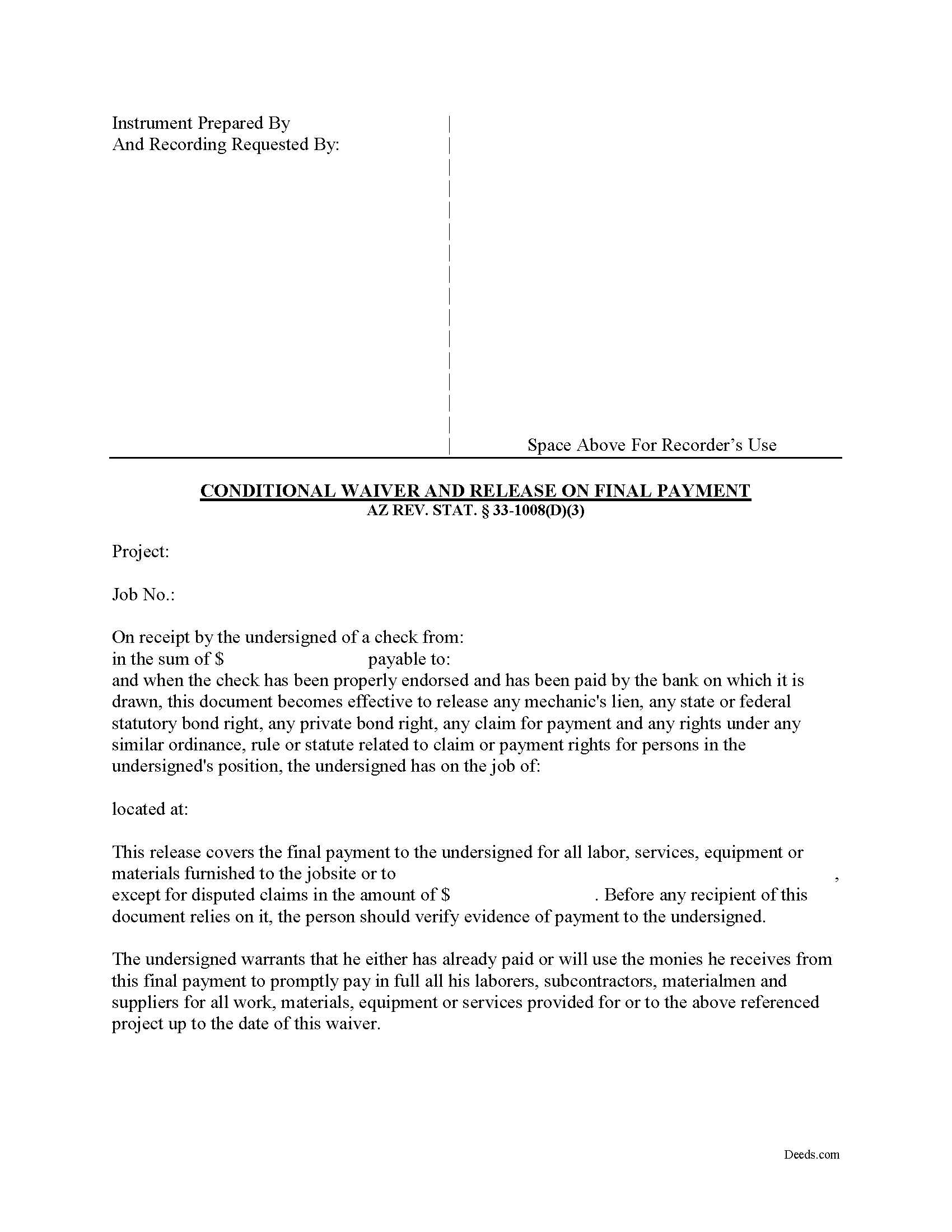

Pinal County Conditional Lien Waiver on Final Payment Form

Pinal County Conditional Lien Waiver on Final Payment Form

Fill in the blank form formatted to comply with all recording and content requirements.

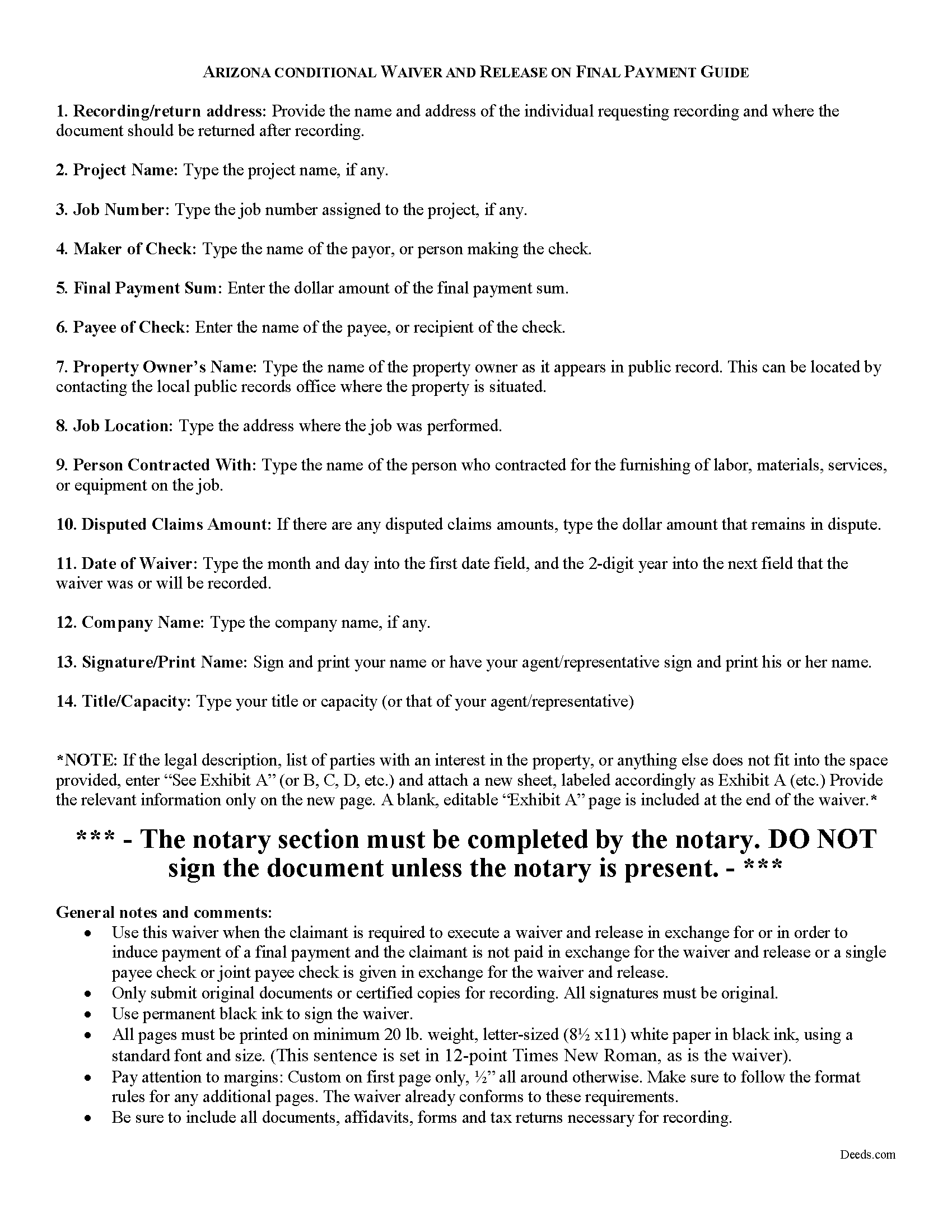

Pinal County Conditional Lien Waiver on Final Payment Guide

Line by line guide explaining every blank on the form.

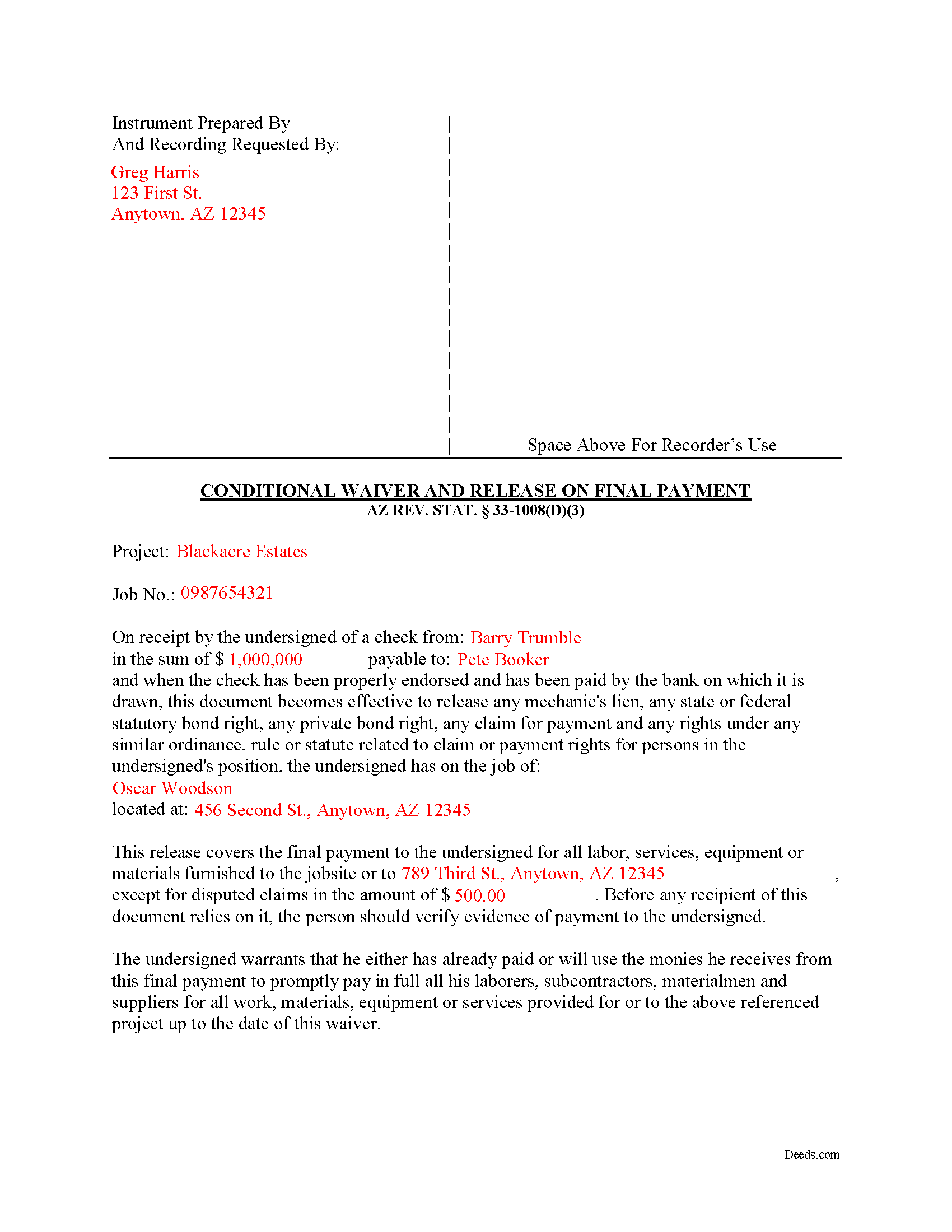

Pinal County Completed Example of the Conditional Lien Waiver on Final Payment Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Arizona and Pinal County documents included at no extra charge:

Where to Record Your Documents

County Recorder: Main Office

Florence, Arizona 85132

Hours: 8:00am to 5:00pm Monday - Friday

Phone: 520-866-6830

Apache Junction Office

Apache Junction, Arizona 85119

Hours: 8:00am to 4:30pm M-F

Phone: (520) 866-6830

Casa Grande Office

Casa Grande, Arizona 85122

Hours: 8:30am - 4:30pm M-F

Phone: (520) 866-6830

Recording Tips for Pinal County:

- Bring your driver's license or state-issued photo ID

- Ask if they accept credit cards - many offices are cash/check only

- Recorded documents become public record - avoid including SSNs

Cities and Jurisdictions in Pinal County

Properties in any of these areas use Pinal County forms:

- Apache Junction

- Arizona City

- Bapchule

- Casa Grande

- Coolidge

- Eloy

- Florence

- Kearny

- Mammoth

- Maricopa

- Oracle

- Picacho

- Queen Creek

- Red Rock

- Sacaton

- San Manuel

- Stanfield

- Superior

- Valley Farms

Hours, fees, requirements, and more for Pinal County

How do I get my forms?

Forms are available for immediate download after payment. The Pinal County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Pinal County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Pinal County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Pinal County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Pinal County?

Recording fees in Pinal County vary. Contact the recorder's office at 520-866-6830 for current fees.

Questions answered? Let's get started!

Lien waivers are part of the Arizona mechanic's lien process. The waiver, given by a contractor, subcontractor, materials supplier or other party to the construction project (the claimant) acknowledging receipt of payment and waiving any future lien rights to the owner's property. Lien waivers are governed under Arizona Revised Statute 33-1008.

In Arizona, lien waivers require strict compliance with the statute and any document purported to waive a lien must follow the statutory format. AZ REV. STAT. 33-1008(A). Any contract or other form attempting to waive lien rights is void as a matter of law. Id. Additionally, lien waivers filed in the state require evidence of actual payment when the waiver is conditioned on receipt of payment. Id.

There are two classifications of lien waivers: conditional and unconditional. Within either class, there are subcategories of "partial" and "final" waivers. Unconditional waivers take effect without payment confirmation, but conditional waivers are effective only when payment is received, usually verified by a check clearing the bank. So, a conditional waiver given after the final payment releases the claimant's right to lien, but only after any check used to pay the bill clears the bank.

The waiver must contain details identifying the job/project, the amount and type of payment, including the name of the person who wrote any checks, the property owner, the location and a description of the work, relevant dates, and the claimant's signature. 33-1008(D)(3).

This article is provided for informational purposes only and should not be relied on as a substitute for the advice of an attorney. Please contact an Arizona attorney with questions about mechanic's lien waivers.

Important: Your property must be located in Pinal County to use these forms. Documents should be recorded at the office below.

This Conditional Lien Waiver on Final Payment meets all recording requirements specific to Pinal County.

Our Promise

The documents you receive here will meet, or exceed, the Pinal County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Pinal County Conditional Lien Waiver on Final Payment form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Robbin J.

June 1st, 2020

Really great website!! Easy to use!! Very helpful!!

Thank you!

Dee S.

October 24th, 2023

Great service and so quick at responding!

We are motivated by your feedback to continue delivering excellence. Thank you!

Robert J.

August 11th, 2020

Ordered the quitclaim forms. Amazing value! Received everything I needed and then some. The forms were easy to use and understand with the help of the guide. The best part was that once completed I used deeds.com's e-recording service to submit the document for recording (our county offices are still closed). Outstanding!

Thank you for the kinds words Robert, glad we could help.

Mary Ann H.

February 4th, 2021

The Deeds.com website was clear and easy to follow. I completed it about 20 minutes. I appreciate the convenience of doing it from home and that I will receive a copy by mail.

Thank you for your feedback. We really appreciate it. Have a great day!

Ryan P.

October 6th, 2020

It was a pleasant surprise to find out how easy the site was to use! Clear directions! very user friendly!

Thank you!

Patricia R.

October 26th, 2022

Very quick to respond with the obvious answers. I asked what form to use when adding my daughter to deed. Answer: talk to an attorney duh.

Thank you!

Sunny S.

November 23rd, 2020

Easy to use and quick turnaround. I would use again.

Thank you!

Cheryl D.

August 24th, 2020

How easy was this. I was pleasantly surprised by the speed and price. Saved me several days of snail mail :) thanks deeds.com!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Elijah H.

December 24th, 2018

Deeds.com worked very well for me. Very Simple packet. And my County uses the same website

Thanks for the kinds words Elijah, we really appreciate it.

Judy A S.

October 15th, 2022

Great do it yourself forms (I used the Quitclaim deed). If you think you're going to need a lot of hand holding you might consider hiring an attorney. The guide and general information provided by deeds.com will help if you have some idea of what you are doing and you are willing to research a little. Your mileage may vary but for me, this was a very efficient and economical way to get my quitclaim deed done.

Thank you for your feedback. We really appreciate it. Have a great day!

Leo b.

March 26th, 2019

Awesome site great paperwork EZ Forms great.

Thank you Leo.

Elizabeth L.

November 5th, 2019

Used this site and the forms a few times now and always a good experience. It's so nice to be able to download these forms to my computer and work on them there. So many others want you to do everything online, pain in my opinion. Thank you Deeds!

Thank you for your feedback. We really appreciate it. Have a great day!

Jacqui G.

April 8th, 2020

Excellent system and serviced!

Thank you!

Clarence F.

January 25th, 2022

very easy to use !!!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Michael L.

September 5th, 2020

Pretty good stuff, not exactly clear on the deed transfer costs and all

Thank you for your feedback. We really appreciate it. Have a great day!