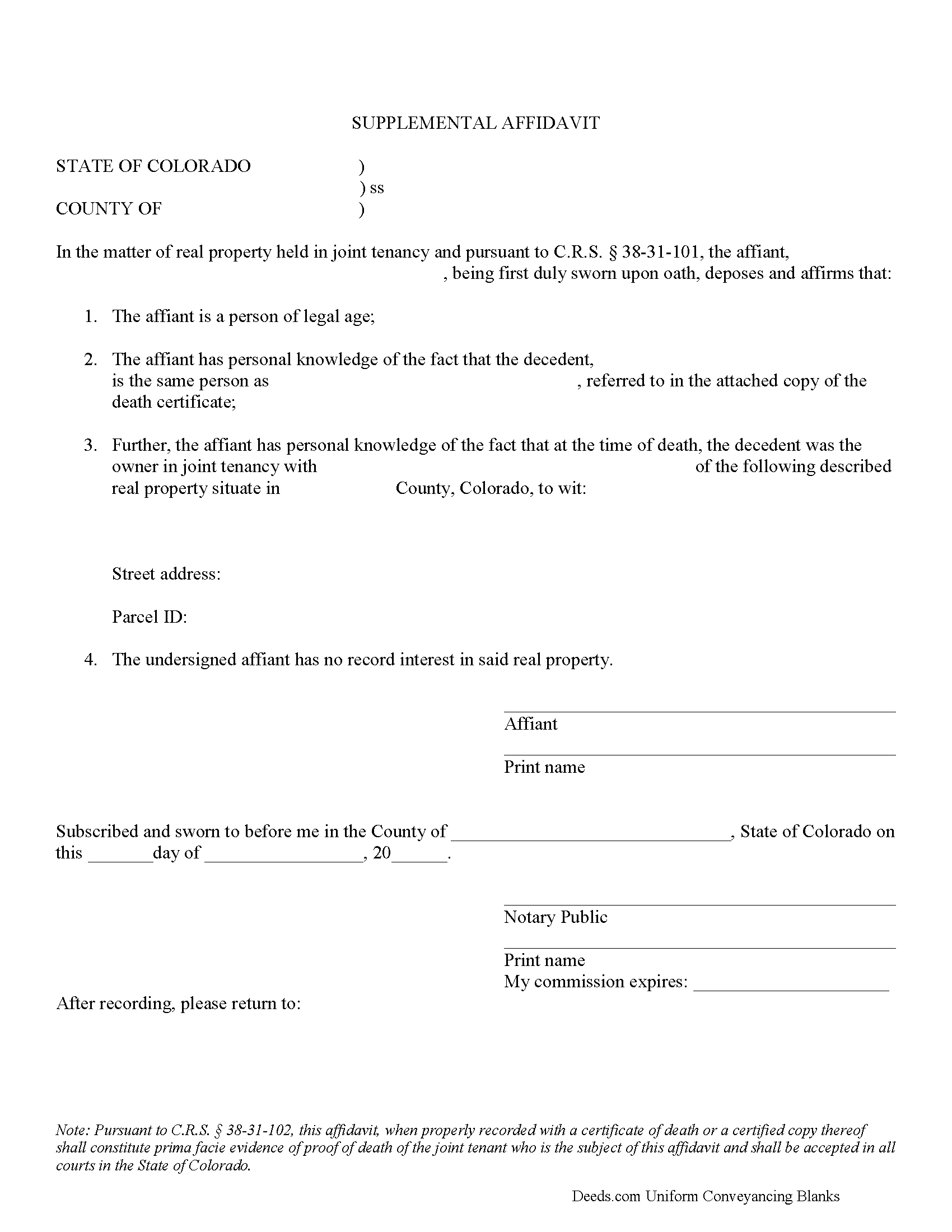

Pitkin County Affidavit of Deceased Joint Tenant Form

Pitkin County Affidavit of Deceased Joint Tenant Form

Fill in the blank form formatted to comply with all recording and content requirements.

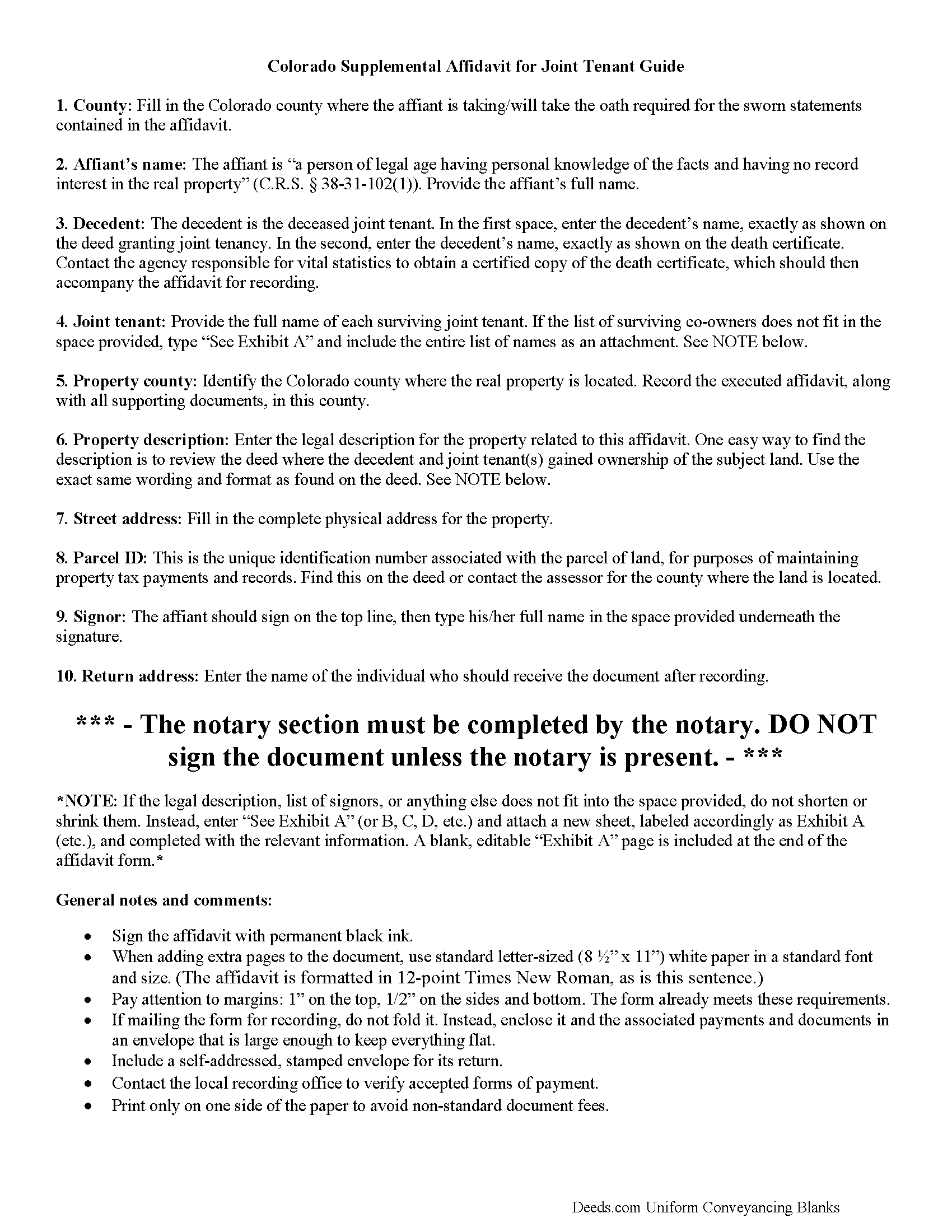

Pitkin County Affidavit of Deceased Joint Tenant Guide

Line by line guide explaining every blank on the form.

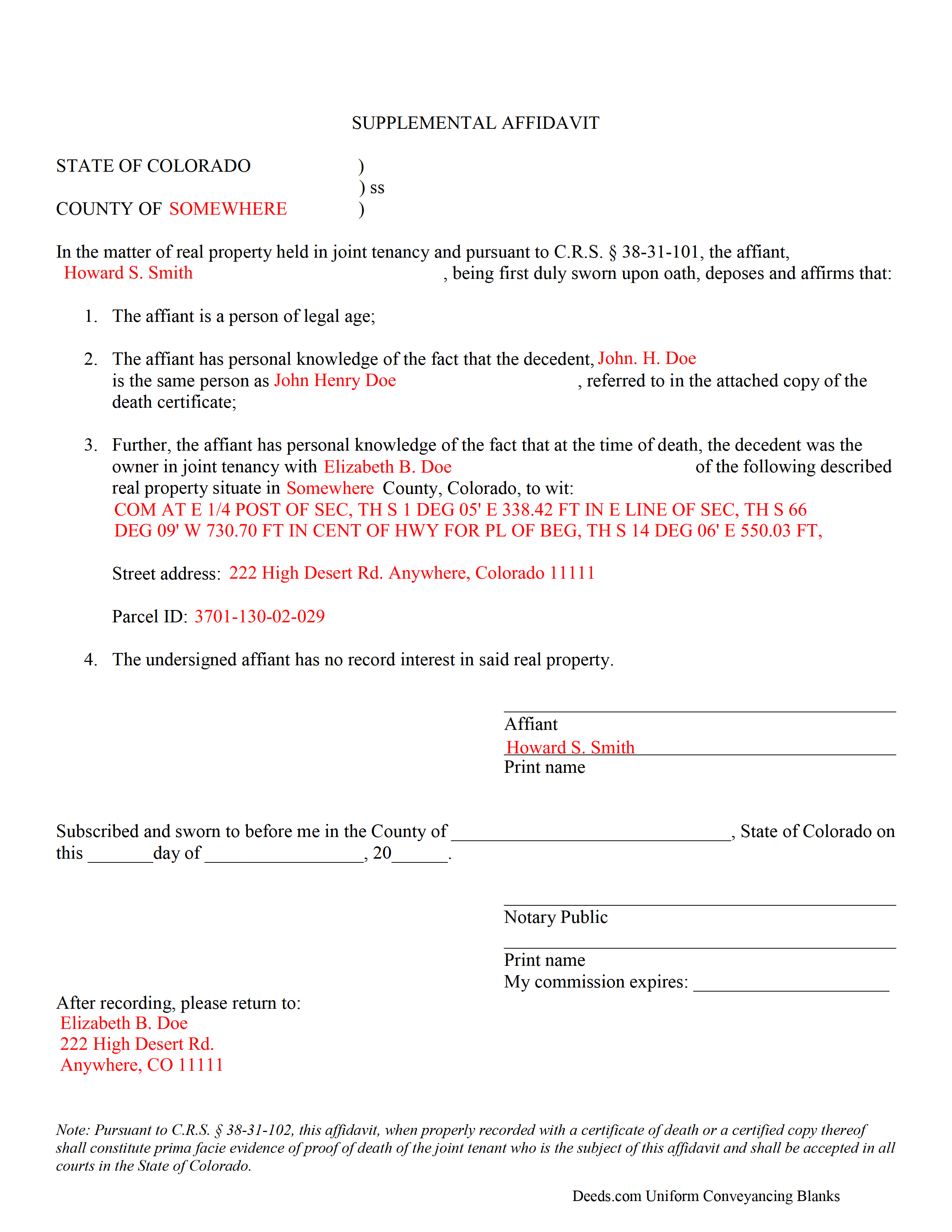

Pitkin County Completed Example of the Affidavit of Deceased Joint Tenant Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Colorado and Pitkin County documents included at no extra charge:

Where to Record Your Documents

Pitkin County Clerk and Recorder

Aspen, Colorado 81611

Hours: 8:30 to 4:30 Mon-Thu; Friday until 5:00

Phone: (970) 920-5180

Recording Tips for Pitkin County:

- Bring your driver's license or state-issued photo ID

- Documents must be on 8.5 x 11 inch white paper

- Leave recording info boxes blank - the office fills these

- Avoid the last business day of the month when possible

Cities and Jurisdictions in Pitkin County

Properties in any of these areas use Pitkin County forms:

- Aspen

- Meredith

- Snowmass

- Snowmass Village

- Woody Creek

Hours, fees, requirements, and more for Pitkin County

How do I get my forms?

Forms are available for immediate download after payment. The Pitkin County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Pitkin County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Pitkin County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Pitkin County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Pitkin County?

Recording fees in Pitkin County vary. Contact the recorder's office at (970) 920-5180 for current fees.

Questions answered? Let's get started!

Use a Colorado supplemental affidavit of deceased joint tenant to provide formal notice that a named joint owner of real property has died.

Removing a Deceased Joint Tenant from a Colorado Real Estate Deed

Colorado law allows two or more people to co-own real property as either tenants in common or joint tenants.

Tenants in common hold individual, but not necessarily equal, shares of the title to real property, which they may sell without consulting the other co-owners. If a tenant in common dies, that portion of the property reverts to his/her estate, with no effect on the shares of the other owners.

Joint tenants, on the other hand, share undivided ownership of the whole property. The primary purpose of joint tenancy relates to the right of survivorship, which states that land titled this way is distributed equally amongst the surviving co-owners when one of them dies. See C.R.S. 38-31-101 for further details about co-ownership of real property.

Even though the shares technically pass to the survivors as a function of law when the deceased co-owner dies, it is necessary to formalize the change. Accomplish this by completing and recording a supplemental affidavit, along with a copy of the deceased co-owner's death certificate. This important step helps to maintain a clear chain of title, which should simplify future sales of the real property. See 38-31-102.

Filing the supplemental affidavit clears the title, but the only way to remove the deceased joint tenant's name from the deed is for the survivors to execute and record a new deed. This instrument should show all joint tenants as grantors, with the decedent appropriately identified, and only the survivors as grantees. A certified copy of the recorded affidavit should accompany the new deed; other required supporting documents may vary from county to county.

Contact an attorney with questions about the affidavit of deceased joint tenant, or for other issues related to real property in Colorado.

(Colorado Affidavit of Deceased Joint Tenant Package includes form, guidelines, and completed example)

Important: Your property must be located in Pitkin County to use these forms. Documents should be recorded at the office below.

This Affidavit of Deceased Joint Tenant meets all recording requirements specific to Pitkin County.

Our Promise

The documents you receive here will meet, or exceed, the Pitkin County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Pitkin County Affidavit of Deceased Joint Tenant form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4578 Reviews )

Laryn A.

March 3rd, 2020

Very happy with the beneficiary deed forms packet. It was helpful to have an example of a properly filled out form. The only suggestion would be is to show where the exemption code should be placed on the form.

Thank you for your feedback. We really appreciate it. Have a great day!

Delsina T.

October 9th, 2020

So helpful. Thank you so much for making this a smooth process.

Thank you!

Dean B.

September 17th, 2020

I needed to cut and paste my phone number with the dashes in order to use this website with my iPhone

Thank you!

Lynd P.

January 14th, 2019

Good

Thanks Lynd.

Maricela N.

May 5th, 2021

very easy and quick to get all the forms needed! Thank you!

Thank you for your feedback. We really appreciate it. Have a great day!

Annette H.

September 8th, 2022

Deeds.com has done a wonderful job! They are quick to get back to me either with the Deed or reason why there is no Deed. You have saved me so much time using your services that I hope to keep using them for years to come! Thank you!

Thank you!

Melody S.

February 11th, 2021

Although I was given quite a bit of information, I wanted my property title. I was not informed of what I would receive before I paid for this service.

Thank you!

Philip S.

May 2nd, 2019

You're service saved the day! I had gone to several lawyers and title companies who all said, at a Minimum, preparing a deed costs $1000... Through your service and some work reading about the requirements as well as calling my county clerks office, I was able to complete the deed and it read accepted and recorded today! Thanks so much.

Thank you for your feedback. We really appreciate it. Have a great day!

Barbara B.

February 17th, 2019

Great forms and instructions!

Thank you Barbara.

jen k.

June 15th, 2022

I tried to use the free stuff you find on the internet. You quickly find out that free is rarely ever (never) free. Even worse, the long term cost can be immeasurable. Glad I realized that before I got too far in. Do yourself a favor, spend a few bucks up front to get the right forms.

Thank you!

Vickie K.

May 5th, 2025

Easy to download, forms look to be pretty easy to use. Thank you!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Marilyn W.

April 25th, 2022

The Mineral Deed transfer form was pretty good. Could have used more info in the guide about where to find legal property descriptions and source of title. Also more space on the pdf for entering return addresses - there was room for only one; I needed three. I will be sending the form to the County Courthouse soon. I hope it works.

Thank you for your feedback. We really appreciate it. Have a great day!

Kelly S.

May 19th, 2020

Fast, easy, responsive.

Thank you!

Christopher Shawn S.

November 4th, 2020

Swift and Concise Process!!! I would recommend, as well as, use again!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Charles F.

November 19th, 2020

Quick and Easy

Thank you for your feedback. We really appreciate it. Have a great day!