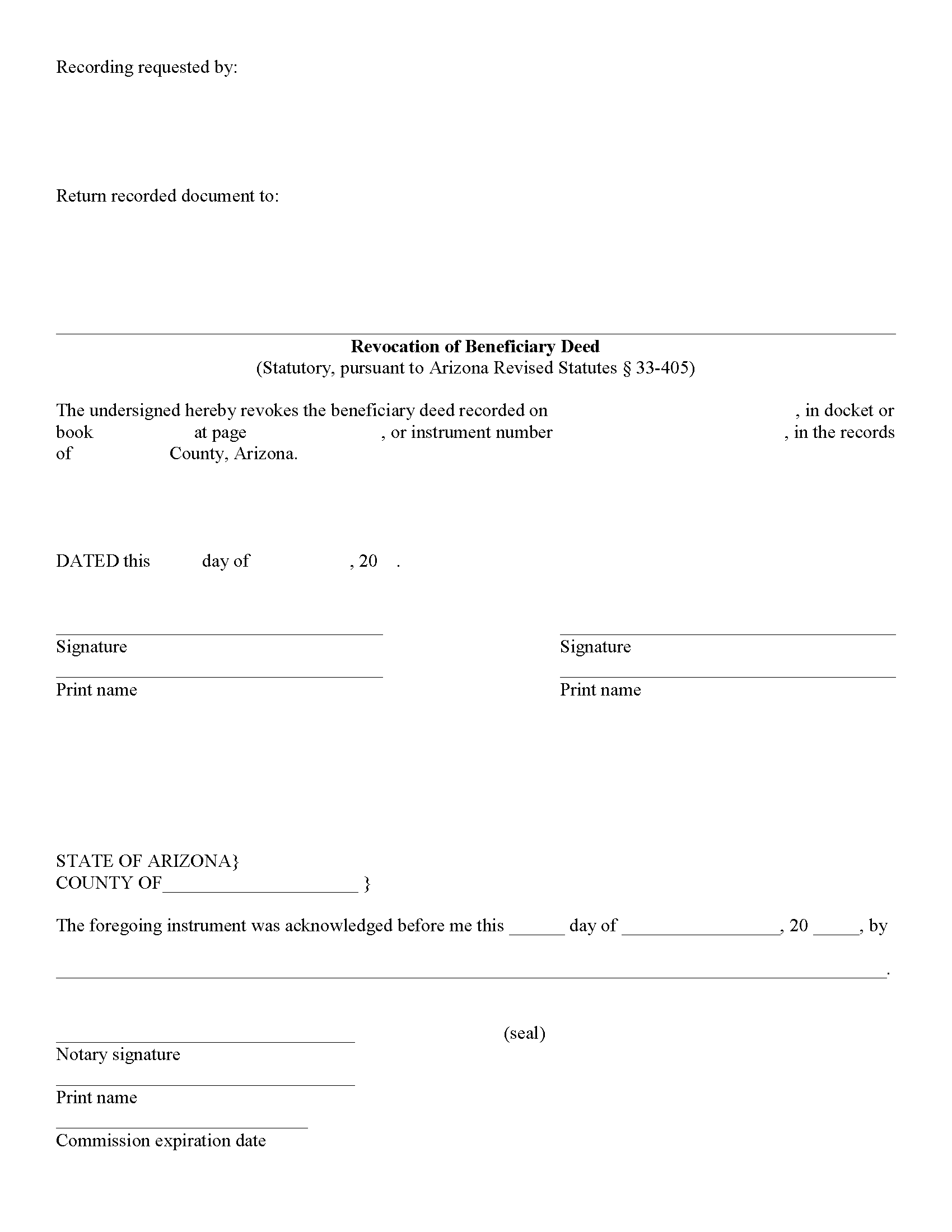

Pinal County Revocation of Beneficiary Deed Form

Pinal County Revocation of Beneficiary Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

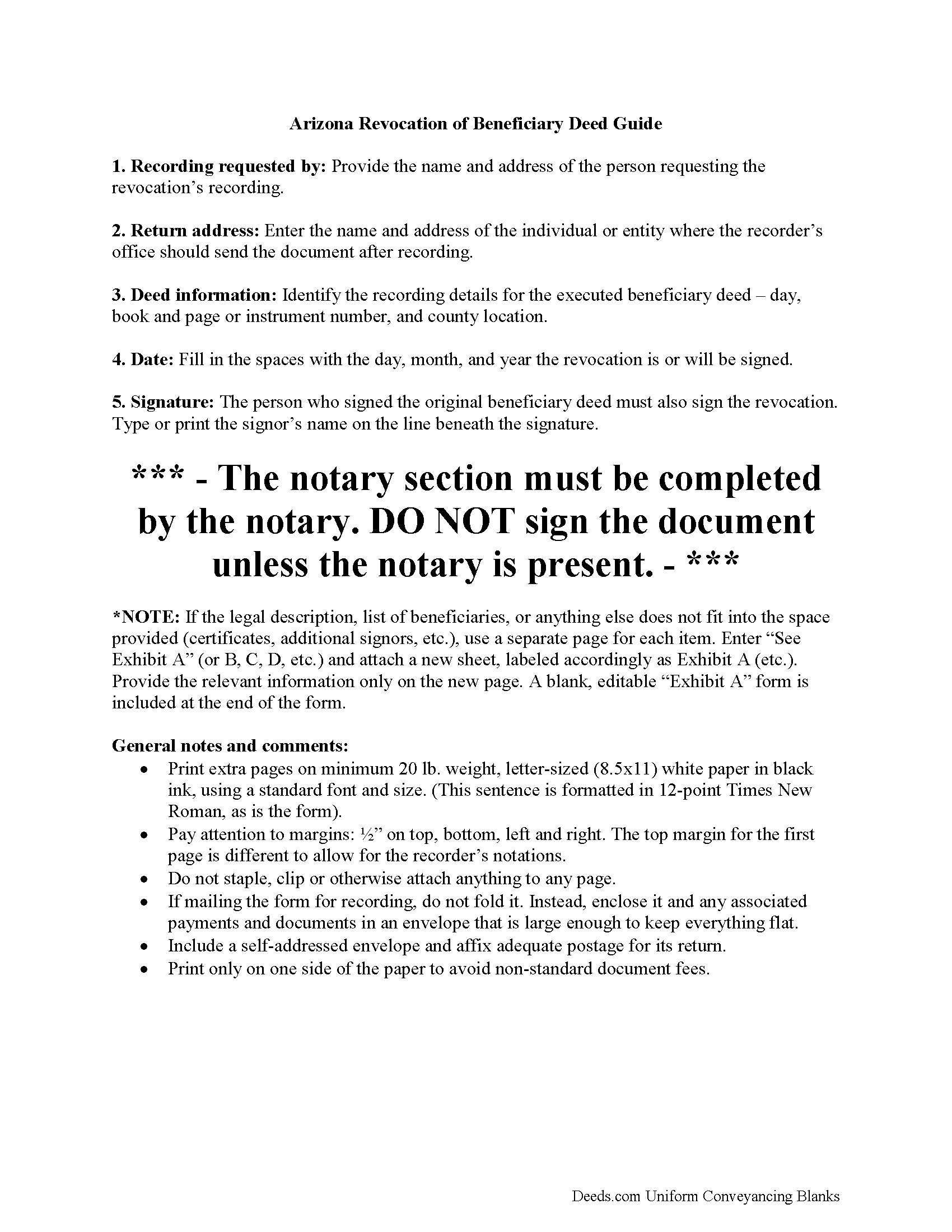

Pinal County Revocation of Beneficiary Deed Guide

Line by line guide explaining every blank on the form.

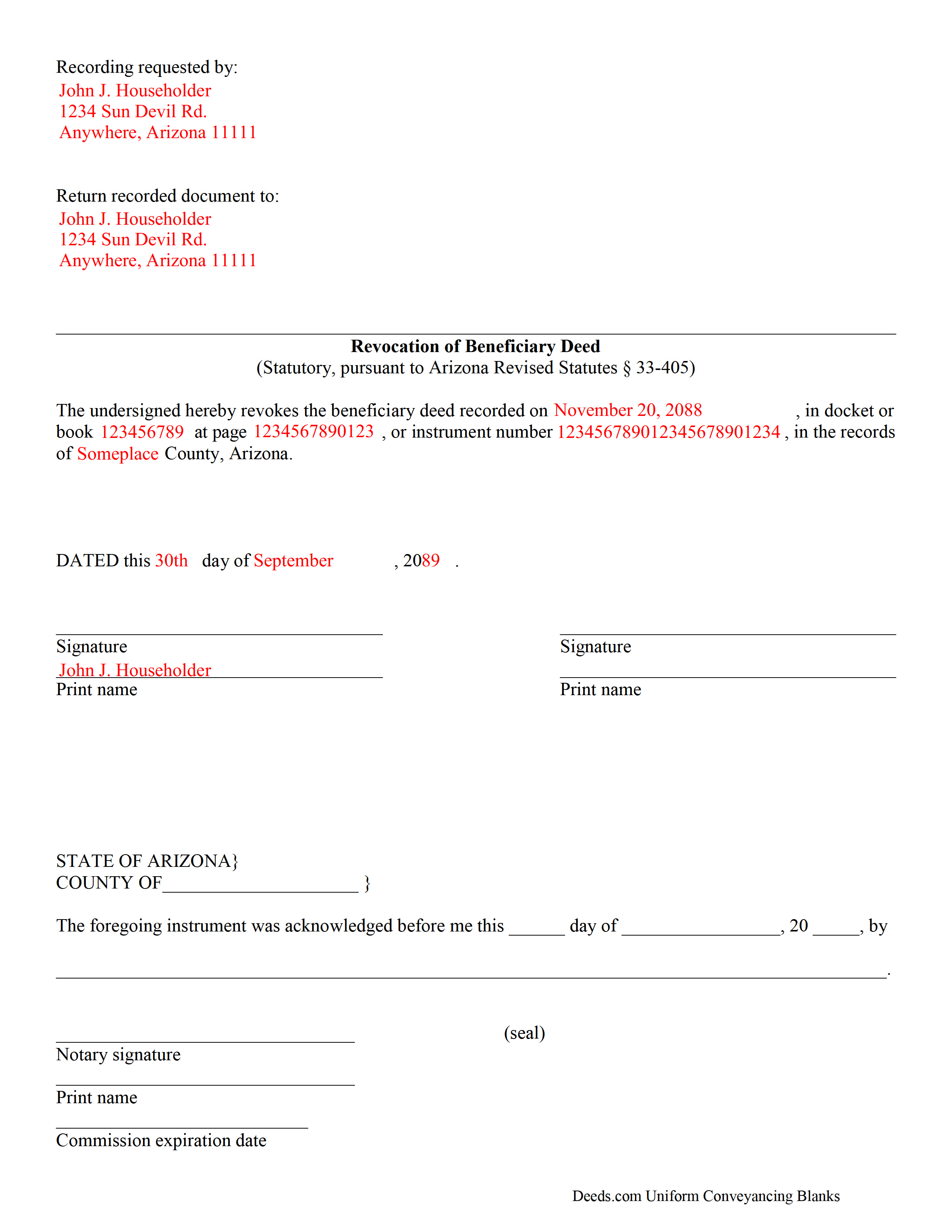

Pinal County Completed Example of the Revocation of Beneficiary Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Arizona and Pinal County documents included at no extra charge:

Where to Record Your Documents

County Recorder: Main Office

Florence, Arizona 85132

Hours: 8:00am to 5:00pm Monday - Friday

Phone: 520-866-6830

Apache Junction Office

Apache Junction, Arizona 85119

Hours: 8:00am to 4:30pm M-F

Phone: (520) 866-6830

Casa Grande Office

Casa Grande, Arizona 85122

Hours: 8:30am - 4:30pm M-F

Phone: (520) 866-6830

Recording Tips for Pinal County:

- Ask if they accept credit cards - many offices are cash/check only

- Recording fees may differ from what's posted online - verify current rates

- Check margin requirements - usually 1-2 inches at top

- Consider using eRecording to avoid trips to the office

Cities and Jurisdictions in Pinal County

Properties in any of these areas use Pinal County forms:

- Apache Junction

- Arizona City

- Bapchule

- Casa Grande

- Coolidge

- Eloy

- Florence

- Kearny

- Mammoth

- Maricopa

- Oracle

- Picacho

- Queen Creek

- Red Rock

- Sacaton

- San Manuel

- Stanfield

- Superior

- Valley Farms

Hours, fees, requirements, and more for Pinal County

How do I get my forms?

Forms are available for immediate download after payment. The Pinal County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Pinal County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Pinal County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Pinal County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Pinal County?

Recording fees in Pinal County vary. Contact the recorder's office at 520-866-6830 for current fees.

Questions answered? Let's get started!

This statutory form meets or exceeds the requirements for revoking an Arizona beneficiary deed.

Arizona's beneficiary deeds are governed by A.R.S. 33-405. The statute provides forms and requirements for managing beneficiary deeds. One aspect of that management is the ability to revoke the deed.

(Arizona Revocation of Beneficiary Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Pinal County to use these forms. Documents should be recorded at the office below.

This Revocation of Beneficiary Deed meets all recording requirements specific to Pinal County.

Our Promise

The documents you receive here will meet, or exceed, the Pinal County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Pinal County Revocation of Beneficiary Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4579 Reviews )

Jared D.

April 29th, 2020

Yes it was awsome experience,thank you

Thank you!

Patricia H.

October 15th, 2020

The process was so easy and result was excellent and expedient. I will definitely recommend your company for future recording needs.

Thank you!

Patricia W.

September 12th, 2020

Had to have help because unable to put phone number in your format. Daughter figured a way around the problem. I am 80 years old but capable of filling out simple forms but not when the format creates problems.

Thank you for your feedback. We really appreciate it. Have a great day!

John W.

March 17th, 2021

I wish that I had known about Deed.com years ago! Very easy and time saving!

Thank you!

Ken J.

May 14th, 2022

I liked the software, it's very easy to use. Once it's saved as a .pdf document on your computer, the source document is lost when you log out. I wish it could be saved and then edited on their site later instead of having to create a new document from scratch each time.

Thank you for your feedback. We really appreciate it. Have a great day!

PAUL B.

August 18th, 2023

Very fast and efficient reply

Thank you!

David D.

May 20th, 2021

Very easy to us & thanks for all the info to fill out the form.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Ginger O.

March 27th, 2019

Thank you for making this so easy to use. I had looked all over the internet and yours was the most user friendly and for a reasonable price.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Mark M.

November 5th, 2020

Deeds was easy to use and worked as specified; they got the recording I needed done finished in one day!

Thank you for your feedback. We really appreciate it. Have a great day!

Kimberly S.

April 21st, 2022

I wasted a lot of my time because I didn't do any research to know what I needed. Nobody fault but mine.

Thank you!

Tanya D.

January 1st, 2019

No review provided.

Edward M.

November 4th, 2021

Thank you for your excellence form services. I can download all the forms easily. If you have the guide on how to fill out all of those forms, that more helpful for me. I don't know how the use E-Recording? Can you tell me how? If my friends ask me about the legal forms services, I will tell them to use your Website. If I wrote some words wrong, please correct them before display publicly.

Thank you for your feedback. We really appreciate it. Have a great day!

Tom D.

May 4th, 2019

I have one suggestion and couple of question I would think that most TOD's would be from married couples. It would be real helpful to have a example of the I(we) block for married couples. Why would I check or not check the "property is registered (torrents)" Do I need a notarized signature of the Grantee

Thank you for your feedback. We really appreciate it. Have a great day!

Laureen M.

November 5th, 2020

This service was extremely helpful. I truly appreciated the way I was communicated with every step of the way in getting my Deed recorded.

Thank you!

Matthew C.

March 29th, 2022

Your Transfer on Death Deed is fine and you have plenty of information about that part. But where is the Confirmatory Deed that is required in many jurisdictions in order to actually pass ownership of a property when the Transfer on Death Deed becomes effective? IT IS MISSING!!

Thank you for your feedback. We really appreciate it. Have a great day!