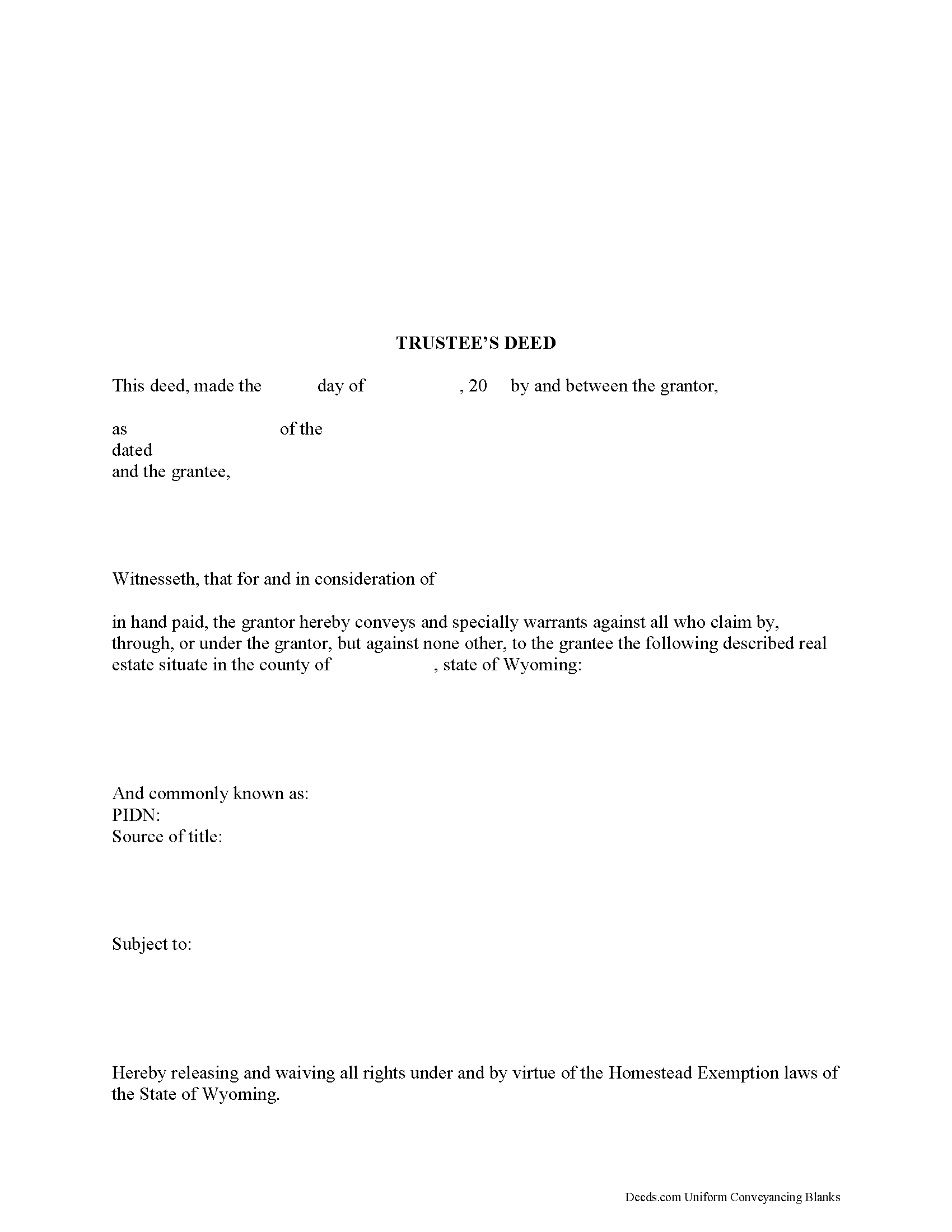

Johnson County Trustee Deed Form

Johnson County Trustee Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

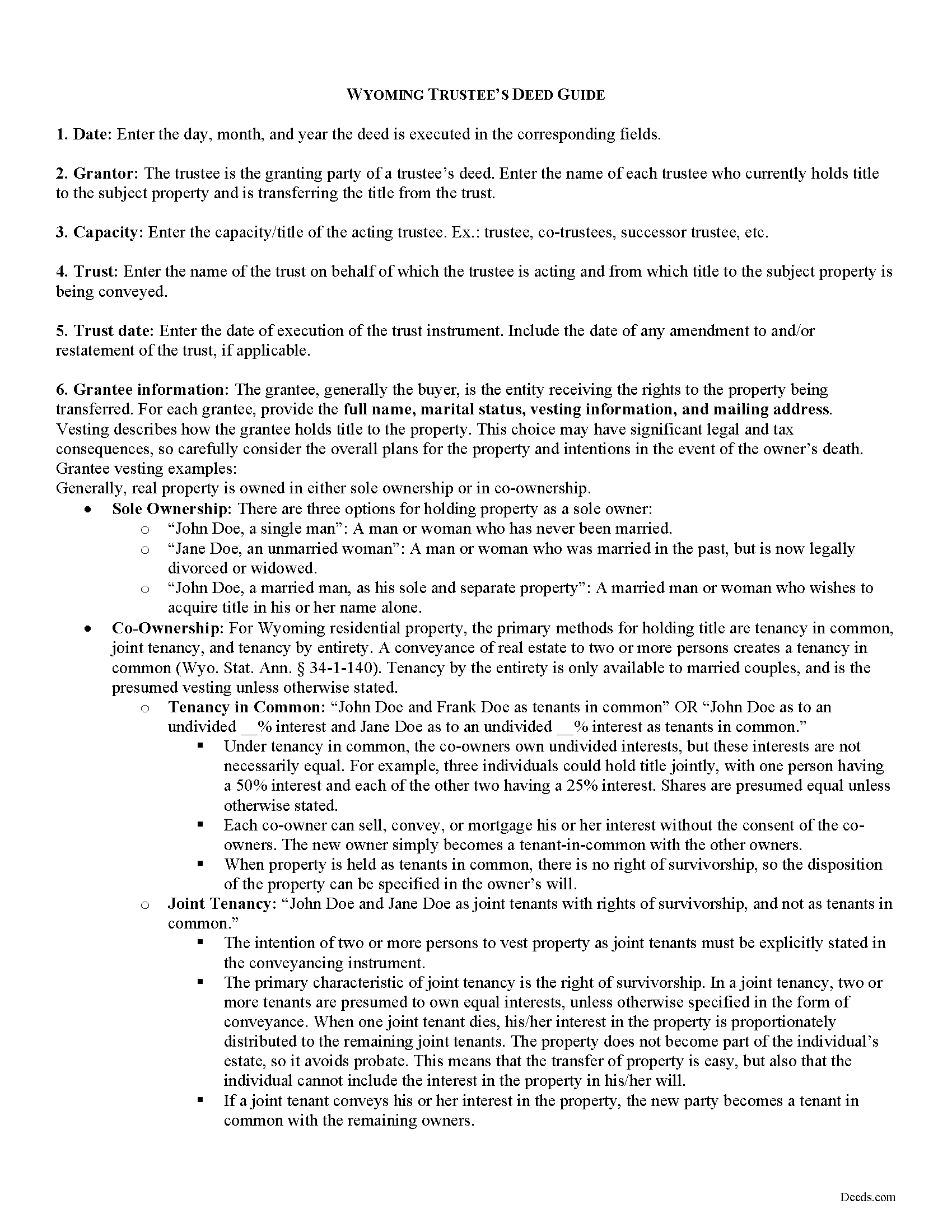

Johnson County Trustee Deed Guide

Line by line guide explaining every blank on the form.

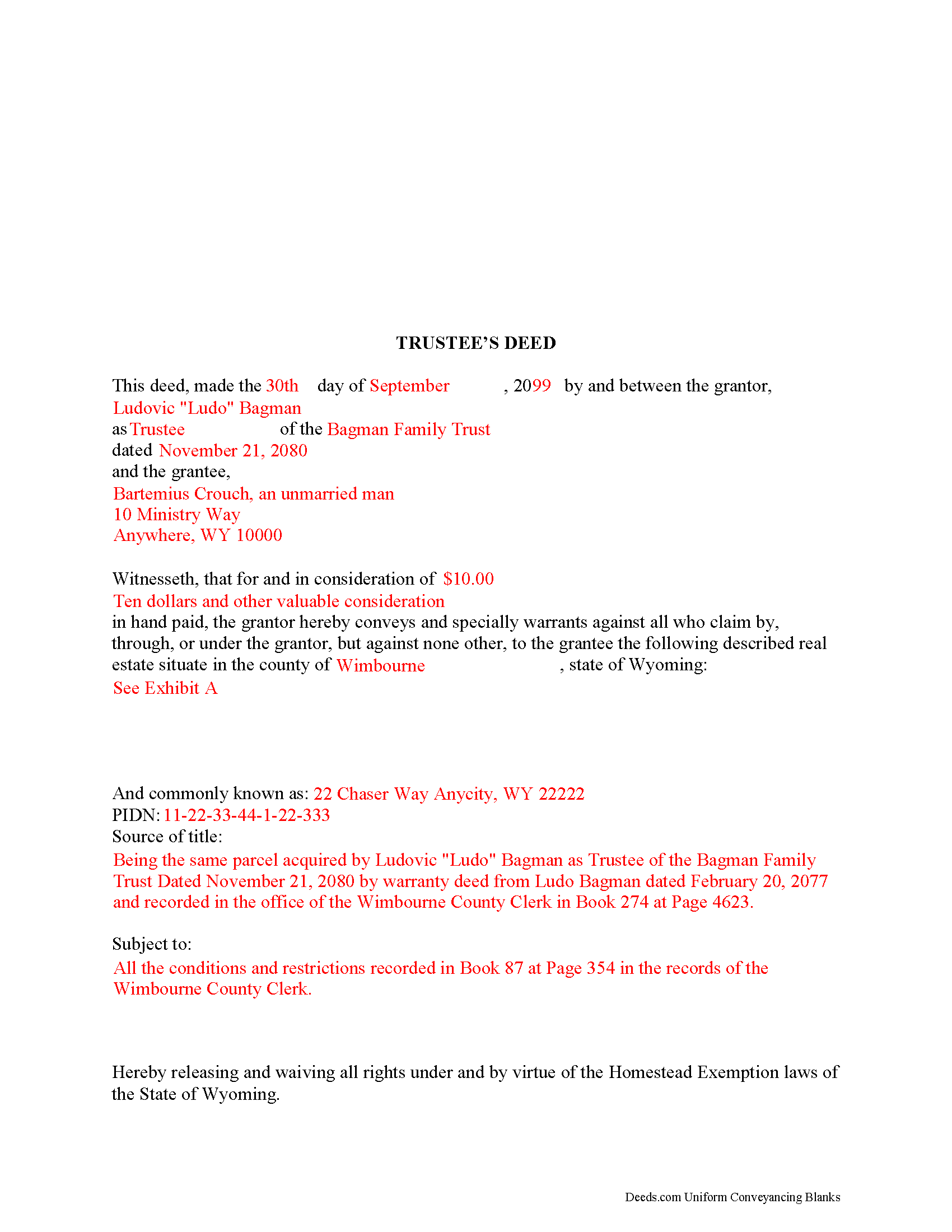

Johnson County Completed Example of the Trustee Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Wyoming and Johnson County documents included at no extra charge:

Where to Record Your Documents

Johnson County Clerk

Buffalo, Wyoming 82834

Hours: Monday - Friday 8:00am - 5:00pm

Phone: (307) 684-7272

Recording Tips for Johnson County:

- Bring your driver's license or state-issued photo ID

- Check that your notary's commission hasn't expired

- Make copies of your documents before recording - keep originals safe

- Avoid the last business day of the month when possible

- If mailing documents, use certified mail with return receipt

Cities and Jurisdictions in Johnson County

Properties in any of these areas use Johnson County forms:

- Buffalo

- Kaycee

- Linch

- Saddlestring

Hours, fees, requirements, and more for Johnson County

How do I get my forms?

Forms are available for immediate download after payment. The Johnson County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Johnson County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Johnson County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Johnson County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Johnson County?

Recording fees in Johnson County vary. Contact the recorder's office at (307) 684-7272 for current fees.

Questions answered? Let's get started!

A trust is an arrangement whereby one person (the settlor) transfers property to another (trustee), who manages it for the benefit of a third (the beneficiary). A settlor may establish a trust to take effect during his lifetime (inter vivos trust), or a trust may be created upon his death through probate pursuant to the provisions of a will (testamentary trust).

The settlor creates a living trust by executing a trust instrument, which generally remains unrecorded. The settlor may elect to serve as the original trustee and name a successor trustee, who will assume the powers and duties of the trustee upon the settlor's death or incapacity.

When real property is transferred into the trust, the property belongs to the trust. As the trust itself cannot hold title to the property, the settlor must execute a deed titling the property in the name of the trustee on behalf of the trust. The trustee is bound to serve the trust pursuant to its terms and the powers and duties of trustees, codified at Wyo. Stat. Ann 4-10-801 to 4-10-817 as part of the Uniform Trust Code in Wyoming.

To convey real property out of the living trust, the trustee must execute a deed as the granting party. A deed executed by a trustee in a representative capacity is simply titled a trustee's deed. In Wyoming, the trustee's deed is functionally equivalent to a special warranty deed. Though warranty deeds and quitclaim deeds are the most commonly used conveyancing forms in Wyoming, the special warranty deed was codified in 2015 at 34-2-136.

A special warranty deed is a conveyance in fee simple to the grantee and contains the covenants that the property is "free from all encumbrances made by the grantor" except those expressly noted in the form of conveyance, and that the grantor "will forever warrant and defend the title of the property in the grantee... against any lawful claim and demand of the grantor and any person claiming or to claim by, through, or under the grantor, but against none other" (34-2-137). Grantors serving in a representative capacity commonly use a special warranty deed for transfers because it limits their obligation to only the time they held title to the property.

The trustee's deed is modified from the statutory form of a special warranty deed to include the trust's vesting information in the granting field. It requires each acting trustee's name, the name of the trust, and the date of the trust instrument. To maintain a clear chain of title, the deed references the prior instrument by which the trustee acquired title. Trustees may present an affidavit or certification of trust to confirm their authority to convey trust property (see 4-10-1014). The deed is signed by each trustee in the presence of a notary public before recording in the county in which the subject property is located.

Consult a lawyer with any questions regarding trusts and trustee's deeds in the State of Wyoming.

(Wyoming TD Package includes form, guidelines, and completed example)

Important: Your property must be located in Johnson County to use these forms. Documents should be recorded at the office below.

This Trustee Deed meets all recording requirements specific to Johnson County.

Our Promise

The documents you receive here will meet, or exceed, the Johnson County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Johnson County Trustee Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Elizabeth B.

November 22nd, 2020

Very efficient

Thank you!

nannette b.

October 27th, 2019

got what I needed quick and easy thank you!!!

Thank you for your feedback. We really appreciate it. Have a great day!

Dave M.

March 10th, 2020

Service as needed. A bit expensive.

Thank you for your feedback. We really appreciate it. Have a great day!

Susan S.

October 4th, 2019

Great forms, easy to understand and use (the guide helped a lot). Recorded with no issues. Will be back when needed.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Barbara E.

March 19th, 2024

Love the accessibility to all counties. Save money and time using Deeds for all our recording needs!

Your satisfaction with our services is of utmost importance to us. Thank you for letting us know how we did!

Chris B.

March 3rd, 2023

Accurate information and easy to use website.

Thank you for your feedback. We really appreciate it. Have a great day!

Donald C.

January 7th, 2020

The service was VERY quick, simple and, easy. I would definetly use this service again.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Debra W.

May 12th, 2020

Thorough information, quickly received !! I'm going to order more! Helpful due to an ILLEGAL FORECLOSURE! Thank you!!!

Thank you for your feedback. We really appreciate it. Have a great day!

Bradley B.

December 20th, 2020

This was a good way to find the owners of land located in the middle of some that I owned. The experience was fairly easy and the cost reasonable.

Thank you!

Kevin C.

August 10th, 2022

Nice site but $30 to download a blank form is a bit much.

Thank you for your feedback. We really appreciate it. Have a great day!

Nancy J.

February 14th, 2019

Forms were not to hard to fill out, Will go to Douglas County Oregon Recorders office in a few weeks and hope I filled them out correctly.

Thank you for your feedback. We really appreciate it. Have a great day!

David W.

February 9th, 2021

Excellent assistance provided by your forms, guide and example.

Thank you!

Christopher Shawn S.

November 4th, 2020

Swift and Concise Process!!! I would recommend, as well as, use again!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Cyndi H.

December 9th, 2020

Excellent! Great communication through the process and quick response.

Thank you!

Norma G.

May 9th, 2019

Thank you! This is very helpful

Thank you!