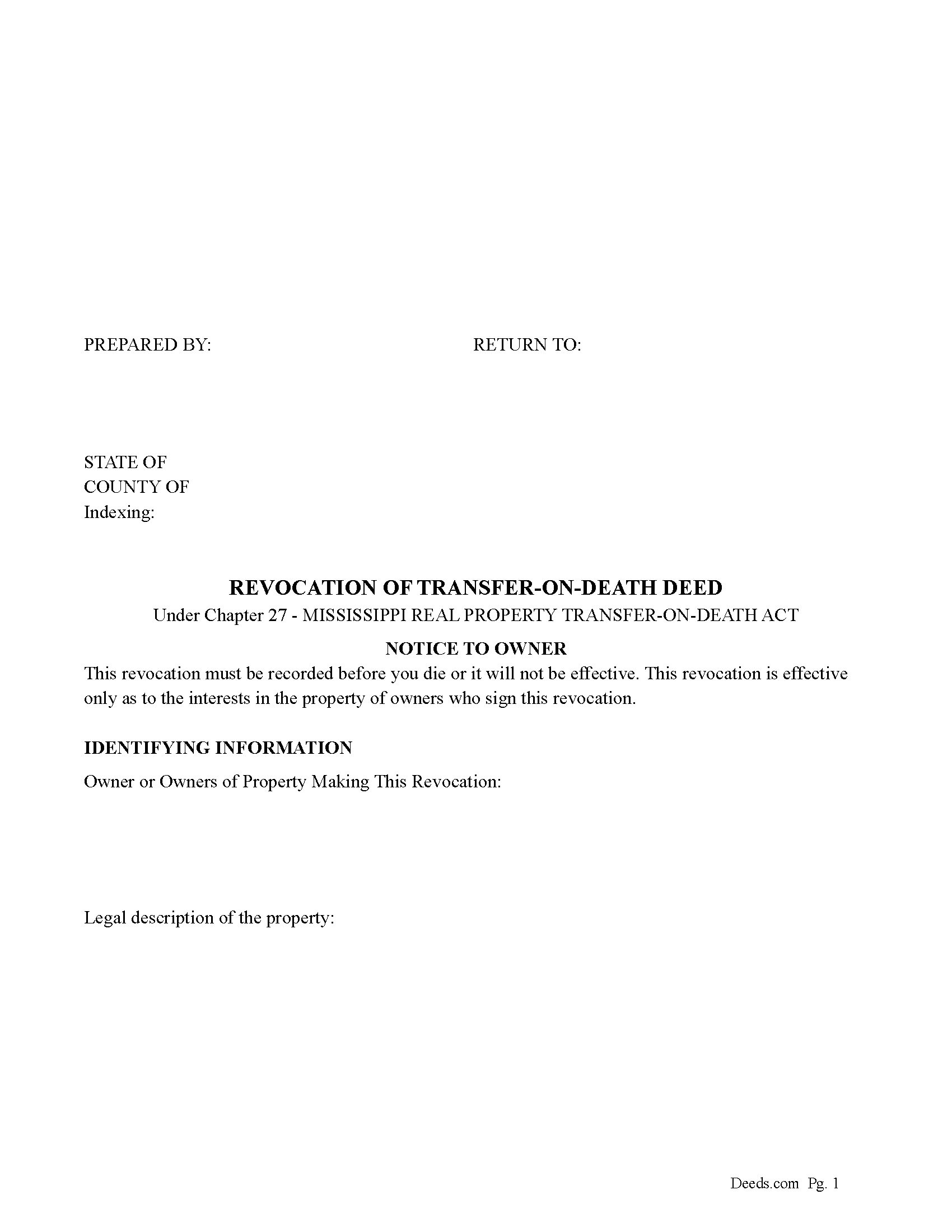

Clarke County Revocation of Transfer on Death Deed Form

Clarke County Revocation of Transfer on Death Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

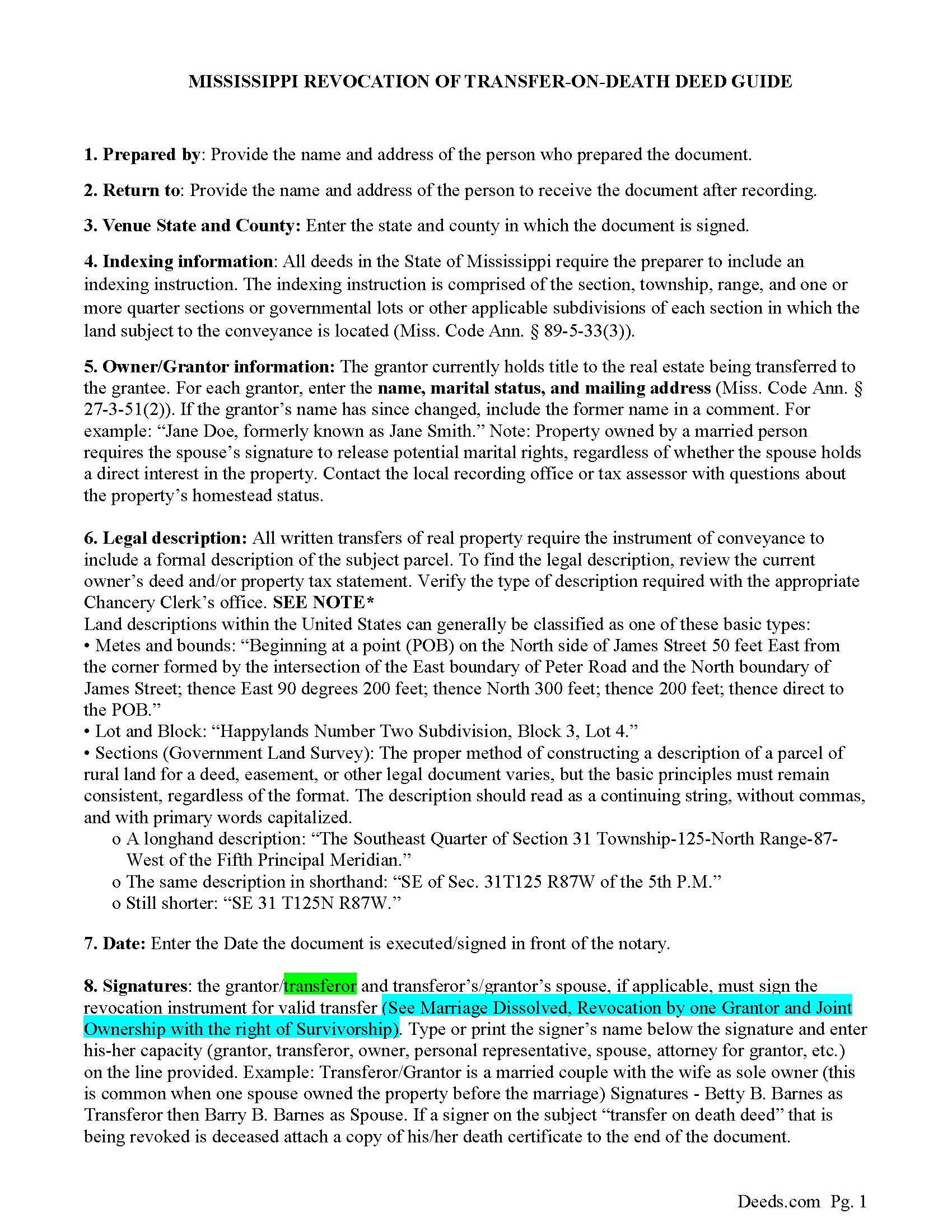

Clarke County Guidelines for Revocation of Transfer on Death Deed

Line by line guide explaining every blank on the form.

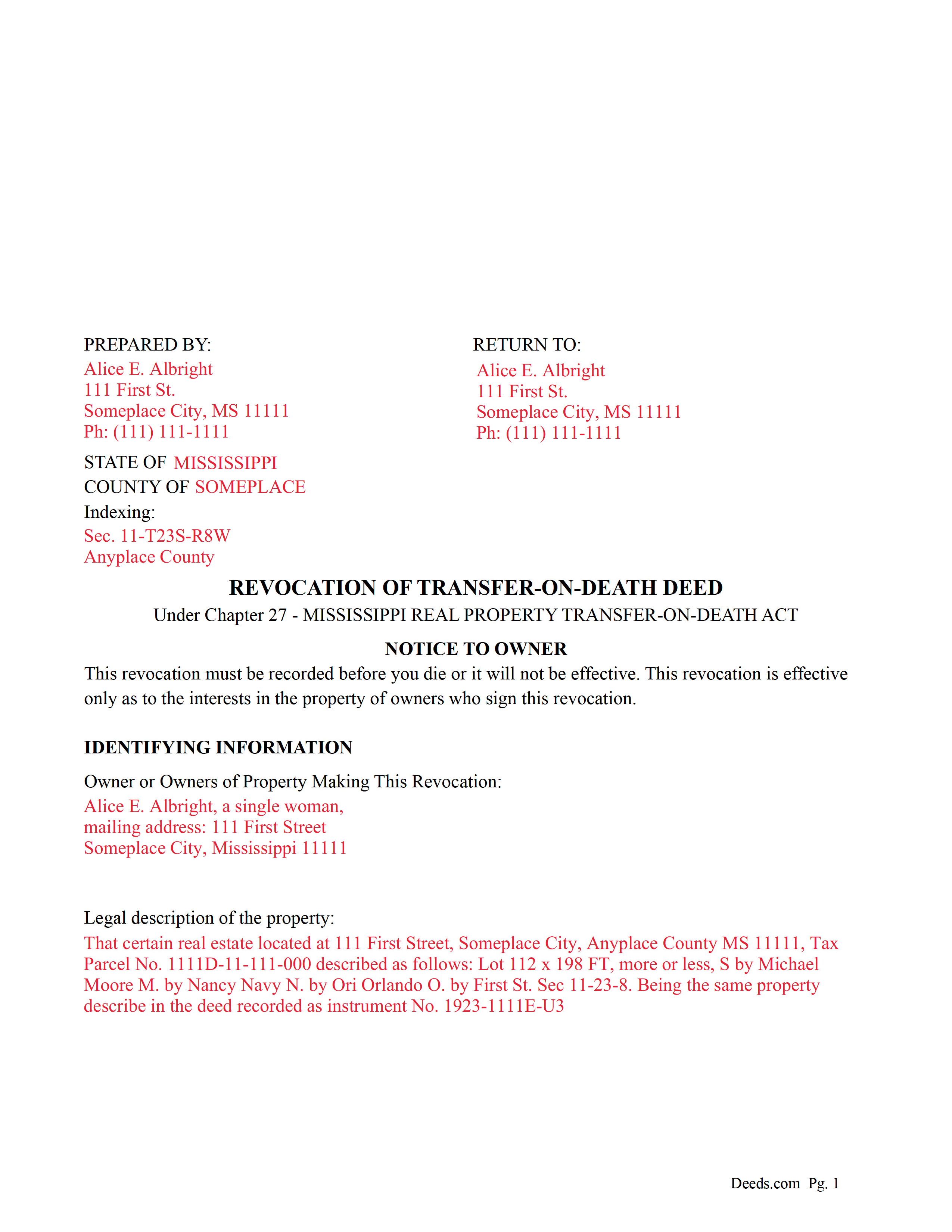

Clarke County Completed Example of a Revocation of Transfer on Death Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Mississippi and Clarke County documents included at no extra charge:

Where to Record Your Documents

Clarke County Chancery Clerk

Quitman, Mississippi 39355

Hours: 8:00 to 12:00 and 1:00 to 5:00 Monday through Friday

Phone: (601) 776-2126, or 3111

Recording Tips for Clarke County:

- Bring your driver's license or state-issued photo ID

- Verify all names are spelled correctly before recording

- Bring extra funds - fees can vary by document type and page count

- Recorded documents become public record - avoid including SSNs

- Request a receipt showing your recording numbers

Cities and Jurisdictions in Clarke County

Properties in any of these areas use Clarke County forms:

- Enterprise

- Pachuta

- Quitman

- Shubuta

- Stonewall

Hours, fees, requirements, and more for Clarke County

How do I get my forms?

Forms are available for immediate download after payment. The Clarke County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Clarke County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Clarke County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Clarke County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Clarke County?

Recording fees in Clarke County vary. Contact the recorder's office at (601) 776-2126, or 3111 for current fees.

Questions answered? Let's get started!

Use this form to revoke or partially revoke a previously recorded Revocable Transfer on Death Deed.

Section 91-27-21 - Revocation by instrument authorized; revocation by act not permitted

(a) Subject to subsections (d) and (e), an instrument is effective to revoke a recorded transfer-on-death deed, or any part of it, if the instrument:

(1) Is one (1) of the following:

(A) A subsequent transfer-on-death deed that revokes the preceding transfer-on-death deed or part of the deed expressly or by inconsistency; or

(B) Except as provided by subsection (b), an instrument of revocation that expressly revokes the transfer-on-death deed or part of the deed;

(2) Is acknowledged by the transferor after the acknowledgment of the deed being revoked; and

(3) Is recorded before the transferor's death in the official records of the chancery clerk of the county where the deed being revoked is recorded.

(b) A will does not revoke or supersede a transfer-on-death deed.

(c) If a marriage between the transferor and a designated beneficiary is dissolved after a transfer-on-death deed is recorded, a final judgment of the court dissolving the marriage operates to revoke the transfer-on-death deed as to that designated beneficiary.

(d) If a transfer-on-death deed is made by more than one (1) transferor, revocation by a transferor does not affect the deed as to the interest of another transferor who does not make that revocation.

(e) A transfer-on-death deed made by joint owners with right of survivorship is revoked only if it is revoked by all of the living joint owners.

(f) This section does not limit the effect of an inter vivos transfer of the real property.

(Mississippi Revocation of TODD Package includes form, guidelines, and completed example) For use in Mississippi only.

Important: Your property must be located in Clarke County to use these forms. Documents should be recorded at the office below.

This Revocation of Transfer on Death Deed meets all recording requirements specific to Clarke County.

Our Promise

The documents you receive here will meet, or exceed, the Clarke County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Clarke County Revocation of Transfer on Death Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4581 Reviews )

Patricia J.

October 31st, 2021

No word "Download" so had a little trouble figuring out how to download, but finally figured it out.

Thank you for your feedback. We really appreciate it. Have a great day!

Tracey H.

November 10th, 2020

The transaction was easy and the download was immediately, What a great service to provide for a reasonable price. I highly recommend this service.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

deborah k.

April 7th, 2022

was very easy to fill out the directions were very helpful

Thank you!

Michael R.

August 25th, 2025

A suggestion: Include instructions on how to add your spouse to the deed, rather than transferring completely to a third party

Thank you for your thoughtful feedback. Adding a spouse to a deed is a common need, and suggestions like yours help us identify where additional guidance would be useful. We’ll take this into consideration as we continue improving our resources.

Tajsha N.

February 24th, 2023

I would absolutely use this service again. It was very convenient and I was pleasantly surprised at how responsive the staff was letting me know updates to my recording package. Also, my documents recorded immediately. I did have trouble uploading my document in the beginning because I didn't realize it had to be a pdf file. Once I figured that out, it was immediately accepted. Great service!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

JACQUELINE R.

March 23rd, 2021

We have been waiting for a Title Company to put a release of Lien together for the past 3 months. I figured it was taking way to long and decided to use template here instead. In less than hour I was able to add all the information on the template and provide forms to our Seller to use. We were buying and he didnt think they were necessary. But I refused to pay him in full until he agreed to sign papers at the bank, and of course in front of a notary. We turned around and filed the Release of lien paperwork at County Clerks office, we officially own our house. Thank you!

Thank you for your feedback. We really appreciate it. Have a great day!

Ralph O.

September 16th, 2024

The experience has been excellent. The site gave me exactly what I was looking for. The documentation we easy to understand.

We are grateful for your feedback and looking forward to serving you again. Thank you!

Bethany F.

April 6th, 2022

quick and easy to use

Thank you!

Rachel F.

February 18th, 2019

Easy and can add our own additional language in spaces provided. Thank you!

Thank you Rachel!

Dennis H.

June 26th, 2019

Thank you for this program. It will help in the future. Dennis Holt

Thank you!

Kimberly M.

May 20th, 2019

Great service once again from Deeds.com. I will be using them again in the future.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Lynne B.

October 17th, 2020

It was very easy to navigate and very fast response time.

Thank you!

Rebecca H.

December 14th, 2020

Very pleased with the ease of this deed form. Completing the deed form to make sure everything was in my name took ten minutes. Thanks.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Paul W.

March 11th, 2022

Exceptionally easy site to navigate. Forms and related documents downloaded quickly and were helpful in completing the forms, which have already been filed with the County Registrar of Deeds. Many thanks for an extremely useful site!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Joy V.

December 24th, 2018

Very helpful and efficient!

Thank you for your feedback. We really appreciate it. Have a great day!