Pickaway County Disclaimer of Interest Form

Pickaway County Disclaimer of Interest Form

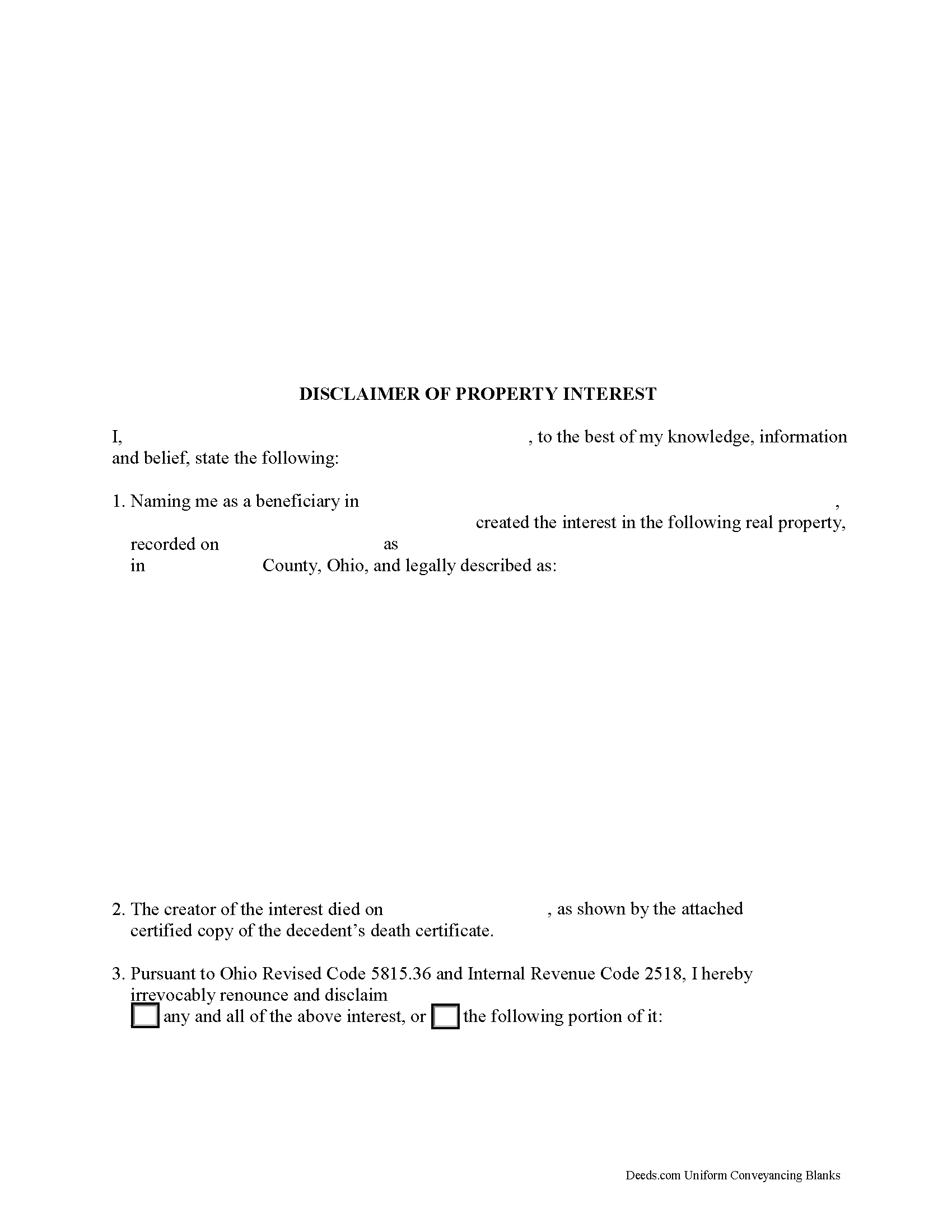

Fill in the blank form formatted to comply with all recording and content requirements.

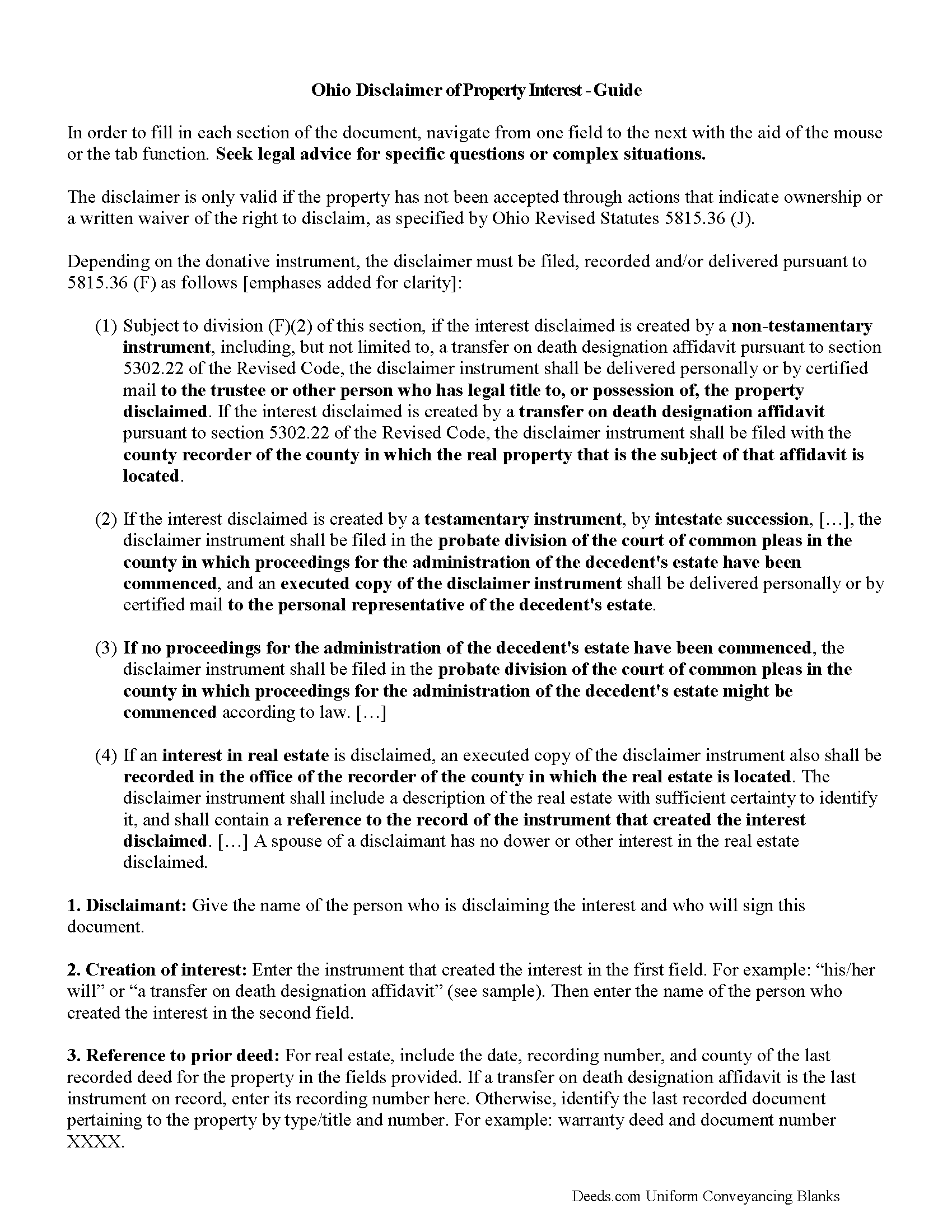

Pickaway County Disclaimer of Interest Guide

Line by line guide explaining every blank on the form.

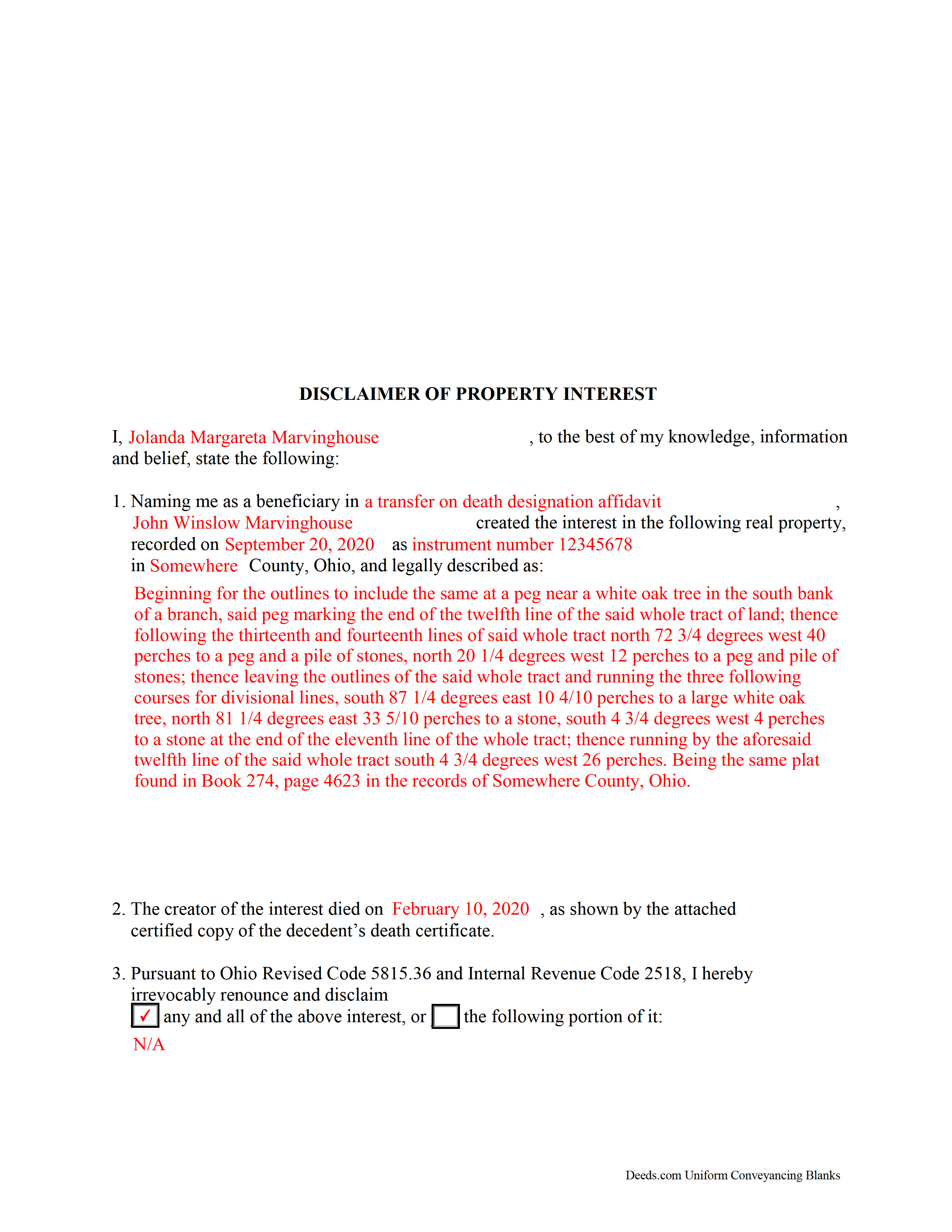

Pickaway County Completed Example of the Disclaimer of Interest Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Ohio and Pickaway County documents included at no extra charge:

Where to Record Your Documents

Pickaway County Recorder

Circleville, Ohio 43113

Hours: 8:00 a.m. - 4:00 p.m. Monday - Friday

Phone: (740) 474-5826

Recording Tips for Pickaway County:

- Ask if they accept credit cards - many offices are cash/check only

- Verify all names are spelled correctly before recording

- Make copies of your documents before recording - keep originals safe

- Bring extra funds - fees can vary by document type and page count

Cities and Jurisdictions in Pickaway County

Properties in any of these areas use Pickaway County forms:

- Ashville

- Circleville

- Commercial Point

- Derby

- New Holland

- Orient

- Tarlton

- Williamsport

Hours, fees, requirements, and more for Pickaway County

How do I get my forms?

Forms are available for immediate download after payment. The Pickaway County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Pickaway County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Pickaway County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Pickaway County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Pickaway County?

Recording fees in Pickaway County vary. Contact the recorder's office at (740) 474-5826 for current fees.

Questions answered? Let's get started!

A beneficiary of an interest in property in Ohio can disclaim all or part of a bequeathed interest in, or power over, that property under Ohio Revised Code 5815.36, as long as it has not been accepted through actions that indicate ownership or through a written waiver of the right to disclaim (Sec. J).

The written disclaimer must identify the donative instrument, which is the document that established the interest, such as a will or a transfer on death designation affidavit. The disclaimer also must contain a description of the disclaimed interest and a declaration of the disclaimer and its extent (Sec. B (3)). It must be signed by the disclaimant or a legally authorized representative

Depending on the donative instrument, the disclaimer must be filed, recorded and/or delivered pursuant to 5815.36 Sec. F as follows.

* If the interest is created by a non-testamentary instrument, including a transfer on death designation affidavit, the disclaimer must be delivered to the trustee or other person who holds legal title or possession of the property.

* In the case of an interest in real estate a transfer on death designation affidavit, the disclaimer must be filed with the recorder of the county in which the real property is located.

* If the interest is created by a testamentary instrument or by intestate succession, file the document in the probate division of the court of common pleas in the county in which proceedings for the administration of the decedent's estate have been commenced. In addition, deliver in person or send by certified mail an executed copy of the disclaimer instrument to the personal representative of the decedent's estate.

* If the interest is in real estate, execute a copy of the disclaimer and submit in the office of the recorder of the county in which the property is situated.

The Ohio statute is consistent with the Internal Revenue Code Section 2518, which requires that the disclaimer must be received no later than 9 months after the transfer is made (e.g. date of death). In order to be effective, the disclaimer must be irrevocable and binding to the disclaimant and all who claim under him or her (Sec. E). Be sure to consult an attorney when in doubt about the drawbacks and benefits of disclaiming inherited property.

(Ohio Disclaimer of Trust Package includes form, guidelines, and completed example)

Important: Your property must be located in Pickaway County to use these forms. Documents should be recorded at the office below.

This Disclaimer of Interest meets all recording requirements specific to Pickaway County.

Our Promise

The documents you receive here will meet, or exceed, the Pickaway County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Pickaway County Disclaimer of Interest form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4581 Reviews )

Gregory G.

April 4th, 2019

Quick and Easy/Immediate Access after payment. Now seeking other forms needed ASAP! Thanks!

Thank you!

James C.

October 20th, 2022

was very helpfull, It provided the refernces to the stat laws so I coul have a deeper look into the issue I was trying to deal with.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Lavonia L.

October 7th, 2024

Found exactly what I was looking for and it helped tremendously.

Thank you for your feedback. We really appreciate it. Have a great day!

Nancy B.

July 22nd, 2021

Very user-friendly. Looks like everything I needed in one place. Great job.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Robert L.

May 10th, 2022

I did not use your service. $19 to upload a document to our local tax accessor office is a bit high. I drove the document to the office myself.

Thank you for your feedback Robert. Glad to hear that you got your document recorded. Sorry to hear that your time, fuel, and wear on your vehicle are valued at less than $19. Have a wonderful day.

Robert S.

July 22nd, 2020

Process was easy to follow and worked as advertised. Thought the price was a little high.

Thank you!

Virginia K.

October 24th, 2021

Easy to use instructions and fast service delivery. I was kept up to date on the status of my filing.

Thank you!

Daniel B.

April 7th, 2023

Very well organized and easy to understand. Will probably use your service again in the future for other forms

Thank you for your feedback. We really appreciate it. Have a great day!

shaun s.

July 26th, 2019

Pretty quick and accurate, thank you

Thank you for your feedback. We really appreciate it. Have a great day!

Lillian F.

May 2nd, 2019

I LOVE THE EASE OF GETTING THE INFORMATION I REQUESTED. YOUR SERVICE IS MORE THAN WHAT I EXPECTED.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Monica U.

January 23rd, 2021

Thank You. Good Service. Questions were answered.

Thank you for your feedback. We really appreciate it. Have a great day!

Darrell S.

April 12th, 2020

Easy to follow forms, and the attached go-by and instructions made it easy to complete.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Brian M.

March 7th, 2024

The document had all the information needed but could have been presented with a more professional look for the price.

We appreciate you highlighting the balance between compliance and presentation. While our main focus is on the legal correctness and statutory compliance of the documents, we also strive to present this information in a clear and accessible manner.

Peggy R.

April 11th, 2022

Thank you it was quick and easy

Thank you!

Gloria C.

January 6th, 2021

AMazing service. Fast and affordable.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!