Saint Clair County Correction Warranty Deed Form

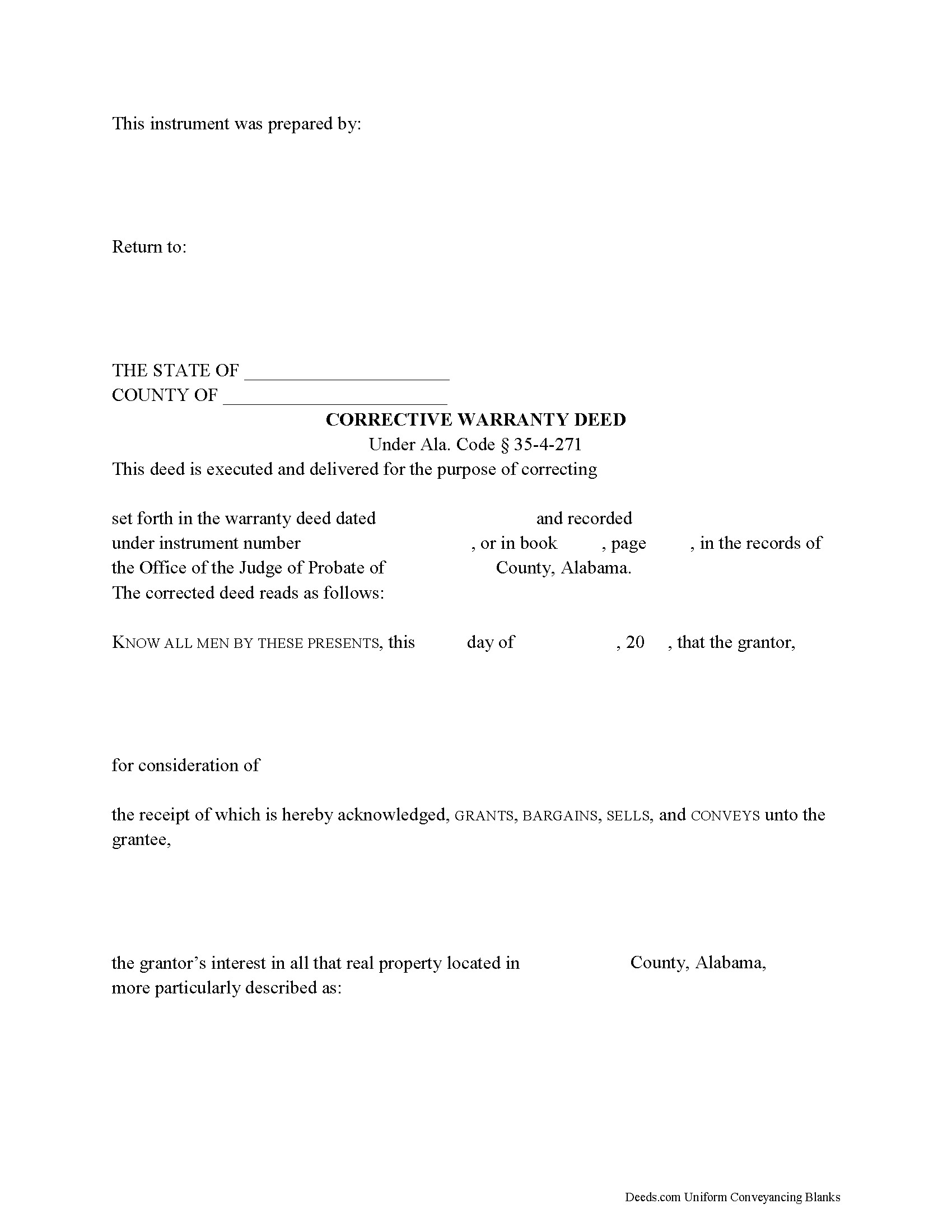

Saint Clair County Correction Warranty Deed

Fill in the blank form formatted to comply with all recording and content requirements.

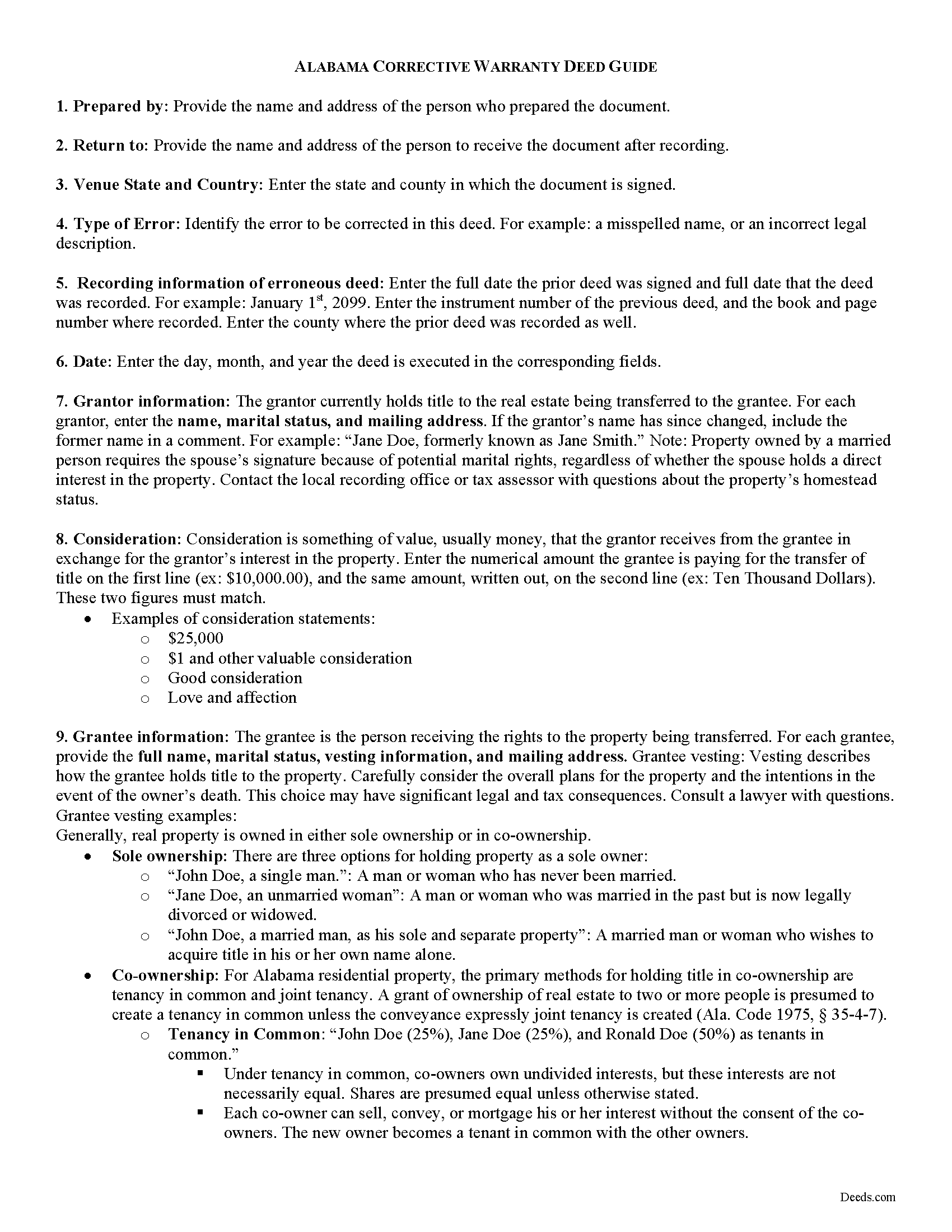

Saint Clair County Correction Warranty Deed Guide

Line by line guide explaining every blank on the form.

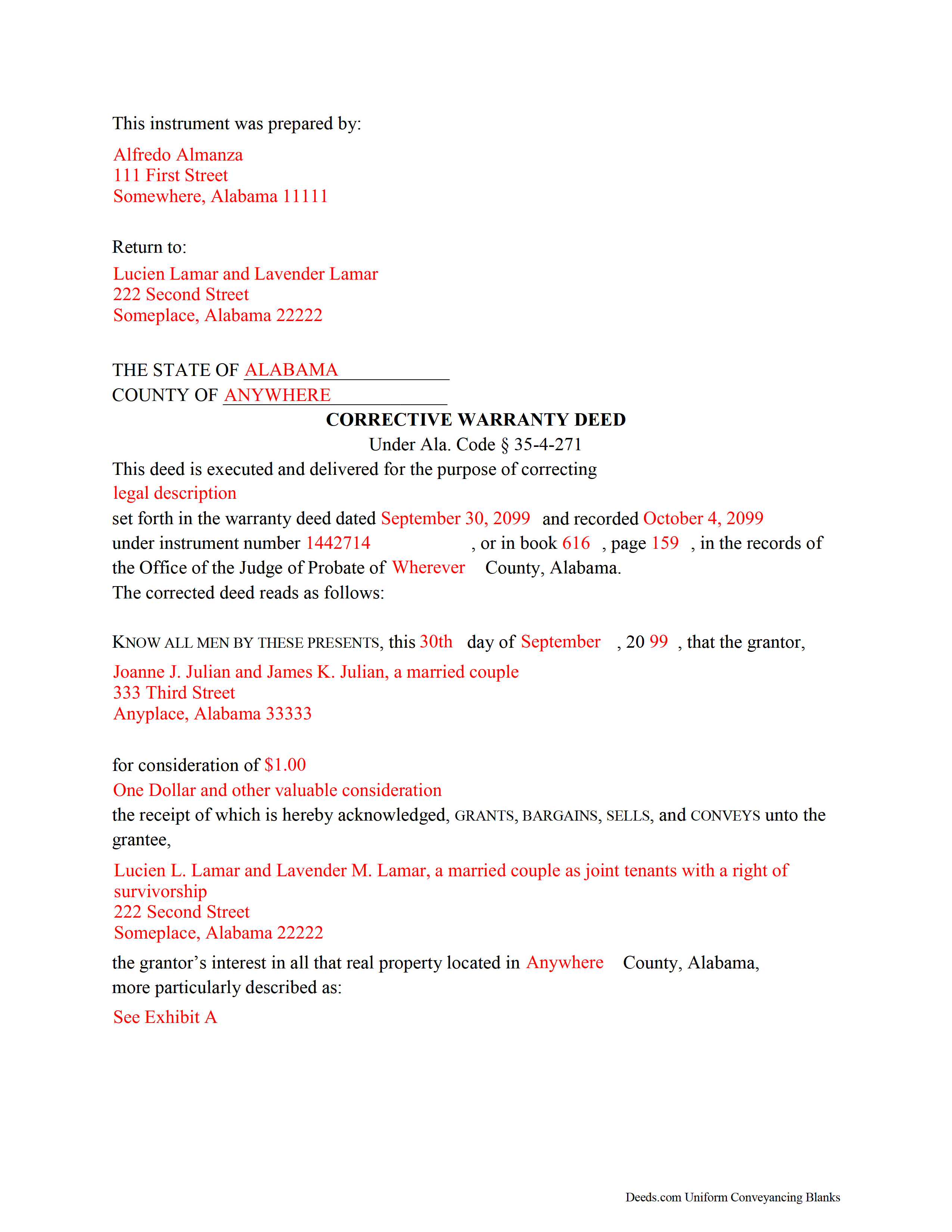

Saint Clair County Completed Example of the Correction Warranty Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Alabama and Saint Clair County documents included at no extra charge:

Where to Record Your Documents

St. Clair County Probate Office

Ashville, Alabama 35953

Hours: 8:00am - 4:30pm M-F

Phone: (205) 594-2120

Pell City Probate Office

Pell City, Alabama 35125

Hours: 8:00am - 4:30pm M-F

Phone: (205) 338-9449

Recording Tips for Saint Clair County:

- Ensure all signatures are in blue or black ink

- Documents must be on 8.5 x 11 inch white paper

- White-out or correction fluid may cause rejection

- Verify all names are spelled correctly before recording

- Check margin requirements - usually 1-2 inches at top

Cities and Jurisdictions in Saint Clair County

Properties in any of these areas use Saint Clair County forms:

- Ashville

- Cook Springs

- Cropwell

- Margaret

- Moody

- Odenville

- Pell City

- Ragland

- Riverside

- Springville

- Steele

- Wattsville

Hours, fees, requirements, and more for Saint Clair County

How do I get my forms?

Forms are available for immediate download after payment. The Saint Clair County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Saint Clair County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Saint Clair County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Saint Clair County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Saint Clair County?

Recording fees in Saint Clair County vary. Contact the recorder's office at (205) 594-2120 for current fees.

Questions answered? Let's get started!

Corrective Warranty Deeds in Alabama

You just bought a new house, have your deed in hand, and you are ready to relax in your new home. But after taking another look at the deed, you notice a mistake in the legal description. Now what?

Alabama law provides for reformation of a deed by judicial intervention under (Ala. Code 1975, 35-4-150), but filing a corrective deed might be an option to resolve simple mistakes.

A corrective deed is an instrument used to fix an error in a deed that was recorded at an earlier date. It can only be used to correct non-material errors, causing no actual change in the substance of the deed. Common minor errors include misspelled names or missing information, such as marital status, or a mistake transcribing courses and distances in the legal description of the property. Major changes to the substance of the deed, or details that effect how property is titled require a new deed.

A corrective warranty deed has the same form as the previously recorded warranty deed containing the error and includes all the same information, in addition to correcting the error. The corrective deed states the nature of the error and recites the date and recording information of the erroneous deed.

The deed must be acknowledged before any of the officers listed in (Ala. Code 1975, 35-4-24). For the corrective deed to be valid, all parties who signed the prior deed must sign the corrective deed in the presence of a notarial official. The execution of a deed must be attested by at least one witness in Alabama (Ala. Code 1975, 35-4-20). If the grantor is married, Alabama requires that both spouses appear before an officer authorized by law to take acknowledgements of deeds and sign the deed (Ala. Code 1975, 6-10-3).

Most transfers of real property are subject to a privilege or license tax, but corrective deeds are exempt under Ala. Code 1975, 40-22-1, and do not require a Real Estate Sales Validation Form (Form RT-1).

This article is provided for informational purposes only and is not a substitute for legal advice. Contact a lawyer with questions about corrective warranty deeds or any other issues related to transferring real property in Alabama.

Important: Your property must be located in Saint Clair County to use these forms. Documents should be recorded at the office below.

This Correction Warranty Deed meets all recording requirements specific to Saint Clair County.

Our Promise

The documents you receive here will meet, or exceed, the Saint Clair County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Saint Clair County Correction Warranty Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4578 Reviews )

James W.

February 27th, 2021

We were able to find deceased parents' deed.

Thank you!

Kelly S.

May 19th, 2020

Fast, easy, responsive.

Thank you!

Scott s.

September 2nd, 2022

Information requested was provided and time to reply was quick!

Thank you!

Gloria L.

June 18th, 2022

Quick and simple process! I wish I would have used them sooner!

Thank you for your feedback. We really appreciate it. Have a great day!

JERRY M.

March 11th, 2020

Had to modify the document form fill field to accept the information required. Had limited number of characters.

Thank you for your feedback. We really appreciate it. Have a great day!

Larry L.

September 18th, 2023

Easy, quick and responsive for recording purposes.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Mike H.

February 11th, 2021

Great

Thank you!

MARIO D S.

March 7th, 2020

Well worth the $20.00 for the Transfer on Death Deed, if you are willing to do the leg work to notarize and record the deed. Money well spent and money well saved. The value is in the short, bullet type instructions and State specific forms and requirements.

Thank you!

Rebecca Q.

January 19th, 2019

Very helpful! Unfortunately, they didn't have what I needed, but they got back to me quickly and didn't charge me anything. Easy to work with.

Thank you for your feedback. We really appreciate it. Have a great day!

COURTNEY K.

August 7th, 2020

I could not be happier with this service! It was so easy and fast!

Thank you!

Julia M.

June 26th, 2024

I live in AZ and have an existing beneficiary deed on my property. I needed to know the process of revoking a beneficiary deed. Your site was very helpful by providing the correct form and instructions for recording it. Thank you!

Your satisfaction with our services is of utmost importance to us. Thank you for letting us know how we did!

Sandra H.

April 1st, 2020

I did not receive the information in a timely fashion as stated on the website. I would not recommend this service.

Thank you for your feedback Sandra. In reviewing your order I see that it did take our staff 11 minutes to respond to your order. That is significantly longer than the 10 minute average listed on our website. Even in these unprecedented times of quarantines and staff shortages our failure is unacceptable. We have fully refunded your account and we do hope that you found something more suitable to your needs elsewhere.

Raymond C.

June 8th, 2021

Fast and relaible service every time. I wouldn't use any other service. I love deeds.com

Thank you for your feedback. We really appreciate it. Have a great day!

Steve W.

February 3rd, 2023

Simple and easy transaction

Thank you for your feedback. We really appreciate it. Have a great day!

Thomas G.

March 16th, 2020

A few parts are confusing'.Like sending Tax statements to WHO ?/ The rest is simple I hope.Have not tried to record yet

Thank you!