Lincoln County Personal Representative Deed of Sale Intestate Form

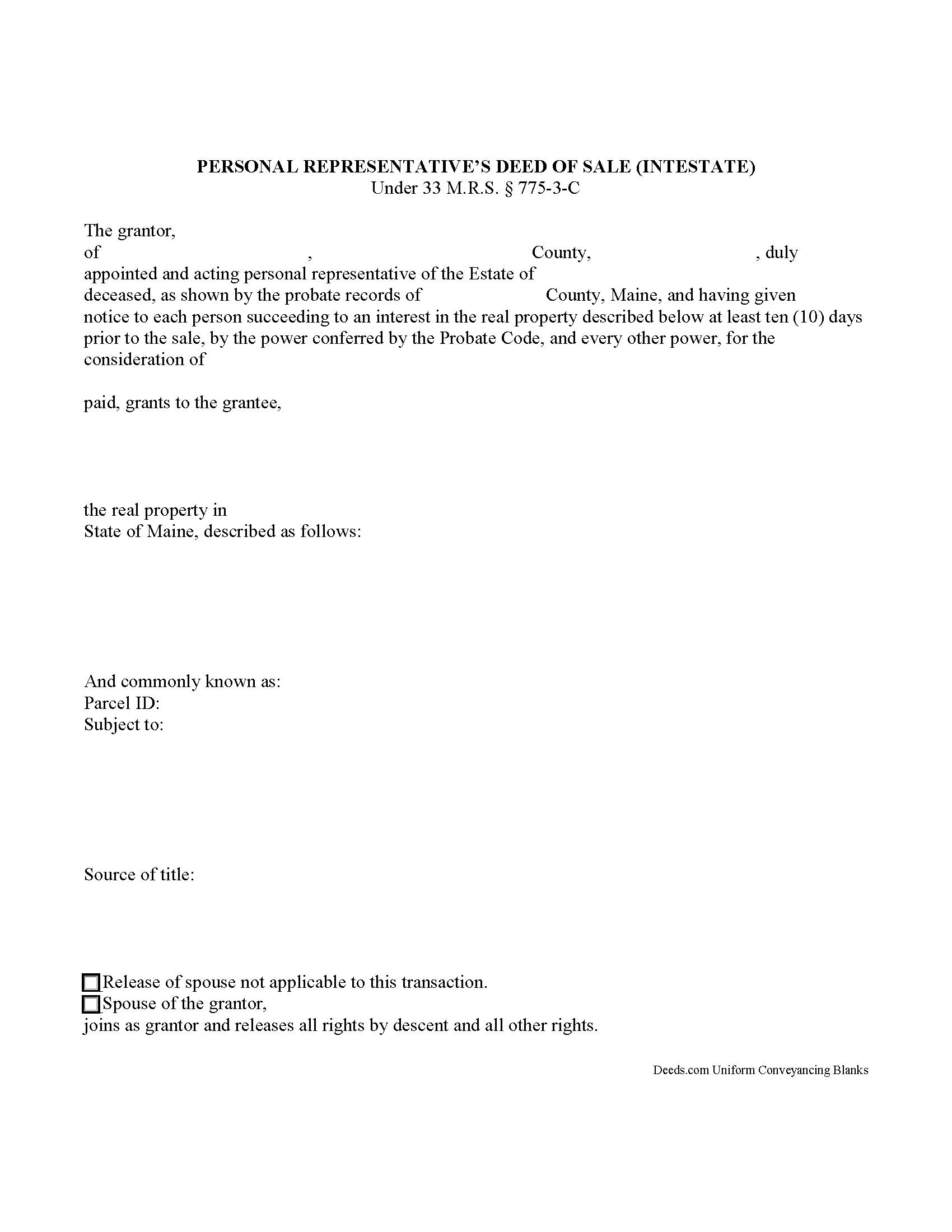

Lincoln County Personal Representative Deed of Sale Form

Fill in the blank form formatted to comply with all recording and content requirements.

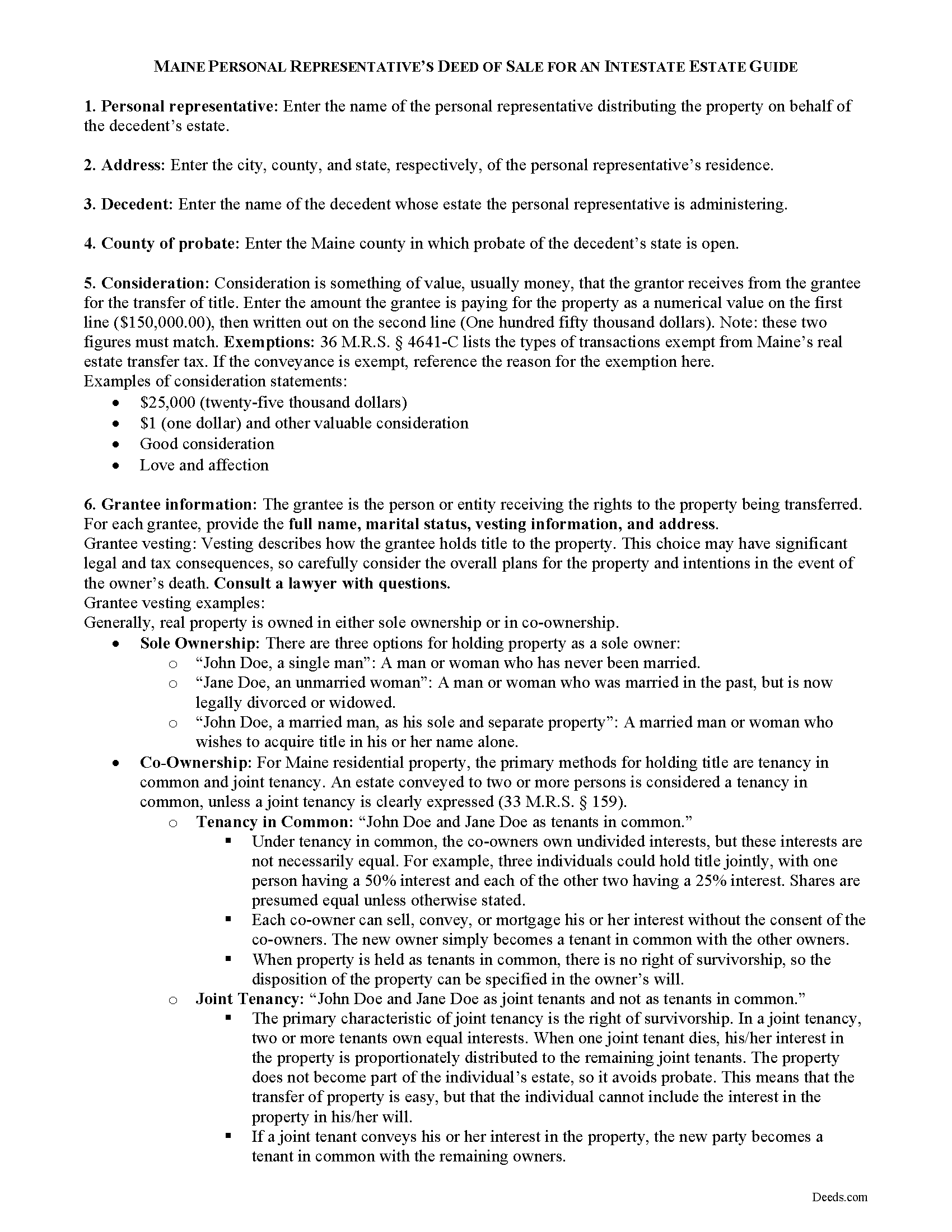

Lincoln County Personal Representative Deed of Sale Guide

Line by line guide explaining every blank on the form.

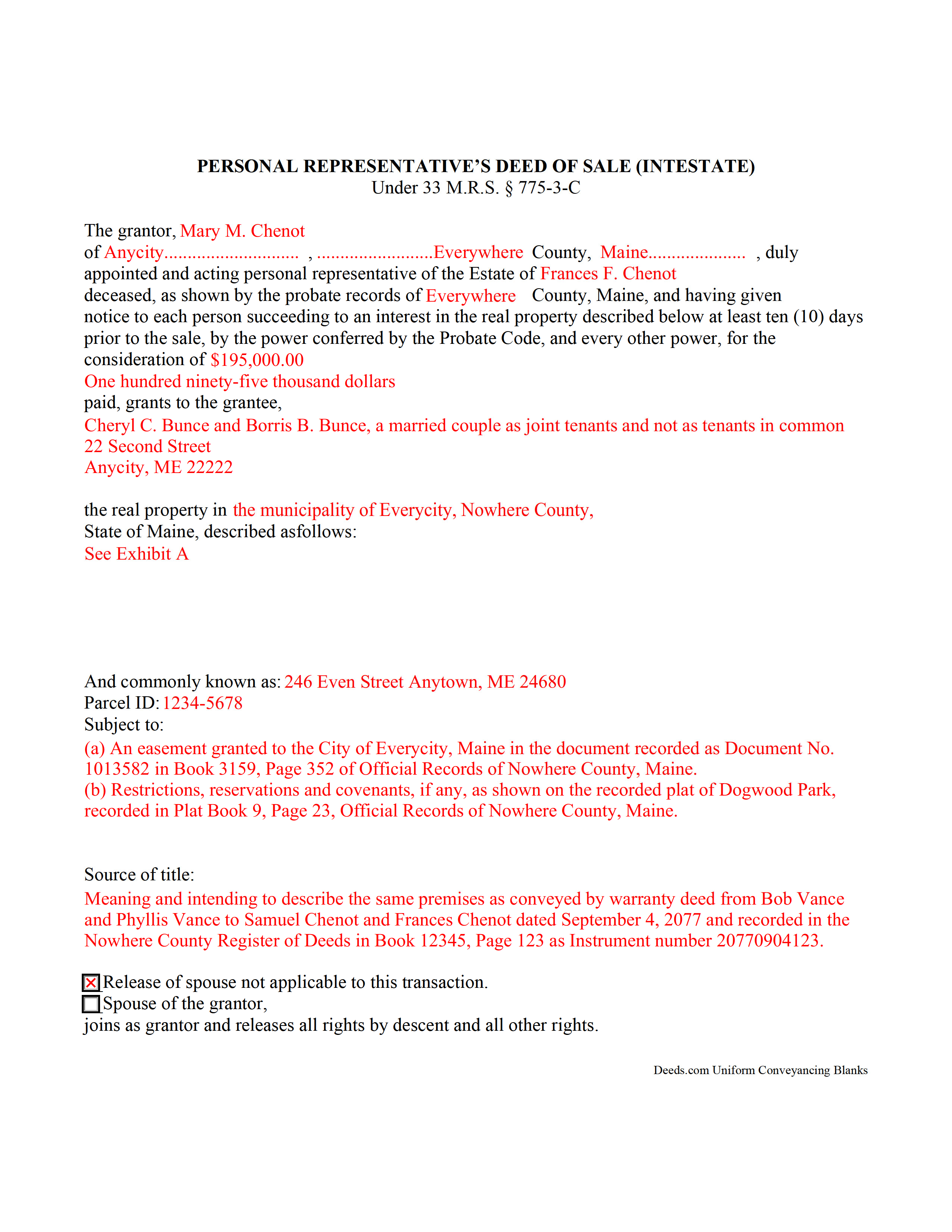

Lincoln County Completed Example of the Personal Representative Deed of Sale Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Maine and Lincoln County documents included at no extra charge:

Where to Record Your Documents

Registry of Deeds

Wiscasset, Maine 04578

Hours: 8:00 to 4:00 Monday through Friday / Recording until 3:30

Phone: (207) 882-7431

Recording Tips for Lincoln County:

- Documents must be on 8.5 x 11 inch white paper

- Ask about their eRecording option for future transactions

- Leave recording info boxes blank - the office fills these

- Both spouses typically need to sign if property is jointly owned

- Recorded documents become public record - avoid including SSNs

Cities and Jurisdictions in Lincoln County

Properties in any of these areas use Lincoln County forms:

- Alna

- Boothbay

- Boothbay Harbor

- Bremen

- Bristol

- Chamberlain

- Coopers Mills

- Damariscotta

- Dresden

- East Boothbay

- Edgecomb

- Isle Of Springs

- Jefferson

- Monhegan

- New Harbor

- Newcastle

- Nobleboro

- Pemaquid

- Round Pond

- South Bristol

- Southport

- Squirrel Island

- Trevett

- Waldoboro

- Walpole

- West Boothbay Harbor

- Whitefield

- Wiscasset

Hours, fees, requirements, and more for Lincoln County

How do I get my forms?

Forms are available for immediate download after payment. The Lincoln County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Lincoln County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Lincoln County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Lincoln County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Lincoln County?

Recording fees in Lincoln County vary. Contact the recorder's office at (207) 882-7431 for current fees.

Questions answered? Let's get started!

The personal representative's (PR) deed of sale for an intestate estate, under 33 M.R.S. 775-3-C, is a fiduciary instrument used to convey real property from an estate to a grantee (purchaser) pursuant to an order for sale. The PR deed conveys interest without any implied covenants of title (33 M.R.S. 771).

A personal representative of an intestate estate is someone selected by the probate court to administer the decedent's estate when the decedent dies without a will.

The PR must give notice of the sale ten at least (10) days ahead of the sale. In addition to meeting the standard content requirements for real estate conveyancing documents, PR deeds must reference information regarding the relevant probate case. Deeds are subject to transfer taxes in Maine, and require a real estate transfer tax form, unless a valid exemption is noted on the deed. File the deed at the appropriate county's Register of Deeds.

Consult a lawyer with questions about Maine personal representative's deeds or with other inquiries related the probate process.

Important: Your property must be located in Lincoln County to use these forms. Documents should be recorded at the office below.

This Personal Representative Deed of Sale Intestate meets all recording requirements specific to Lincoln County.

Our Promise

The documents you receive here will meet, or exceed, the Lincoln County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Lincoln County Personal Representative Deed of Sale Intestate form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Willie P.

June 15th, 2022

got the forms needed plus all the information needed to fill them out.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Harry B.

July 9th, 2019

I received exactly what I was looking for on Deeds.com. Not only that, but this website provided instructions for form completion, and an example of a completed form. I'm certainly glad I chose this website.

Thank you for your feedback. We really appreciate it. Have a great day!

Elliot B.

January 31st, 2022

Outstanding forms and the recording service made a short day of what I needed to do. Will be back for the next one, thanks!

Thank you for your feedback. We really appreciate it. Have a great day!

Philip B.

October 18th, 2019

Pleased with the results, except for the "notice of confidentiality rights" above the QUIT CLAIM DEED headline. Is it needed to be included on the form or can it be removed ? How can it be removed, I do not see a reason for it to be on the print out copy. Thank you.

Thank you!

Erik N.

May 31st, 2025

I liked it, very much.

Thank you!

Kathryn M.

May 1st, 2019

Never know an online service was available for recording county documents. It was so easy and simple and FAST! Within a matter of a couple hours it's done. I would definitely recommend Deeds.com to anyone.

Thank you Kathryn, we really appreciate that.

Robert P.

May 22nd, 2022

Easy to use. Documents as stated.

Thank you for your feedback. We really appreciate it. Have a great day!

Edwin M.

July 2nd, 2021

Good marks from me. Keep up the good work !

Thank you!

James S.

December 2nd, 2020

It worked great. But it turns out I didn't need it.

Thank you!

Walton A.

February 3rd, 2022

Thanks ..this was very helpful and easy!

Thank you!

Kari G.

July 15th, 2021

The service was prompt and attentive to my questions. I would've just appreciated a heads up that I also needed to contact the county directly (and provide contact info) to receive a certified copy of the document (Notice of Commencement) in order to submit the certified copy to the Building Department. This was an extra step that I haven't had to complete before using another eRecording service. Even if this extra step is a result of the county's system. I would still have expected a head's up (since there wasn't any info regarding this on the county's site for eRecording).

Thank you for your feedback. We really appreciate it. Have a great day!

Jennifer S.

December 11th, 2019

Fabulous

Thank you!

Stacie L.

April 1st, 2020

The deed is great. However, I do not believe your Statement of Full Consideration is up to date as it does not give the reference for an exemption on the Transfer on Death Deed.

Thank you Stacie. We'll take a look at those supplemental forms. Have a great day!

RICHARD M.

March 12th, 2022

EASY TO USE AND GREAT I COULD DOWNLOAD MULTIPLE DOCUMENTS

Thank you!

Marlene B.

February 21st, 2024

I appreciated the fact that the forms were by Texas County and I knew I had the right form. The form were fairly easy to complete. I had trouble completing the form because the property description was long and kept disappearing and I had to re-type. It would also have helped it I could have saved and not had to start over every time.

Your satisfaction with our services is of utmost importance to us. Thank you for letting us know how we did!