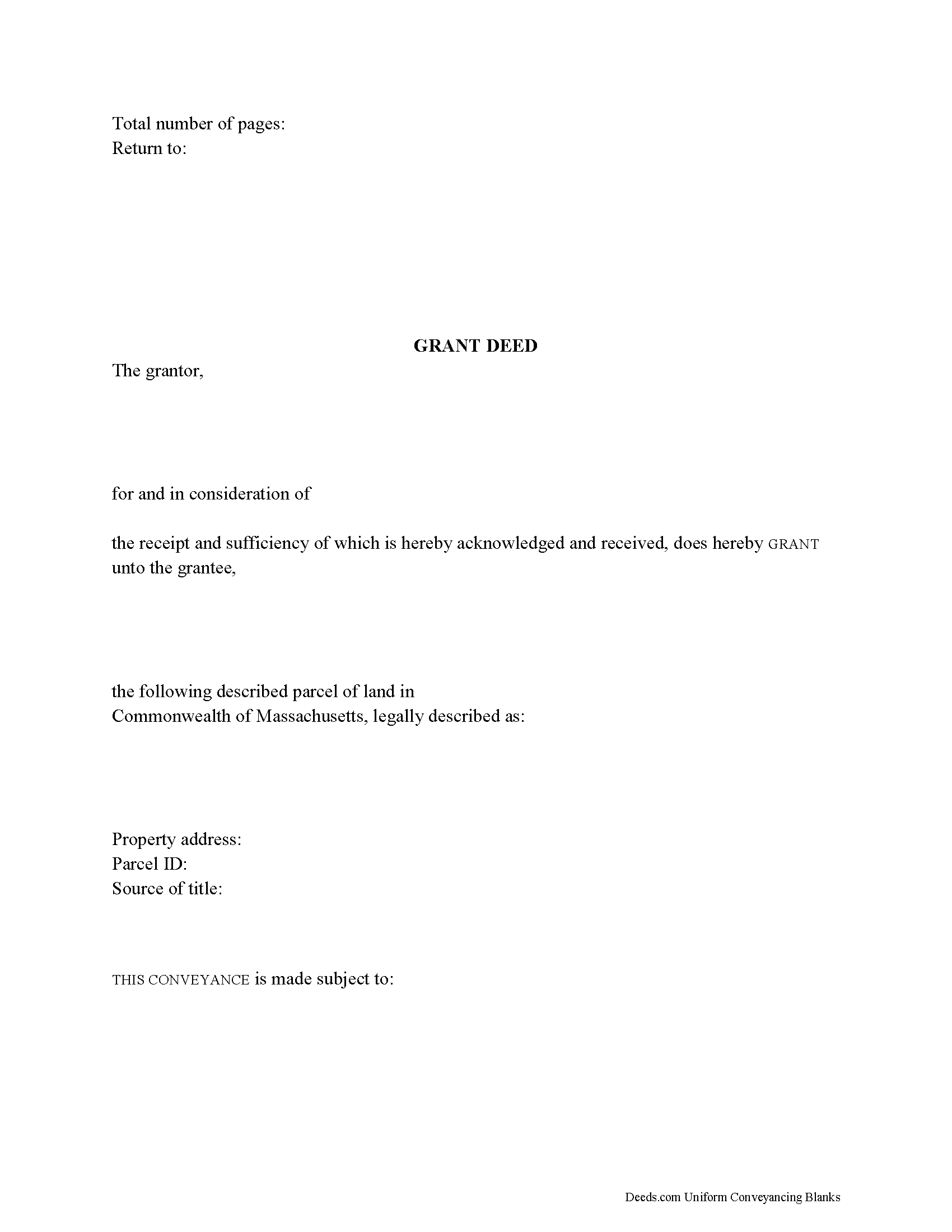

Plymouth County Grant Deed Form

Plymouth County Grant Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

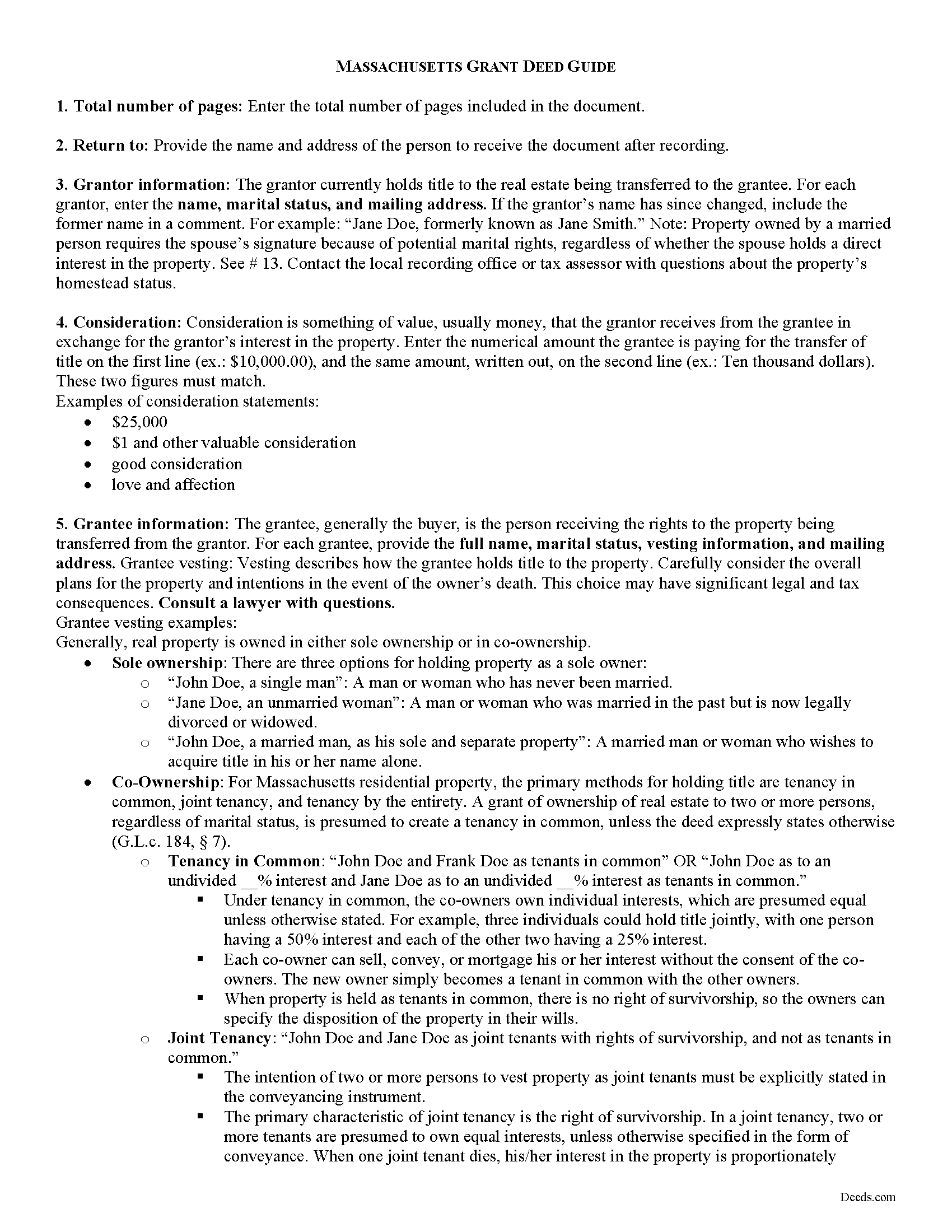

Plymouth County Grant Deed Guide

Line by line guide explaining every blank on the form.

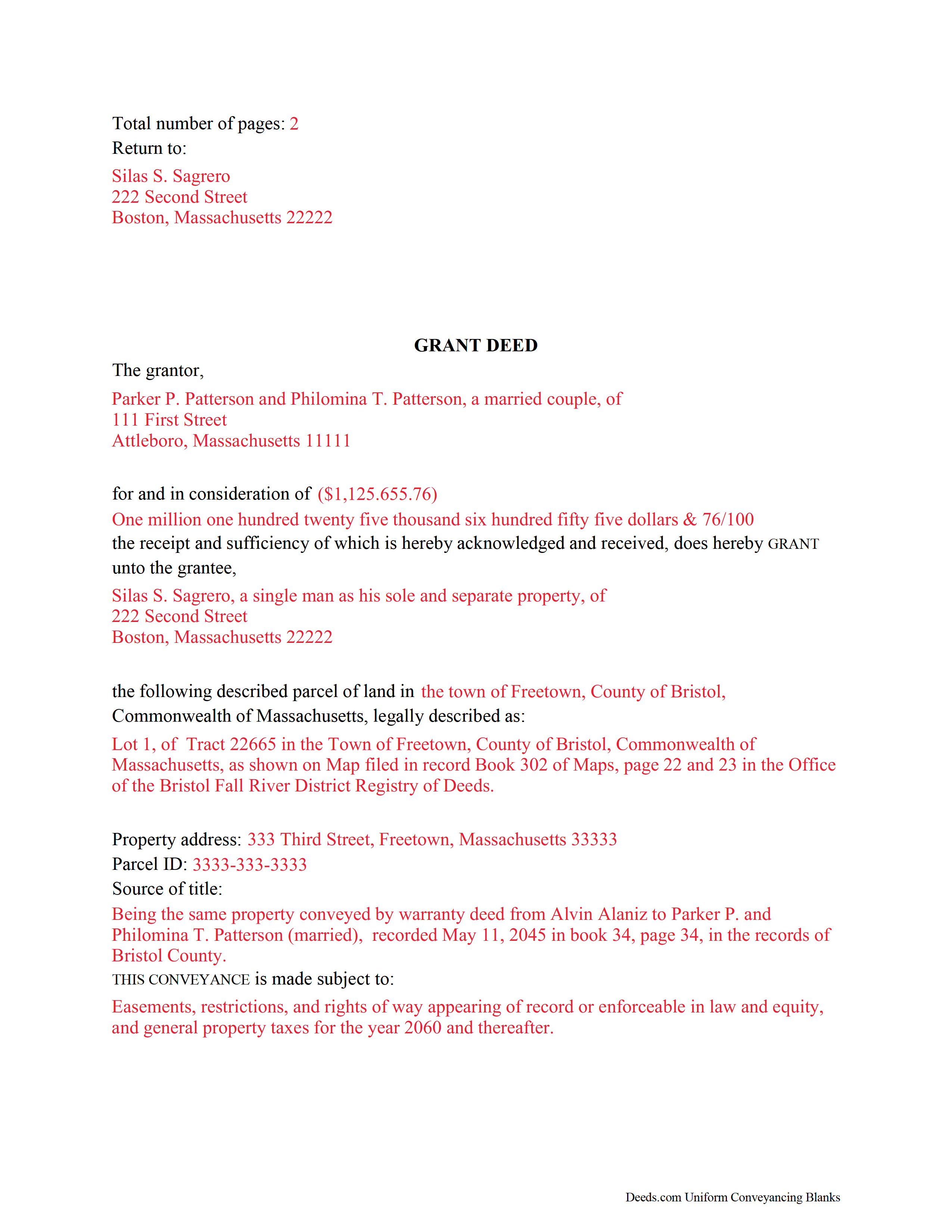

Plymouth County Completed Example of the Grant Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Massachusetts and Plymouth County documents included at no extra charge:

Where to Record Your Documents

Plymouth - Main Office with Land Court

Plymouth, Massachusetts 02360

Hours: 8:15 to 4:30 M-F / Recording until 4:00

Phone: (508) 830-9200

Brockton Satellite Office

Brockton, Massachusetts 02301

Hours: 8:30 to 12:00 & 12:45 to 4:15 M-F / Recording until 4:00

Phone: (508) 830-9200

Rockland Satellite Office

Rockland, Massachusetts 02370

Hours: 8:30 to 12:00 & 12:45 to 4:15 M-F / Recording until 4:00

Phone: (508) 830-9200

Recording Tips for Plymouth County:

- Both spouses typically need to sign if property is jointly owned

- Check margin requirements - usually 1-2 inches at top

- Bring extra funds - fees can vary by document type and page count

- Some documents require witnesses in addition to notarization

Cities and Jurisdictions in Plymouth County

Properties in any of these areas use Plymouth County forms:

- Abington

- Accord

- Brant Rock

- Bridgewater

- Brockton

- Bryantville

- Carver

- Duxbury

- East Bridgewater

- East Wareham

- Elmwood

- Green Harbor

- Greenbush

- Halifax

- Hanover

- Hanson

- Hingham

- Hull

- Humarock

- Kingston

- Lakeville

- Manomet

- Marion

- Marshfield

- Marshfield Hills

- Mattapoisett

- Middleboro

- Minot

- Monponsett

- North Carver

- North Marshfield

- North Pembroke

- North Scituate

- Norwell

- Ocean Bluff

- Onset

- Pembroke

- Plymouth

- Plympton

- Rochester

- Rockland

- Scituate

- South Carver

- Wareham

- West Bridgewater

- West Wareham

- White Horse Beach

- Whitman

Hours, fees, requirements, and more for Plymouth County

How do I get my forms?

Forms are available for immediate download after payment. The Plymouth County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Plymouth County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Plymouth County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Plymouth County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Plymouth County?

Recording fees in Plymouth County vary. Contact the recorder's office at (508) 830-9200 for current fees.

Questions answered? Let's get started!

Real estate conveyances in Massachusetts are governed under Massachusetts General Laws Chapters 183 and 184. While the statutes do not specifically mention grant deeds, they are still useful for conveying title to real property in the state.

A grant deed transfers the right, title, and interest in real estate from the grantor (seller) to the grantee (buyer). Grant deeds typically include explicit covenants that the grantor is seized of, or owns, the land granted, has the right to convey the land, and that the deed discloses every lien or encumbrance associated with the property.

In addition to meeting all state and local standards for recorded documents, a lawful deed identifies each grantor and grantee by name, address, and marital status (G.L.c. 183 sec. 6). State law requires that all land records contain information on how the grantee will hold title (G.L.c. 184 sec. 7). For Massachusetts residential property, the primary methods for holding title are tenancy in common, joint tenancy, and tenancy by the entirety. A grant of ownership of real estate to two or more persons, regardless of marital status, is presumed to create a tenancy in common, unless the deed expressly states otherwise (G.L.c. 184 sec. 7).

As with any conveyance of real estate, a grant deed requires a complete legal description of the parcel. The deed must state the amount of the full consideration, or the total price paid by the grantee for the transfer (G.L.c. 183 sec. 6). Based on the consideration paid, the seller pays an excise tax (also known as a transfer tax or stamp tax) to the Registry of Deeds' office (G.L.c. 64D sec. 1,2).

Record the completed deed at the local County Registry of Deeds office. Some counties (Berkshire, Bristol, Essex, Middlesex, Worcester) are split into two or more recording districts. Make sure to record the deed in the correct recording district. If the deed pertains to registered land, submit the deed to the Registry District of the Land Court. Include all relevant affidavits, forms, and fees along with the deed for recording. For guidance related to supplemental documentation, speak with the local Registry of Deeds office.

This article is provided for informational purposes only and is not a substitute for legal advice. Contact a lawyer with questions about grant deeds or transfers of real property in Massachusetts.

(Massachusetts GD Package includes form, guidelines, and completed example)

Important: Your property must be located in Plymouth County to use these forms. Documents should be recorded at the office below.

This Grant Deed meets all recording requirements specific to Plymouth County.

Our Promise

The documents you receive here will meet, or exceed, the Plymouth County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Plymouth County Grant Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4588 Reviews )

Elizabeth R.

April 20th, 2023

It was easy to download and save the Revocation of Beneficiary of Deed form. The example and instructions helped a lot. When I went to file with the county clerk's office, she read through it carefully and said "perfect" when she was through. Thank you for making it so easy!

Thank you!

Bernardo M.

March 11th, 2022

You think you're purchasing 1 form for $25 but you are getting several which explains the $25. My printer ran out of black ink and I couldn't change the color of the text so that it would print. I couldn't copy and paste it to Word and work on it there. I'm going to purchase ink today so that it will at least print right. I will have to retype the text in Word; not good.

Thank you for your feedback. We really appreciate it. Have a great day!

Woody P.

August 28th, 2021

I was informed that a quit Claim Deed that I had submitted, did not meet county requirements. I ordered the correct form and was surprised that the form included instructions and a sample "completed" form for me to follow. I found it al very helpful. Thank you !!!

Thank you!

Karen L.

October 3rd, 2022

Good service could give a little more detail on where to location some of the information needed. Overall fairly simply to use.

Thank you for your feedback. We really appreciate it. Have a great day!

Victoria L.

February 25th, 2019

This is a fantastic website and financial savings to many. Being able to download and complete the document I needed vs having my attorney complete saved me $800. I would highly recommend this website.

Thank you for the kind words Victoria. Have a great day!

Susan B.

August 8th, 2023

I guess I got what I paid for. The site said I would be able to download blank PDF forms that I could fill out on my computer. I expected fillable forms, like I download for taxes. Instead the forms I got could only be completed by using Adobe Sign and Fill tools. These are much harder to use than fillable forms.

Thank you for your feedback. We really appreciate it. Have a great day!

Lori A.

February 14th, 2023

It was quick and easy. A little expensive but convient

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Carol H.

December 22nd, 2021

Great help Quite useful

Thank you!

Will C.

April 8th, 2019

I was very happy with my interaction. The county didn't supply the book and page which was what I needed. The tech refunded my money since I didn't get the info I needed. I will use Deeds.com again.

Thank you for your feedback. We really appreciate it. Have a great day!

vickie w.

February 22nd, 2020

easy & convenience .good service

Thank you for your feedback. We really appreciate it. Have a great day!

Thomas D.

January 6th, 2019

Can I use this for easement in gross ? Like to grant cousins easement to use river front property with riparian rights ?

Sorry, we are unable to give advice on specific legal situations.

Lillian B.

October 27th, 2022

Easy peasy

Thank you!

JJ G.

September 18th, 2020

Was very easy and helpful. No going down to the courthouse

Thank you!

Dianna B.

July 23rd, 2020

Amazingly easy! I absolutely love it because it is so efficient and I only have to pay for when I use it. I use to have to drive to the recorders office or to a Kiosk station. The turn-around time was really quick as well.

Thank you!

Janepher M.

January 27th, 2019

Easy and informative site. Helped me figure out what I was looking for.

Thank you Janepher, we appreciate your feedback!