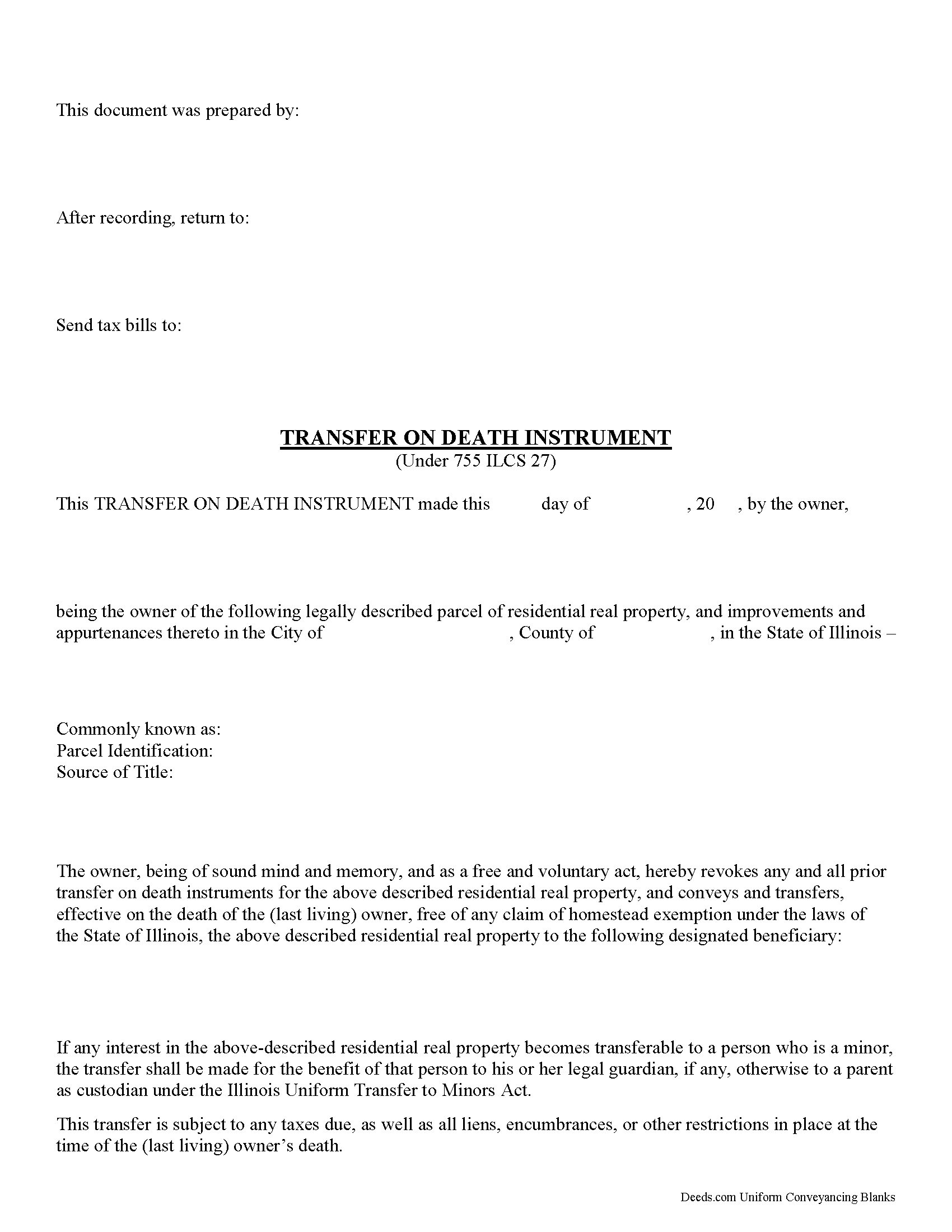

Illinois Transfer on Death Instrument Forms

Illinois Transfer on Death Instrument Overview

How to Use This Form

- Select your county from the list on the left

- Download the county-specific form

- Fill in the required information

- Have the document notarized if required

- Record with your county recorder's office

Comparable to Ladybird, beneficiary, and enhanced life estate deeds, these instruments permit homeowners to name a beneficiary to gain title to their residential real property following the owner's death, while retaining absolute possession of and control over the property while alive. Because the Illinois document DOES NOT transfer ownership when it's executed, the owner may revoke the transfer at will, and is allowed to reallocate, sell, or otherwise dispose of the real estate as desired with no penalties, restrictions or obligation.

(Illinois Transfer on Death Package includes form, guidelines, and completed example)

Important: County-Specific Forms

Our transfer on death instrument forms are specifically formatted for each county in Illinois.

After selecting your county, you'll receive forms that meet all local recording requirements, ensuring your documents will be accepted without delays or rejection fees.

How to Use This Form

- Select your county from the list above

- Download the county-specific form

- Fill in the required information

- Have the document notarized if required

- Record with your county recorder's office

Common Uses for Transfer on Death Instrument

- Transfer property between family members

- Add or remove names from property titles

- Transfer property into or out of trusts

- Correct errors in previously recorded deeds

- Gift property to others