. I received the correct forms, an example filled out, and a guide specific to my state. I have already submitted it for review to my county assessor's office (they were extremely helpful also) and it looks as if it should sail through. Thank you Deeds.com!

Thank you for your feedback. We really appreciate it. Have a great day!

Kathleen M.

December 29th, 2023

I am very happy with this service

Your kind words have brightened our teams day! Thank you for the positive feedback.

Janey M.

March 12th, 2019

Easy to use site. Just what I needed!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Richard S.

July 12th, 2019

Prompt and reliable service!!

Thank you!

Charles D.

December 14th, 2023

The included instructions and example made the document easy to complete. And the additional documents for no additional charge were nice.

Thank you for your feedback. We really appreciate it. Have a great day!

Ron E.

January 23rd, 2020

Seems like this is a very easy process to get what you need.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Tracy A.

April 27th, 2022

Thanks, it was a big help!!!

Thank you!

Donald B.

November 21st, 2021

Pretty good forms, they would probably be better if I read the directions but...

Thank you!