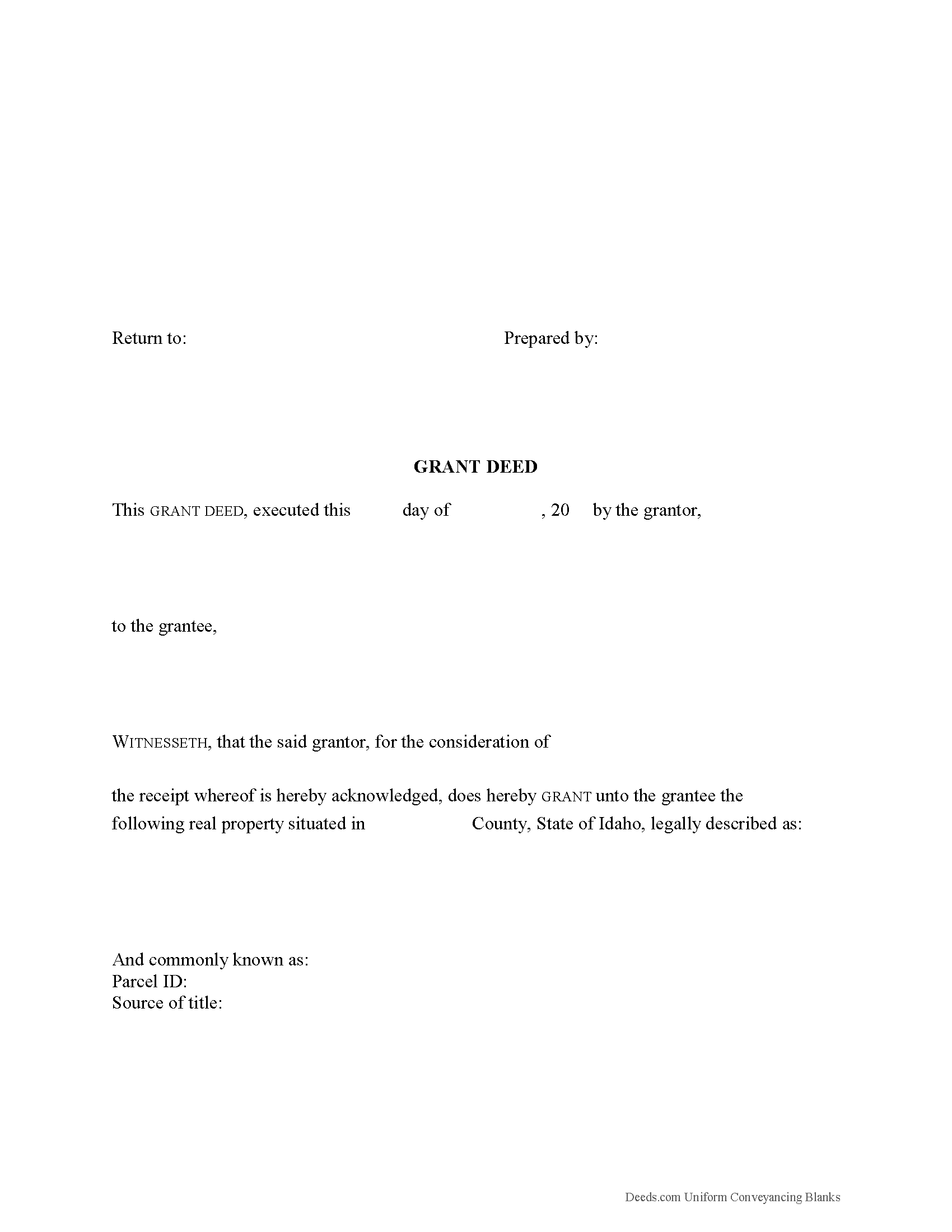

Madison County Grant Deed Form

Madison County Grant Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

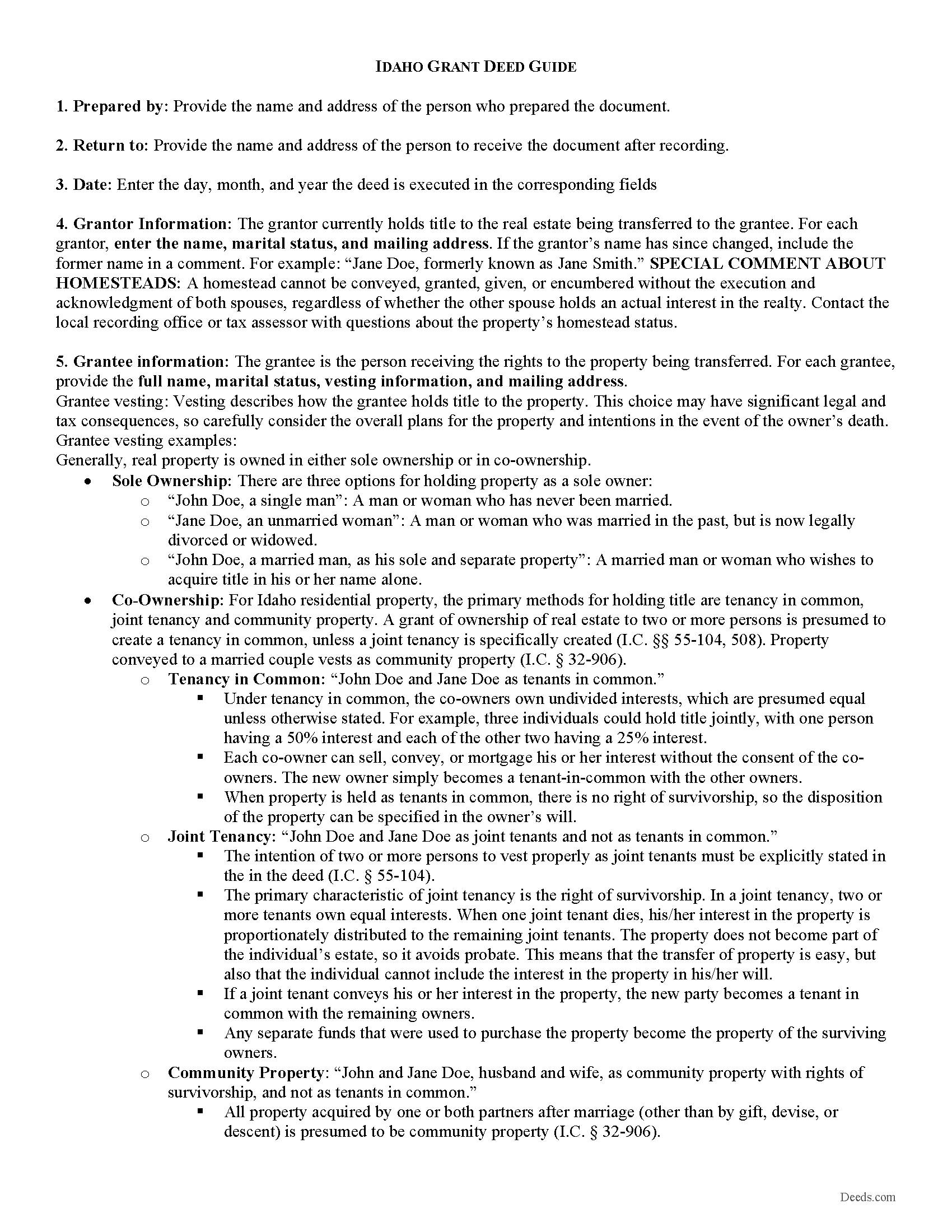

Madison County Grant Deed Guide

Line by line guide explaining every blank on the form.

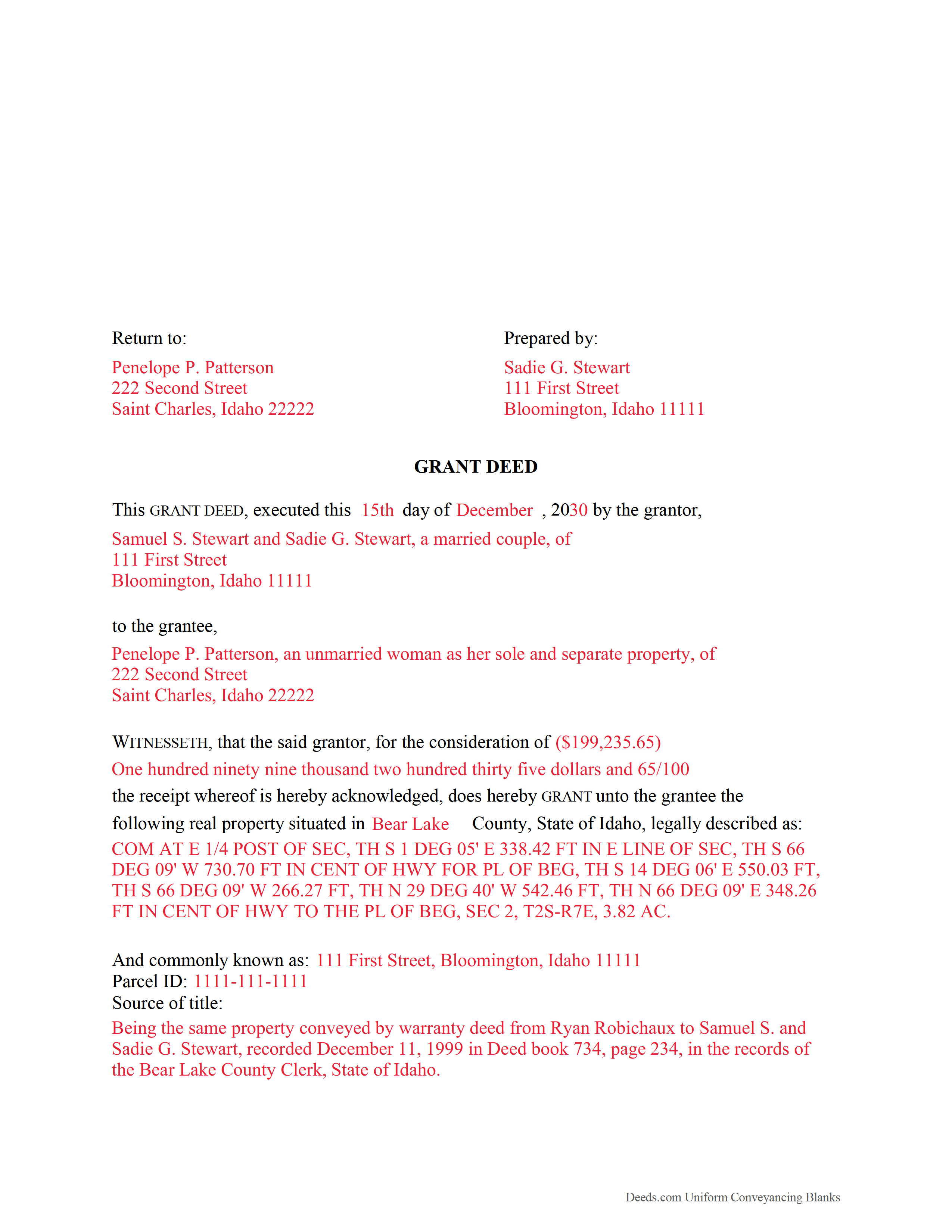

Madison County Completed Example of the Grant Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Idaho and Madison County documents included at no extra charge:

Where to Record Your Documents

Madison County Clerk-Auditor-Recorder

Rexburg, Idaho 83440

Hours: 8:00 to 4:30 M-F

Phone: (208) 359-6219

Recording Tips for Madison County:

- Bring your driver's license or state-issued photo ID

- Verify all names are spelled correctly before recording

- Ask about their eRecording option for future transactions

Cities and Jurisdictions in Madison County

Properties in any of these areas use Madison County forms:

- Rexburg

- Sugar City

Hours, fees, requirements, and more for Madison County

How do I get my forms?

Forms are available for immediate download after payment. The Madison County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Madison County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Madison County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Madison County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Madison County?

Recording fees in Madison County vary. Contact the recorder's office at (208) 359-6219 for current fees.

Questions answered? Let's get started!

A grant deed, also referred to as a bargain and sale deed, is a legal document used to transfer, or convey, rights in real property from a grantor (seller) to a grantee (buyer). Idaho does not provide a statutory form for a grant deed, but the statutes identify the warranties implied by the word "grant" in a deed. In Idaho, the word "grant" guarantees that previous to the execution of the conveyance, the grantor has not conveyed the same property, or any right, title, or interest therein to any person other than the grantee, and that the estate is free from encumbrances at the time of execution of the deed (I.C. 55-612). Therefore, if the grantee later discovers that the grantor has sold the property to a third party, or if there are encumbrances not mentioned in the deed, the grantee can sue the grantor to recover the value of the property.

In addition to meeting all state and local recording standards, the deed must include the grantor's full name and marital status, as well as the grantee's full name, marital status, mailing address, and vesting. Vesting describes how the grantee holds title to the property. For Idaho residential property, the primary methods for holding title are tenancy in common, joint tenancy and community property. A grant of ownership of real estate to two or more persons is presumed to create a tenancy in common, unless a joint tenancy is specifically created (I.C. 55-104, 508). Property conveyed to a married couple vests as community property (I.C. 32-906).

A lawful grant deed must be signed by the grantor and contain an acknowledgement. Acknowledgements may be made at any place within the state of Idaho, before a justice or clerk of the Supreme Court, or a notary public, of the Secretary of State, or United States commissioner and must meet the requirements as set forth in I.C. 55-707. Once acknowledged or proved and certified as provided, it should be recorded in the recorder's office in the county where such lands are located. If left unrecorded, a grant deed is void as against any subsequent purchaser or mortgagee of the same property whose conveyance is first duly recorded (I.C. 55-812).

This article is provided for informational purposes only and is not a substitute for the advice of an attorney. Contact an attorney with questions about grant deeds or any other issues related to the transfer of real property in Idaho.

Important: Your property must be located in Madison County to use these forms. Documents should be recorded at the office below.

This Grant Deed meets all recording requirements specific to Madison County.

Our Promise

The documents you receive here will meet, or exceed, the Madison County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Madison County Grant Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4588 Reviews )

Linda Munguia N.

May 29th, 2021

Easy process. Appreciated the detailed instructions for filing.

Thank you!

Barbara G.

January 30th, 2020

Thank you everything was as expected very good service

Thank you Barbara, we really appreciate you.

Michael W.

February 8th, 2025

Wonderful service.

Thank you!

Jesse B.

December 23rd, 2018

Bought a quit claim deed form. Came with great instructions that were easy to follow and allowed me to do it over a couple of times until I got it right. Was also cheaper than most other options I found online.

Thank you for your feedback. We really appreciate it. Have a great day!

Trent D.

April 17th, 2022

You Guys are Fantastic and the service you all provide. Is PRICELESS!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Aldona P.

April 9th, 2020

Awesome Job! thank you

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Kerrin S.

April 13th, 2020

This was so efficient. Thank you for offering this service!

Thank you for your feedback. We really appreciate it. Have a great day!

Carol D.

January 17th, 2019

No review provided.

Thank you!

Van S.

March 25th, 2022

Easy to use...very informative...ttook care of exactly what I was looking for.

Thank you for your feedback. We really appreciate it. Have a great day!

Deloris L.

August 25th, 2020

I downloaded documents easy. But haven't started work on them yet. Seems to be ok.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Dennis F.

December 20th, 2024

The release of mortgage form was OK, and accepted at the recorder's office, but there were some problems. Many of the fields to type in were too small to accept the data, and I could not find a way to change the field size or use a smaller font. Otherwise I was satisfied.

Your feedback is a crucial part of our dedication to ongoing improvement. Thank you for your insightful comments.

Judith G.

January 25th, 2019

Thank you, it was easy and fast. The clerks office filed without question.

Thank you Judith, have a fantastic day!

Sol B.

February 13th, 2020

Got me all the info I was looking for Thanks you deeds.com

Thank you!

KRISSA O.

January 2nd, 2025

Smooth process, no issues.

Thank you!

William M.

May 22nd, 2021

On multiple tries, I could not get validation mail through my Yahoo email address. I tried Gmail, worked the first time. The rest of the process was super easy and fast.

Thank you!