Dauphin County Grant Deed Form

Dauphin County Grant Deed Form

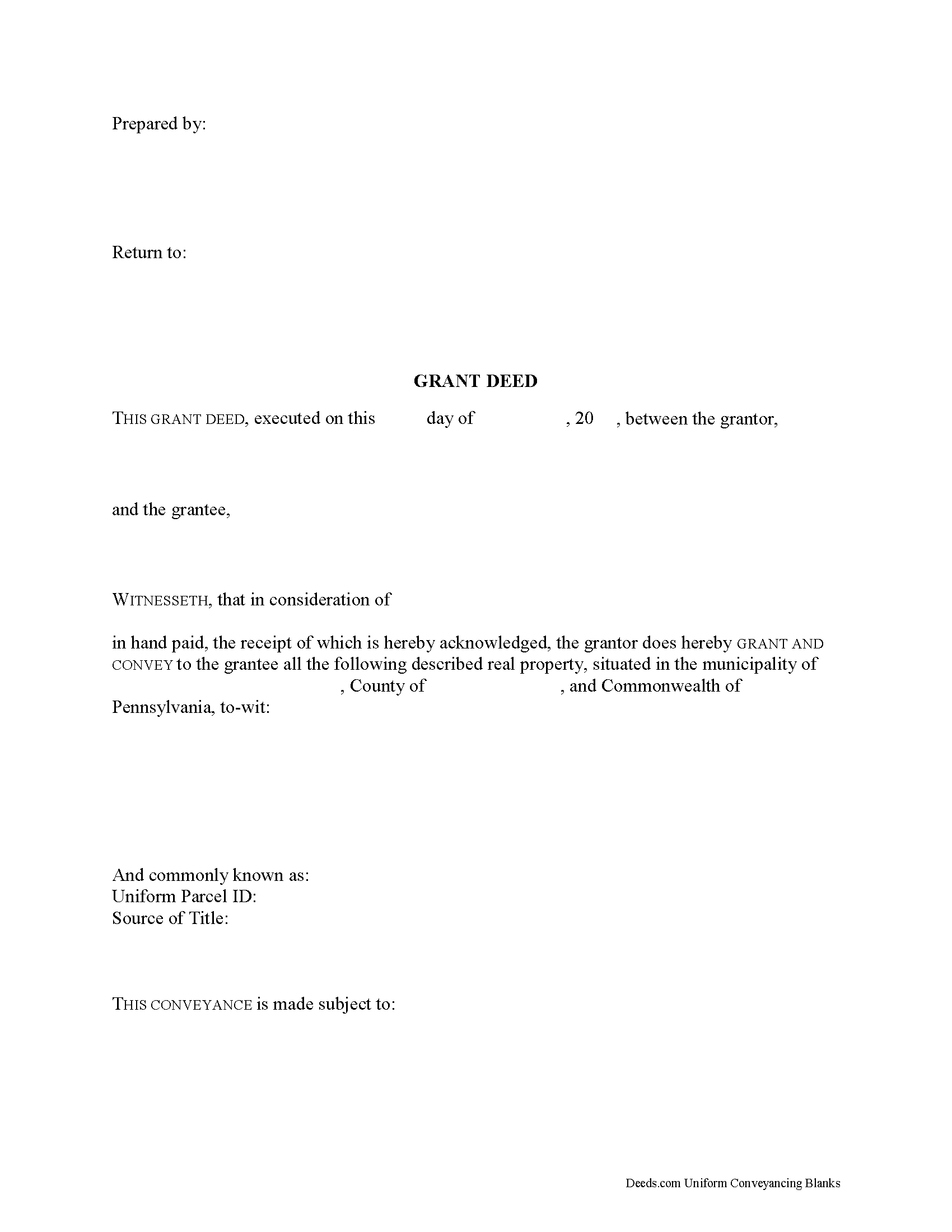

Fill in the blank form formatted to comply with all recording and content requirements.

Dauphin County Grant Deed Guide

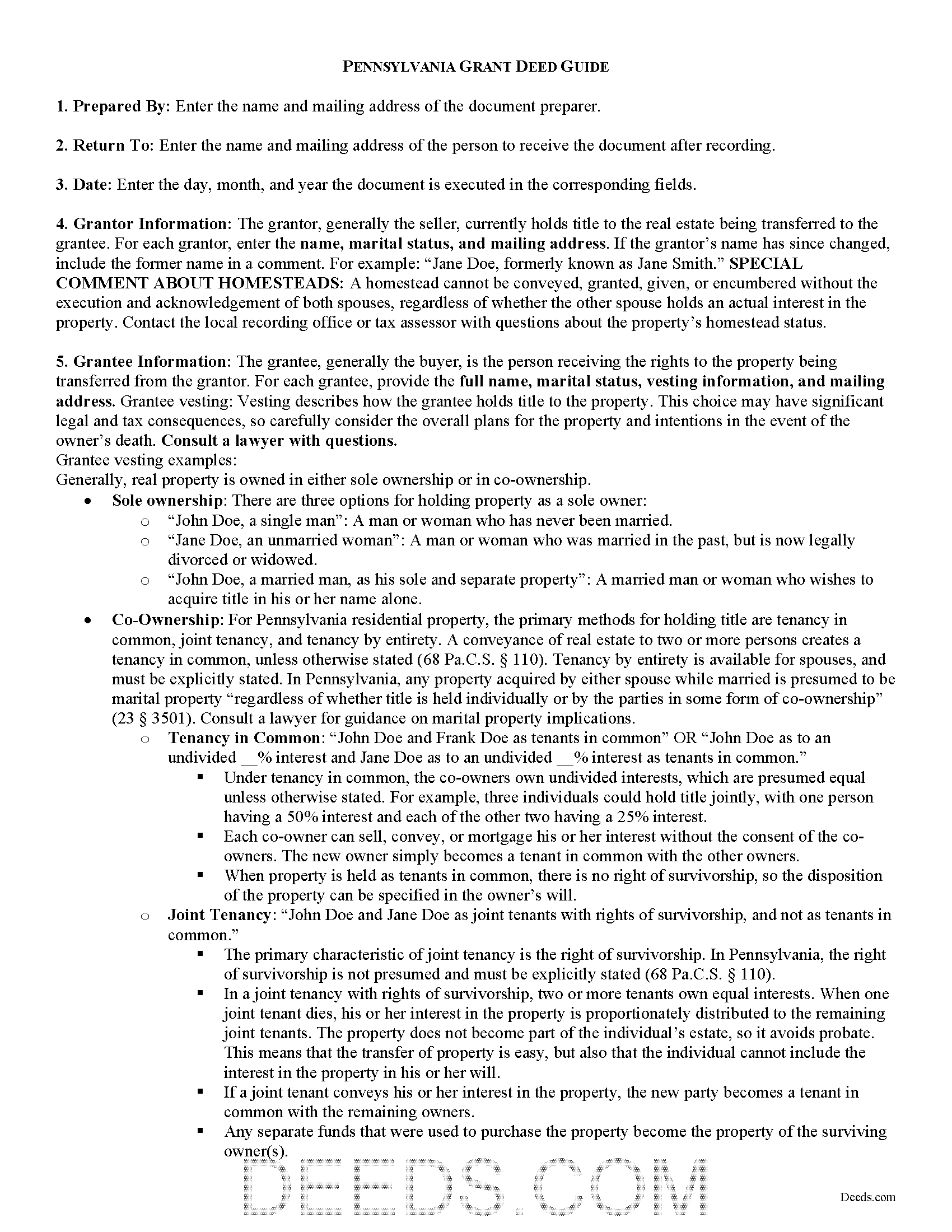

Line by line guide explaining every blank on the form.

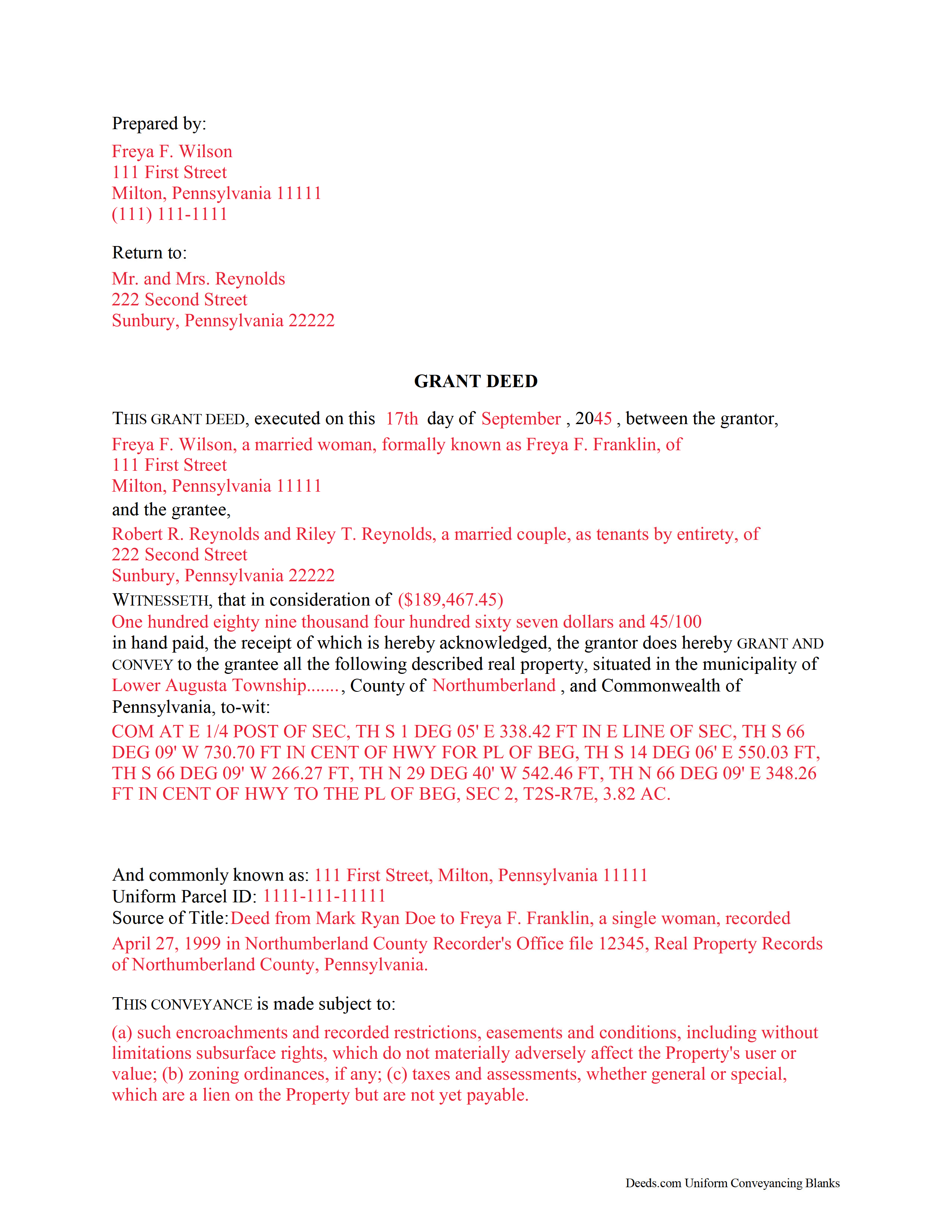

Dauphin County Completed Example of the Grant Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Pennsylvania and Dauphin County documents included at no extra charge:

Where to Record Your Documents

Recorder of Deeds - County Courthouse

Harrisburg, Pennsylvania 17101

Hours: 8:00 to 4:30 M-F

Phone: (717) 780-6560

Recording Tips for Dauphin County:

- Ask if they accept credit cards - many offices are cash/check only

- Avoid the last business day of the month when possible

- Leave recording info boxes blank - the office fills these

Cities and Jurisdictions in Dauphin County

Properties in any of these areas use Dauphin County forms:

- Berrysburg

- Dauphin

- Elizabethville

- Grantville

- Gratz

- Halifax

- Harrisburg

- Hershey

- Highspire

- Hummelstown

- Lykens

- Middletown

- Millersburg

- Pillow

- Wiconisco

- Williamstown

Hours, fees, requirements, and more for Dauphin County

How do I get my forms?

Forms are available for immediate download after payment. The Dauphin County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Dauphin County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Dauphin County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Dauphin County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Dauphin County?

Recording fees in Dauphin County vary. Contact the recorder's office at (717) 780-6560 for current fees.

Questions answered? Let's get started!

In Pennsylvania, title to real property can be transferred from one party to another by executing a grant deed, but the state does not include an official form in the statutes. Use a grant deed to transfer a fee simple interest with covenants that the title is free of any encumbrances (except for those stated in the deed) and that the grantor holds an interest in the property and is free to convey it. The word "grant" in the conveyancing clause typically signifies a grant deed.

A lawful grant deed includes the grantor's full name, mailing address, and marital status; the consideration given for the transfer; and the grantee's full name, mailing address, marital status, and vesting. Vesting describes how the grantee holds title to the property. Generally, real property is owned in either sole ownership or in co-ownership. For Pennsylvania residential property, the primary methods for holding title are tenancy in common, joint tenancy, and tenancy by entirety. A conveyance of real estate to two or more persons creates a tenancy in common, unless otherwise stated (68 Pa.C.S. Section 110). A tenancy by entirety is available for spouses, and must be explicitly stated. In Pennsylvania, any property acquired by either spouse while married is presumed to be marital property "regardless of whether title is held individually or by the parties in some form of co-ownership" (23 Pa.C.S. Section 3501). Consult a lawyer for guidance on marital property implications.

As with any conveyance of realty, a grant deed requires a complete legal description of the parcel. Recite the prior deed reference to maintain a clear chain of title, and detail any restrictions associated with the property. Finally, the form must meet all state and local standards for recorded documents. The completed deed must be signed by the grantor (and his or her spouse, if applicable) in the presence of a notary.

All deeds in Pennsylvania require a certificate of residence. This certificate ensures the accuracy of the information used for updating the billing address for property tax bills and assessment notices, and should contain addresses recognized by the USPS. Enter the full name and mailing addresses of both the grantee and the tax bill recipient. The certificate must be signed by the grantee or the grantee's agent.

Any deed pertaining to an interest in real property for which a coal severance applies requires a notice pursuant to 52 Pa.C.S. 1551 (as part of the Conveyance Document Notice of Coal or Surface Support Severance Law). Any deed pertaining to an interest in real property situated in a Pennsylvania county in which bituminous coal has been found and separately assessed for taxation requires an additional notice signed by the grantee pursuant to 52 Pa.C.S. 1406.14 (as part of the Bituminous Mine Subsidence and Land Conservation Act). Note on the face of the deed whether the instrument requires either notice. Contact a lawyer to review the specific situation and ensure the deed contains all required notices.

Pennsylvania levies a Realty Transfer Tax based on the consideration paid, which is due upon recording. If the transfer is exempt from the tax, state the reason for the exemption on the face of the deed. See 61 Pa.C.S. 91.193(6) for a list of exemptions.

All deeds require a Statement of Value Form. Some counties require multiple copies. Contact the recorder for more information. Deeds falling under the jurisdiction of more than one municipality must stipulate the division of transfer taxes.

Some Pennsylvania counties require that deeds be submitted to the assessor prior to recording. Contact the local recording office to verify correct recording procedure. Record the original completed deed, along with any additional materials, at the Recorder of Deeds' office in the county where the property is located. (The City of Philadelphia handles recording for property in city limits.)

This article is provided for informational purposes only and is not a substitute for the advice of an attorney. Contact a lawyer with questions about grant deeds, or for any other issues related to the transfer of real property in Pennsylvania.

(Pennsylvania GD Package includes form, guidelines, and completed example)

Important: Your property must be located in Dauphin County to use these forms. Documents should be recorded at the office below.

This Grant Deed meets all recording requirements specific to Dauphin County.

Our Promise

The documents you receive here will meet, or exceed, the Dauphin County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Dauphin County Grant Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4578 Reviews )

DAVID K.

May 15th, 2020

You are definitely the place to go for forms and other things which I need to solve my problems. Thanks for your help.

Thank you!

MARK S.

February 28th, 2020

I filed my beneficiary deed today and it went off without a hitch. I really appreciated the guidelines and the example that came with the form The guide lines cleared up some questions I had regarding tenancy by the entirety which I had been trying to figure out.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Robert B.

June 28th, 2019

Fast and easy and Jefferson County Colorado excepted the forms.

Thank you!

Pamela S.

February 7th, 2025

I love the convenience and professionalism!

Your satisfaction with our services is of utmost importance to us. Thank you for letting us know how we did!

Veronica S.

June 4th, 2020

Very convenient and quick. I will definitely use it again.

Thank you!

Dennis D.

November 7th, 2019

Downloaded perfect. Can hardly wait to get them done.

Thank you!

James G.

November 18th, 2019

Deed.com had some hard to find mineral interest deeds for Oklahoma.I'm an attorney in Texas with no Ok experience. The examples on Deed.com were very useful and saved me lots of time. James G.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

BARBARA S.

November 22nd, 2020

Easy to use; great back-up documentation; reasonably priced.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Susan S.

July 28th, 2020

The actual transfer of deed form seems to be the only one not fillable in Adobe. Seems odd.

Thank you!

Mary N.

January 13th, 2021

Very easy to use.

Thank you Mary.

Craig L.

October 14th, 2020

Fast and easy and saved me $240. What's not to like? Five stars.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Steve R.

April 28th, 2023

Quick, clean, easy. A hat trick.

Thank you!

Jon W.

September 16th, 2021

Useless for me. My deed could not be pulled. After investigation, I got a copy online directly from WV for $3. No one but editors of this will ever see this. Shame.

Thank you for your feedback. We really appreciate it. Have a great day!

Terrence L.

April 29th, 2020

Awesome service! 4 services wouldn't handle a 1-time filing, but Deeds.com got the job done in less than 21 hours, for only $15 (plus filing fees). This saved me days of difficulty and aggravation, esp. during COVID-19 lockdown!

Thank you for your feedback. We really appreciate it. Have a great day!

Peter E.

September 28th, 2020

I think Deeds is a great site for learning. On recording a document, I had trouble. It was me, because I was new to the site.

Thank you!