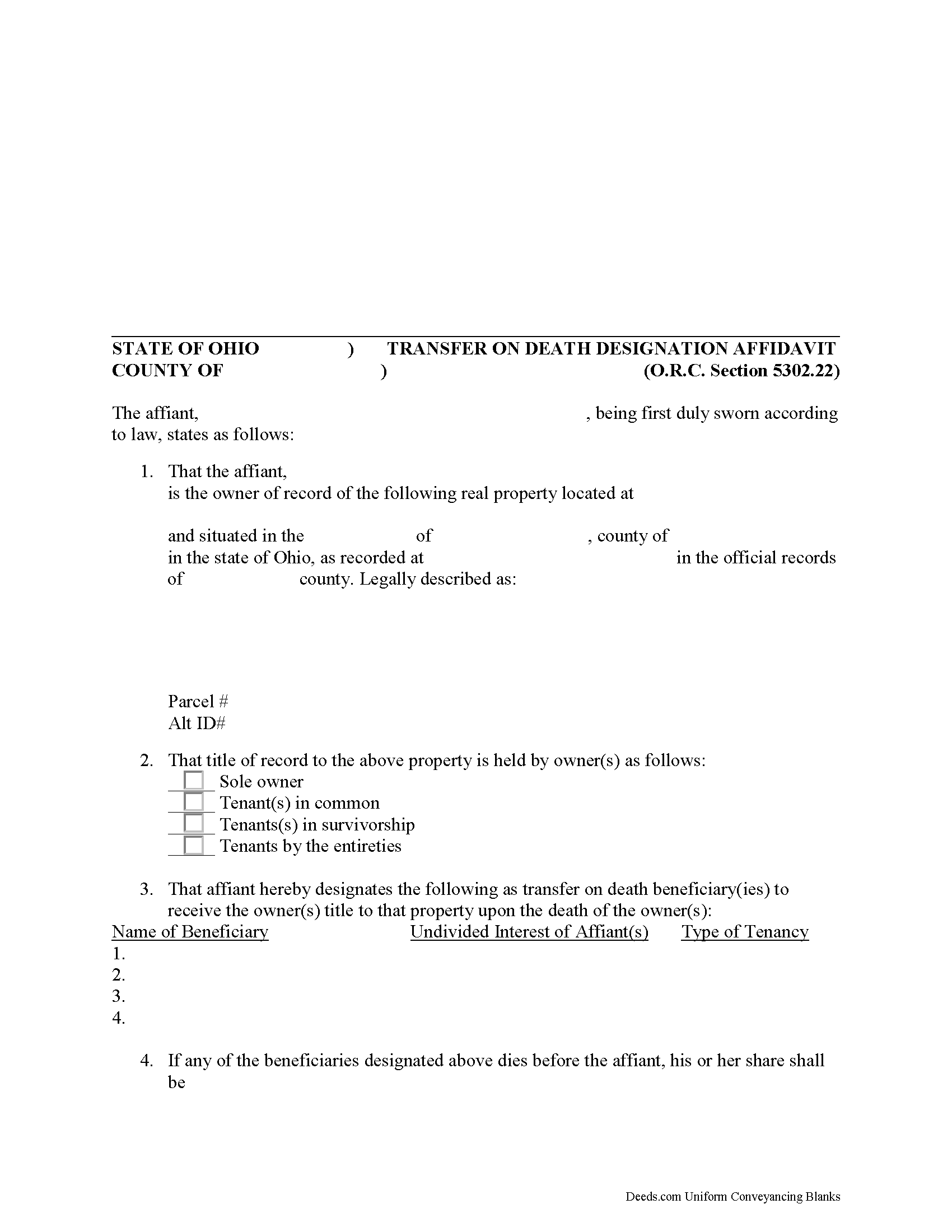

Hocking County Transfer on Death Designation Affidavit Form

Hocking County Transfer on Death Designation Affidavit

Fill in the blank form formatted to comply with all recording and content requirements.

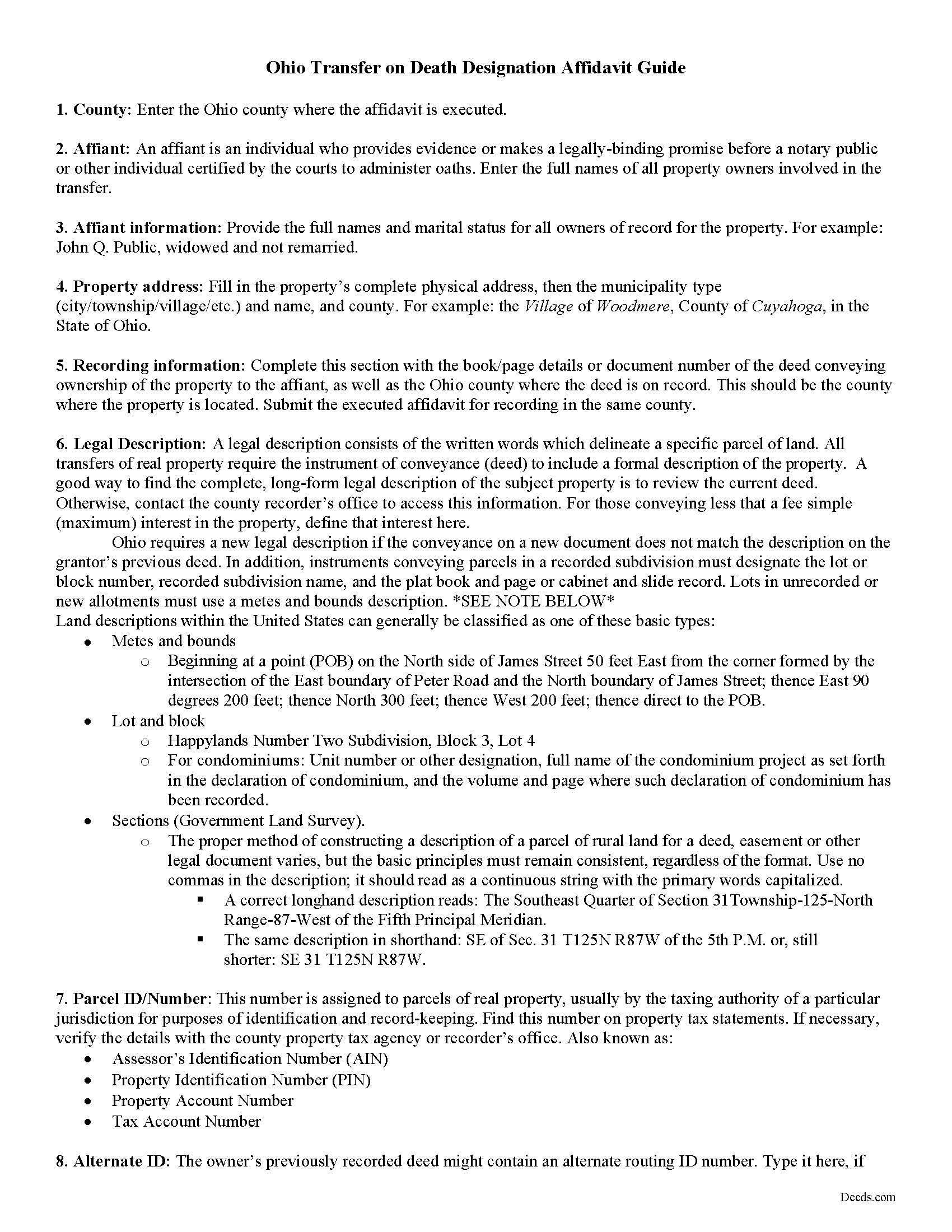

Hocking County Transfer on Death Designation Affidavit Guide

Line by line guide explaining every blank on the form.

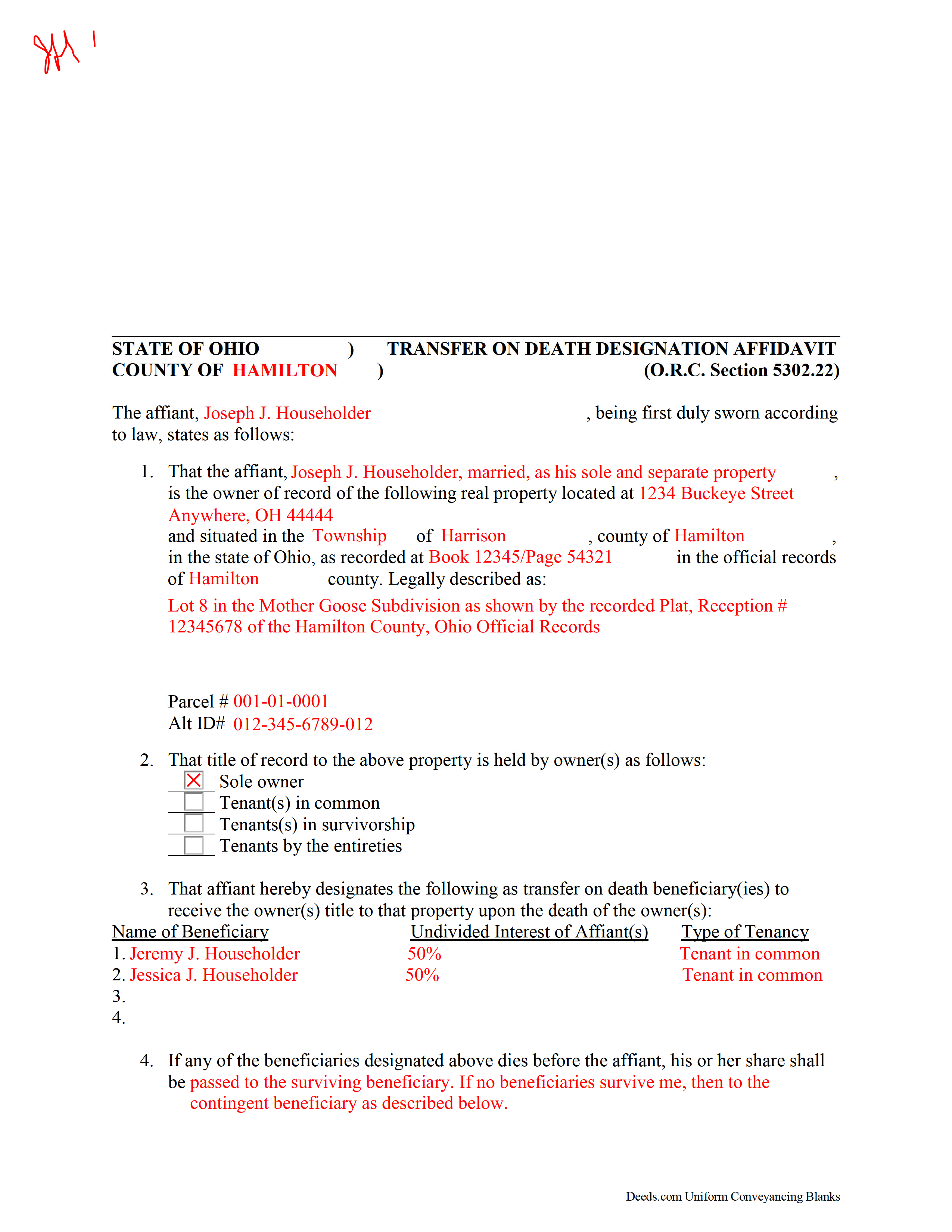

Hocking County Completed Example of the Transfer on Death Designation Affidavit Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Ohio and Hocking County documents included at no extra charge:

Where to Record Your Documents

Hocking County Recorder

Logan, Ohio 43138

Hours: 8:30 a.m. - 4:00 p.m. Monday - Friday

Phone: 740-385-2031

Recording Tips for Hocking County:

- Ensure all signatures are in blue or black ink

- Bring your driver's license or state-issued photo ID

- Check that your notary's commission hasn't expired

- Avoid the last business day of the month when possible

- Recording fees may differ from what's posted online - verify current rates

Cities and Jurisdictions in Hocking County

Properties in any of these areas use Hocking County forms:

- Carbon Hill

- Haydenville

- Laurelville

- Logan

- Murray City

- Rockbridge

- South Bloomingville

- Union Furnace

Hours, fees, requirements, and more for Hocking County

How do I get my forms?

Forms are available for immediate download after payment. The Hocking County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Hocking County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Hocking County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Hocking County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Hocking County?

Recording fees in Hocking County vary. Contact the recorder's office at 740-385-2031 for current fees.

Questions answered? Let's get started!

Authorized under section 5302.22 of the Ohio Revised Code, the Transfer on Death Designation Affidavit (TDDA) allows owners of real estate situated in Ohio to plan the conveyance of their property to designated beneficiaries after their death. The conveyance occurs separately from a will and without the need for probate. These instruments are known in other states as transfer on death deeds, beneficiary deeds, or Lady Bird deeds, and all fall under the heading of Non-probate Transfers on Death.

TDDAs are useful estate planning tools, because unlike "regular" deeds (warranty, grant, quitclaim, etc.), which permanently transfer the owner's interest in the property, the grantor retains full ownership and control of the property while alive, and may change the beneficiaries, modify the terms, or even sell the property with no restriction or penalty. This flexibility is possible because the grantor accepts no consideration from any of the beneficiaries.

In addition to meeting all state and local standards for recorded documents, TDDAs must include a statement by "the individual executing the affidavit that the individual is the person appearing on the record of the real property as the owner of the real property or interest in the real property at the time of the recording of the affidavit and the marital status of that owner." Married owners must include a statement by "the owner's spouse stating that the spouse's dower rights are subordinate to the vesting of title to the real property or interest in the real property in the transfer on death beneficiary or beneficiaries designated in the affidavit" (RC 5302.22(D)(3)). It must also designate "one or more persons, identified by name, as transfer on death beneficiary or beneficiaries" ( 5302.22(D)(4)).

File the completed and notarized affidavit for recording in the county where the property is located. NOTE THAT THE AFFIDAVIT IS ONLY VALID WHEN SUBMITTED FOR RECORDING WHILE THE GRANTOR IS STILL ALIVE.

The transfer of property rights is completed when the owner dies and the beneficiary completes and records an affidavit of confirmation under R.C. 5302.222.

Using this instrument might affect tax obligations or eligibility for certain income or asset-dependent programs. Please contact an attorney with questions about this or any other issues related to estate planning or transferring real property in Ohio.

(Ohio Transfer on Death Designation Package includes form, guidelines, and completed example)

Important: Your property must be located in Hocking County to use these forms. Documents should be recorded at the office below.

This Transfer on Death Designation Affidavit meets all recording requirements specific to Hocking County.

Our Promise

The documents you receive here will meet, or exceed, the Hocking County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Hocking County Transfer on Death Designation Affidavit form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4606 Reviews )

Michael M.

January 11th, 2019

I downloaded the gift deed and I can not type my info onto it what am I doing wrong. Please advise

Sounds like you may be trying to complete the form in your browser. The document needs to be downloaded and saved to you computer, then opened in Adobe.

Kevin R.

January 4th, 2024

Deeds.com made a very difficult time in our lives much easier to deal with. So happy that we found this app when we did!

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

Conrad R.

January 28th, 2023

Easy to obtain form, easy to use. Came with instrucions and references to state statutes. Very Helpful.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Joseph M.

January 4th, 2021

Very easy to use the service and responses came very quickly.

Thank you!

Judith F.

October 15th, 2021

Easy to understand and use!

Thank you!

Karen B.

January 13th, 2020

Completed although having the sample really helped. Now to file.

Thank you for your feedback. We really appreciate it. Have a great day!

David R A.

April 18th, 2023

Way overpriced But serves the Purpose.

Thank you for your feedback. We really appreciate it. Have a great day!

MARK S.

March 17th, 2020

Forms seem direct, simple, not what a "big firm" might have, appear sufficient to do the job -- safety in following at least the basics

Thank you!

Julie C.

July 21st, 2020

The process worked great! It's a great solution for recording documents at the county during the pandemic and in the future if you don't want to leave home!!

Thank you!

Terri E.

October 6th, 2023

Quick Accurate experience will recommend this service to my friends

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Barbara E.

April 4th, 2019

Fast efficient, just what I needed.

Thank you so much Barbara. We appreciate your feedback.

Sara W.

November 9th, 2020

Got the legal forms, they worked. Nothing exciting but that probably a good thing.

Thank you Sara, we appreciate you.

James R.

August 10th, 2022

This site is a blessing in disguise-/>

Thank you!

Peter W.

February 28th, 2019

Thanks worked out great

Thank you for the follow up Peter. Have a great day!

timothy h.

November 12th, 2020

Too complicated and too expensive

Sorry to hear that Timothy, we do hope that you found something more suitable to your needs elsewhere. Have a wonderful day.