Sullivan County Quitclaim Deed Form

Sullivan County Quitclaim Deed Form

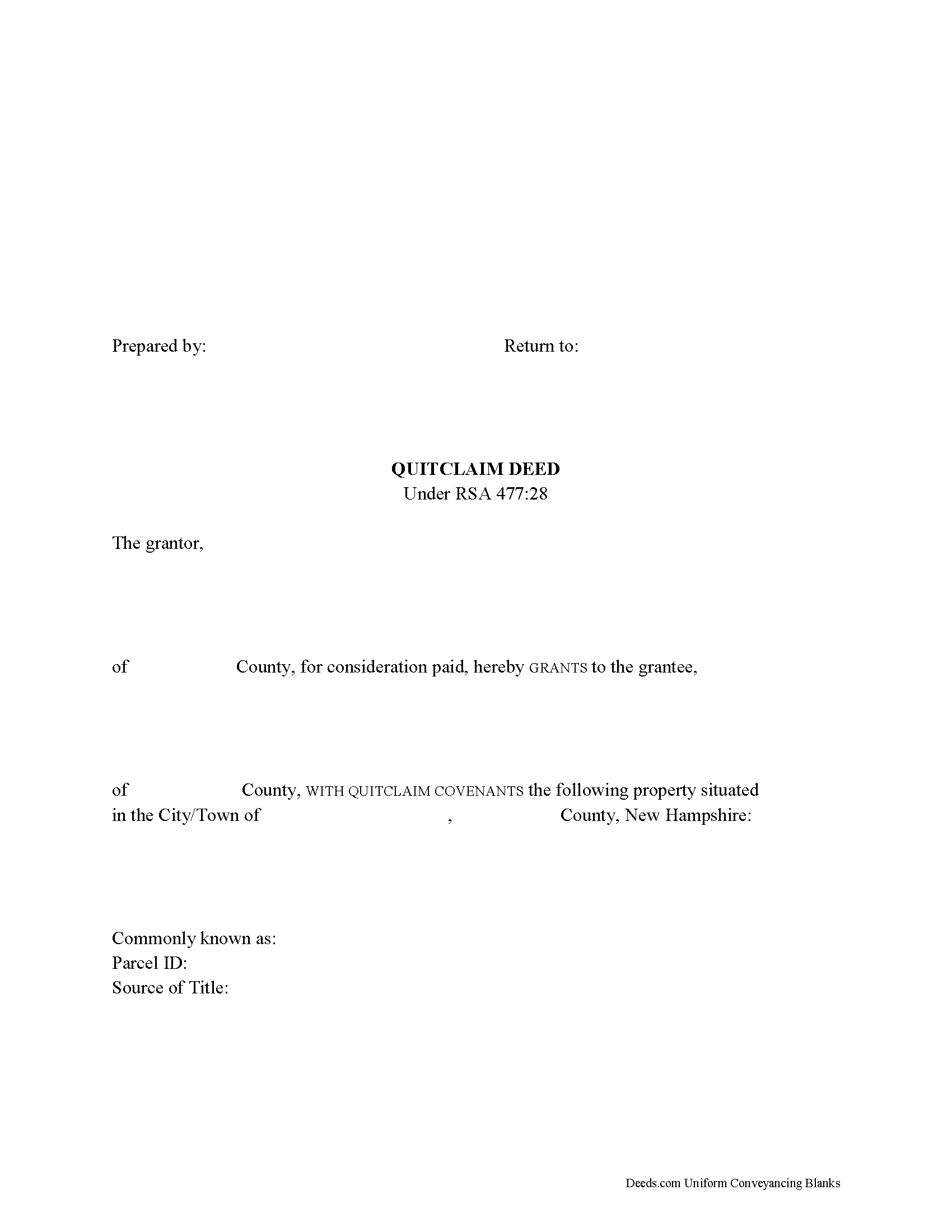

Fill in the blank Quitclaim Deed form formatted to comply with all New Hampshire recording and content requirements.

Sullivan County Quitclaim Deed Guide

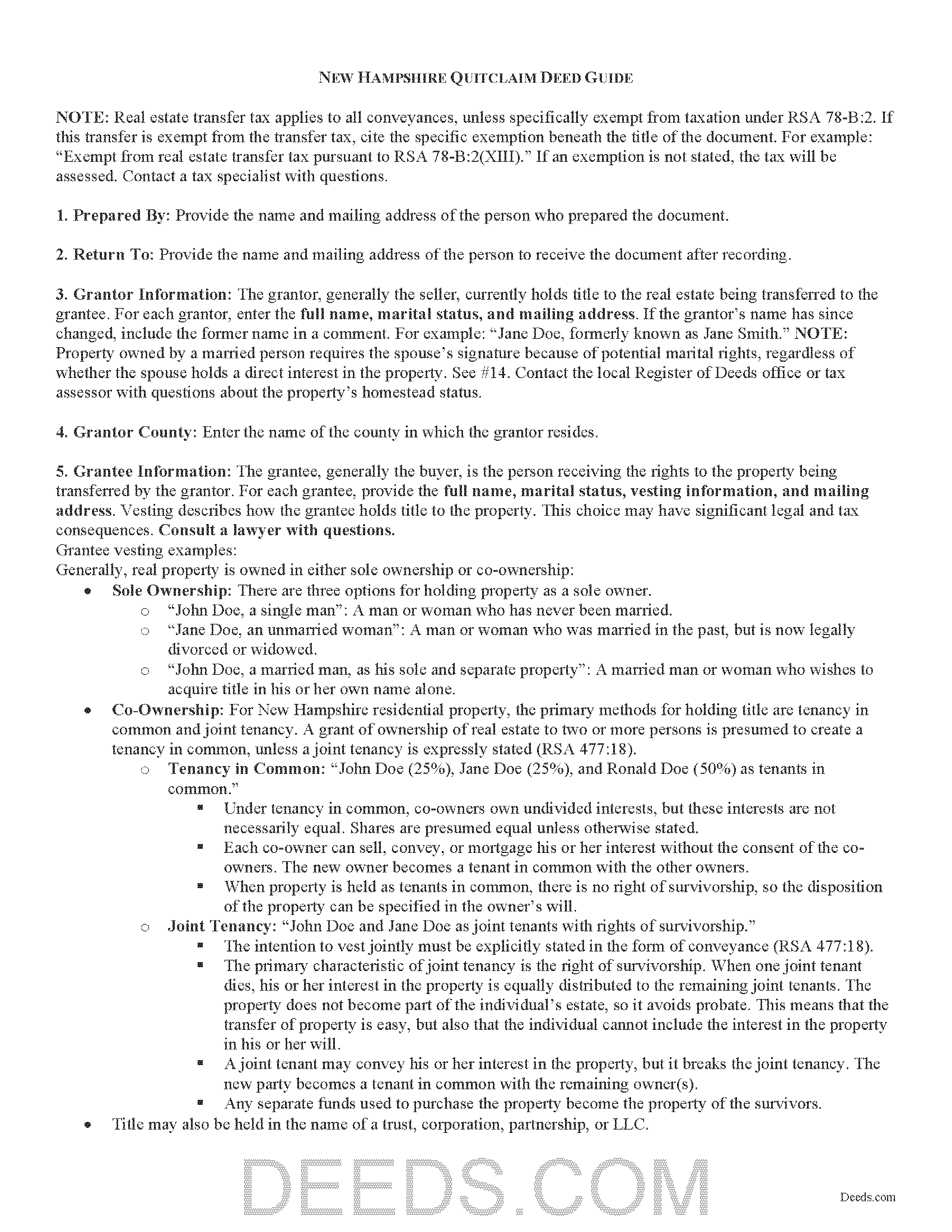

Line by line guide explaining every blank on the Quitclaim Deed form.

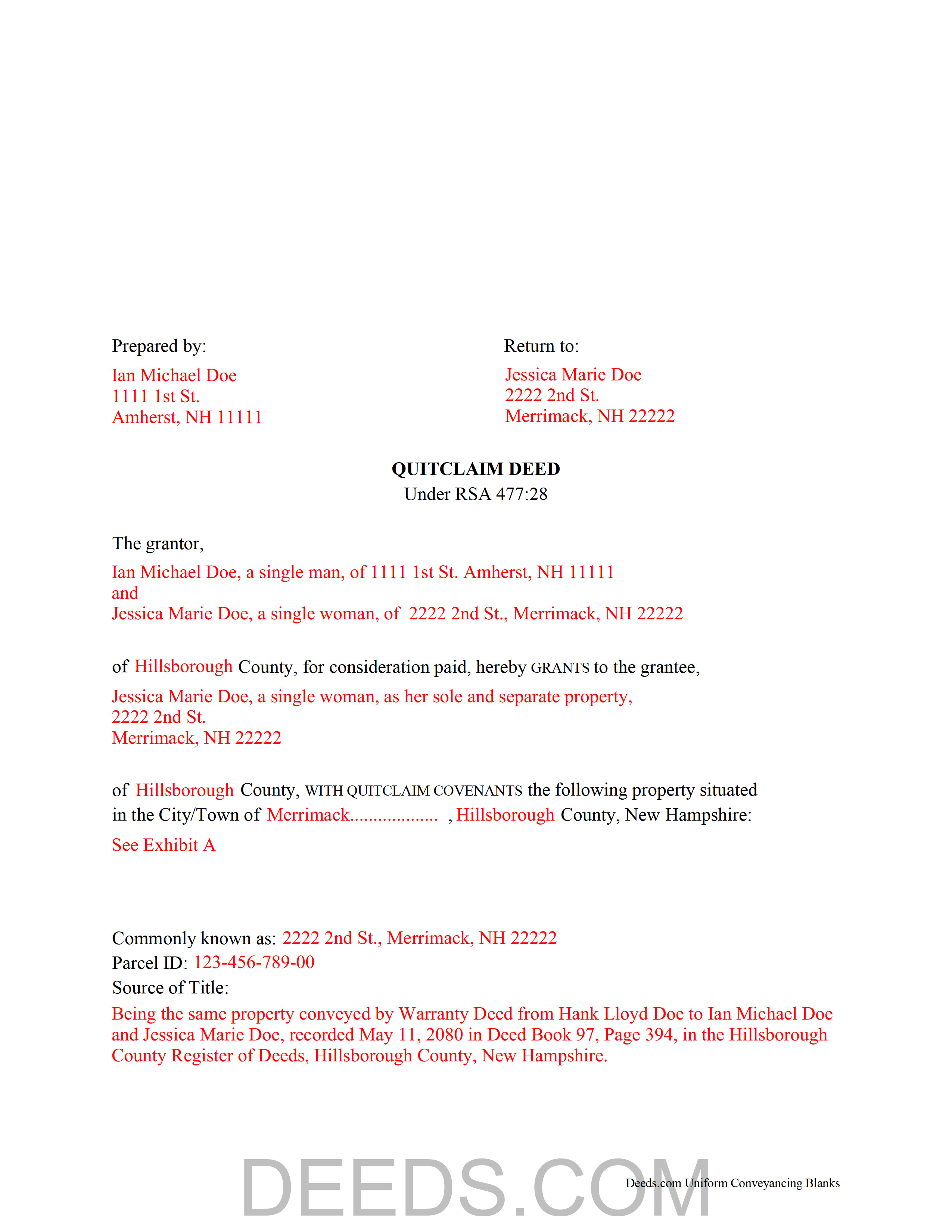

Sullivan County Completed Example of the Quitclaim Deed Document

Example of a properly completed New Hampshire Quitclaim Deed document for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional New Hampshire and Sullivan County documents included at no extra charge:

Where to Record Your Documents

Register of Deeds

Newport, New Hampshire 03773

Hours: Monday through Friday 8:00am - 4:00pm / Recordings until 3:30pm

Phone: (603) 863-2110

Recording Tips for Sullivan County:

- Documents must be on 8.5 x 11 inch white paper

- Make copies of your documents before recording - keep originals safe

- Bring multiple forms of payment in case one isn't accepted

Cities and Jurisdictions in Sullivan County

Properties in any of these areas use Sullivan County forms:

- Acworth

- Charlestown

- Claremont

- Cornish

- Cornish Flat

- Georges Mills

- Goshen

- Grantham

- Guild

- Lempster

- Meriden

- Newport

- Plainfield

- South Acworth

- Springfield

- Sunapee

- Washington

Hours, fees, requirements, and more for Sullivan County

How do I get my forms?

Forms are available for immediate download after payment. The Sullivan County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Sullivan County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Sullivan County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Sullivan County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Sullivan County?

Recording fees in Sullivan County vary. Contact the recorder's office at (603) 863-2110 for current fees.

Questions answered? Let's get started!

In New Hampshire, real property can be transferred from one party to another by executing a quitclaim deed.

Quitclaim deeds are statutory in New Hampshire under RSA 477:28. Any deed that follows this form has the force and effect of transferring fee simple title with covenants. The grantor promises that, at the time of conveyance, the property is free from all encumbrances made by the grantor, except for restrictions stated within the deed. The grantor also promises to warrant and defend the property against any lawful claims and demands made by, through, or under him or her, but none other (RSA 477:28). This means that the grantor guarantees the title only against claims that arose during the time he or she held title to the property.

A lawful quitclaim deed includes the grantor's full name, mailing address, and marital status, and the grantee's full name, mailing address, marital status, and vesting. Vesting describes how the grantee holds title to the property. Generally, real property is owned in either sole ownership or in co-ownership.

For New Hampshire residential property, the primary methods for holding title in co-ownership are tenancy in common and joint tenancy. A grant of ownership of real estate to two or more persons is presumed to create a tenancy in common, unless a joint tenancy is expressly stated (RSA 477:18).

As with any conveyance of realty, a quitclaim deed requires a complete legal description of the parcel. Recite the prior deed reference to maintain a clear chain of title, and detail any restrictions associated with the property. Indicate whether the grantor is married and, if applicable, include the full name of the spouse in the field provided. This ensures that any spousal interest in the property is conveyed and does not encumber the property (RSA 480:5-a). Finally, the deed must meet all state and county standards of form and content for recorded documents.

Sign the deed in the presence of a notary public or other authorized official. For a valid transfer, record the deed at the recording office in the county where the property is located. Contact the same office to confirm accepted forms of payment.

A Real Estate Transfer Tax Declaration of Consideration must be filed for both the grantor and grantee (RSA 78-B:1). Contact the local assessor's office to determine the appropriate version of the form.

The grantee must file an original Form PA-34, Inventory of Property Transfer, with the Department of Revenue Administration within 30 days of recording of the deed, and also file a copy of the PA-34 with the local assessing official of the municipality where the property is located (RSA 74:18).

This article is provided for informational purposes only and is not a substitute for legal advice. Contact an attorney with questions about using quitclaim deeds or for any other issues related to transfers of real property in New Hampshire.

(New Hampshire QD Package includes form, guidelines, and completed example)

Important: Your property must be located in Sullivan County to use these forms. Documents should be recorded at the office below.

This Quitclaim Deed meets all recording requirements specific to Sullivan County.

Our Promise

The documents you receive here will meet, or exceed, the Sullivan County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Sullivan County Quitclaim Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Daniel F.

March 26th, 2021

We have been very happy with all that Deeds have done very timely and helpful

Thank you!

Jerry K G.

August 23rd, 2022

I got what I asked for, almost instantly.

Thank you!

Gabriela C.

August 2nd, 2022

Easy

Thank you!

Trina P.

February 22nd, 2023

Deeds.com is a quick and effective way at finding property deeds. I had the results I needed in a couple hours without having to miss work to get to the clerks office, which is well worth the price of the service.

Thank you for your feedback. We really appreciate it. Have a great day!

Maricela N.

May 5th, 2021

very easy and quick to get all the forms needed! Thank you!

Thank you for your feedback. We really appreciate it. Have a great day!

DEBORAH H.

January 22nd, 2024

This is my fourth try, and I hope my form is complete and acceptable.

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

Resa J.

April 11th, 2019

Seamless. Excellent.

Thank you for your feedback Resa. Have a wonderful day!

Lawrence D.

March 14th, 2019

My first time using it; very fast service. I am an estate planning attorney (44 years). None of my old title company contacts are around anymore to provide deed copies, so this is a great source. I will be using it again.

Thank you Lawrence, we appreciate your feedback. Have a fantastic day!

Bill M.

March 10th, 2021

PROS: Quick communication. Completed the task expediently. CONS: Deciphering what was being referred to on the website when needing the proper classification wasn't clear. Had to delve through your unfamiliar territory. But managed. OVERALL: Got the job done swiftly and the end result was satisfactory. Will use again.

Thank you!

Roger G.

October 25th, 2019

Straight to the point and easy to use site.

Thank you!

Amy S.

May 4th, 2023

Fast and easy access.

Thank you!

James J.

October 2nd, 2021

Thank you for service. The deed process was easy to complete. My new deed was accepted by the county clerk and the tax assessors office.

Thank you for your feedback. We really appreciate it. Have a great day!

David P.

February 18th, 2019

re: Transfer Upon Death Deed For Valencia County, NM, why not have ONE button to download all necessary forms? Individual buttons are tedious.

Thank you for your feedback David. The short answer is because not everyone needs all the forms. We will look into adding an option for downloading all the provided documents at once.

Don M.

September 9th, 2021

I find the site very difficult to nagitagte.

Sorry to hear that Don, we’ll try harder.

Tim R.

May 9th, 2019

Quick and efficient

Thank you Tim, we appreciate your feedback.