Pinal County Quitclaim Deed Form

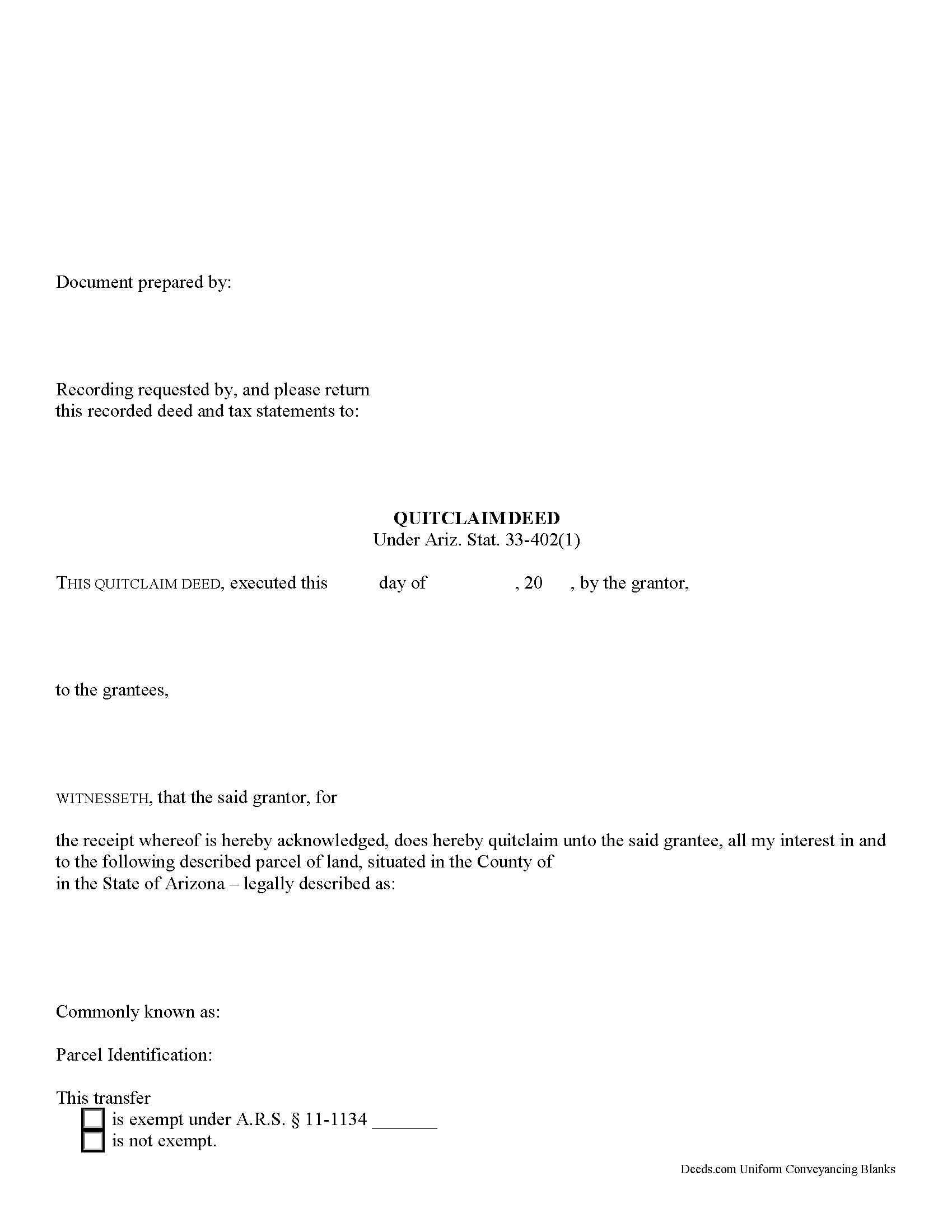

Pinal County Quitclaim Deed Form

Fill in the blank Quitclaim Deed form formatted to comply with all Arizona recording and content requirements.

Pinal County Quitclaim Deed Guide

Line by line guide explaining every blank on the Quitclaim Deed form.

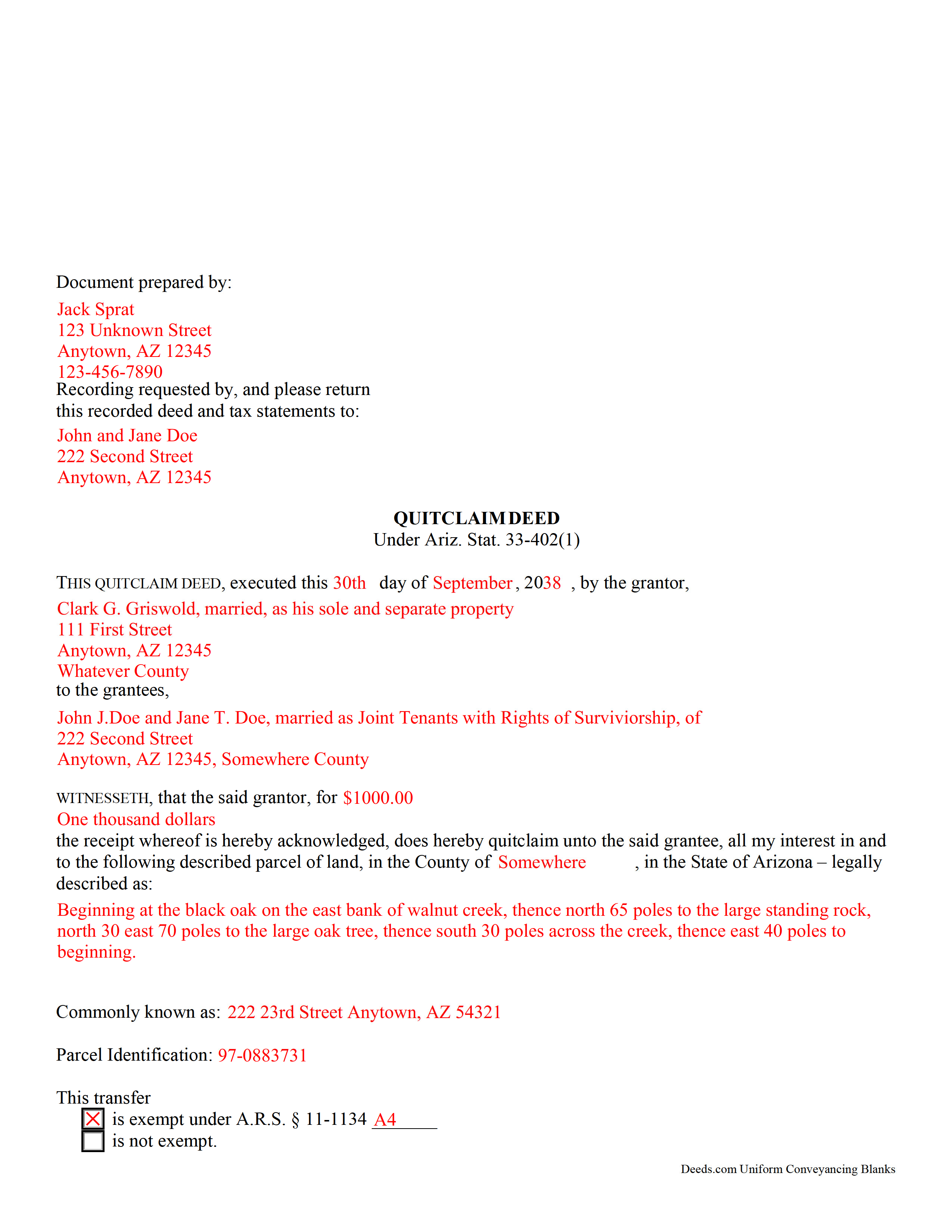

Pinal County Completed Example of the Quitclaim Deed Document

Example of a properly completed Arizona Quitclaim Deed document for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Arizona and Pinal County documents included at no extra charge:

Where to Record Your Documents

County Recorder: Main Office

Florence, Arizona 85132

Hours: 8:00am to 5:00pm Monday - Friday

Phone: 520-866-6830

Apache Junction Office

Apache Junction, Arizona 85119

Hours: 8:00am to 4:30pm M-F

Phone: (520) 866-6830

Casa Grande Office

Casa Grande, Arizona 85122

Hours: 8:30am - 4:30pm M-F

Phone: (520) 866-6830

Recording Tips for Pinal County:

- Ensure all signatures are in blue or black ink

- Check that your notary's commission hasn't expired

- Double-check legal descriptions match your existing deed

- Bring extra funds - fees can vary by document type and page count

- If mailing documents, use certified mail with return receipt

Cities and Jurisdictions in Pinal County

Properties in any of these areas use Pinal County forms:

- Apache Junction

- Arizona City

- Bapchule

- Casa Grande

- Coolidge

- Eloy

- Florence

- Kearny

- Mammoth

- Maricopa

- Oracle

- Picacho

- Queen Creek

- Red Rock

- Sacaton

- San Manuel

- Stanfield

- Superior

- Valley Farms

Hours, fees, requirements, and more for Pinal County

How do I get my forms?

Forms are available for immediate download after payment. The Pinal County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Pinal County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Pinal County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Pinal County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Pinal County?

Recording fees in Pinal County vary. Contact the recorder's office at 520-866-6830 for current fees.

Questions answered? Let's get started!

Quitclaim deeds are documents used to transfer the owner's interest (if any) in real property to someone else, with no warranties of title. The transfer may or may not include consideration (something of value, usually money). They are generally used to clear clouded titles, to settle boundary disputes between neighbors, or to make gifts of real property, and include no warranties of title for the new owners. These deeds are also appropriate for situations like divorce, where the idea is simply removing one party's name from a deed, or relinquishing marital rights in real estate.

For Arizona quitclaim deeds under Section 33-402(1) to be valid, they must conform to specific statutory requirements set forth by 33-401, as well as other relevant state and local standards for recording.

The quitclaim deed must be in writing and contain a heading that identifies the nature of the document. Original forms are preferred. LEGIBLE certified copies are also acceptable, but all signatures must be original. The grantor or an authorized agent must sign the deed in front of an officer certified to take acknowledgments. If the deed marks a change in ownership of real property, provide the prior recording information, including date, docket and page of the earlier document, and a complete legal description of the land. Quitclaim deeds should also contain the names and addresses of all grantors and grantees named in the document, as well as a statement clarifying how the grantee wishes to hold title (vesting). Identify the type and amount of consideration exchanged for ownership of the property (usually money). (Ariz. Rev. Stat. 33-401, et al (2012))

Arizona follows a "notice" recording act. This means that any document conveying title to real property must be correctly recorded or the transaction is not complete (Ariz. Rev. Stat. 33-411). In addition, it is the transferor's (grantor) obligation to record the quitclaim deed within sixty days of the transfer or to accept responsibility to defend the transferee (grantee) in any future claims against the grantee's ownership of the land. (Ariz. Rev. Stat. 33-411.01).

(Arizona Quitclaim Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Pinal County to use these forms. Documents should be recorded at the office below.

This Quitclaim Deed meets all recording requirements specific to Pinal County.

Our Promise

The documents you receive here will meet, or exceed, the Pinal County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Pinal County Quitclaim Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4579 Reviews )

Kyle K.

June 10th, 2020

Very quick and simple process! Will be using this service much more.

Thank you!

charles g.

December 2nd, 2019

very good forms. they covered everything i needed.

Thanks Charles, we really appreciate your feedback. Have a great day!

Steve R.

June 17th, 2023

Hopefully filling out and filing the paperwork is as easy as this was.

Thank you for your feedback. We really appreciate it. Have a great day!

oscar r.

December 17th, 2021

VERY MUCH HELPFUL SAVED ME 600 on not having to hire attorney

Thank you!

LIsa B.

January 27th, 2023

Deeds.com made this process of electronic document recording so easy! The communication was quick, friendly, helpful and efficient. I am out of state and have administrative items to handle for my father who has Alzheimer's. Deeds.com is a great service. I highly recommend them, and will use them again when the time comes.

Thank you!

Michael W.

October 21st, 2022

Easy to use and fast

Thank you!

Howard T.

February 26th, 2019

Easy to use and it is very user friendly.

Thank you!

Donald P.

November 12th, 2019

Very fast and efficient. Easy to fill out but was upset the latest tax exemptions ruled in 2014 did not seem to be included. Exclusion of sale to blood relatives, etc. _ the one I needed.

Thank you for your feedback. We really appreciate it. Have a great day!

Arnold R.

March 11th, 2022

this online service worked efficiently and as quickly as the registry allowed it to record new deeds. Thank you for providing services

Thank you for your feedback. We really appreciate it. Have a great day!

Nancy v.

February 3rd, 2022

Amazing! So easy to get all the forms. Very impressive!

Thank you!

Valerie R.

October 7th, 2020

My expereince with Deeds.com was easy and efficent. Great way to efile documents during these trying times.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

fran g.

April 25th, 2021

To hard for me. But with that being said it's a great option for most people.

Thank you!

Doreen P.

December 13th, 2018

I have uploaded 2 documents for E recording, I have searched thinking it would prompt me to a business customer service contact info tel no. ? I am concerned as to the fees related to the recording of both instruments? please advise? thank you

Thank you for your feedback. We really appreciate it. Have a great day!

Tanya H.

July 21st, 2020

Could not be happier with deeds.com forms. The guide helped more than one can imagine, great resource.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Rose H.

March 22nd, 2021

I am so glad I found this resource! As the Executor of a family members estate I wanted to save money by bypassing a lawyer as it seemed pretty straight forward to tranfer a Life Estate to the remainderman. (I had original deeds). But talking with 3 different states and 4 different counties - none of which seemed to need the same documents, I was almost ready to dump this in a lawyer's lap. This resource makes it simple!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!