Placer County Deed Corrective Affidavit Form

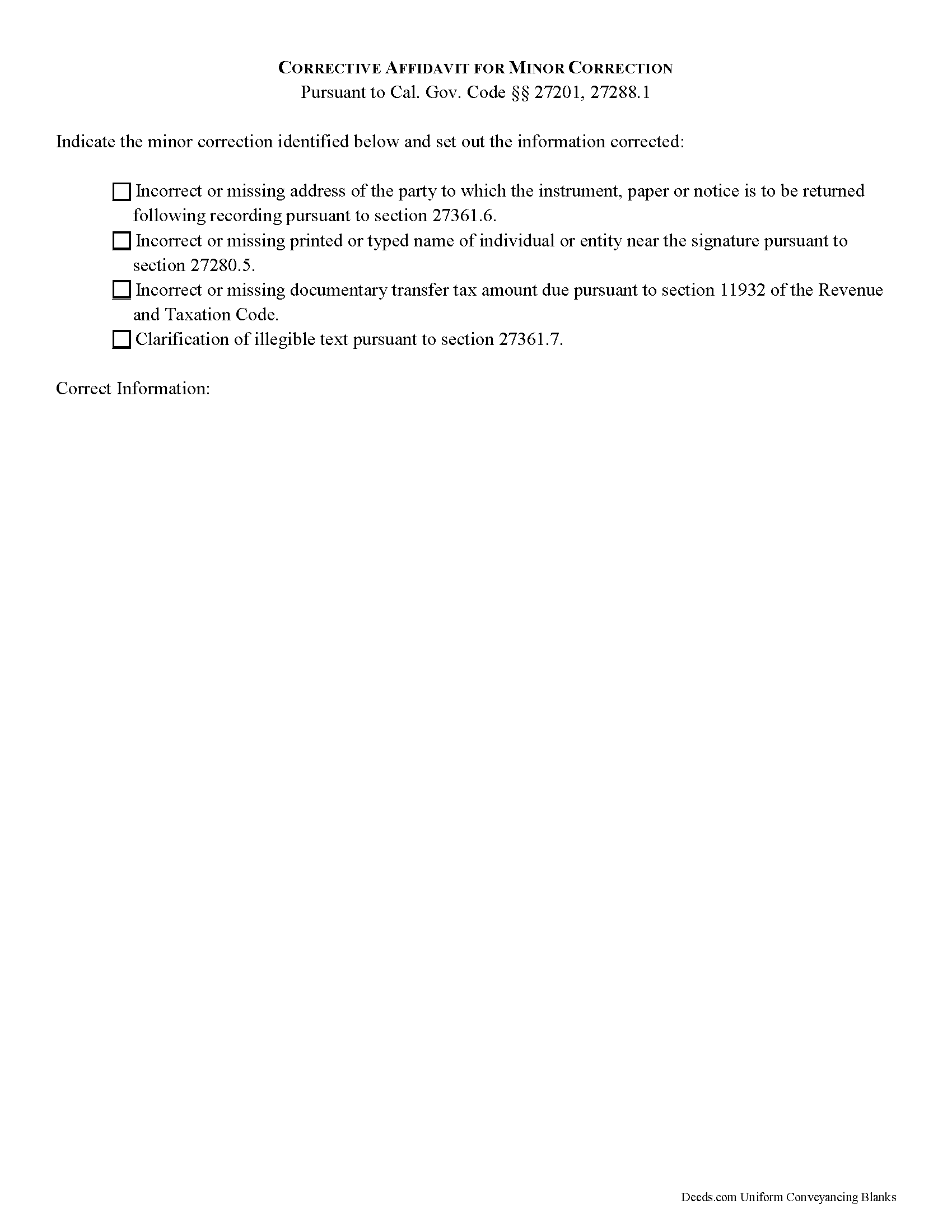

Placer County Corrective Affidavit for Minor Correction Form

Fill in the blank form formatted to comply with all recording and content requirements.

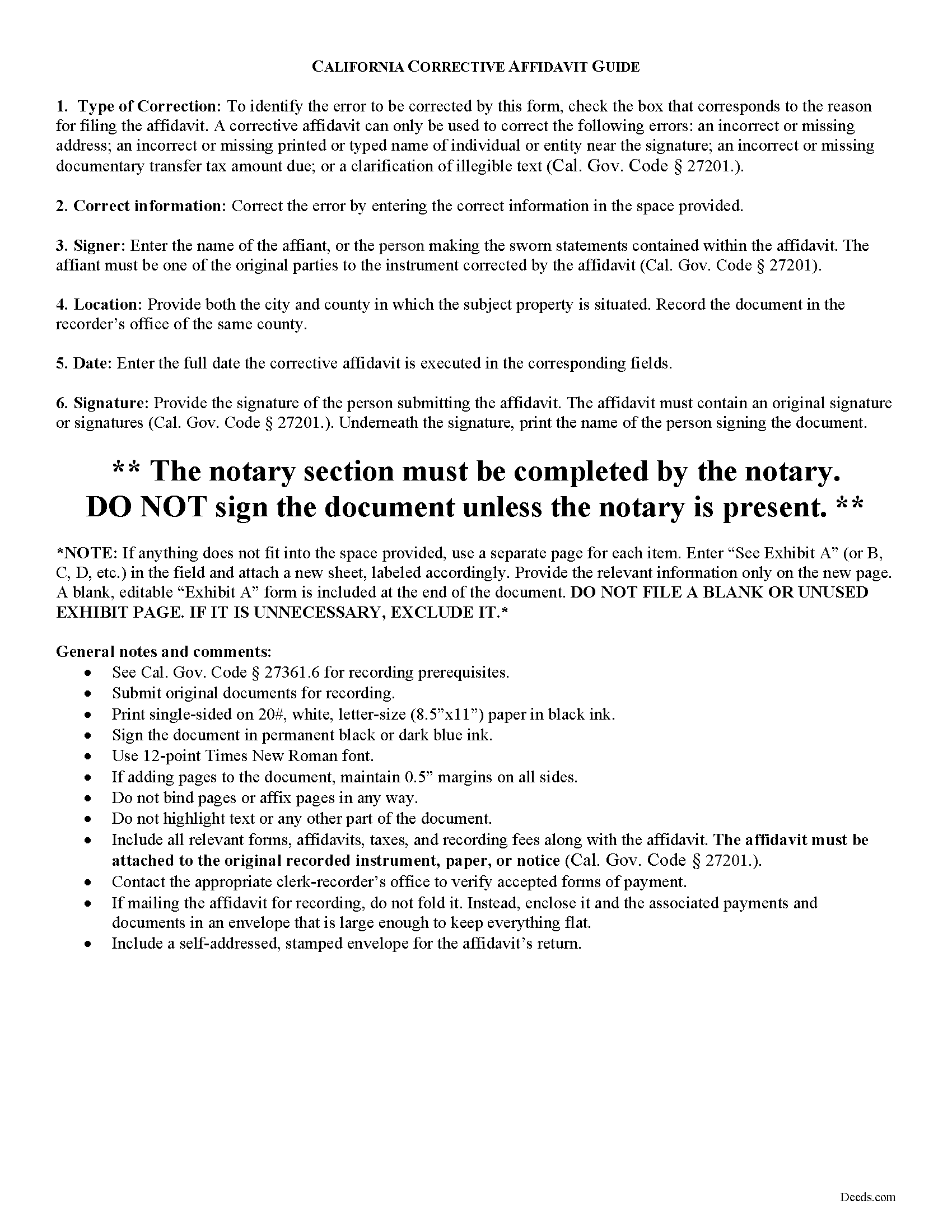

Placer County Corrective Affidavit Guide

Line by line guide explaining every blank on the form.

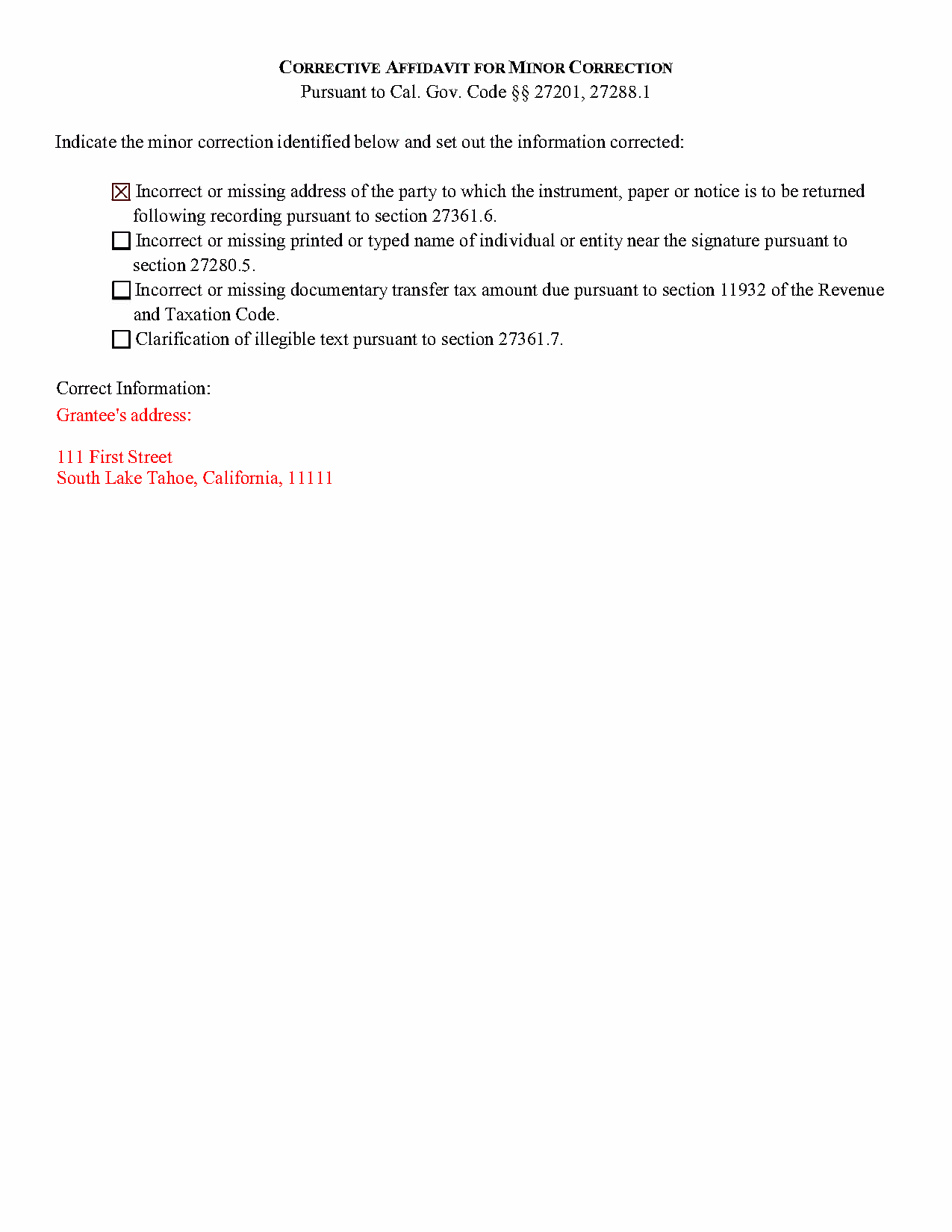

Placer County Completed Example of the Corrective Affidavit Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional California and Placer County documents included at no extra charge:

Where to Record Your Documents

Satellite Office

Auburn, California 95603

Hours: Monday through Friday 8 a.m. to 4 p.m.

Phone: (530) 886-5600

Placer County Clerk-Recorder

Auburn, California 95603

Hours: Mon to Fri 8:00 to 5:00 / Recording until 4:00

Phone: (530) 886-5600

Recording Tips for Placer County:

- Ensure all signatures are in blue or black ink

- Bring extra funds - fees can vary by document type and page count

- Request a receipt showing your recording numbers

Cities and Jurisdictions in Placer County

Properties in any of these areas use Placer County forms:

- Alta

- Applegate

- Auburn

- Carnelian Bay

- Colfax

- Dutch Flat

- Emigrant Gap

- Foresthill

- Gold Run

- Granite Bay

- Homewood

- Kings Beach

- Lincoln

- Loomis

- Meadow Vista

- Newcastle

- Olympic Valley

- Penryn

- Rocklin

- Roseville

- Sheridan

- Tahoe City

- Tahoe Vista

- Weimar

Hours, fees, requirements, and more for Placer County

How do I get my forms?

Forms are available for immediate download after payment. The Placer County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Placer County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Placer County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Placer County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Placer County?

Recording fees in Placer County vary. Contact the recorder's office at (530) 886-5600 for current fees.

Questions answered? Let's get started!

Corrective Affidavits in California

Typically, any rerecorded document must be resigned and acknowledged as a new document. However, an erroneous document will not be recorded as a new document if it is presented with a corrective affidavit (Cal. Gov. Code 27201.). A corrective affidavit is a statutory device under Cal. Gov. Code 27201, used to correct a minor error in a document that has been recorded at an earlier date.

Minor errors are those that, when corrected, cause no actual change in the substance of the document. Section 27201 of the Government Code states that a corrective affidavit can only be used to correct the following: an incorrect or missing return address; a clarification of illegible text; an incorrect or missing printed or typed name near the signature; or an incorrect or missing documentary transfer tax amount due.

More extensive corrections to recorded documents typically require a new deed. Adding or removing a grantee, for example, or making material changes to the legal description, may all require a new document of conveyance. When in doubt about the appropriate vehicle to address the error, consult with a lawyer.

A correction deed is exempt from transfer tax because no transfer is being made, and no consideration is exchanged (Cal. Rev. and Tax. Code 11911). Some counties demand a documentary transfer tax affidavit stating the reason for the exemption, to be filed in addition to the other documents being recorded, so check the county recorder's website to confirm any local requirements.

For the correction to be valid, the affidavit must be attached to the original recorded document with a cover sheet complying with Cal. Gov. Code 27361.6, stating the reason for rerecording on the cover sheet, by the person who submitted the original document for recording (Cal. Gov. Code 27201.).

The affidavit itself must include the information corrected, be certified by the party submitting the affidavit under penalty of perjury, and be acknowledged pursuant to Cal. Gov. Code 27287. The affidavit can be acknowledged by any one of the officials listed in Cal. Civ. Code 1181. Finally, the form must meet all state and local standards for recorded documents. Submit the completed affidavit, along with any necessary supporting materials, to the local recording office to correct and update the public data.

This article is provided for informational purposes only and is not a substitute for legal advice. Contact an attorney with questions about corrective affidavits, or for any other issues related to real property in California.

(California Correction Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Placer County to use these forms. Documents should be recorded at the office below.

This Deed Corrective Affidavit meets all recording requirements specific to Placer County.

Our Promise

The documents you receive here will meet, or exceed, the Placer County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Placer County Deed Corrective Affidavit form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4585 Reviews )

Mary Ann G.

April 16th, 2019

Couldn't find the deed form that I needed. Needs to have a short summary to determine the correct form.

Sorry to hear that Mary Ann, we appreciate your feedback.

Arthur S.

July 19th, 2019

It is great and fast you get 5 stars from me

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Gene L.

August 5th, 2020

Worked perfect. Thanks.

Thank you!

Gene N.

November 11th, 2021

My mind is blown! For some reason, our veteran title companies wouldn't record our deed but luckily, the assessor's page recommended Deeds and other sites to e-record. It was so simple and so convenient!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Deborah K.

February 2nd, 2023

great job but, I wanted to upload a document. I got it wrong, but the info was good.

Thank you!

Eileen D.

August 5th, 2020

Very easy to use. The example form was a big help in making sure I had the forms filled out correctly.

Thank you!

Munir S.

August 2nd, 2024

Good service. Easy to use, responsive, fast, and fairly priced. First time user, will continue to use it for future needs. Recommend.

Thank you for your positive words! We’re thrilled to hear about your experience.

Elizabeth J.

May 17th, 2019

It is very good and I would use the site again.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

James S.

April 22nd, 2019

easy to use

Thank you James.

Robert C.

February 10th, 2022

Wow! Wish I had found DEEDS.com a few hours earlier. Quickly was able to pay a reasonable fee for some documents/templates along with an explanation. Very pleased

Thank you for your feedback. We really appreciate it. Have a great day!

James S.

September 21st, 2021

The affidavit guidance was a great help and helped reduce the stress that usually comes with dealing with legalese. The Preliminary Change of Ownership that CA requires is quite complex since it covers a hoard of situations. I was left with a bit of uncertainty, but I definitely wouldn't want to try it without guidance.

Thank you for your feedback. We really appreciate it. Have a great day!

Sheila G.

September 11th, 2019

I was very pleased with the responses and quick access to info.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Oldemar T.

June 7th, 2020

Messaging system should reach customer email. It took me a couple of days to find out the processor had messaged me. A customer notification should be implemented for every message left in the account.

Thank you!

James S.

July 16th, 2019

The forms download was quick and easy. The example deed was excellent. However, the payment method should include PayPal, not just credit cards.

Thank you for your feedback James, we appreciate it.

MARY LACEY M.

July 1st, 2024

The service provided by the staff at Deeds.com is consistently excellent with prompt replies and smooth recording transactions. I am grateful to have their service available as driving to downtown Phoenix to record documents is always a daunting prospect. Their assistance in recording our firm's documents has been 100% accurate and a pleasure.

Thank you for your positive words! We’re thrilled to hear about your experience.