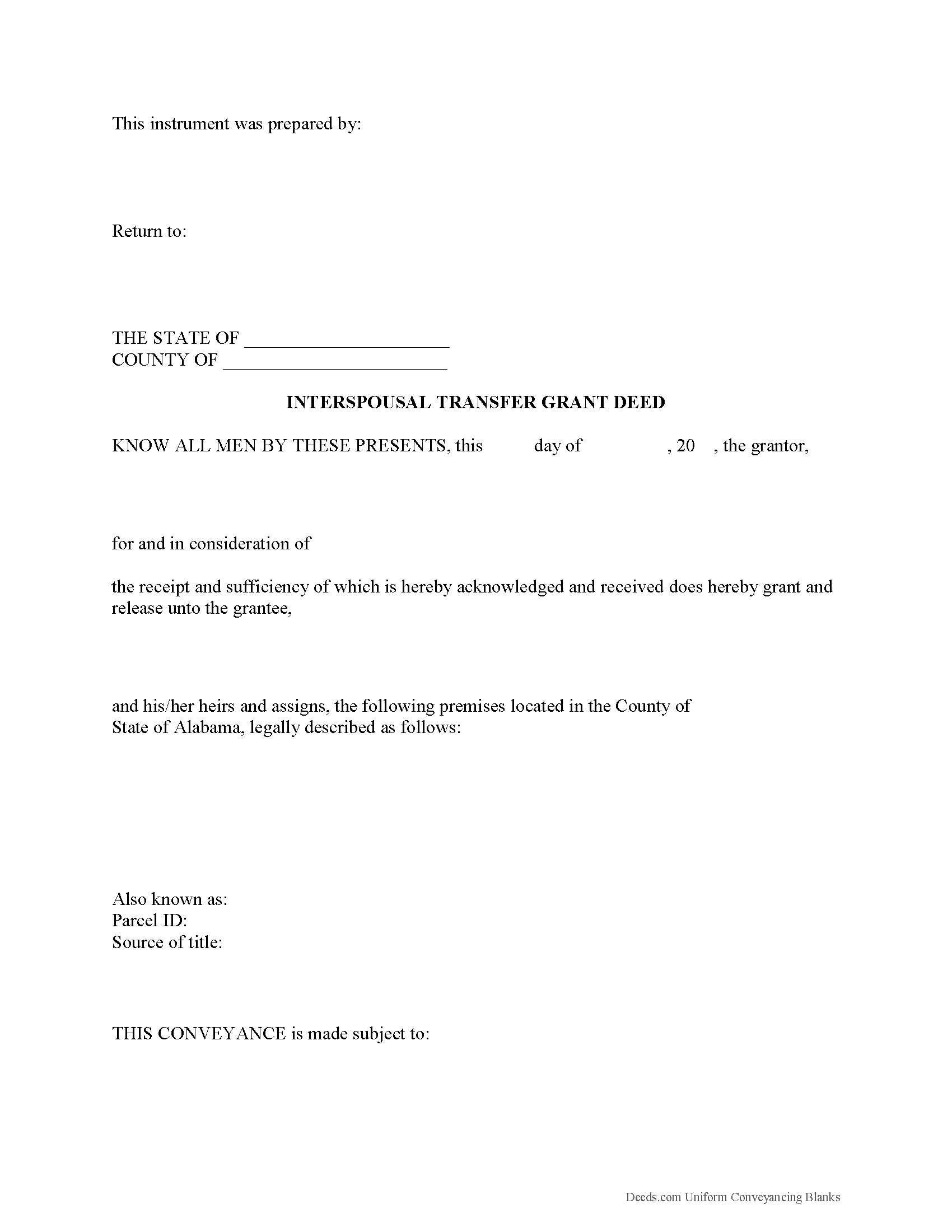

Saint Clair County Interspousal Transfer Grant Deed Form

Saint Clair County Interspousal Transfer Grant Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

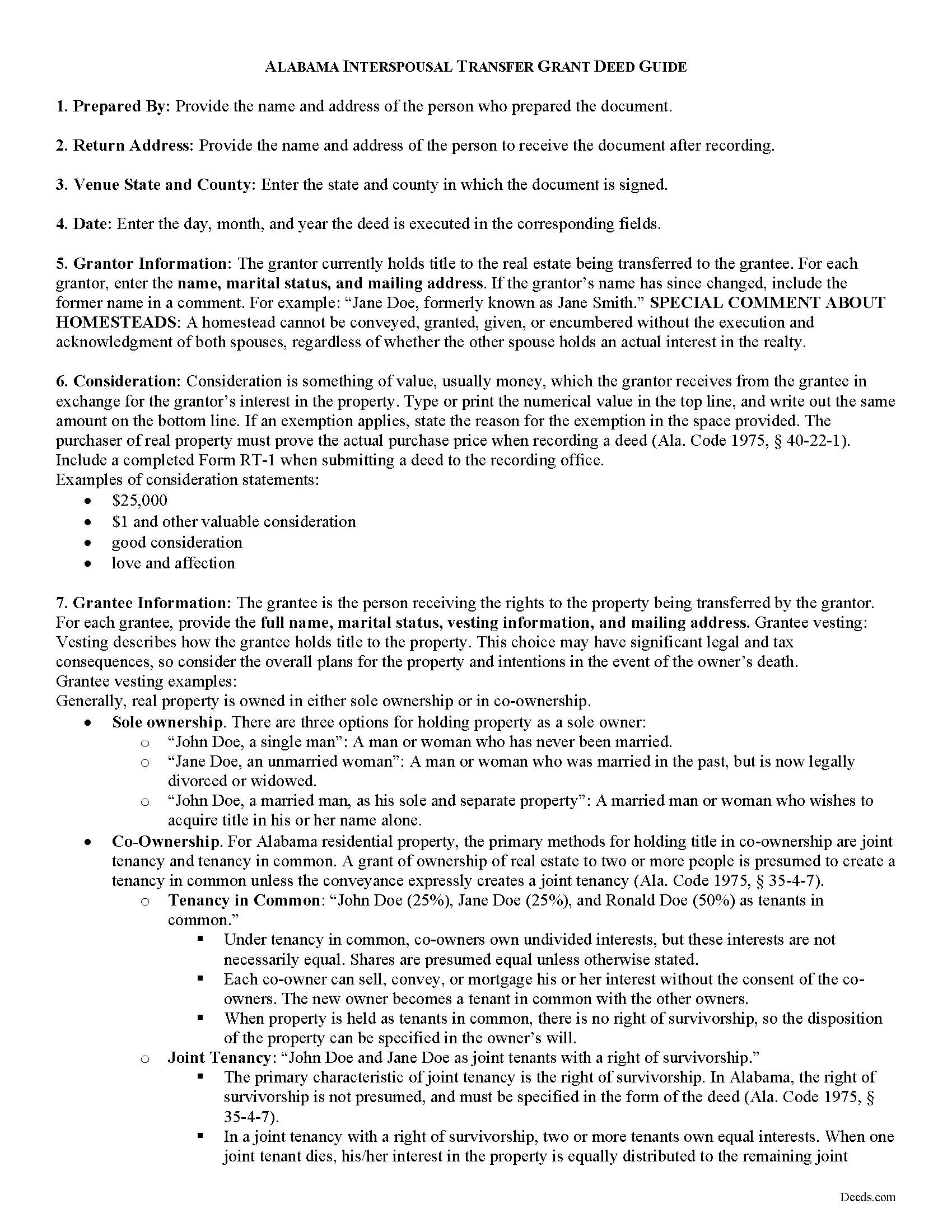

Saint Clair County Interspousal Transfer Grant Deed Guide

Line by line guide explaining every blank on the form.

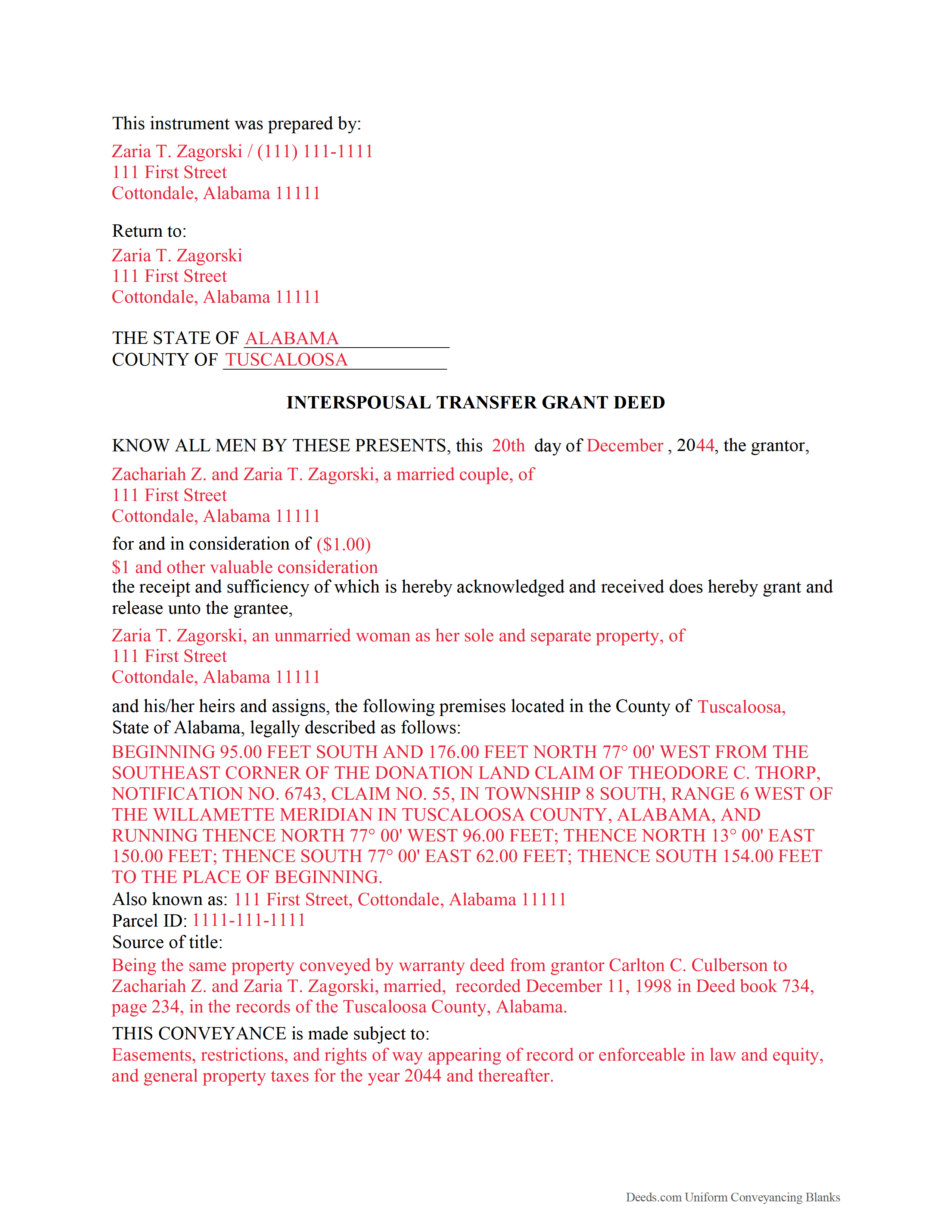

Saint Clair County Completed Example of an Interspousal Transfer Grant Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Alabama and Saint Clair County documents included at no extra charge:

Where to Record Your Documents

St. Clair County Probate Office

Ashville, Alabama 35953

Hours: 8:00am - 4:30pm M-F

Phone: (205) 594-2120

Pell City Probate Office

Pell City, Alabama 35125

Hours: 8:00am - 4:30pm M-F

Phone: (205) 338-9449

Recording Tips for Saint Clair County:

- Ensure all signatures are in blue or black ink

- Check that your notary's commission hasn't expired

- Ask about their eRecording option for future transactions

- Avoid the last business day of the month when possible

- Bring extra funds - fees can vary by document type and page count

Cities and Jurisdictions in Saint Clair County

Properties in any of these areas use Saint Clair County forms:

- Ashville

- Cook Springs

- Cropwell

- Margaret

- Moody

- Odenville

- Pell City

- Ragland

- Riverside

- Springville

- Steele

- Wattsville

Hours, fees, requirements, and more for Saint Clair County

How do I get my forms?

Forms are available for immediate download after payment. The Saint Clair County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Saint Clair County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Saint Clair County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Saint Clair County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Saint Clair County?

Recording fees in Saint Clair County vary. Contact the recorder's office at (205) 594-2120 for current fees.

Questions answered? Let's get started!

An interspousal transfer grant deed is a legal document used by a married couple who owns real property together to voluntarily transfer one spouse's interest in the property to the other [1]. A grant deed guarantees that the grantor (owner) has a present interest in the property, and formalizes the transfer of that interest to the grantee (the recipient). It also guarantees that the property is not encumbered by any undisclosed liens or restrictions, which in turn means that there are no legal claims to the title by third parties. Depending on the circumstance, the transfer of property is either contractual, by gift, or a change in legal title.

This type of deed is most commonly used during a divorce, where one spouse is awarded sole ownership of the property. In some cases, an interspousal transfer grant deed can be filed when a couple would like to refinance their home, and one spouse has poor credit. Sometimes, lenders will ask one spouse to file this type of deed removing him or herself as an owner if the other is borrowing money so that the former cannot claim any of the recovered debt from a foreclosure sale.

No matter the circumstance or the instrument chosen to execute the transfer, the spouse transferring his or her interest in the property waives all legal rights to it. Since the property is no longer jointly owned by the couple, it is imperative that the spouses or former spouses have a trusting relationship. Most of the time, the property is exempt from being refinanced, which can be a perk of making interspousal transfers. But there may be some risk involved, especially if the relationship between the spouses is strained. For example, during a divorce, if one spouse transfers his or her interest in the property to the other, and the property is exempt from refinancing, the spouse who no longer holds interest in the property may still be held liable for mortgage payments because the spouse was a co-signer of the loan [2]. The spouse who no longer holds interest can be held accountable by a judge for paying fifty percent of the mortgage for a property he or she no longer owns.

A lawful interspousal transfer grant deed includes the grantor's full name and marital status, as well as the grantee's full name, marital status, mailing address, and vesting. Vesting describes how the grantee holds title to the property. For Alabama residential property, the primary methods for holding title in co-ownership are tenancy in common and joint tenancy. The right of survivorship is not presumed in Alabama, and must be specified in the form of the deed (Ala. Code 1975, 35-4-7).

As with any conveyance of real estate, an interspousal transfer grant deed requires a complete legal description of the parcel. In Alabama, if the legal description references a plat, the plat should be attached to the deed, or the deed should describe the plat book and office in which it can be found (35-4-74). Recite the source of title to establish a clear chain of title, and detail any restrictions associated with the property.

Guarantees and responsibilities must be stated in the deed as well. These guarantees indicate that the grantor owns the property free and clear of encumbrances, and the seller assumes the responsibility for settling any future claims. If there is a time limit on the guarantees, it must also be incorporated in the deed. The finished copy of the deed must be duly signed by the parties and notarized according to law.

All transfers of real property in Alabama are subject to a transfer tax. Instruments will not be accepted for recording until the tax is paid (40-22-1.). A Real Estate Sales Validation Form (Form RT-1) must be signed by the grantor, grantee, owner or agent, and requires the total purchase price, the actual value, or the assessor's market value of the property (40-22-1.). In the case of a non-resident transfer, include a Non-Resident Withholding Form under (40-18-86.).

Record the original completed deed, along with any additional materials, in the recording division of the probate office of the county where the property is located. Include all relevant documents, affidavits, forms, and fees with the along with the deed for recording. Contact the same office to verify which additional materials are necessary, as well as the accepted forms of payment.

In some cases, there is no exchange of consideration when the property is transferred using an interspousal transfer grant deed. The federal government may identify such transfers as gifts, and which are potentially subject to the federal gift tax. The transfer of property from a spouse or former spouse isn't subject to gift tax if it meets any of the following exceptions: It is made in settlement of marital support rights, it qualifies for the marital deduction, it is made under a divorce decree, or it is made under a written agreement, and the couple is divorced within a specified period. If the transfer of property doesn't qualify for an exemption, or only qualifies in part, report that the transfer is subject to gift tax on IRS Form 709 [2], [3].

This article is provided for informational purposes only and is not a substitute for the advice of an attorney. Contact a lawyer with any questions about interspousal transfer grant deeds or other issues related to the transfer of real property. For questions regarding federal and state taxation laws, consult a tax specialist.

[1] https://www.boe.ca.gov/proptaxes/pdf/ah401.pdf

[2] http://thelawdictionary.org/article/quitclaim-deed-impact-ownership-mortgage-and-bankruptcy/

[3] https://taxmap.ntis.gov/taxmap/pubs/p504-005.htm#en_us_publink1000176059

(Alabama Interspousal Transfer Grant Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Saint Clair County to use these forms. Documents should be recorded at the office below.

This Interspousal Transfer Grant Deed meets all recording requirements specific to Saint Clair County.

Our Promise

The documents you receive here will meet, or exceed, the Saint Clair County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Saint Clair County Interspousal Transfer Grant Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4577 Reviews )

yvonne e.

July 19th, 2020

Poor communication. Confusing charges. (Waiting for explanation) overall, not thrilled and at this point would not recommend.

Sorry to hear of your confusion. We've gone ahead and canceled your order. We do hope that you find something more suitable to your needs elsewhere. Have a wonderful day.

Judith D.

November 25th, 2022

If my availability does not coincide with your business hours it should not prevent me from uploading my documents and making payment. You should allow people to upload their documents at any time with the understanding that you will process them on your next business day.

Thank you!

Robert W.

February 22nd, 2020

With the guide everything went great

Thank you!

Marsha D.

September 25th, 2020

Outstanding product and so easy to use! Highly recommend this product. We successfully used the Virginia deeds. Thank you.

Thank you!

LuAnn F.

September 8th, 2022

Simple and quick access to the form I needed

Thank you!

Deborah D.

January 12th, 2021

Very easy to use, got everything I needed. Reasonable price.

Thank you!

GLENN C.

January 22nd, 2020

Your response was very thorough

Thank you for your feedback. We really appreciate it. Have a great day!

Nancy S.

July 6th, 2021

Terrific service, I found just what I needed, and priced reasonably. The decision to purchase a form instead of trying to create one of my own was easy to make. I will return to this service again.

Thank you!

Catherine B.

October 26th, 2021

Was looking for information and forms relating to a trust my parents created, but what I purchased seems geared toward trusts containing real estate only, which is not what I needed. Clearly I missed something prior to purchasing something I can not use. Perhaps additional clarification for us without any experience is this area would be helpful.

Thank you for your feedback. We really appreciate it. Have a great day!

Mike H.

February 11th, 2021

Great

Thank you!

FE P.

March 4th, 2023

Looked into a good number of DIY deeds on the internet. Very glad that I chose Deeds.com. They made it easy to make your own deed based on your state and the process based on the sample included was easy to follow. Also the cost was very reasonable. Great company.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Michael M.

February 20th, 2020

Thanks worked out great as the form was perfect and no problems filing it with the county.

Thank you for your feedback. We really appreciate it. Have a great day!

Joey D.

July 29th, 2019

Great product delivered immediately at very reasonable price. Highly recommend !

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Catherine S.

December 19th, 2019

Description of document could have been better

Thank you!

Roy W.

April 29th, 2020

It's fine

Thank you!