Madison County Trustee Deed Upon Sale Form

Madison County Trustee Deed Upon Sale Form

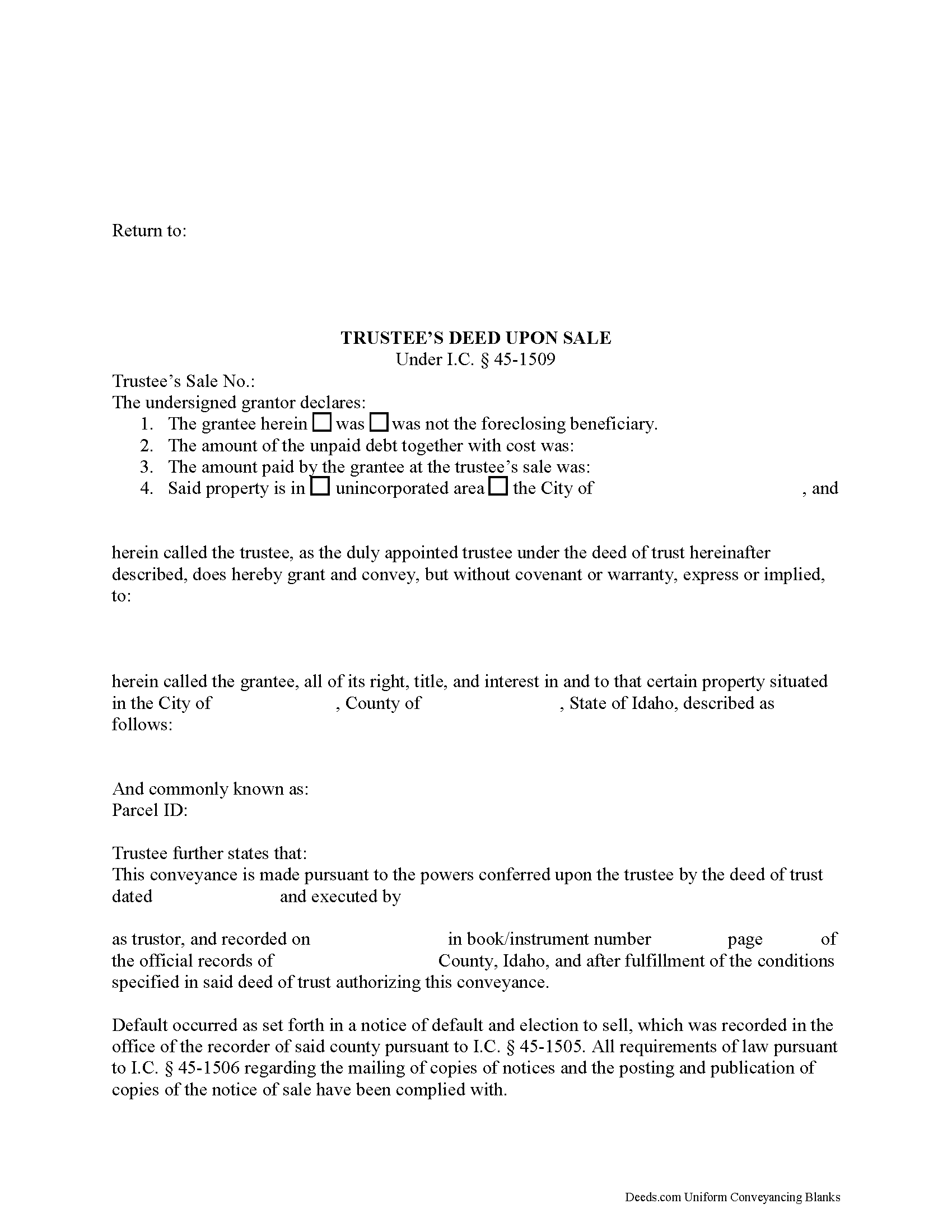

Fill in the blank form formatted to comply with all recording and content requirements.

Madison County Trustee Deed Upon Sale Guide

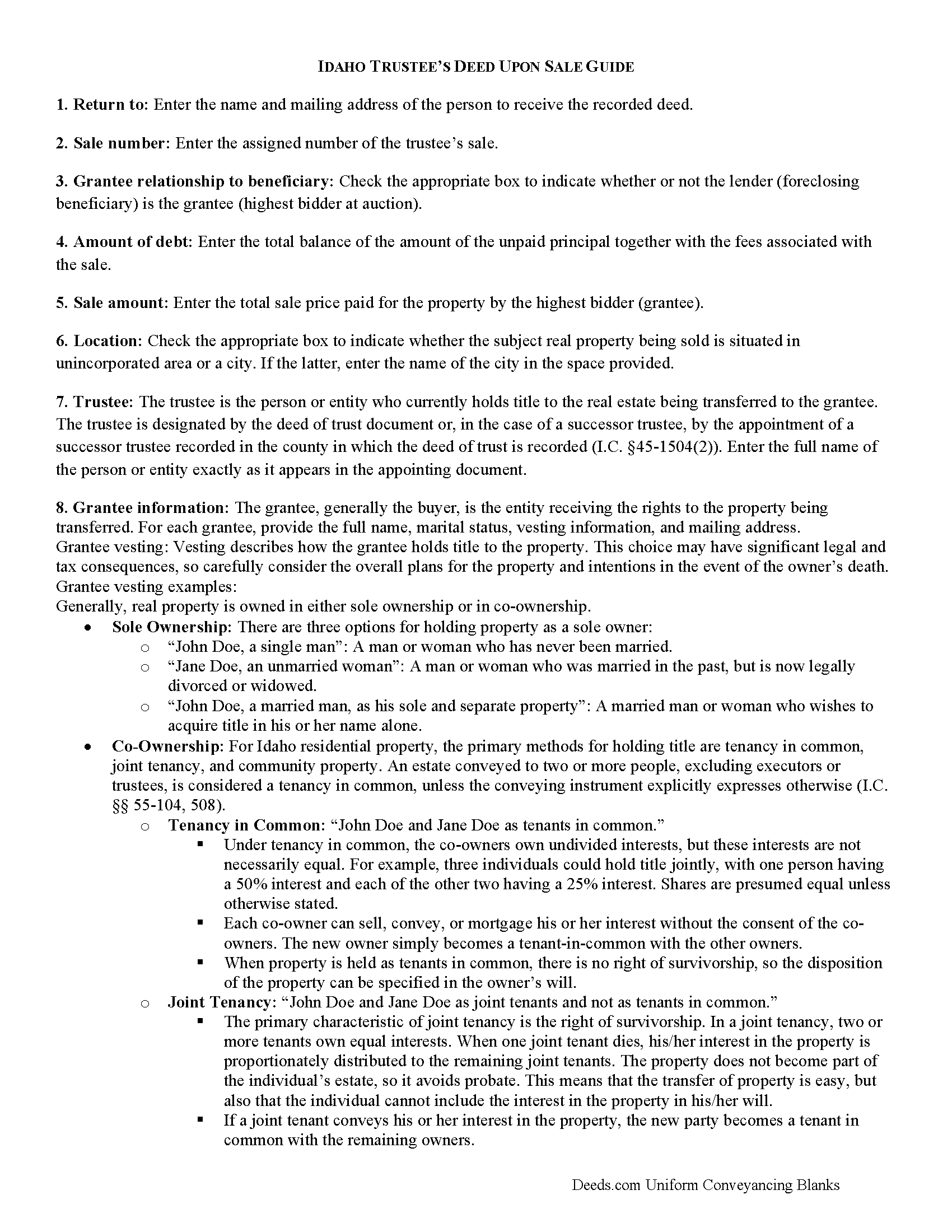

Line by line guide explaining every blank on the form.

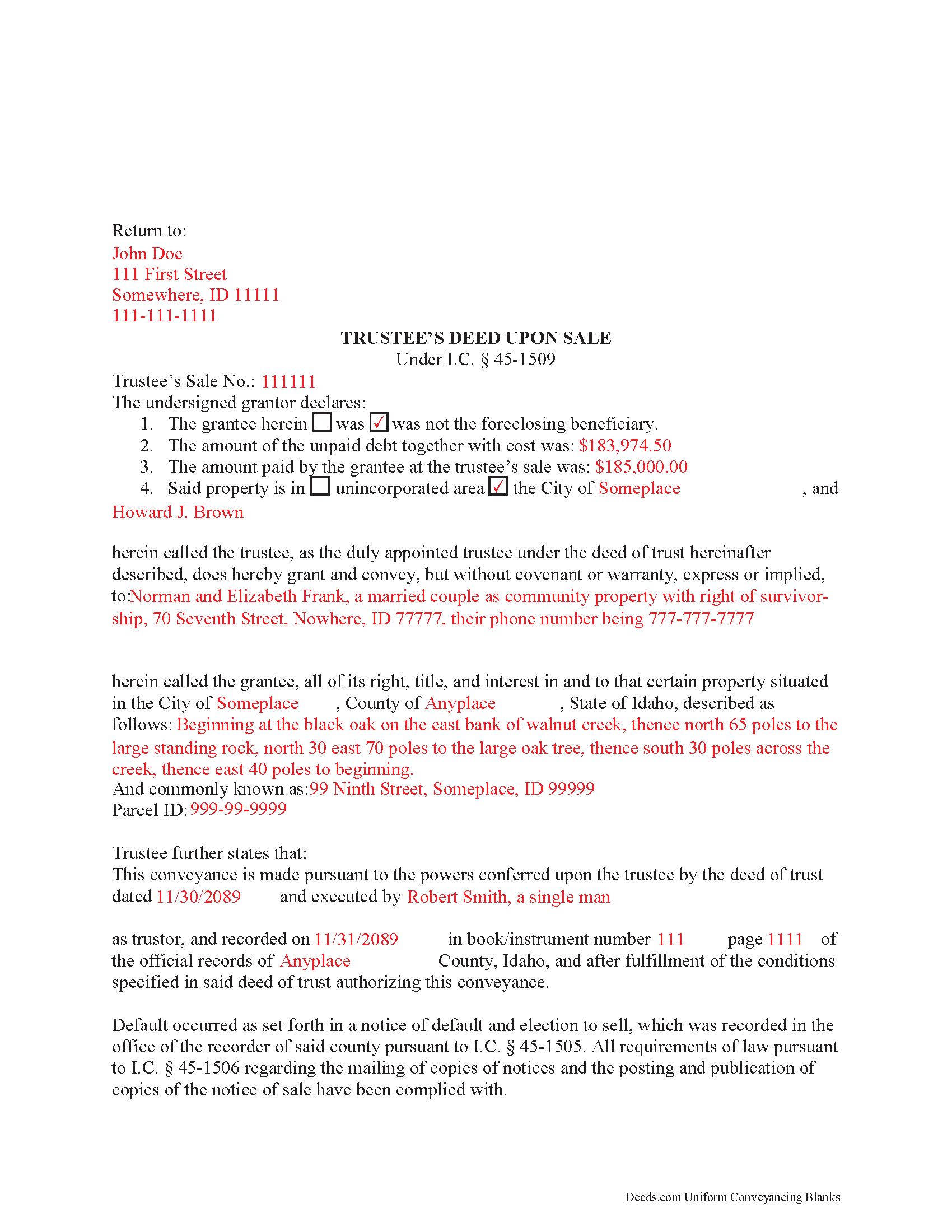

Madison County Completed Example of the Trustee Deed upon Sale Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Idaho and Madison County documents included at no extra charge:

Where to Record Your Documents

Madison County Clerk-Auditor-Recorder

Rexburg, Idaho 83440

Hours: 8:00 to 4:30 M-F

Phone: (208) 359-6219

Recording Tips for Madison County:

- Verify all names are spelled correctly before recording

- White-out or correction fluid may cause rejection

- Bring extra funds - fees can vary by document type and page count

- Ask about their eRecording option for future transactions

- Have the property address and parcel number ready

Cities and Jurisdictions in Madison County

Properties in any of these areas use Madison County forms:

- Rexburg

- Sugar City

Hours, fees, requirements, and more for Madison County

How do I get my forms?

Forms are available for immediate download after payment. The Madison County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Madison County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Madison County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Madison County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Madison County?

Recording fees in Madison County vary. Contact the recorder's office at (208) 359-6219 for current fees.

Questions answered? Let's get started!

The Idaho Trustee's Deed Upon Sale is codified at I.C. 45-1509.

A trustee uses a trustee's deed upon sale to convey real property sold at a trustee's sale following foreclosure under a deed of trust. A deed of trust is a security instrument that, along with a promissory note, sets out the terms for repaying a loan used to purchase real property. Some states use deeds of trust in the place of mortgages.

The three parties involved in a deed of trust are the lender, the borrower (the grantor under the deed of trust), and the trustee. The trustee is generally a title insurance agent who holds legal title to the real property until the borrower has fulfilled the obligation of the deed of trust. The borrower holds equitable title.

If the borrower defaults on the terms of the deed of trust, the trustee, under the direction of the lender, may act on the power of sale clause in the deed, and initiate non-judicial foreclosure proceedings on the property. Statutory requirements, including the mailing of notices of default and sale, must be met before a trustee's sale is held at public auction. See I.C. Title 45 for more information.

The trustee's deed names the trustee as the grantor and conveys title to the highest bidder at the sale. In addition to describing the real property being conveyed, the deed recites basic information from the deed of trust, including the date of the instrument, the grantor's name, and a reference to where the deed can be found on record. The trustee's deed also includes references to facts about the default and the trustee's sale itself, and is recorded in the county in which the subject property is situated (I.C. 45-1509).

The foreclosure process is complicated, and each situation is unique. Contact an attorney for legal guidance.

Important: Your property must be located in Madison County to use these forms. Documents should be recorded at the office below.

This Trustee Deed Upon Sale meets all recording requirements specific to Madison County.

Our Promise

The documents you receive here will meet, or exceed, the Madison County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Madison County Trustee Deed Upon Sale form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Gary B.

March 30th, 2021

After spending $21 to obtain a Quit Claim Deed form, I realized that I was in over my head. There are a lot of legal considerations and I am not familiar enough with the legal terms and choices to feel confident doing it myself. I since hired a paralegal service to prepare my Quit Claim. I wish I knew the knowledge required before I purchased.

Glad to hear you sought the assistance of a legal professional familiar with your specific situation Gary. We always recommend this to anyone not completely sure of what they are doing.

Barbara D.

November 11th, 2021

Very helpful, clear and precise. The example further clarifies exactly what is needed to be included in information.

Thank you!

Ken B.

August 9th, 2022

Instructions were easy to follow

Thank you!

James T.

July 12th, 2021

Very easy to use. Straightforward and informative

Thank you for your feedback. We really appreciate it. Have a great day!

Stanley S.

September 23rd, 2022

Extremely convenient and easy to execute the document. Instructions and example are very helpful. I have bookmarked the site and will surely use again. 5 stars!!

Thank you!

Mack H.

July 16th, 2020

I got what I was looking for! Turned out well and like I thought it would.

Thank you!

Donald W.

December 8th, 2019

Could not have been any easier to download the quit claim forms. The provided instructions and samples look to be helpful. Only have to set aside the time to fill out. Thanks

Thank you!

Thomas F.

May 16th, 2019

Haven't filed yet but it seems everything I need is here. Easy process

Thank you!

Heidi S.

August 5th, 2021

I had prompt service thank you

Thank you!

Andrew D.

August 12th, 2019

I was very pleased with the entire package we received. It will certainly make my job easier.

Thank you for your feedback. We really appreciate it. Have a great day!

Sara R.

June 19th, 2019

Worked well for me to create a deed for a house I inherited. It was very thorough and easy to use. I have no experience with the law so I just googled terms I didn't understand and was fine. I also called land records a lot and ended up not needing a lot of the material included, but it was still good to have it.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Bea Lou H.

December 2nd, 2022

easy access and easy to find what I was looking for. Thank you

Thank you for your feedback. We really appreciate it. Have a great day!

David C.

January 17th, 2020

Very fast service

Thank you!

Joyce D.

October 29th, 2021

Great service. Fast and efficient.

Thank you!

Randy B.

February 3rd, 2019

The form was exactly what we needed and the directions were spot on and perfectly clear. Filling out government forms can be an experience filled with anxiety but deeds.com made it easy and practically worry free.

Thanks Randy, we really appreciate your feedback.