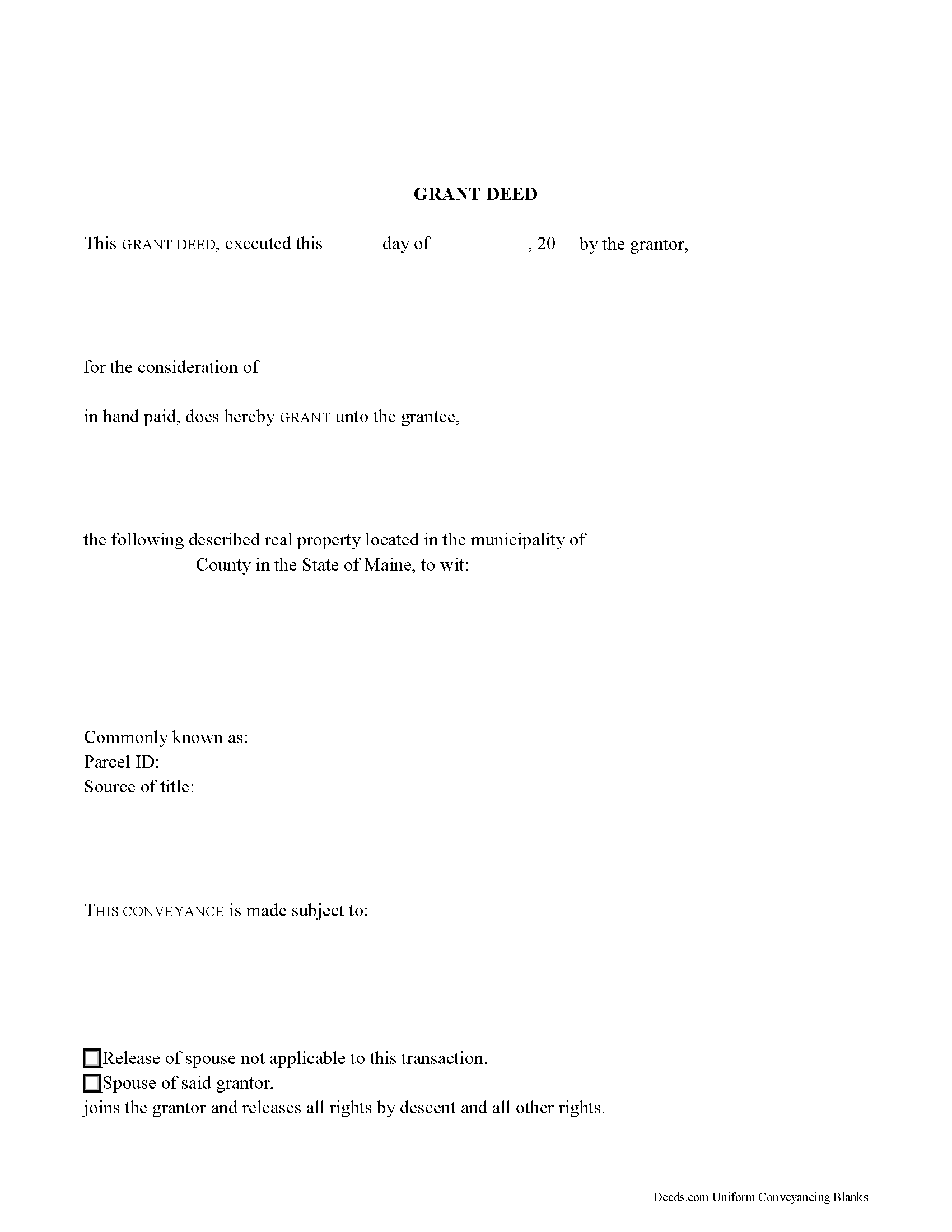

Lincoln County Grant Deed Form

Lincoln County Grant Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

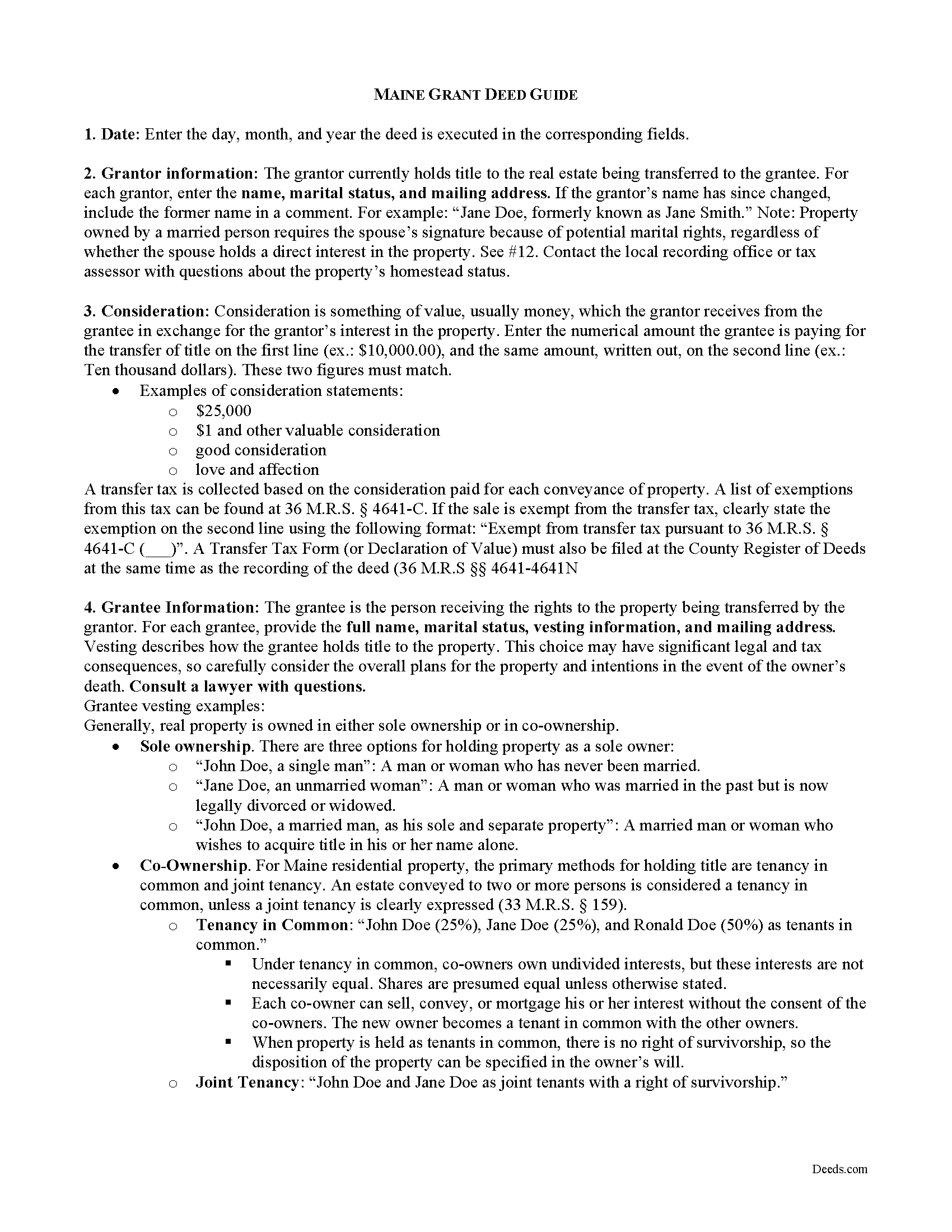

Lincoln County Grant Deed Guide

Line by line guide explaining every blank on the form.

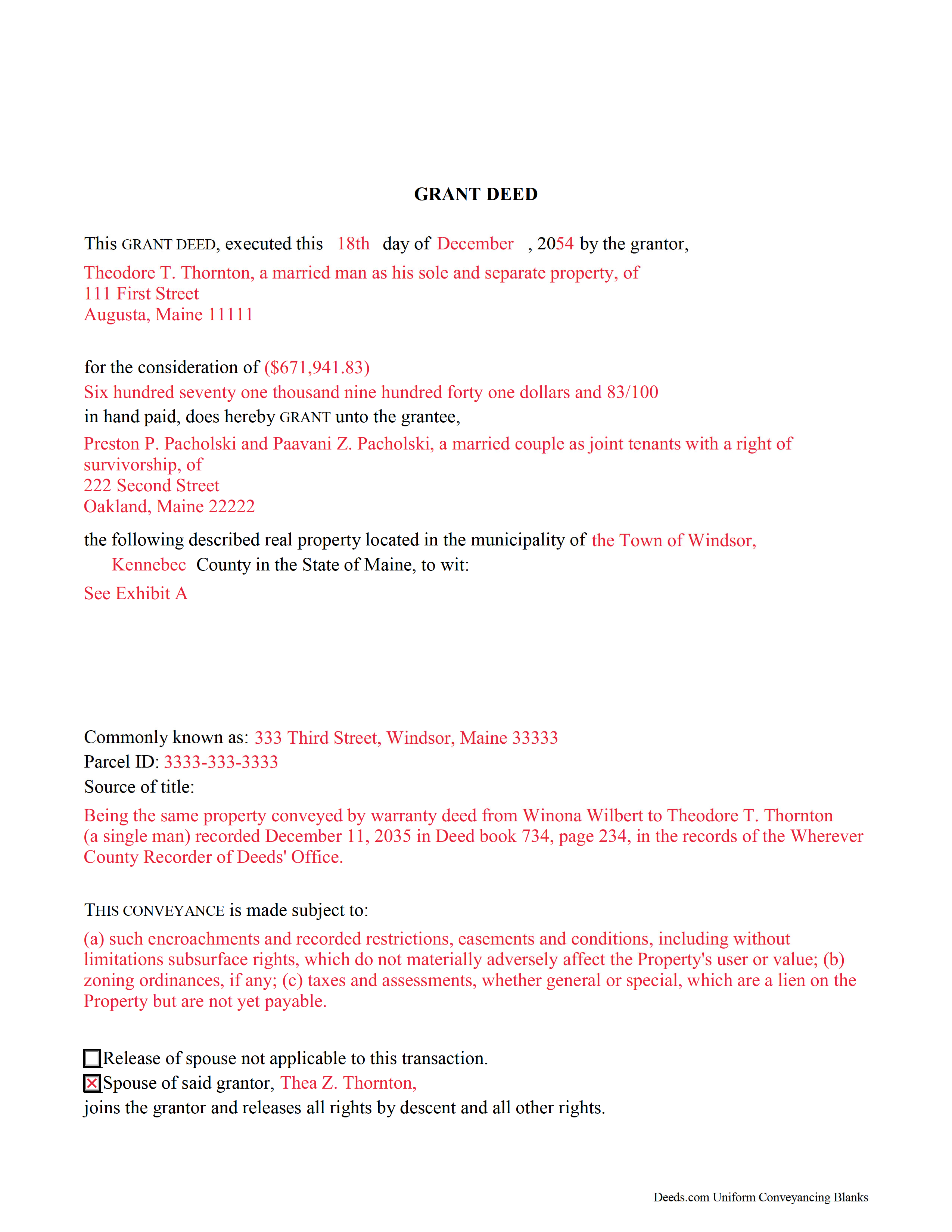

Lincoln County Completed Example of the Grant Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Maine and Lincoln County documents included at no extra charge:

Where to Record Your Documents

Registry of Deeds

Wiscasset, Maine 04578

Hours: 8:00 to 4:00 Monday through Friday / Recording until 3:30

Phone: (207) 882-7431

Recording Tips for Lincoln County:

- Documents must be on 8.5 x 11 inch white paper

- Recording fees may differ from what's posted online - verify current rates

- Request a receipt showing your recording numbers

Cities and Jurisdictions in Lincoln County

Properties in any of these areas use Lincoln County forms:

- Alna

- Boothbay

- Boothbay Harbor

- Bremen

- Bristol

- Chamberlain

- Coopers Mills

- Damariscotta

- Dresden

- East Boothbay

- Edgecomb

- Isle Of Springs

- Jefferson

- Monhegan

- New Harbor

- Newcastle

- Nobleboro

- Pemaquid

- Round Pond

- South Bristol

- Southport

- Squirrel Island

- Trevett

- Waldoboro

- Walpole

- West Boothbay Harbor

- Whitefield

- Wiscasset

Hours, fees, requirements, and more for Lincoln County

How do I get my forms?

Forms are available for immediate download after payment. The Lincoln County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Lincoln County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Lincoln County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Lincoln County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Lincoln County?

Recording fees in Lincoln County vary. Contact the recorder's office at (207) 882-7431 for current fees.

Questions answered? Let's get started!

Real property transfers are governed by Title 33 of the Maine Revised Statutes, but the statutes do not specifically address grant deeds.

A grant deed is a legal document used to transfer, or convey, rights in real property from a grantor (seller) to a grantee (buyer). It contains covenants, or guarantees, that the grantor has not previously sold the real property interest now being conveyed to the grantee, and that the property is being conveyed to the grantee without any liens or encumbrances, except for those specifically disclosed in the deed. Grant deeds do not generally require the grantor to defend title claims.

A lawful grant deed identifies the names and addresses of each grantor and grantee. In addition, it states how the grantee will vest (hold) title. For Maine residential property, the primary methods for holding title are tenancy in common and joint tenancy. An estate conveyed to two or more persons is considered a tenancy in common unless a joint tenancy is clearly expressed (33 M.R.S. 159).

Include the source of title and a complete legal description of the property; without these two things, the document does not constitute notice to third parties (33 M.R.S. 201-A(2)). The deed must be signed by the grantor and notarized and acknowledged before any of the officials listed in 33 M.R.S. 203. If applicable, the grantor's spouse must sign the deed to release his or her interest in the property (33 M.R.S. 772-A-1).

A Transfer Tax Form (or Declaration of Value) must be filed at the County Register of Deeds' office at the same time as the recording of the deed (36 M.R.S 4641-4641N). If the sale is exempt from the transfer tax, state the exemption clearly on the deed. The transfer tax is collected based on the consideration paid for each transfer of property. Find a list of transfers exempt from this tax at 36 M.R.S. 4641-C.

In addition to the content requirements set forth by statute, the form must meet all state and local standards for recorded documents. These may vary from county to county, so contact the local recording office with questions.

Record the deed at the Register of Deeds' office in which the property is located. If the property is located in more than one county, record the deed in both counties (33 M.R.S. 201). All recorded real estate deeds, leases, or other written instruments pertaining to real estate in Maine will take precedence over unrecorded documents (33 M.R.S. 201).

This article is provided for informational purposes only and is not a substitute for legal advice. Contact a lawyer with questions about grant deeds or transfers of real property in Maine.

(Maine GD Package includes form, guidelines, and completed example)

Important: Your property must be located in Lincoln County to use these forms. Documents should be recorded at the office below.

This Grant Deed meets all recording requirements specific to Lincoln County.

Our Promise

The documents you receive here will meet, or exceed, the Lincoln County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Lincoln County Grant Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

rosie s.

March 24th, 2019

Very please with the service

Thank you!

John H.

September 13th, 2021

Quality product. Forms are as advertised. Easy to use site.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Walter R.

February 15th, 2022

I was able to get all the Forms I required and it was straight forward and easy. Thank you , Walt R.

Thank you!

Jack B.

May 2nd, 2020

The service was fast, but I didn't learn about the results until I logged in. I would have liked to get email when the report was finished.

Thank you for your feedback. We really appreciate it. Have a great day!

PETER C.

October 7th, 2020

The process was quick and simple to follow. Very efficient way to document Deeds.

Thank you!

William G.

January 11th, 2021

I am very pleased with Deeds.com. They responded back very quickly, checked my forms, gave an example for a correction, and submitted the forms over the weekend. What more could you ask?

Thank you!

Rhonda D.

February 24th, 2021

The boxes do not allow you to add the entire information. The after recording return to box would not let me add a zipcode.

Thanks for the feedback Rhonda, we’ll take a look at that input field.

Yunyan B.

November 12th, 2019

Great website, fraction of the price if doing title research elsewhere

Thank you for your feedback. We really appreciate it. Have a great day!

Marvita J.

September 26th, 2020

Deeds.com was fast and easy and I got everything I needed in one stop!

Thank you for your feedback. We really appreciate it. Have a great day!

Ma Luisa R.

July 2nd, 2020

Great service and fast

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

BARRY D.

March 24th, 2024

Could not have been easier. Instructions were clear. Guidelines and example were clearly written. Erecording worked fast and let me skip a dreaded trip downtown to be ignored by government employees who hate their jobs.

Thank you for your positive words! We’re thrilled to hear about your experience.

Michael R.

April 11th, 2023

This process was so easy.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Gertrude F.

April 24th, 2022

I like that DEEDS.com has a variety of forms tht I may need. However, I was disappointed that I am not able to save the PDF forms after I fill in the spaces. If I need to edit anything, I have to go back to the blank form and redo the whole thing. Perhap I am doing something wrong.

Thank you!

David W.

February 9th, 2021

Excellent assistance provided by your forms, guide and example.

Thank you!

Armando R.

February 17th, 2021

Great service, quick and affordable. Thank you!

Thank you!