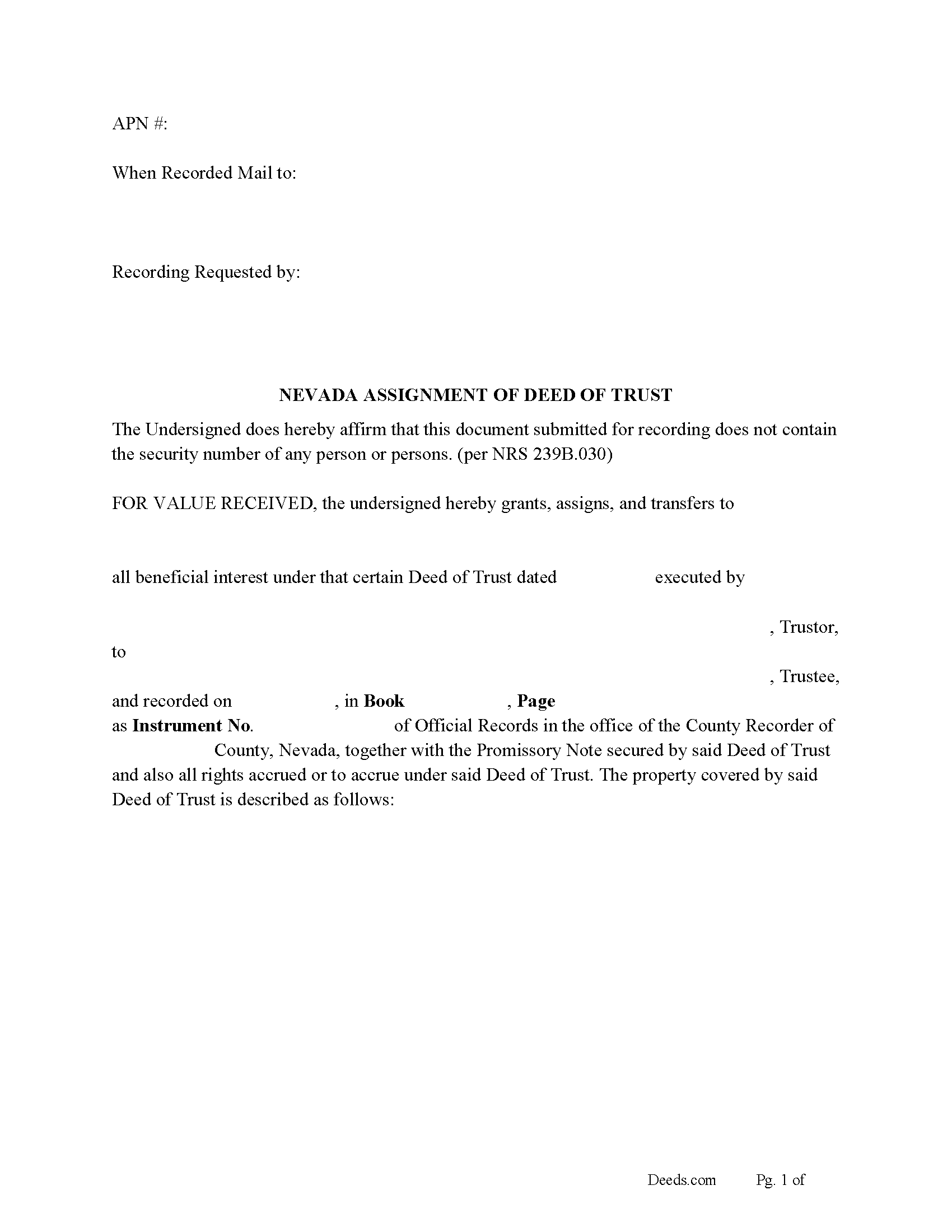

Elko County Assignment of Deed of Trust Form

Elko County Assignment of Deed of Trust Form

Fill in the blank Assignment of Deed of Trust form formatted to comply with all Nevada recording and content requirements.

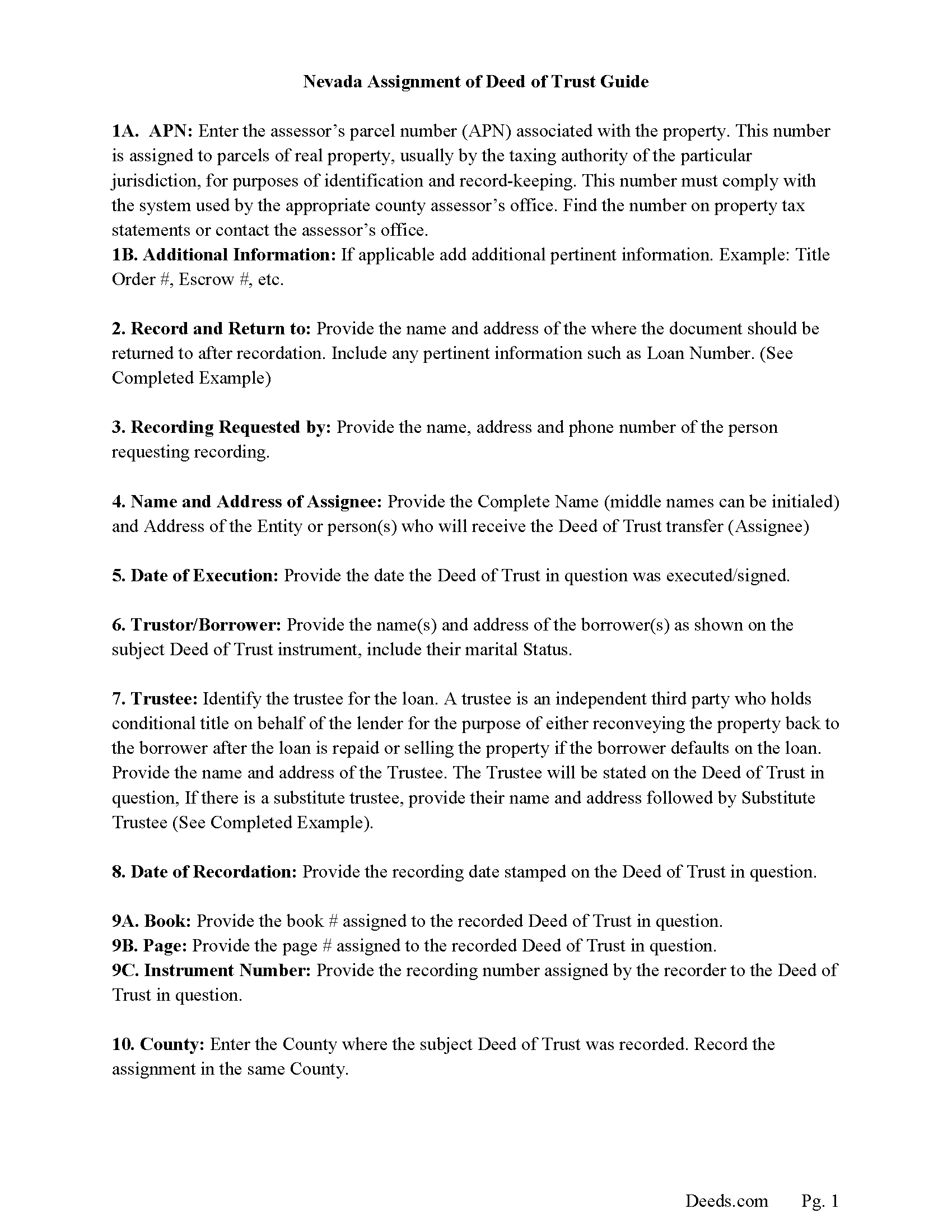

Elko County Guidelines for Assignment of Deed of Trust

Line by line guide explaining every blank on the form.

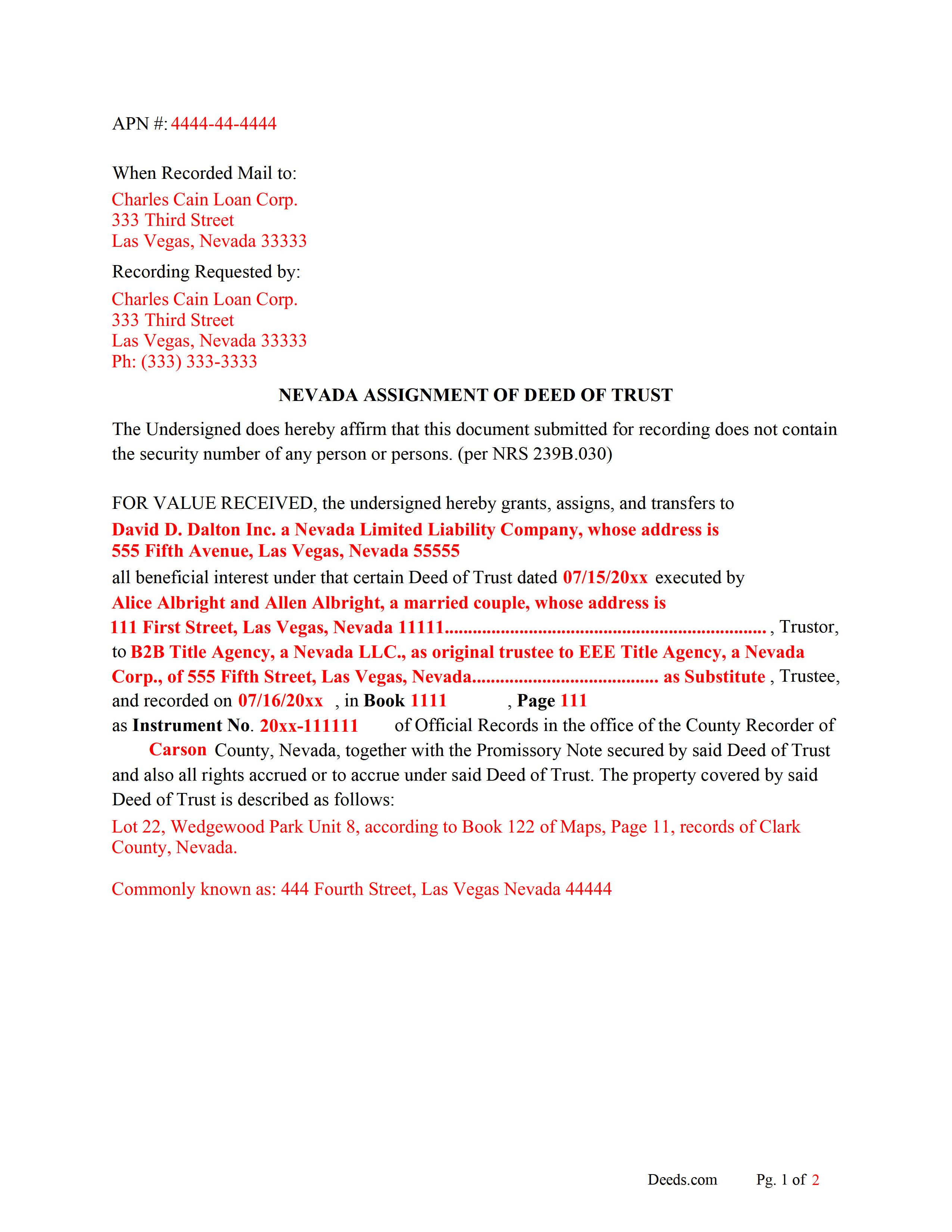

Elko County Completed Example of the Assignment of Deed of Trust Document

Example of a properly completed form for reference.

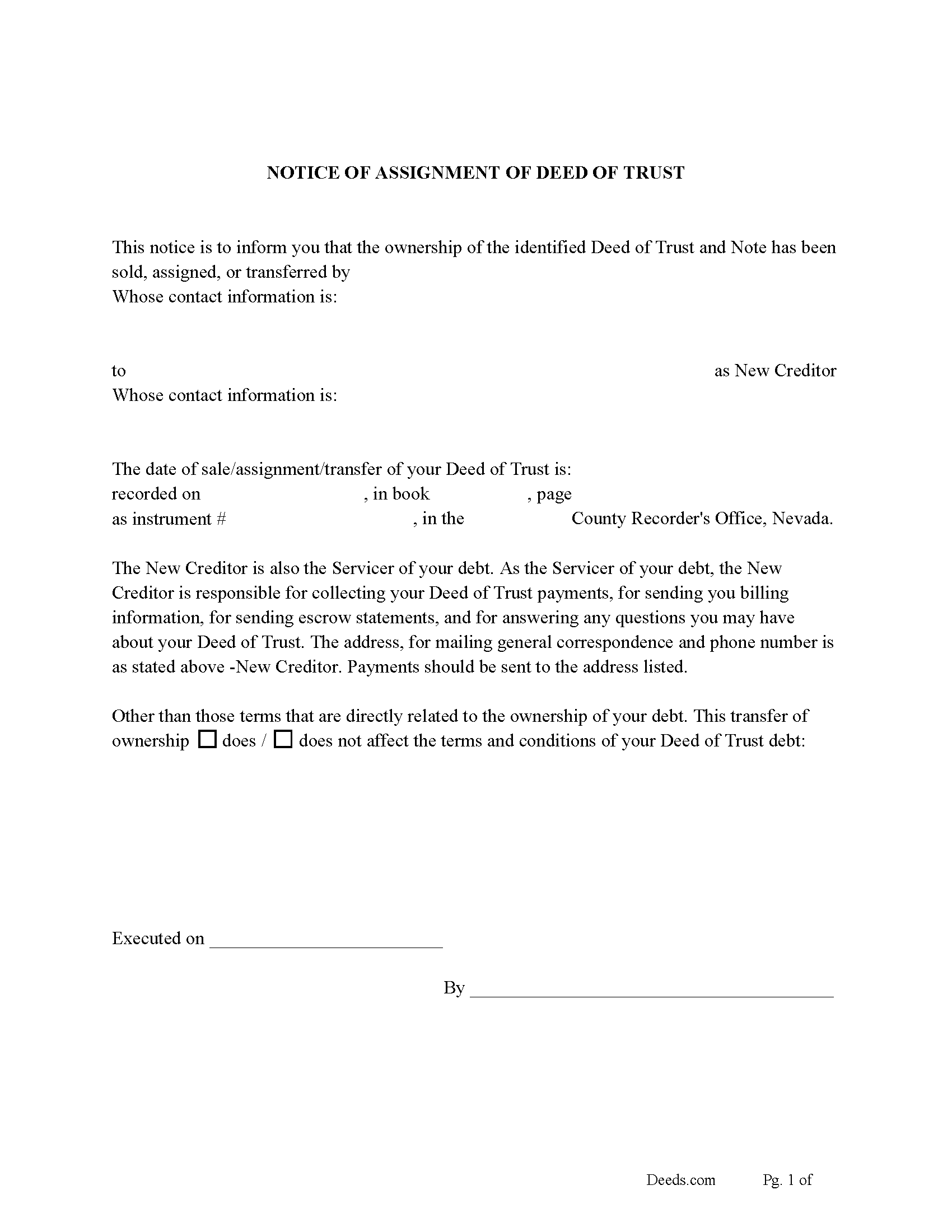

Elko County Notice of Assignment of Deed of Trust Form

Fill in the blank form formatted to comply with content requirements.

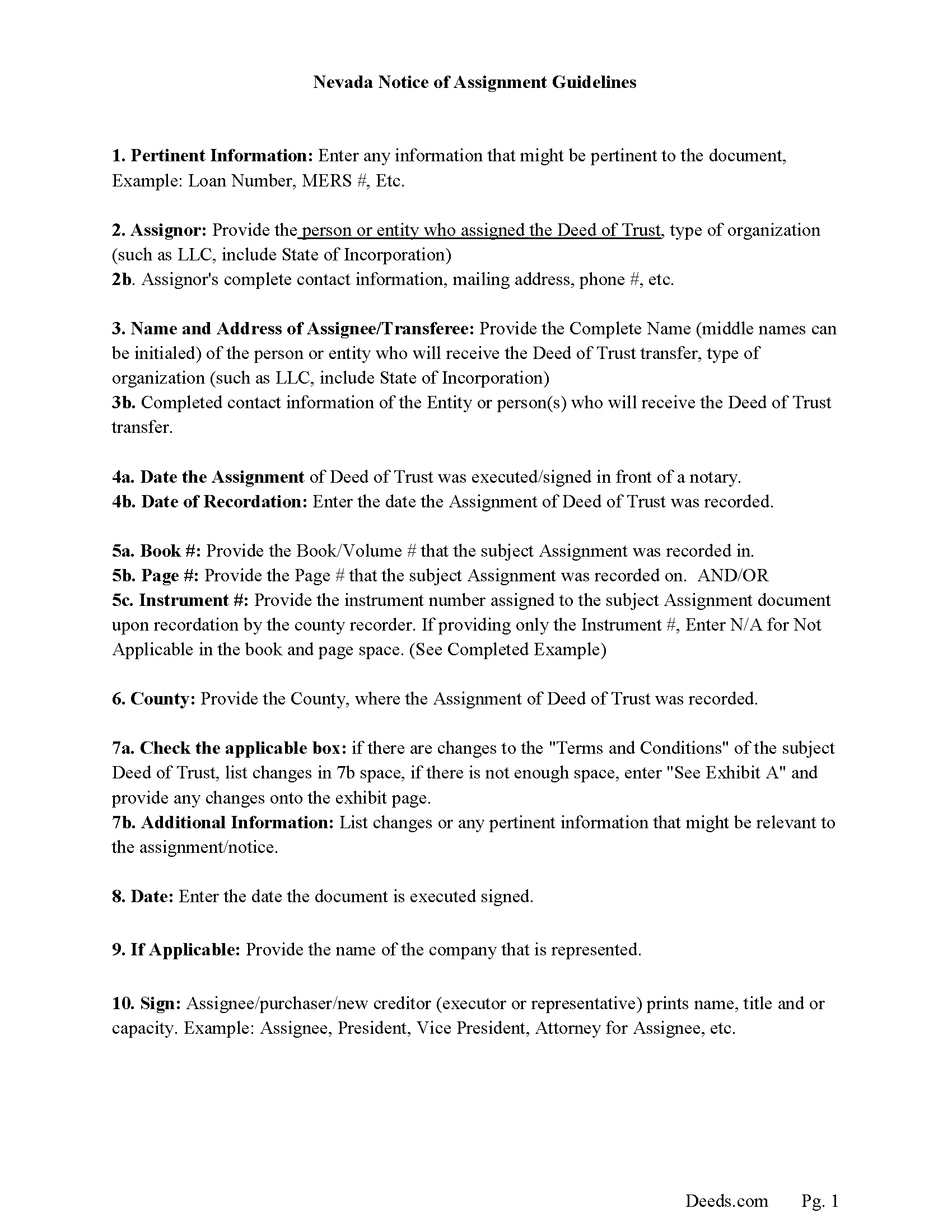

Elko County Notice of Assignment Guidelines

Line by line guide explaining every blank on the form.

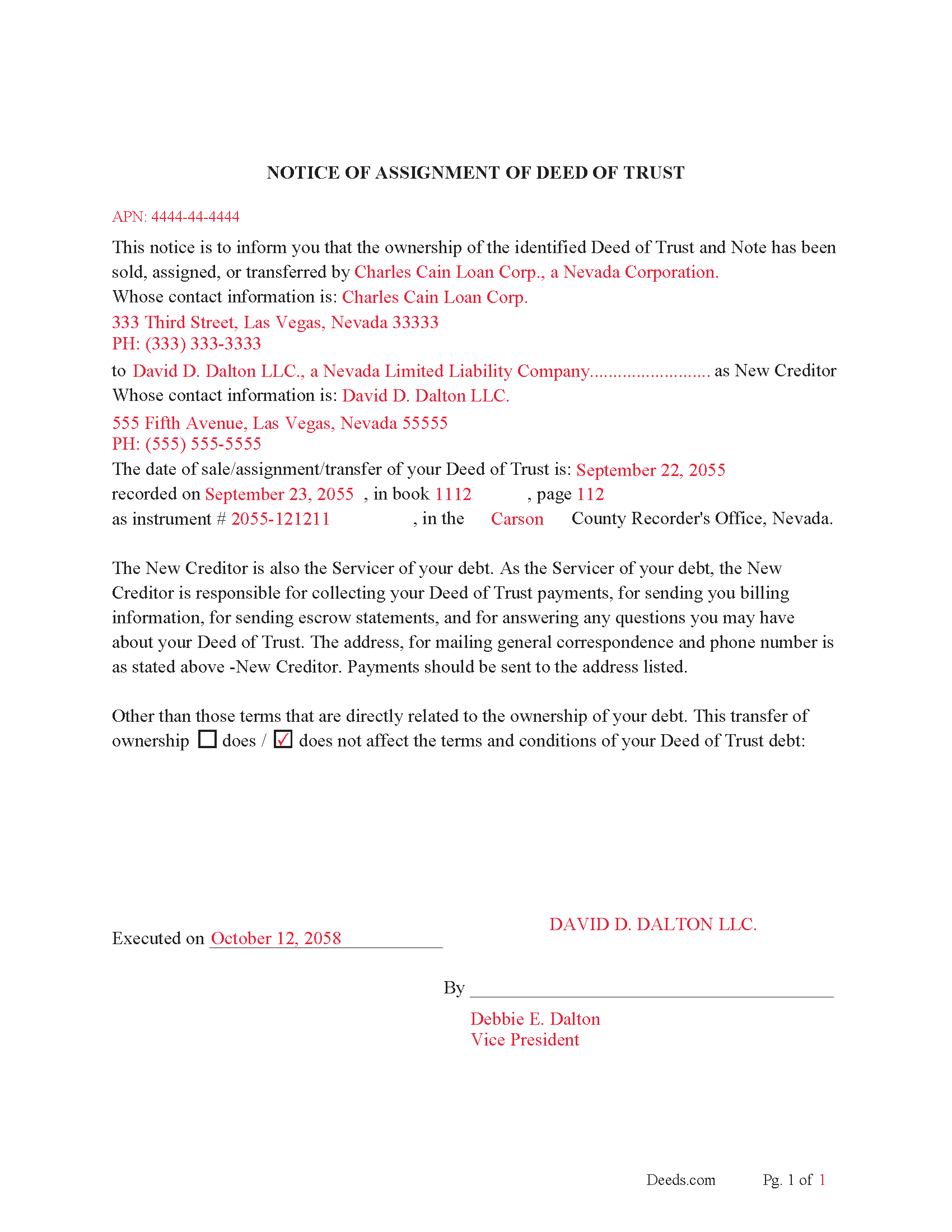

Elko County Completed Example of Notice of Assignment Document

Example of a properly completed form for reference.

All 6 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Nevada and Elko County documents included at no extra charge:

Where to Record Your Documents

Elko County Recorder

Elko, Nevada 89801

Hours: 8:00 to 5:00 M-F

Phone: (775) 738-6526

Recording Tips for Elko County:

- Ensure all signatures are in blue or black ink

- Ask about their eRecording option for future transactions

- Make copies of your documents before recording - keep originals safe

- Recorded documents become public record - avoid including SSNs

- Recording fees may differ from what's posted online - verify current rates

Cities and Jurisdictions in Elko County

Properties in any of these areas use Elko County forms:

- Carlin

- Deeth

- Elko

- Halleck

- Jackpot

- Jarbidge

- Lamoille

- Montello

- Mountain City

- Owyhee

- Ruby Valley

- Spring Creek

- Tuscarora

- Wells

- West Wendover

Hours, fees, requirements, and more for Elko County

How do I get my forms?

Forms are available for immediate download after payment. The Elko County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Elko County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Elko County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Elko County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Elko County?

Recording fees in Elko County vary. Contact the recorder's office at (775) 738-6526 for current fees.

Questions answered? Let's get started!

In this form the beneficiary/lender transfers interest in a Deed of Trust and Promissory Note to another party. (Any assignment of the beneficial interest under a deed of trust must be recorded in the office of the recorder of the county in which the property is located, and from the time any of the same are so filed for record shall operate as constructive notice of the contents thereof to all persons) (If the beneficial interest under a deed of trust has been assigned, the trustee under the deed of trust may not exercise the power of sale pursuant to NRS 107.080 unless and until the assignment is recorded pursuant to this subsection.) (NRS106.210). The borrower of a Deed of Trust may request to the servicer for a [certified copy of the note, the deed of trust and all assignments of the note and deed of trust if:]

[(a)The real property subject to the deed of trust is a single-family dwelling;

(b) The grantor is the owner of record of the real property;

(c) The grantor currently occupies the real property as his or her principal residence; and

(d) The servicer or beneficiary of the deed of trust is a banking or financial institution (as defined in NRS 106.295) or any other business entity that is licensed, registered or otherwise authorized to do business in this State.] [NRS107.071]

Not more than 10 days after receipt of a written request pursuant to subsection 1, the servicer of the deed of trust shall provide to the grantor the identity, address and any other contact information of the current owner or assignee of the note and deed of trust. NRS107.071(2)

If the servicer of the deed of trust does not provide a certified copy of each document requested pursuant to subsection 1 within 30 days after receipt of the request, or if the documents provided by the servicer indicate that the beneficiary of the deed of trust does not have a recorded interest in or lien on the real property which is subject to the deed of trust: (107.071 (3)

(a)The grantor of the deed of trust may report the servicer and the beneficiary of the deed of trust to the Division of Mortgage Lending or the Division of Financial Institutions of the Department of Business and Industry, whichever is appropriate; and

(b)The appropriate division may take whatever actions it deems necessary and proper, including, without limitation, enforcing any applicable laws or regulations or adopting any additional regulations.

NRS107.440 "Mortgage servicer" defined."Mortgage servicer" means a person who directly services a residential mortgage loan, or who is responsible for interacting with a borrower, managing a loan account on a daily basis, including, without limitation, collecting and crediting periodic loan payments, managing any escrow account or enforcing the note and security instrument, either as the current owner of the promissory note or as the authorized agent of the current owner of the promissory note. The term includes a person providing such services by contract as a subservicing agent to a master servicer by contract. The term does not include a trustee under a deed of trust, or the trustee's authorized agent, acting under a power of sale pursuant to a deed of trust.

Current Borrowers must be notified of the assignment. Notification consists of contact information of the new creditor, recording dates, recording instrument numbers, changes in loan, etc. Included are "Notice of Assignment of Deed of Trust" forms.

The Truth and lending act requires that borrowers be notified when their Deed of Trust has been sold, transferred, or assigned to a new creditor. Generally, within 30 days to avoid up to $2,000.00 in statutory damages, plus reasonable attorney's fees. Systematic violations can reach up $500,000.00.

(Nevada AODOT Package includes form, guidelines, and completed example) For use in Nevada only.

Important: Your property must be located in Elko County to use these forms. Documents should be recorded at the office below.

This Assignment of Deed of Trust meets all recording requirements specific to Elko County.

Our Promise

The documents you receive here will meet, or exceed, the Elko County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Elko County Assignment of Deed of Trust form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Joni F.

March 24th, 2021

It was easy to navigate and I found my information without any trouble.

Thank you!

Mark M.

November 5th, 2020

Deeds was easy to use and worked as specified; they got the recording I needed done finished in one day!

Thank you for your feedback. We really appreciate it. Have a great day!

rita t.

November 4th, 2019

Thanks for asking, everything was fine. Forms worked as expected, no problems.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Patricia C.

July 11th, 2019

The website works fine. The process of changing my Mineral Deed is sure more expensive in Texas. But I appreciate the convenience of the website and the pages of directions.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Harry C.

February 11th, 2019

I got the wrong state and now they want to charge me again for the proper state. My fault, BUT!!!!

Sorry to hear that Harry. We've gone ahead and canceled the order you made in error. Have a wonderful day.

Cheryl W.

August 10th, 2019

Have yet to use. Appears over whelming, we will see.

Thank you for your feedback. We really appreciate it. Have a great day!

Kelli B.

January 31st, 2019

Amazingly simple and fast. A great service.

Thank you!

Munir S.

August 2nd, 2024

Good service. Easy to use, responsive, fast, and fairly priced. First time user, will continue to use it for future needs. Recommend.

Thank you for your positive words! We’re thrilled to hear about your experience.

Larry M.

August 19th, 2021

Everything went well except that any information that I typed in on the computer download moves upward so that the letters or numbers are somewhat elevated above the line that should be even with the words on the form. I think it will be acceptable to the county recorder, but I don't especially like to submit things that appear uneven. I asked for help but just received a robotic reply that said to take steps that I already had done. So unless you know a way to correct this I likely won't use your forms again.

Thank you!

Mallah B.

October 7th, 2021

I think this company offers a great service that is non-discriminatory and allows me to save time going downtown and hassle dealing with different personalities.

Thank you for your feedback. We really appreciate it. Have a great day!

Rosa Irene G.

December 4th, 2020

nd your site/forms. The cost is also great. Thank you so much for making this affordable to everyone.

Thank you for your feedback. We really appreciate it. Have a great day!

Deborah D.

June 1st, 2023

What I thought was gonna be a long drawn out tedious process was literally 10min tops... The help was quick and a load off. Thanks y'all.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Linda S.

March 8th, 2019

I am quite pleased with this website. I was able to complete my task with relative ease thanks to all the help these forms provided .The example forms really helped me to navigate the process. I would recommend this service highly.

Thank you Linda, we really appreciate your feedback.

Beverly D.

April 15th, 2021

Very User friendly site

Thank you for your feedback. We really appreciate it. Have a great day!

Gisela A.

April 11th, 2019

Great selection of documents. Properly formatted form also included great instructions and the example was very helpful. Filed it myself - no problem!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!