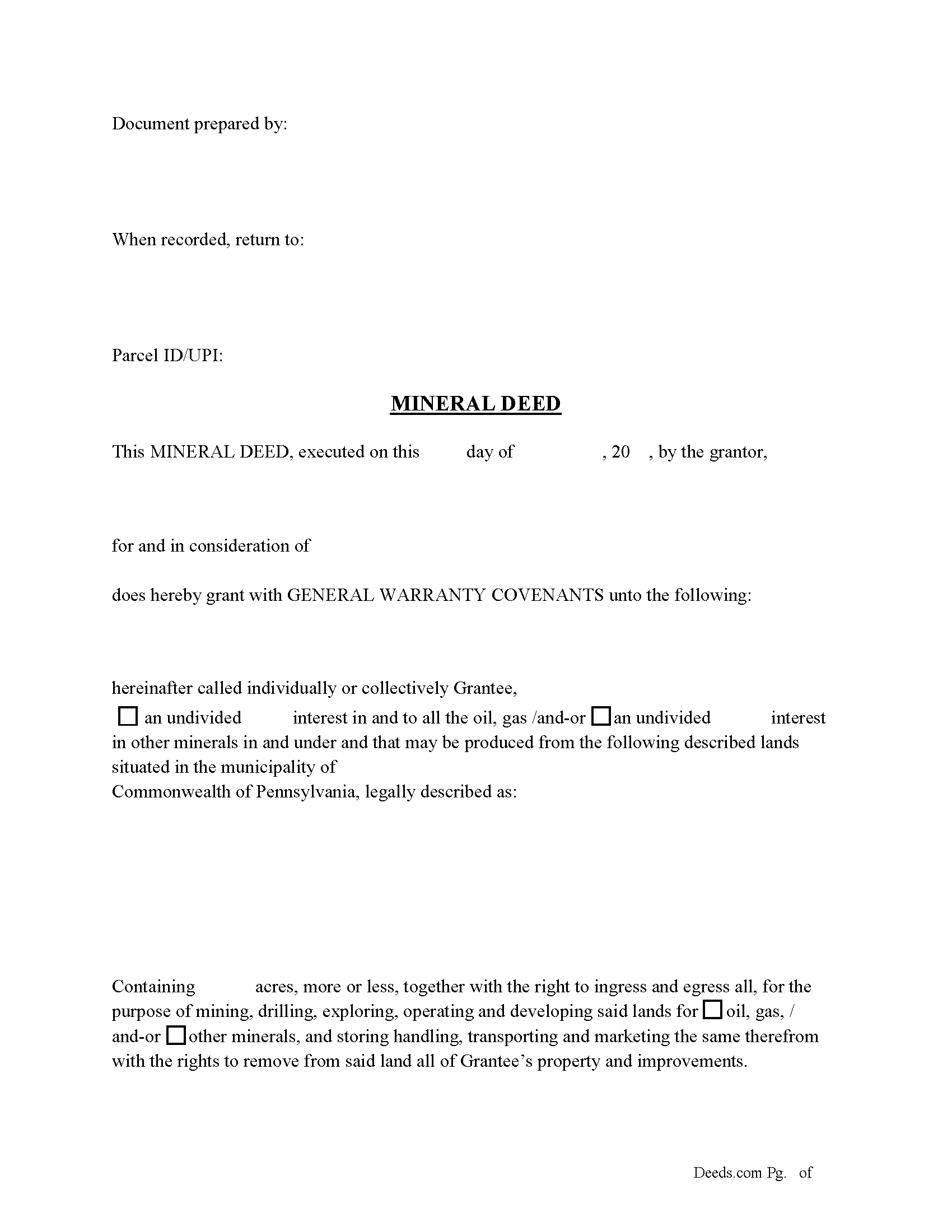

Philadelphia County Mineral Deed Form

Philadelphia County Mineral Deed Form

Fill in the blank Mineral Deed form formatted to comply with all Pennsylvania recording and content requirements.

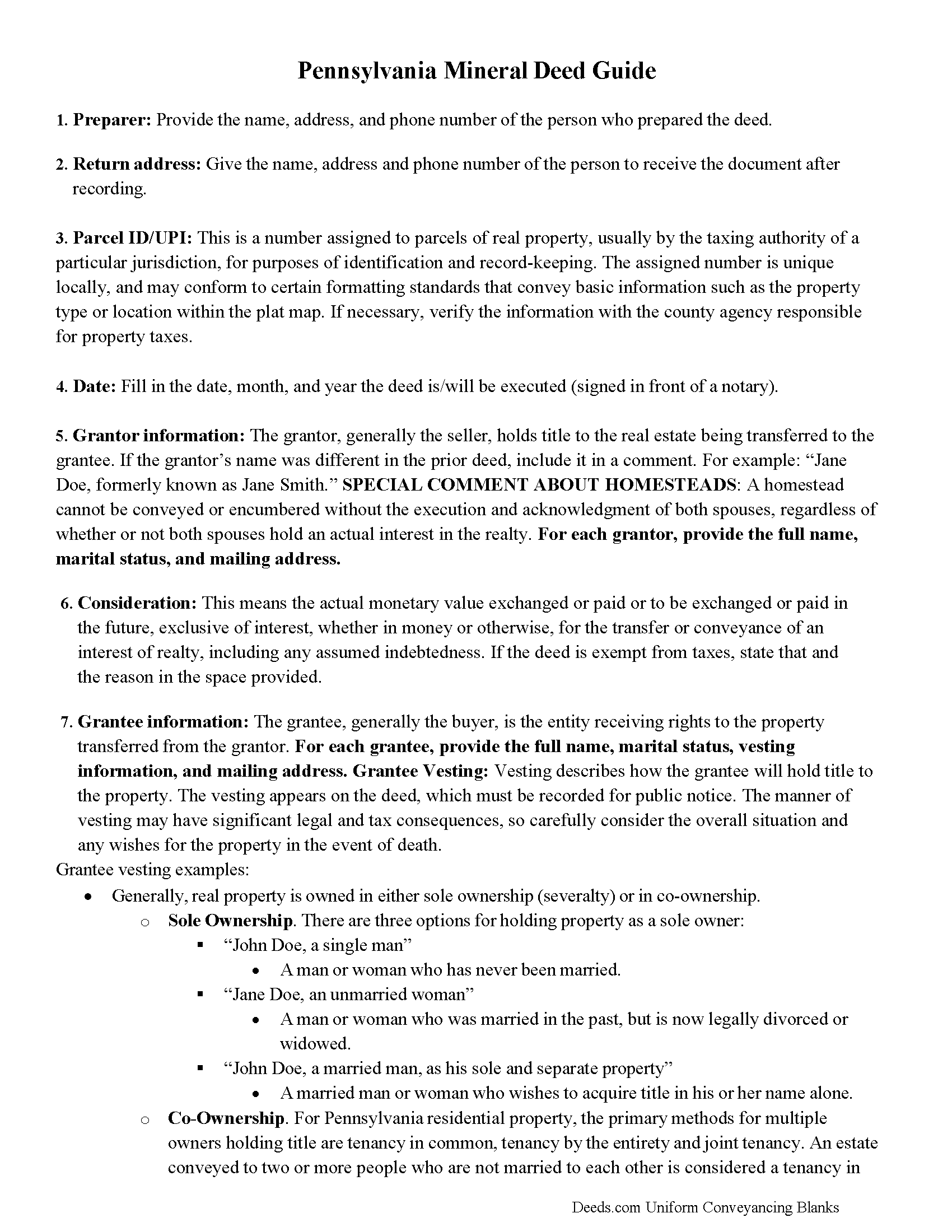

Philadelphia County Mineral Deed Guide

Line by line guide explaining every blank on the Mineral Deed form.

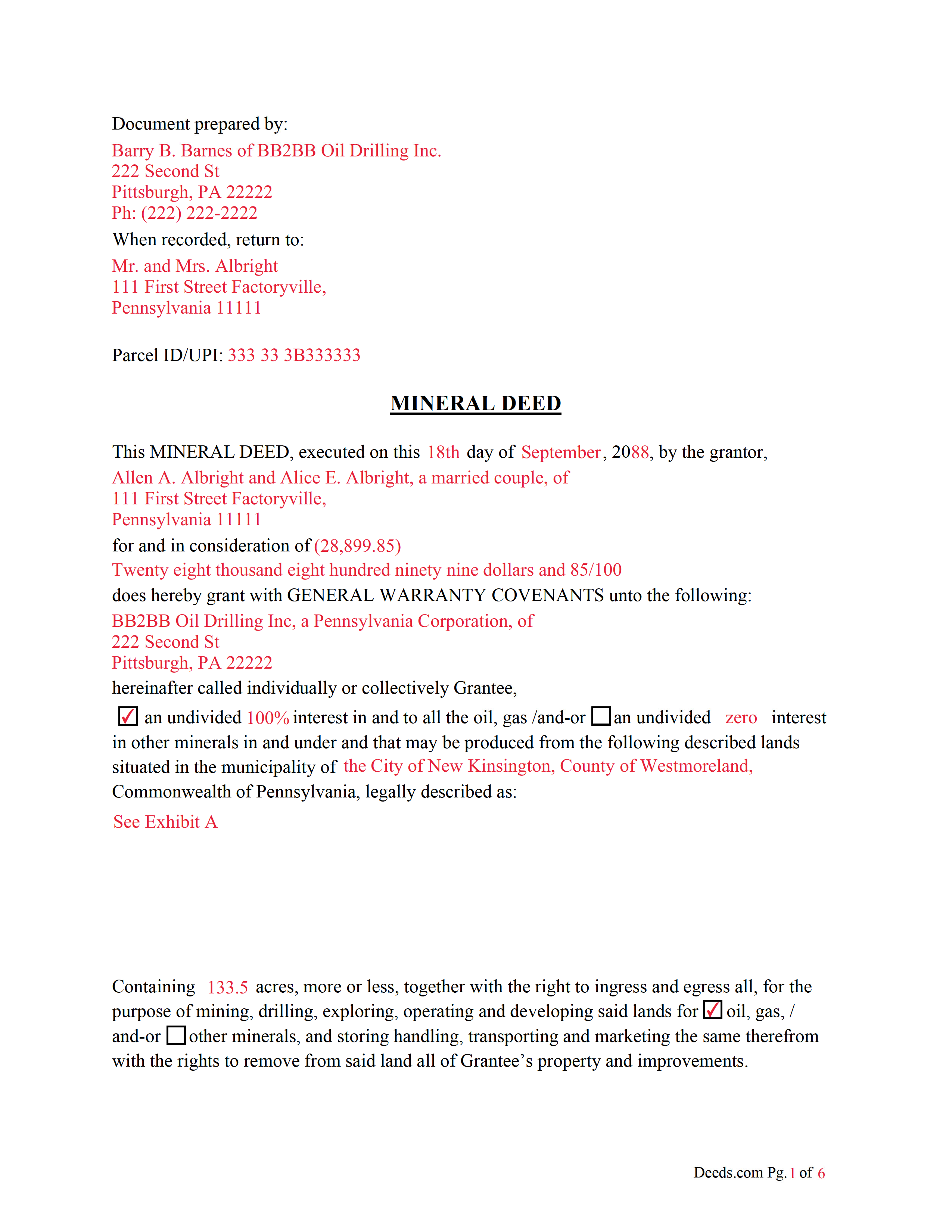

Philadelphia County Completed Example of the Mineral Deed Document

Example of a properly completed Pennsylvania Mineral Deed document for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Pennsylvania and Philadelphia County documents included at no extra charge:

Where to Record Your Documents

Records Dept - Recording Div

Philadelphia, Pennsylvania 19129

Hours: 8:00 to 2:00 M-F

Phone: (215) 686-2260

Recording Tips for Philadelphia County:

- Double-check legal descriptions match your existing deed

- Verify all names are spelled correctly before recording

- Recorded documents become public record - avoid including SSNs

Cities and Jurisdictions in Philadelphia County

Properties in any of these areas use Philadelphia County forms:

- Philadelphia

Hours, fees, requirements, and more for Philadelphia County

How do I get my forms?

Forms are available for immediate download after payment. The Philadelphia County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Philadelphia County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Philadelphia County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Philadelphia County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Philadelphia County?

Recording fees in Philadelphia County vary. Contact the recorder's office at (215) 686-2260 for current fees.

Questions answered? Let's get started!

The General Mineral Deed in Pennsylvania has the option to transfers ALL oil, gas, AND-OR other mineral rights from the grantor to the grantee. THIS IS NOT A LEASE. There are no Exceptions or Reservations included.

The transfer includes the oil, gas and other minerals of every kind and nature. It also transfers any and all rights to receive royalties, overriding royalties, net profits interests or other payments out of or with respect to those oil, gas and other minerals. The Grantor can stipulate the percentage of Mineral Rights the Grantee will receive and is made subject to any rights existing under any valid and subsisting oil and gas lease or leases of record.

This general mineral deed gives the grantee the right to access, for the purpose of mining, drilling, exploring, operating and developing said lands for oil, gas, and other minerals, and storing handling, transporting and marketing of such.

In this document the Grantor Warrants and will defend said Title to Grantee. Use of this document has a permanent effect on your rights to the property, if you are not completely sure of what you are executing seek the advice of a legal professional.

(Mineral Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Philadelphia County to use these forms. Documents should be recorded at the office below.

This Mineral Deed meets all recording requirements specific to Philadelphia County.

Our Promise

The documents you receive here will meet, or exceed, the Philadelphia County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Philadelphia County Mineral Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4578 Reviews )

Pamela J.

October 10th, 2021

Thank you the service was prompt and efficient.

Thank you!

Suzanne A.

February 25th, 2024

The purchase and download from Deeds.com were pleasantly straightforward. The actual of filing not so obvious in our case.

Your insights are invaluable to us and help us strive for better service. Thank you for taking the time to share your thoughts.

Mark R.

September 30th, 2022

All documents were site specific and up-to-date. Not recorded yet but have high hopes.

Thank you for your feedback. We really appreciate it. Have a great day!

James B.

June 9th, 2019

Reliable and fast. A great assest.

Thank you!

Donna C.

June 24th, 2021

I was very impressed with the system. Easy to navigate. Took less than 15 minutes to get what I needed.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Kenneth C.

August 24th, 2020

Great forms, easy to use if you have at least a sixth grade education.

Thank you!

George W.

February 26th, 2021

Phenomenal service! If only every request and transaction with other companies could be this seamless and efficient!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Judith F.

October 15th, 2021

Easy to understand and use!

Thank you!

Angela J M.

September 29th, 2023

Quick turnaround (about 24hrs) easy process.

Thank you for your feedback. We really appreciate it. Have a great day!

Vicki C.

March 10th, 2023

I purchased a Deed on Death for Washington State. Very user friendly site. Thank you 5star

Thank you for your feedback. We really appreciate it. Have a great day!

Flordeliza R.

February 6th, 2023

Once I was able to get my scanner working and provide good quality scans, the turnaround was quick and my documents were recorded and returned to me the same day with the Recorder's Stamp for download. Deeds.com staff was able to guide me to make sure my package was complete. Thank you!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Dianna B.

July 23rd, 2020

Amazingly easy! I absolutely love it because it is so efficient and I only have to pay for when I use it. I use to have to drive to the recorders office or to a Kiosk station. The turn-around time was really quick as well.

Thank you!

Bobbie N.

February 24th, 2022

Thank you so much for making the site so easy to use.

Thank you for your feedback. We really appreciate it. Have a great day!

Margaret A.

April 30th, 2021

Thank for the help. Needed that disclaimer to avoid filing a full ITR tax return to get an L-9

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Norman K.

August 13th, 2021

Easy to use, would like to convert to a Word doc though

Thank you!