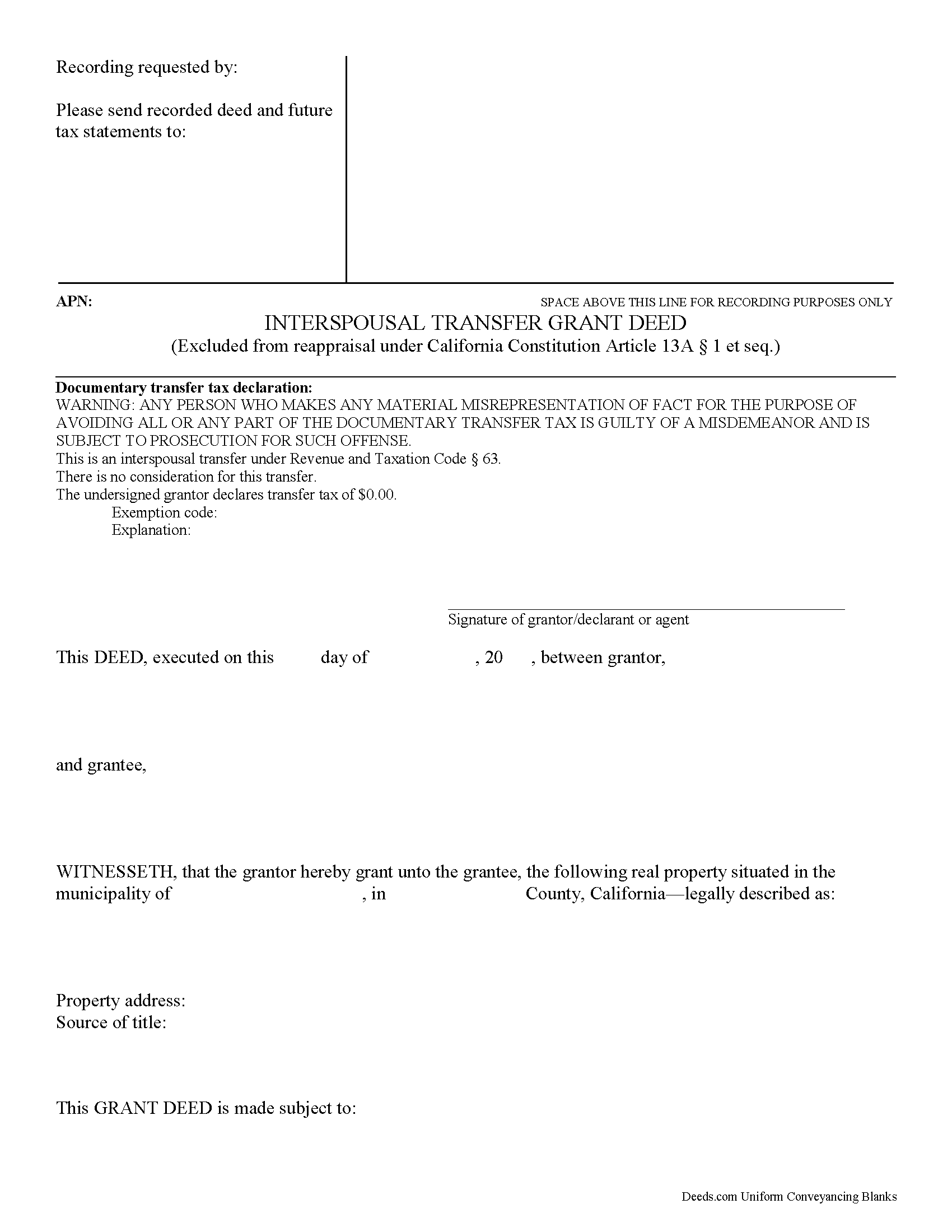

Placer County Interspousal Transfer Grant Deed Form

Placer County Interspousal Transfer Grant Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

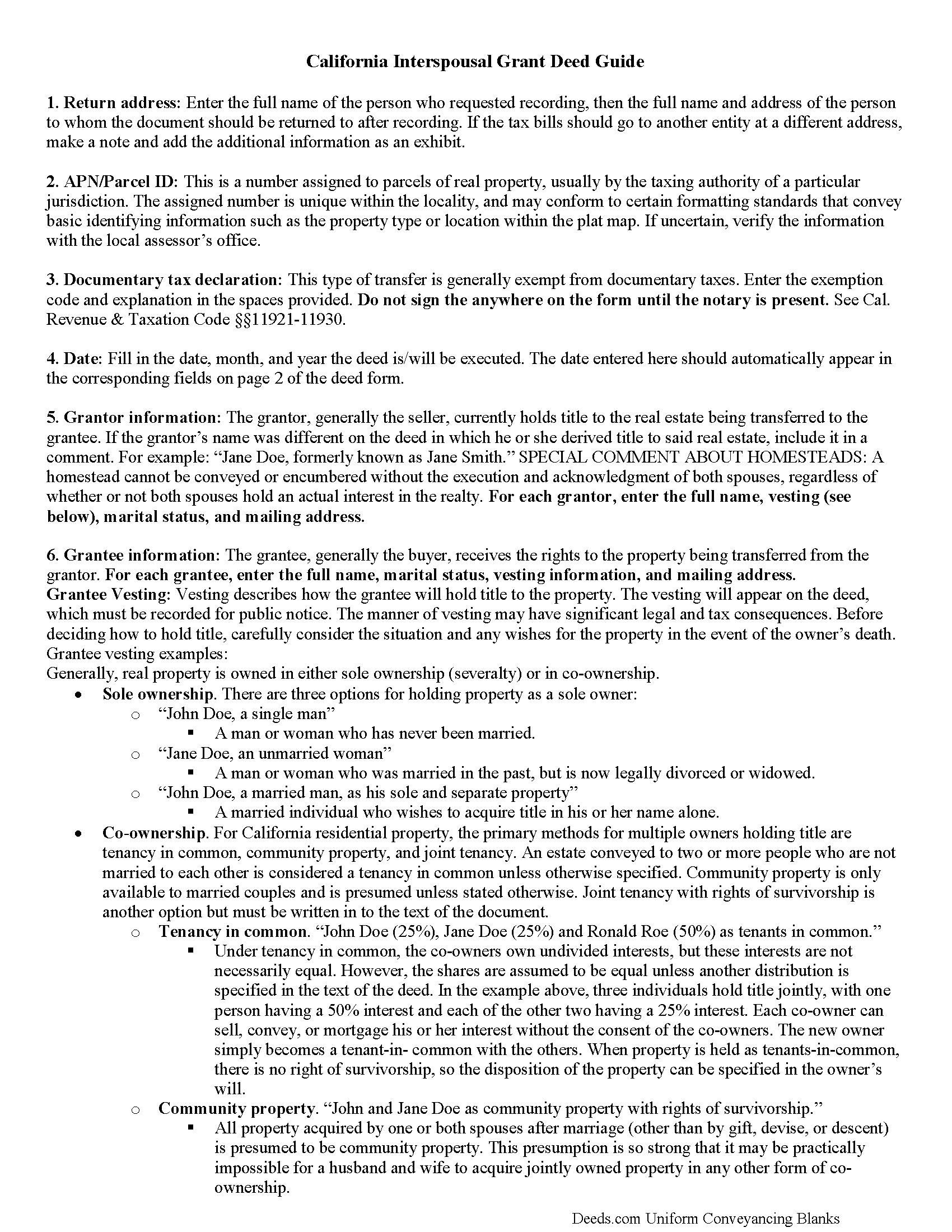

Placer County Interspousal Transfer Grant Deed Guide

Line by line guide explaining every blank on the form.

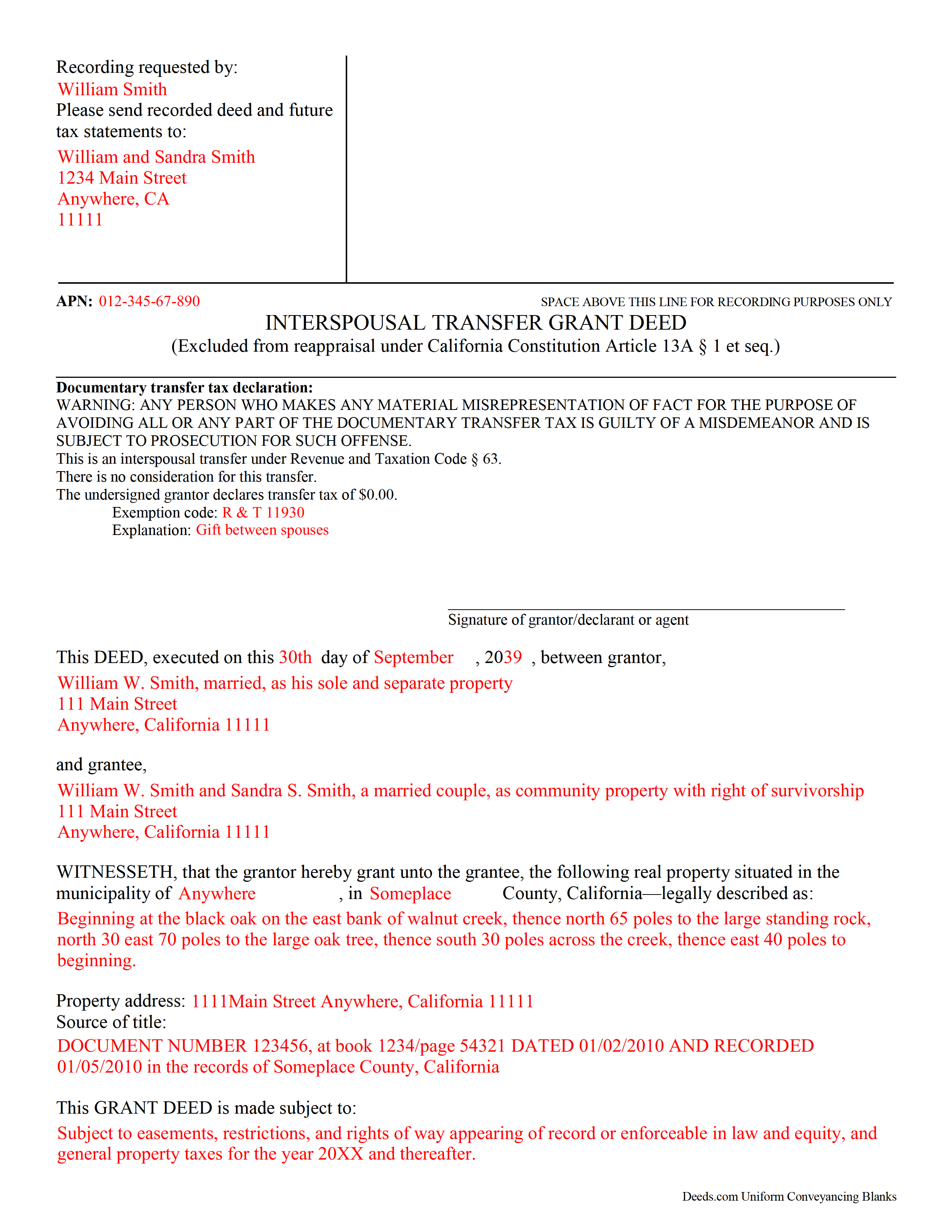

Placer County Completed Example of the Interspousal Transfer Grant Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional California and Placer County documents included at no extra charge:

Where to Record Your Documents

Satellite Office

Auburn, California 95603

Hours: Monday through Friday 8 a.m. to 4 p.m.

Phone: (530) 886-5600

Placer County Clerk-Recorder

Auburn, California 95603

Hours: Mon to Fri 8:00 to 5:00 / Recording until 4:00

Phone: (530) 886-5600

Recording Tips for Placer County:

- Check that your notary's commission hasn't expired

- Make copies of your documents before recording - keep originals safe

- Leave recording info boxes blank - the office fills these

- Avoid the last business day of the month when possible

Cities and Jurisdictions in Placer County

Properties in any of these areas use Placer County forms:

- Alta

- Applegate

- Auburn

- Carnelian Bay

- Colfax

- Dutch Flat

- Emigrant Gap

- Foresthill

- Gold Run

- Granite Bay

- Homewood

- Kings Beach

- Lincoln

- Loomis

- Meadow Vista

- Newcastle

- Olympic Valley

- Penryn

- Rocklin

- Roseville

- Sheridan

- Tahoe City

- Tahoe Vista

- Weimar

Hours, fees, requirements, and more for Placer County

How do I get my forms?

Forms are available for immediate download after payment. The Placer County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Placer County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Placer County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Placer County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Placer County?

Recording fees in Placer County vary. Contact the recorder's office at (530) 886-5600 for current fees.

Questions answered? Let's get started!

A California Interspousal Transfer Grant Deed is used to create, transfer, or terminate a real property ownership interest between spouses. This instrument applies to a present owner's interest and has been drafted to comply with the Revenue and Taxation Code Section 63.

A transfer of real property ownership interests between spouses is excluded from reappraisal under the California Constitution Article 13 A &1 et seq. and transfer taxes, as this conveyance establishes sole and separate property of a spouse (RT 11911)

(California Interspousal Transfer Grant Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Placer County to use these forms. Documents should be recorded at the office below.

This Interspousal Transfer Grant Deed meets all recording requirements specific to Placer County.

Our Promise

The documents you receive here will meet, or exceed, the Placer County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Placer County Interspousal Transfer Grant Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4580 Reviews )

Christopher Shawn S.

November 4th, 2020

Swift and Concise Process!!! I would recommend, as well as, use again!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Gary B.

September 16th, 2022

Great service. Comprehensive. Reasonably priced.

Thank you for your feedback. We really appreciate it. Have a great day!

Fred B.

May 19th, 2020

Great site and very easy to use. I will be using this for all of my search and form requirements.

Thank you for your feedback. We really appreciate it. Have a great day!

Carmen C.

August 23rd, 2021

Hassle free, easy access to form and instructions include on how to complete.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Linda M.

October 23rd, 2019

Happy with the forms and the service, would recommend to others.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Gary B.

September 28th, 2021

The whole experience was amazing. Your site was easy to work with and the staff was supper responsive. We were in and out in a flash!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Rico J.

November 3rd, 2021

Plenty of great information.

Thank you!

James B.

March 10th, 2021

Was a lot easier than driving to the County Building and faster than expected. Thank you!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Marcia H.

April 18th, 2021

This was so easy and fast! Plus it had all the information I needed in one place. The example was right on point too!

Thank you for your feedback. We really appreciate it. Have a great day!

Roland P.

December 28th, 2021

The website is easy to navigate. Unfortunately, you were not able to record the deed. However, I appreciate the fast response.

Thank you for your feedback. We really appreciate it. Have a great day!

Dennis K.

June 9th, 2020

Easily downloaded and filled out form for quit claim deed was approved as soon as i dropped it off.

Thank you for your feedback. We really appreciate it. Have a great day!

Cassandra C.

February 7th, 2022

I was easy fast and easy to order and download.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Thomas R.

June 21st, 2024

First time user. Was pleased with the easy of use and the step-by-step directions provided by the website.

We are motivated by your feedback to continue delivering excellence. Thank you!

Maryel T.

December 23rd, 2018

Good site, had the information I needed. Quicker than I expected. Thanks.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Nigel S.

June 24th, 2025

Very simple to use. The 'completed examples' are very helpful.

Thank you for your feedback. We really appreciate it. Have a great day!