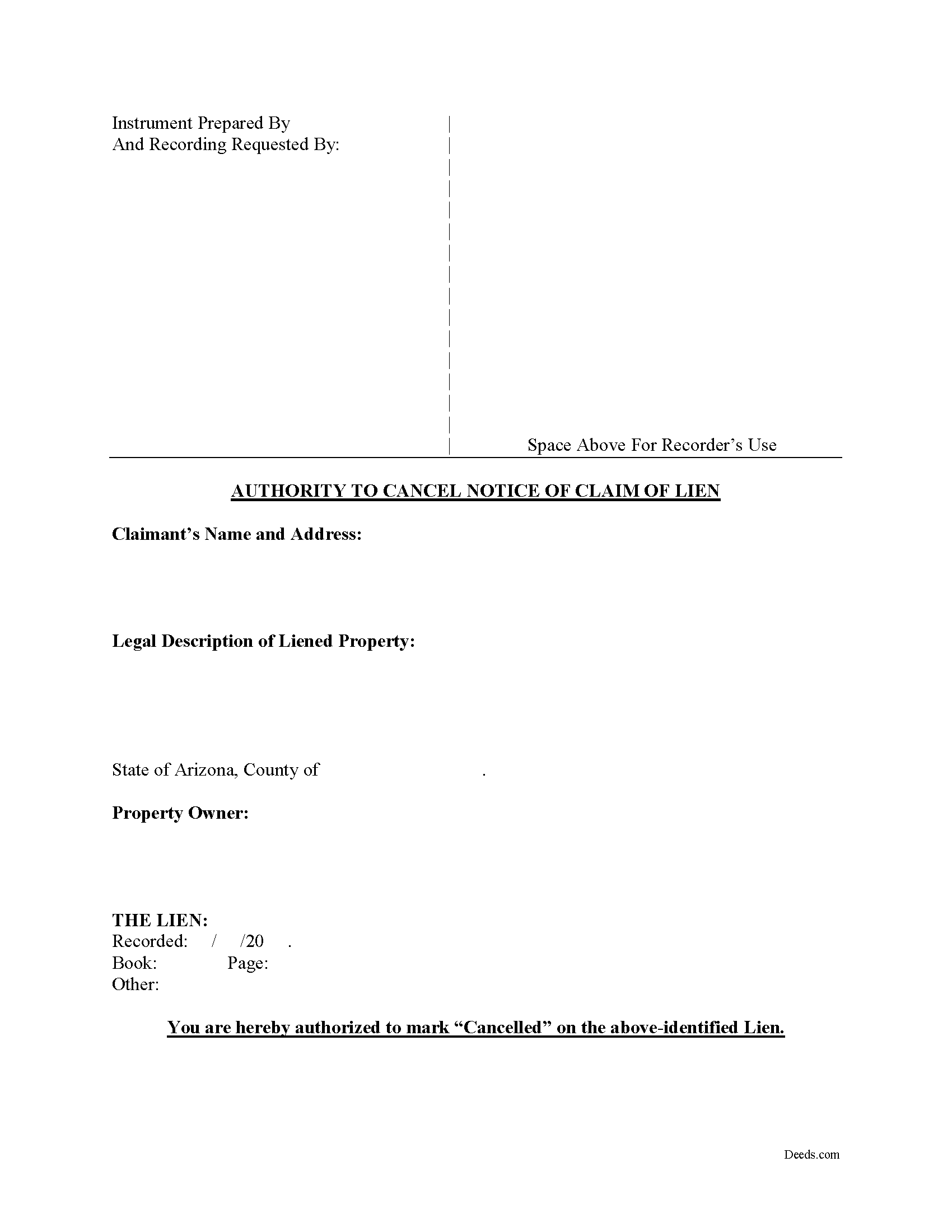

Pinal County Authority to Cancel Notice of Claim of Lien Form

Pinal County Authority to Cancel Notice of Claim of Lien Form

Fill in the blank form formatted to comply with all recording and content requirements.

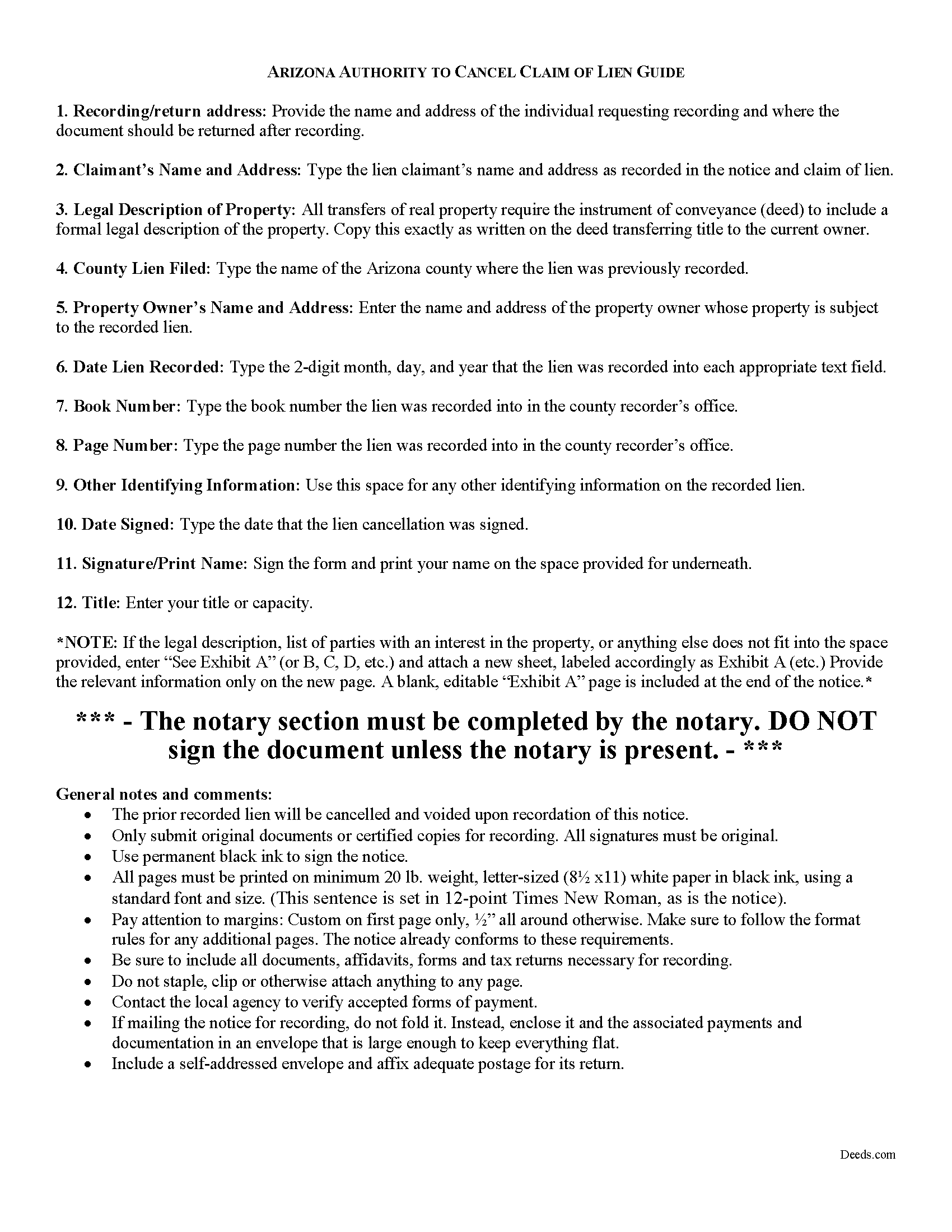

Pinal County Authority to Cancel Notice of Claim of Lien Guide

Line by line guide explaining every blank on the form.

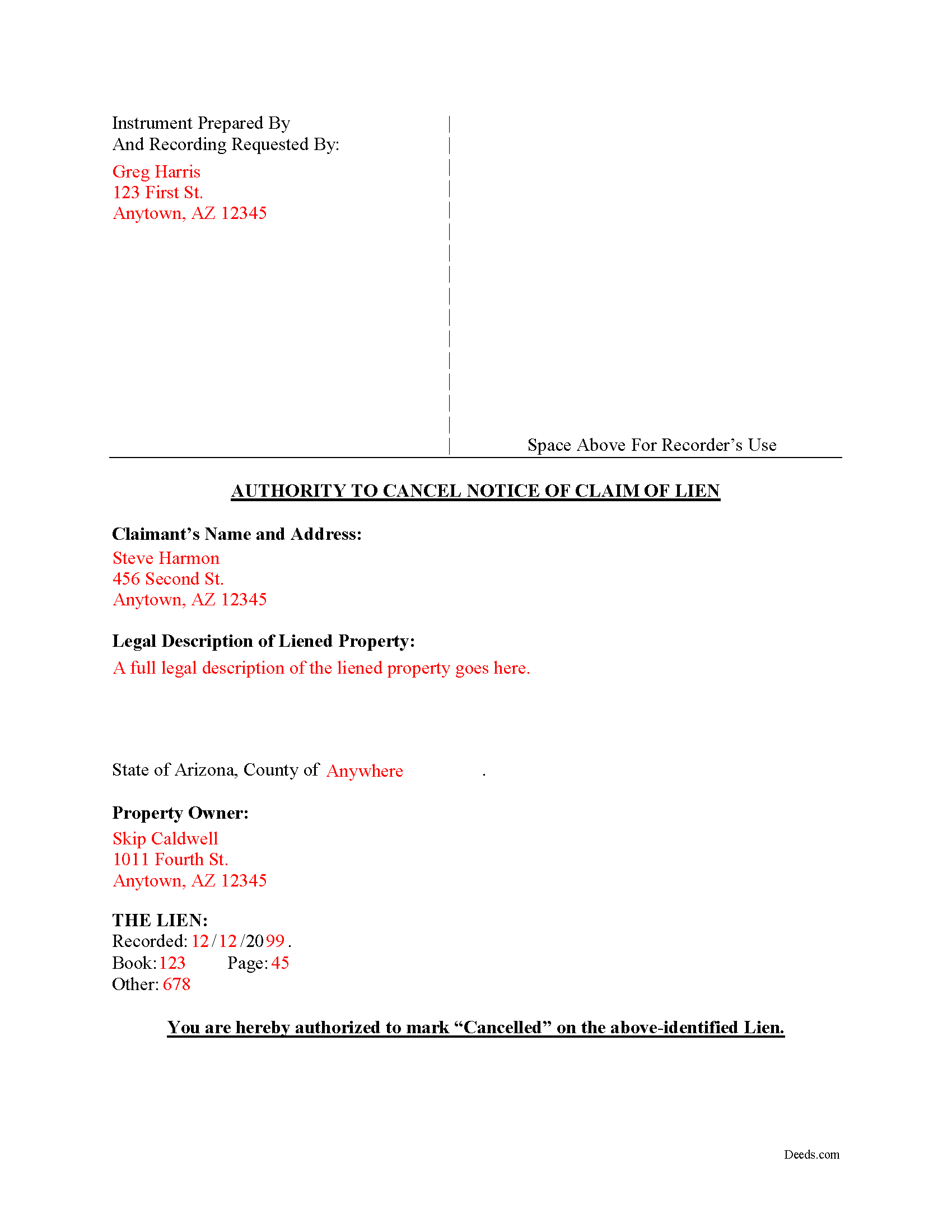

Pinal County Completed Example of the Authority to Cancel Notice of Claim of Lien Docment

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Arizona and Pinal County documents included at no extra charge:

Where to Record Your Documents

County Recorder: Main Office

Florence, Arizona 85132

Hours: 8:00am to 5:00pm Monday - Friday

Phone: 520-866-6830

Apache Junction Office

Apache Junction, Arizona 85119

Hours: 8:00am to 4:30pm M-F

Phone: (520) 866-6830

Casa Grande Office

Casa Grande, Arizona 85122

Hours: 8:30am - 4:30pm M-F

Phone: (520) 866-6830

Recording Tips for Pinal County:

- Check that your notary's commission hasn't expired

- Bring extra funds - fees can vary by document type and page count

- Multi-page documents may require additional fees per page

Cities and Jurisdictions in Pinal County

Properties in any of these areas use Pinal County forms:

- Apache Junction

- Arizona City

- Bapchule

- Casa Grande

- Coolidge

- Eloy

- Florence

- Kearny

- Mammoth

- Maricopa

- Oracle

- Picacho

- Queen Creek

- Red Rock

- Sacaton

- San Manuel

- Stanfield

- Superior

- Valley Farms

Hours, fees, requirements, and more for Pinal County

How do I get my forms?

Forms are available for immediate download after payment. The Pinal County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Pinal County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Pinal County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Pinal County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Pinal County?

Recording fees in Pinal County vary. Contact the recorder's office at 520-866-6830 for current fees.

Questions answered? Let's get started!

Cancelling a Recorded Lien in Arizona

When a recorded claim of lien is satisfied, the claimant must cancel it within 20 days. AZ REV. STAT. 33-1006(A). Additionally, if a lien prohibited under 33-1002 (against the dwelling of an owner-occupant) has been recorded, the claimant must release than lien within 20 days of a request made by the owner-occupant. AZ REV. STAT. 33-1006(B). Finally, there is a penalty for failure to release the lien within the proper time. Failure to grant a lien release will subject the lienholder to liability of one thousand dollars as well as for actual damages caused by not releasing the lien. AZ REV. STAT. 33-1006(C).

The lien release form is a simple document that identifies the claimant's name and address, description of the property, county, and recording details of the lien (book and page number). By recording the lien cancellation, the county recorder will cancel the previously recorded mechanic's lien.

This article is provided for informational purposes and should not be relied on as a substitute for the advice of an attorney. If you have any questions about cancelling a mechanic's lien, please contact an Arizona attorney.

Important: Your property must be located in Pinal County to use these forms. Documents should be recorded at the office below.

This Authority to Cancel Notice of Claim of Lien meets all recording requirements specific to Pinal County.

Our Promise

The documents you receive here will meet, or exceed, the Pinal County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Pinal County Authority to Cancel Notice of Claim of Lien form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Rut P M.

November 15th, 2020

I was very pleased with the document I downloaded. I was able to edit it easily and save a copy both as a permanent copy or one that could still be edited. I also liked being able to cut and paste longer paragraphs. It cost a little more than I expected; however, it was worth it be cause I didn't have to fill it out by hand. Great job!

Thank you for your feedback. We really appreciate it. Have a great day!

Cathy W.

September 3rd, 2021

Just what I was looking for

Thank you!

Carlos M.

January 4th, 2023

so far so good. thanks

Thank you!

Catherine O.

February 23rd, 2021

Love the fact that you can buy a form instead of a subscription. I would highly recommend this site.

Thank you for your feedback. We really appreciate it. Have a great day!

Armando B.

October 23rd, 2021

This was so simple to get around your web site. Guide was easy to follow. Great experience. Would use again.

Thank you for your feedback. We really appreciate it. Have a great day!

Lauren W.

October 30th, 2019

I took a chance and downloaded the Beneficiary Deed form -- would have liked to have been able to see the form before I paid, but I took a chance as everywhere else I looked online wanted me to fill out form online and then pay $30+ for each deed. I'm doing several, so I was glad to be able to just download the blank form that appears to be one I can directly type into on my computer. Yay! Would use your site again if needed. Thanks!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Margarette S.

November 27th, 2019

I found your website easy to use and very informative.

Thank you for your feedback. We really appreciate it. Have a great day!

FRANK D.

September 28th, 2019

Excellent software along with my other Will/Trust programs. I always use your program regarding deeds.

Thank you!

Dean B.

September 17th, 2020

I needed to cut and paste my phone number with the dashes in order to use this website with my iPhone

Thank you!

Linda M.

October 23rd, 2019

Happy with the forms and the service, would recommend to others.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Donna L.

October 17th, 2021

So far so good. Looks nice but a more condensed version, when the recorder charges by the page, should be offered.

Thank you for your feedback. We really appreciate it. Have a great day!

Glenn H.

January 15th, 2022

Searched online 3 hours until I found Deeds.com, afterwards smooth sailing definitely 5 stars

Thank you for your feedback. We really appreciate it. Have a great day!

Derrell S.

August 26th, 2019

I like the simplicity of your site and the reasonable charge for your services but for some reason you were unable to fulfill my order. Would appreciate knowing why. Derrell Sweem

Thank you for your feedback. We really appreciate it. Have a great day!

Leo H.

May 26th, 2021

The deed was very easy to use and the material provided were helpful in completing the form. We haven't filed it yet, but I assume that all will go well.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Gary G.

June 26th, 2019

Ordered the forms I needed for my state and county and everything worked out perfectly. All the forms came with examples (filled in) and very detailed instructions for each block that required an entry. I was able to fill everything out on my computer and save the files for future use, if required. Deeds provides an excellent product. I highly recommend their products and will use their services again.

Thank you for your feedback. We really appreciate it. Have a great day!