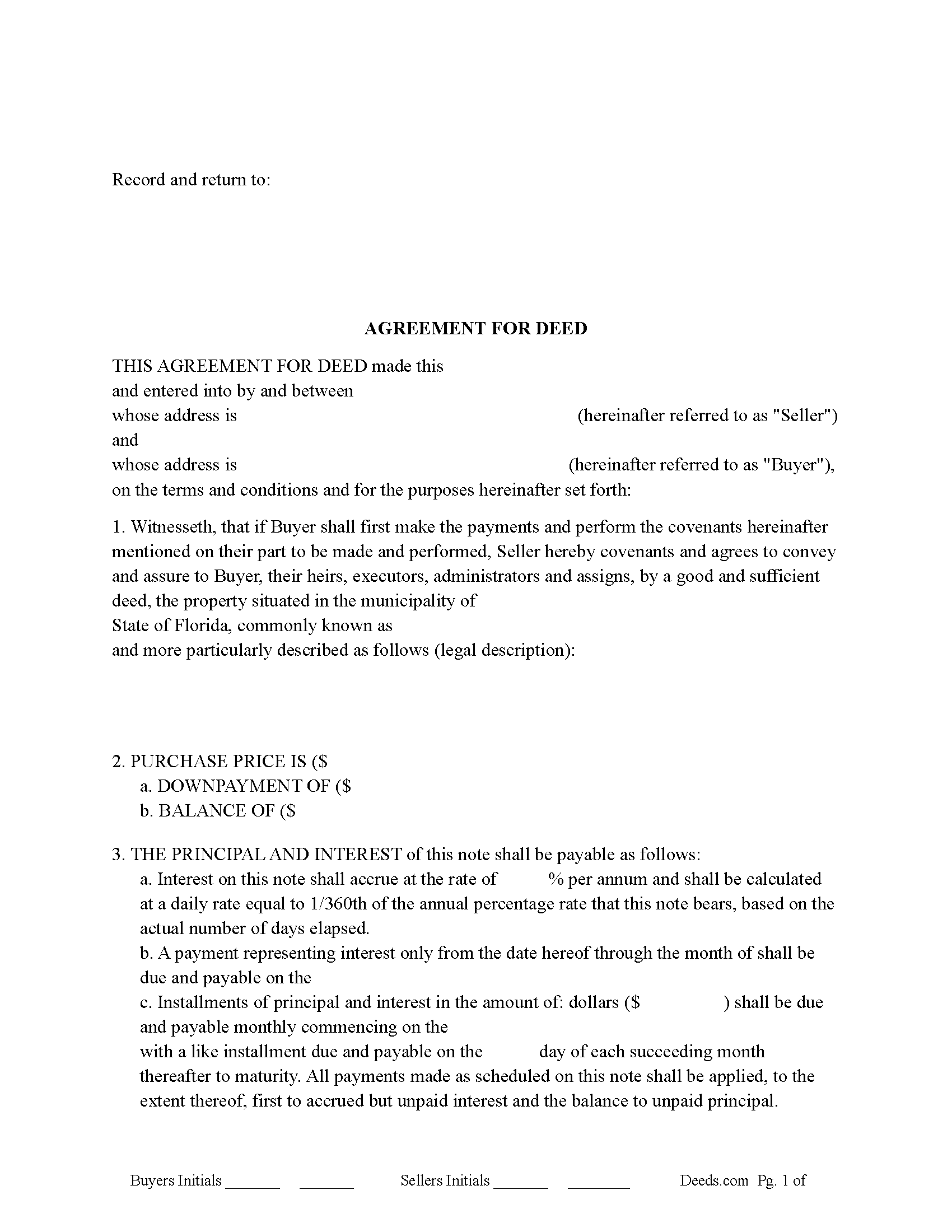

Polk County Agreement for Deed Form

Polk County Agreement for Deed Form

Fill in the blank Agreement for Deed form formatted to comply with all Florida recording and content requirements.

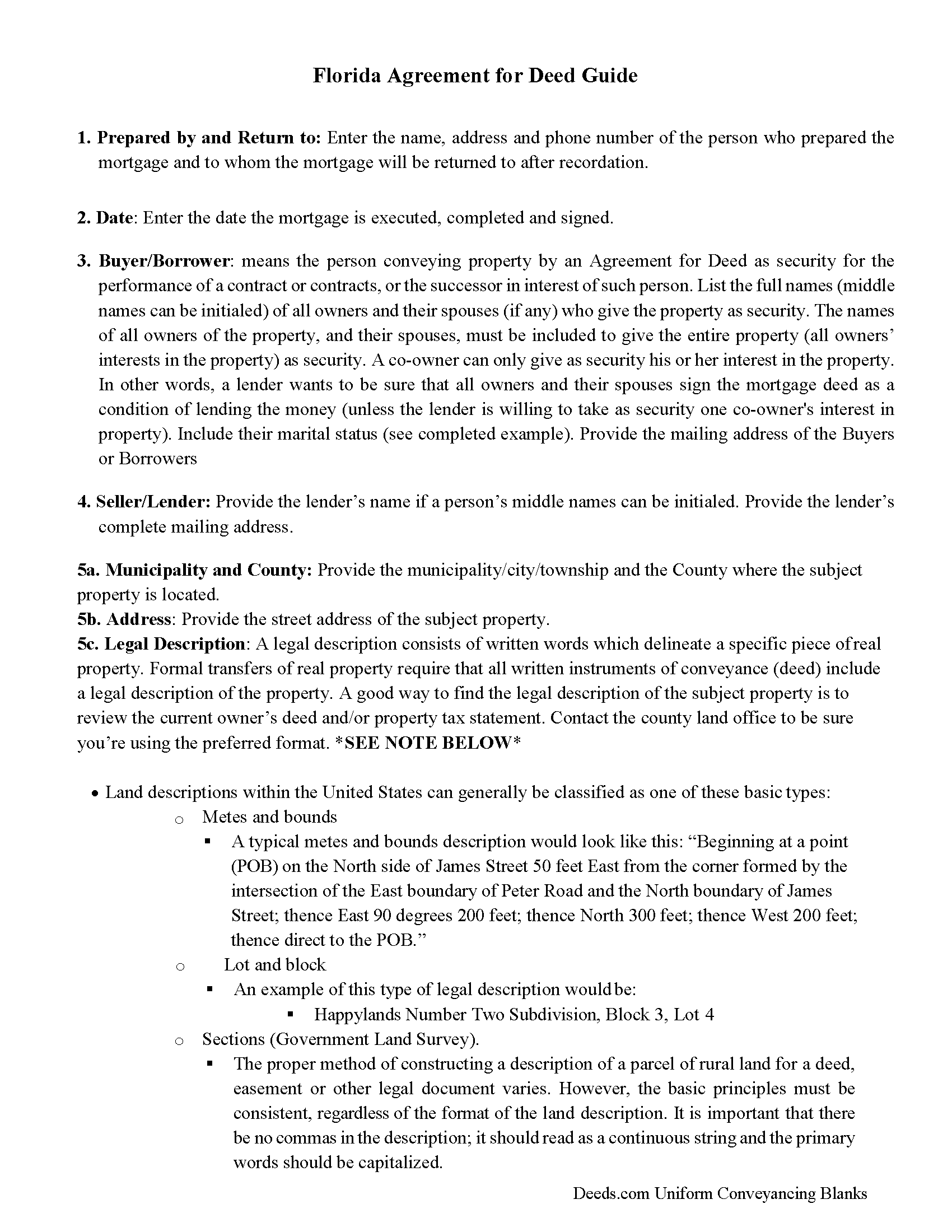

Polk County Agreement for Deed Guide

Line by line guide explaining every blank on the Agreement for Deed form.

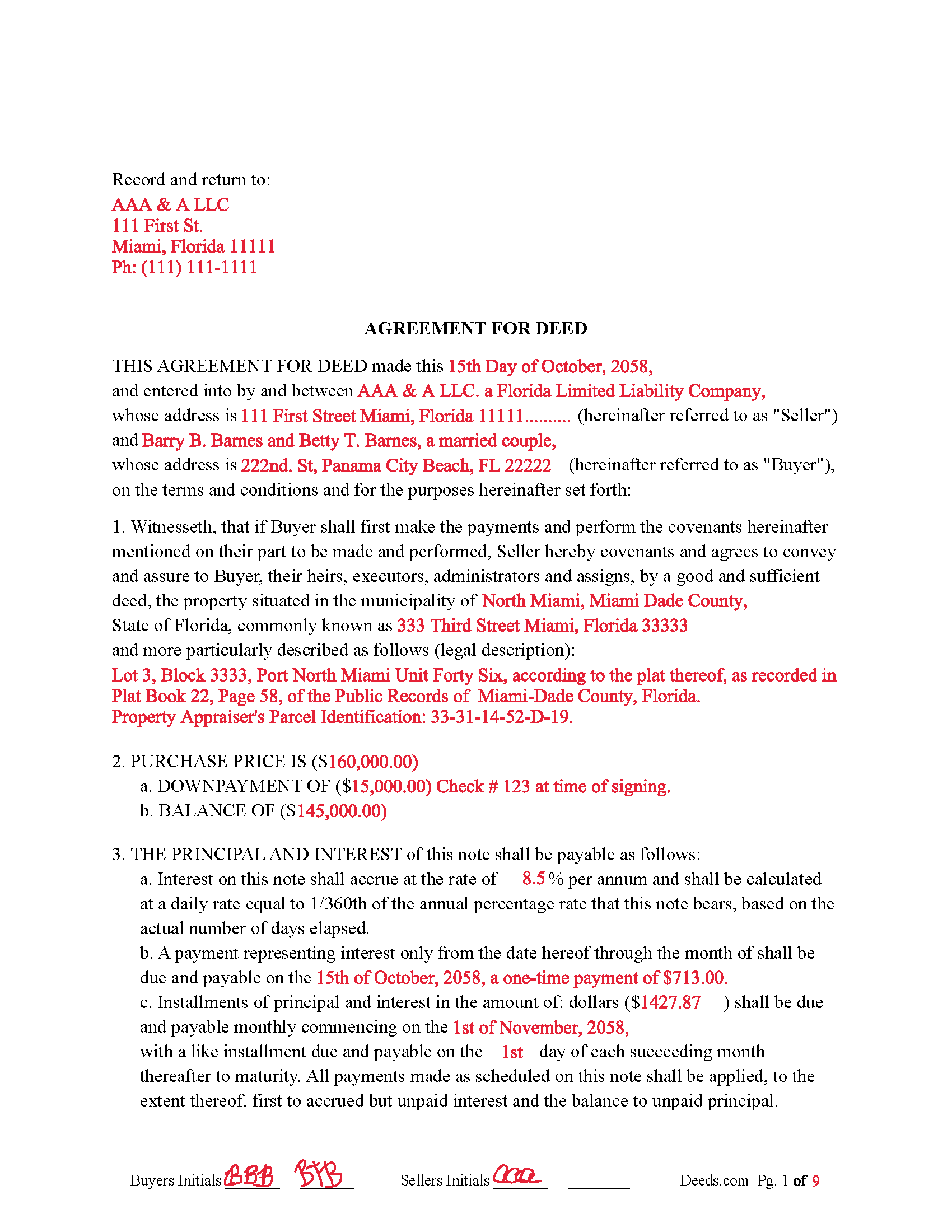

Polk County Completed Example of the Agreement for Deed Document

Example of a properly completed Florida Agreement for Deed document for reference.

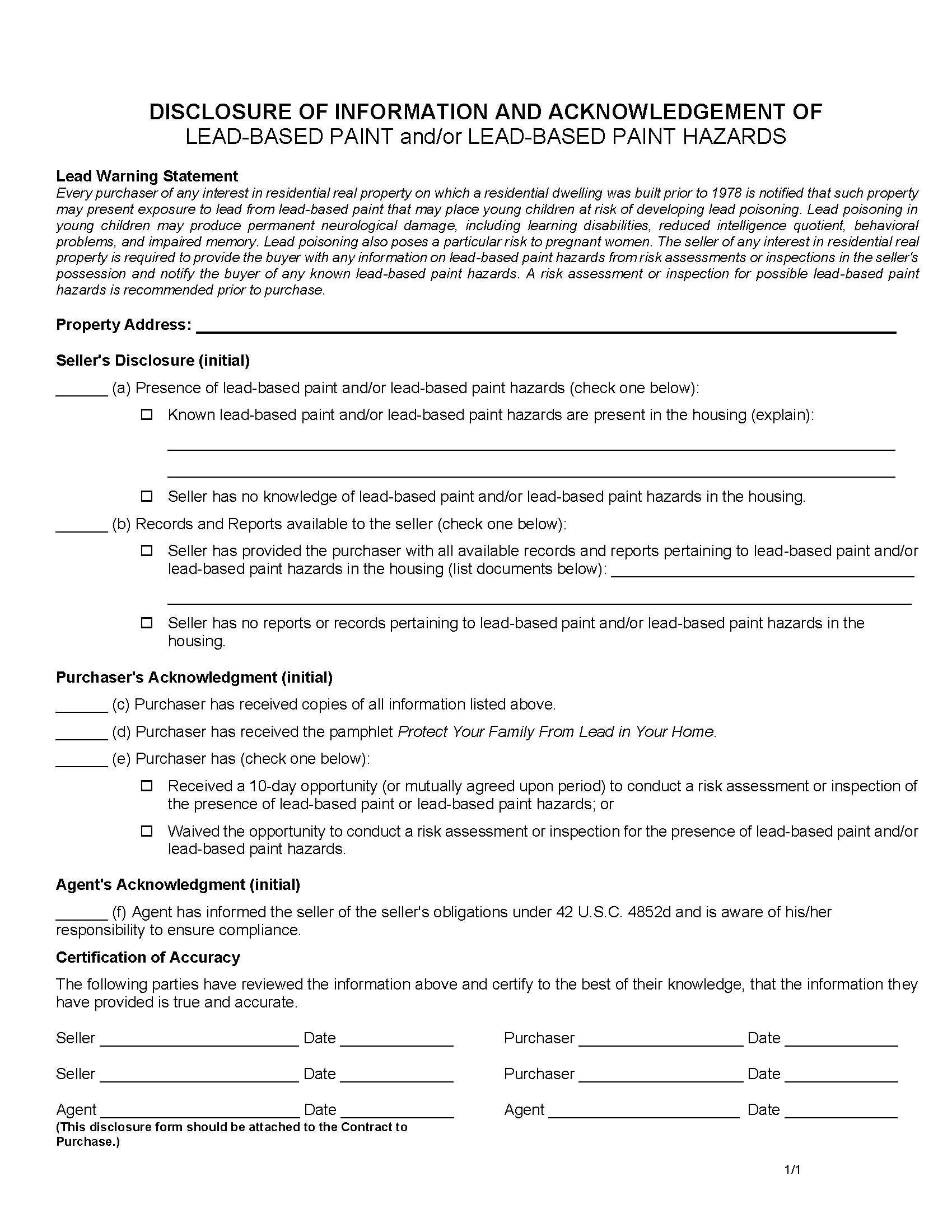

Polk County Lead Based Paint Disclosure Form

Required for residential property built before 1978.

Polk County Residential Property Disclosure

Required form for residential property.

All 5 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Florida and Polk County documents included at no extra charge:

Where to Record Your Documents

Clerk of Circuit Court - Official Records

Bartow, Florida 33830

Hours: 8:00am - 5:00pm M-F

Phone: (863) 534-4516

Mail to: Clerk of Circuit Court - Official Records

Bartow, Florida 33831

Hours: for mailing purposes

Phone: N/A

Northeast Branch - NE Polk Co. Gov. Center

Winter Haven, Florida 33881

Hours: 8:00am - 5:00pm M-F

Phone: (863) 401-2400

Lakeland Branch

Lakeland, Florida 33801

Hours: 8:00am - 5:00pm M-F

Phone: (863) 603-6412

Recording Tips for Polk County:

- Verify all names are spelled correctly before recording

- Bring extra funds - fees can vary by document type and page count

- Recording fees may differ from what's posted online - verify current rates

- Ask about their eRecording option for future transactions

- Verify the recording date if timing is critical for your transaction

Cities and Jurisdictions in Polk County

Properties in any of these areas use Polk County forms:

- Alturas

- Auburndale

- Babson Park

- Bartow

- Bradley

- Davenport

- Dundee

- Eagle Lake

- Eaton Park

- Fort Meade

- Frostproof

- Haines City

- Highland City

- Homeland

- Indian Lake Estates

- Kathleen

- Kissimmee

- Lake Alfred

- Lake Hamilton

- Lake Wales

- Lakeland

- Lakeshore

- Loughman

- Mulberry

- Nalcrest

- Nichols

- Polk City

- River Ranch

- Waverly

- Winter Haven

Hours, fees, requirements, and more for Polk County

How do I get my forms?

Forms are available for immediate download after payment. The Polk County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Polk County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Polk County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Polk County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Polk County?

Recording fees in Polk County vary. Contact the recorder's office at (863) 534-4516 for current fees.

Questions answered? Let's get started!

An "Agreement for Deed," also known as a land contract or contract for deed, is a financing arrangement where the seller retains the legal title to the property until the buyer fulfills the terms of the agreement, typically by paying the purchase price over time. In Florida, this type of agreement can be useful in specific situations:

When to Use an Agreement for Deed in Florida

1. Buyers with Limited Financing Options:

Credit Issues: Buyers who may have difficulty obtaining traditional mortgage financing due to poor credit scores or lack of credit history can use an Agreement for Deed.

Self-Employed or Irregular Income: Buyers with irregular income or those who are self-employed and may not meet traditional lending criteria can benefit from this arrangement.

2. Seller Financing:

Investment Strategy: Sellers who prefer to receive steady payments over time rather than a lump sum can use an Agreement for Deed as a form of seller financing.

Retaining Title: Sellers who wish to retain legal title until the buyer has paid in full can protect their interest in the property through this method.

3. Ease of Transfer:

Simplified Process: This type of agreement can simplify the process of property transfer, avoiding some of the complexities and costs associated with traditional mortgages and closing procedures.

4. Negotiable Terms:

Flexibility: The terms of an Agreement for Deed can be tailored to fit the needs of both the buyer and seller, including down payment amount, interest rate, and payment schedule.

5. Quick Sale:

Market Advantage: Sellers can use this agreement to attract buyers in a sluggish real estate market by offering more flexible financing options.

Legal Considerations and Requirements

• Documentary Stamp Tax: As mentioned, Florida law considers an Agreement for Deed a transfer of interest in real property, subject to documentary stamp tax at the time of recording the contract. Imposition of Documentary Stamp Tax: Florida law considers the execution of a land contract as a transfer of interest in real property. Consequently, the documentary stamp tax applies to the full purchase price outlined in the land contract. This tax is similar to the tax imposed on traditional deeds.

• Timing of Tax Payment: The documentary stamp tax must be paid at the time the land contract is recorded. The responsibility for this tax typically falls on the seller, but the terms can vary depending on the agreement between the buyer and seller.

• Tax Calculation: The tax is calculated based on the purchase price of the property. As of now, the rate is $0.70 per $100 of the total purchase price, although this rate can change, and there may be additional surtaxes in certain counties.

• Default and Foreclosure: If the buyer defaults, the seller may need to follow formal foreclosure procedures to reclaim the property.

• Consumer Protection: Florida law requires certain disclosures and protections for buyers in these agreements, such as the right to cancel within seven business days of execution without penalty. 498.028 CONTRACTS AND CONVEYANCE INSTRUMENTS.--The contract for purchase of subdivided lands shall contain, and the subdivider shall comply with, the following provisions:

(1) The purchaser shall have an absolute right to cancel the contract for any reason whatsoever for a period of 7 business days following the date on which the contract was executed by the purchaser.

(2) In the event the purchaser elects to cancel within the period provided, all funds or other property paid by the purchaser shall be refunded without penalty or obligation within 20 days of the receipt of the notice of cancellation by the developer.

(3) If the property is sold under an agreement for deed or a contract for deed where title to the property is not conveyed to the purchaser within 180 days or if the promised improvements to the property have not been completed, the agreement or contract shall contain the following language in conspicuous type immediately above the line for the purchaser's signature:

YOU MAY NOT RECEIVE YOUR LAND UNDER THIS CONTRACT IF THE SUBDIVIDER FILES FOR BANKRUPTCY PROTECTION OR OTHERWISE IS UNABLE TO PERFORM UNDER THE TERMS OF THIS CONTRACT PRIOR TO YOUR RECEIVING A DEED EVEN IF YOU HAVE MADE ALL THE PAYMENTS PROVIDED FOR UNDER THIS CONTRACT. IF YOU HAVE ANY QUESTIONS ABOUT THE MEANING OF THIS DOCUMENT, CONSULT AN ATTORNEY.

• Recording the Agreement: To protect both parties, the Agreement for Deed should be recorded with the county recorder's office.

Use for residential, vacant land, rental property, condominiums and planned unit developments. For use in Florida only.

Important: Your property must be located in Polk County to use these forms. Documents should be recorded at the office below.

This Agreement for Deed meets all recording requirements specific to Polk County.

Our Promise

The documents you receive here will meet, or exceed, the Polk County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Polk County Agreement for Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Maxwell G.

March 5th, 2025

I am so very happy with the service provided by Deeds.com. The process was simple and saved me a lot of time by not having to go to the courthouse, wait in line, and waste a big part of my day. In addition, the cost is a lot less than I expected. I highly recommend this service.

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

Rita M.

January 12th, 2019

I have not received the deed via email. That is what I was expecting. Let me know if I am incorrect in my thinking.

Thanks for reaching out. While we do send some email notifications, we do not email documents. All orders are available via your account. You can log into your account from the menu button at the top left of most pages on the website.

ARACELI V.

July 9th, 2020

AWESOME COMPANY RELIABLE FAST AND EASY, VERY ECONOMIC, LOVE TO WORK WITH THEM , GREAT CUSTOMER SERVICE , THEY REPLY TO YOU FAST

Thank you for your feedback. We really appreciate it. Have a great day!

Karen D.

September 25th, 2020

Very easy to use and understand. Thank you.

Thank you!

Phyllis B.

May 24th, 2022

I saved a ton of money doing it on my own versus through legal counsel. When I took it to the auditor/recorder today, there was absolutely no problems.

Thank you for your feedback. We really appreciate it. Have a great day!

GLENN B.

August 21st, 2023

Great affordable quick service

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Linda W.

August 3rd, 2020

Received feedback in a timely manner and got a quick reponse.

Thank you!

Joseph R.

July 23rd, 2022

Deeds.com has saved me quite a bit in attorney fees by making legal forms available on line. Easy to use, just fill in the blanks.

Thank you for your feedback. We really appreciate it. Have a great day!

Judith F.

October 15th, 2021

Easy to understand and use!

Thank you!

Michelle G.

April 26th, 2021

EXCEPTIONAL CUSTOMER SERIVCE!!! THANK YOU!!!

Thank you for your feedback. We really appreciate it. Have a great day!

Charlotte B.

August 2nd, 2021

I was very impressed with this service. It's a very important tool to be able to get the documents filed properly. I was not able to understand how to fill in the blanks on line.

Thank you for your feedback. We really appreciate it. Have a great day!

Mary N.

January 13th, 2021

Very easy to use.

Thank you Mary.

Judy H.

October 20th, 2023

great response to my question.

We are delighted to have been of service. Thank you for the positive review!

Marissa G.

March 4th, 2020

The NV Clark County deed upon death was perfect! Our county doesn't offer a template, but rather has a long list of rules and specifications where they expect you to make your own document. I didnt want to risk making an unacceptable form so I purchased the template from Deeds.com. It was easy to use and very thorough. Our deed upon death was notarized and filed with the county with no issue. Save yourselves the time and headache and get the template!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

William S.

June 26th, 2022

The forms worked well for entering information. I have finished without much trouble. Since the forms are Adobe PDF files you need the free app to use them but you can't edit unless you have the paid Adobe program. And, it was a reasonable price.

Thank you for your feedback. We really appreciate it. Have a great day!