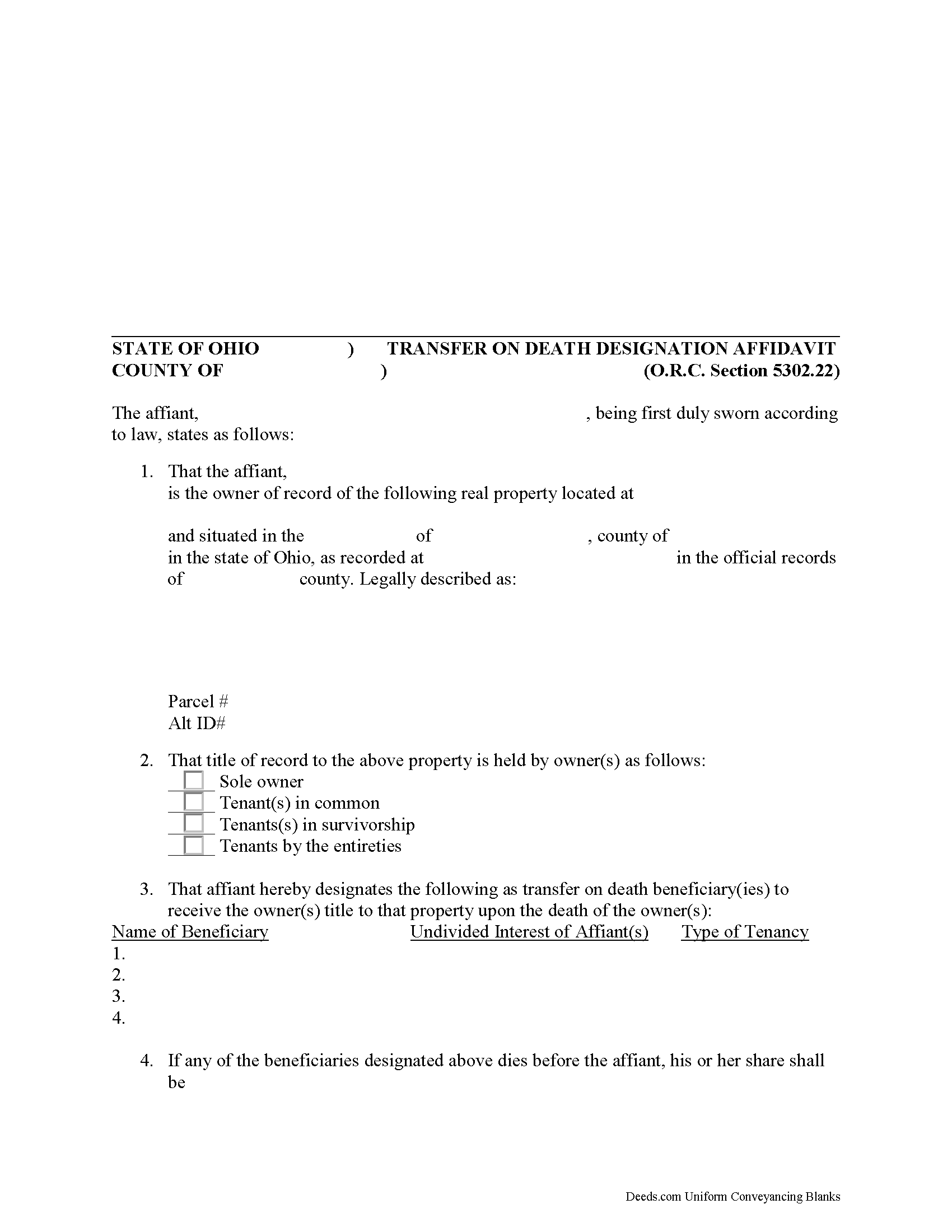

Hamilton County Transfer on Death Designation Affidavit Form

Hamilton County Transfer on Death Designation Affidavit

Fill in the blank form formatted to comply with all recording and content requirements.

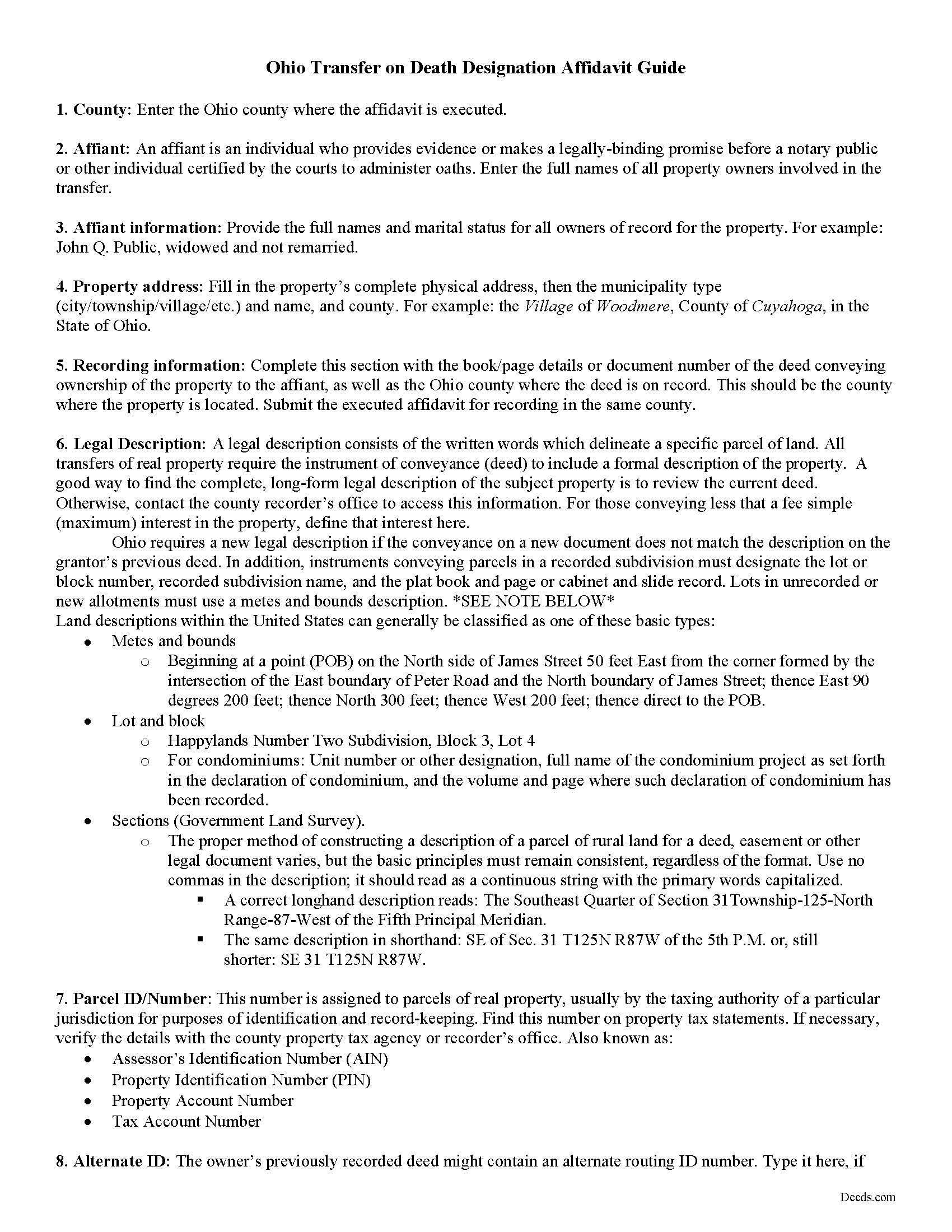

Hamilton County Transfer on Death Designation Affidavit Guide

Line by line guide explaining every blank on the form.

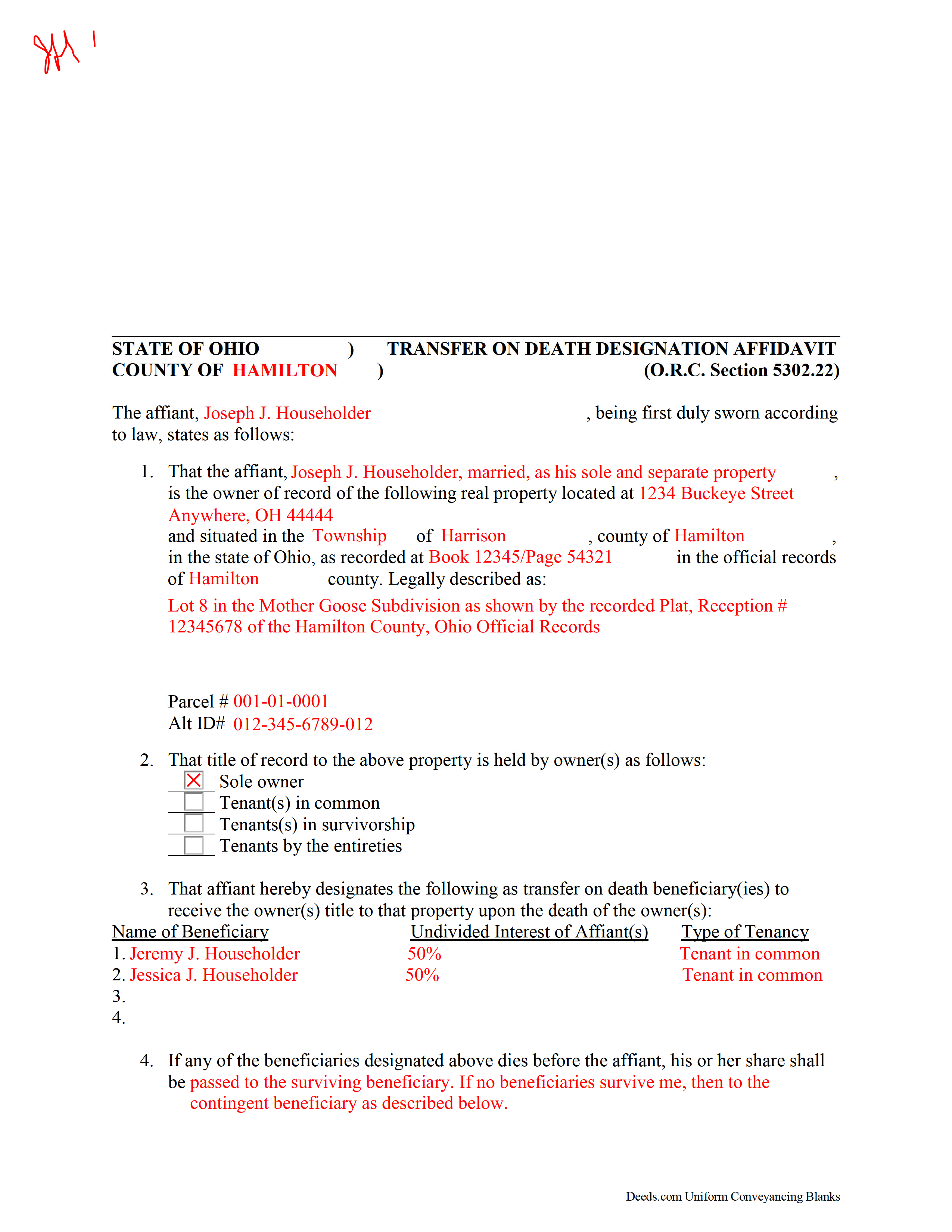

Hamilton County Completed Example of the Transfer on Death Designation Affidavit Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Ohio and Hamilton County documents included at no extra charge:

Where to Record Your Documents

Hamilton County Recorder

Cincinnati, Ohio 45202

Hours: 7:30 AM - 4:30 Monday - Friday pm EST. Recording until 4:15 pm.

Phone: (513) 946-4600 or 4588

Recording Tips for Hamilton County:

- Verify all names are spelled correctly before recording

- Check that your notary's commission hasn't expired

- Leave recording info boxes blank - the office fills these

- Ask about their eRecording option for future transactions

- Make copies of your documents before recording - keep originals safe

Cities and Jurisdictions in Hamilton County

Properties in any of these areas use Hamilton County forms:

- Addyston

- Camp Dennison

- Cincinnati

- Cleves

- Harrison

- Hooven

- Miamitown

- Mount Saint Joseph

- North Bend

- Terrace Park

Hours, fees, requirements, and more for Hamilton County

How do I get my forms?

Forms are available for immediate download after payment. The Hamilton County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Hamilton County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Hamilton County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Hamilton County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Hamilton County?

Recording fees in Hamilton County vary. Contact the recorder's office at (513) 946-4600 or 4588 for current fees.

Questions answered? Let's get started!

Authorized under section 5302.22 of the Ohio Revised Code, the Transfer on Death Designation Affidavit (TDDA) allows owners of real estate situated in Ohio to plan the conveyance of their property to designated beneficiaries after their death. The conveyance occurs separately from a will and without the need for probate. These instruments are known in other states as transfer on death deeds, beneficiary deeds, or Lady Bird deeds, and all fall under the heading of Non-probate Transfers on Death.

TDDAs are useful estate planning tools, because unlike "regular" deeds (warranty, grant, quitclaim, etc.), which permanently transfer the owner's interest in the property, the grantor retains full ownership and control of the property while alive, and may change the beneficiaries, modify the terms, or even sell the property with no restriction or penalty. This flexibility is possible because the grantor accepts no consideration from any of the beneficiaries.

In addition to meeting all state and local standards for recorded documents, TDDAs must include a statement by "the individual executing the affidavit that the individual is the person appearing on the record of the real property as the owner of the real property or interest in the real property at the time of the recording of the affidavit and the marital status of that owner." Married owners must include a statement by "the owner's spouse stating that the spouse's dower rights are subordinate to the vesting of title to the real property or interest in the real property in the transfer on death beneficiary or beneficiaries designated in the affidavit" (RC 5302.22(D)(3)). It must also designate "one or more persons, identified by name, as transfer on death beneficiary or beneficiaries" ( 5302.22(D)(4)).

File the completed and notarized affidavit for recording in the county where the property is located. NOTE THAT THE AFFIDAVIT IS ONLY VALID WHEN SUBMITTED FOR RECORDING WHILE THE GRANTOR IS STILL ALIVE.

The transfer of property rights is completed when the owner dies and the beneficiary completes and records an affidavit of confirmation under R.C. 5302.222.

Using this instrument might affect tax obligations or eligibility for certain income or asset-dependent programs. Please contact an attorney with questions about this or any other issues related to estate planning or transferring real property in Ohio.

(Ohio Transfer on Death Designation Package includes form, guidelines, and completed example)

Important: Your property must be located in Hamilton County to use these forms. Documents should be recorded at the office below.

This Transfer on Death Designation Affidavit meets all recording requirements specific to Hamilton County.

Our Promise

The documents you receive here will meet, or exceed, the Hamilton County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Hamilton County Transfer on Death Designation Affidavit form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4580 Reviews )

janice l.

June 12th, 2021

Exact form needed with perfect instructions. Easy Peazy! Just got my fully recorded document back today. Saved hundreds. Just make sure and read all the instructions .

Thank you for your feedback. We really appreciate it. Have a great day!

Susan S.

October 4th, 2019

Great forms, easy to understand and use (the guide helped a lot). Recorded with no issues. Will be back when needed.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Renee M.

September 15th, 2021

My sister in law is in a hospital ICU with Covid, so we were trying to get her affairs in order. Deeds.com made this difficult situation so much better by making this process very easy to understand and do.

Glad we could help Renee, hoping the very best for you and your family.

chris a.

February 17th, 2021

It was easy to complete the deed but on the third page I only need one signature in stead of 3 I need to delete 2 or put n//a in those blocks I will continue to use your services and have recommended it to others

Thank you for your feedback. We really appreciate it. Have a great day!

Maribel I.

September 15th, 2022

It would be helpful to be able to edit verbiage on the form. I was preparing a Deed of Distribution; therefore, there was no consideration paid. I had to type the language into a Word document instead.

Thank you for your feedback. We really appreciate it. Have a great day!

DARRYL B.

June 16th, 2020

Professional and convenient.

Thank you for your feedback. We really appreciate it. Have a great day!

Belinda B.

June 22nd, 2022

Very difficult navigating this site.

Sorry to hear of your struggle. Thank you for your feedback.

Donaldo C.

August 7th, 2020

Deeds.com is very helpful when filling a Deed. I appreciate that. Thank you.

Thank you!

EVE A.

October 31st, 2022

Site was easy to navigate. I found the lien discharge form I was looking for immediately and the download and completion was simple. Thank you for having a great site.

Thank you for your feedback. We really appreciate it. Have a great day!

Beverly J. A.

November 27th, 2022

The forms where easy to follow with the directions showing how to fill out the forms that I needed.

Thank you for your feedback. We really appreciate it. Have a great day!

Robert E.

June 14th, 2022

The deed forms seem to be what I need but I am unable to save anything that I do with them. I ask for some assistance in this matter but did not get any.

Thank you for your feedback. We really appreciate it. Have a great day!

Tierre J.

January 3rd, 2019

I put in two orders. I did not get any results from either order and I am still waiting for my refunds.

Thank you for your feedback. Sorry we were not able to pull the information you requested. We reviewed your account and the payment voids were processed as your were notified. Sometimes, depending on your financial institution, it can take a few days for the pending charges to fall off of your statement reporting.

Jorge O.

June 11th, 2019

Everything work excellent. Don't think any update is needed at this time. Thank you

Thank you!

Janice U.

July 26th, 2019

So far everything is going really well. Thank you!

Thank you!

luisana w.

September 9th, 2022

Super easy, excellente

Thank you!