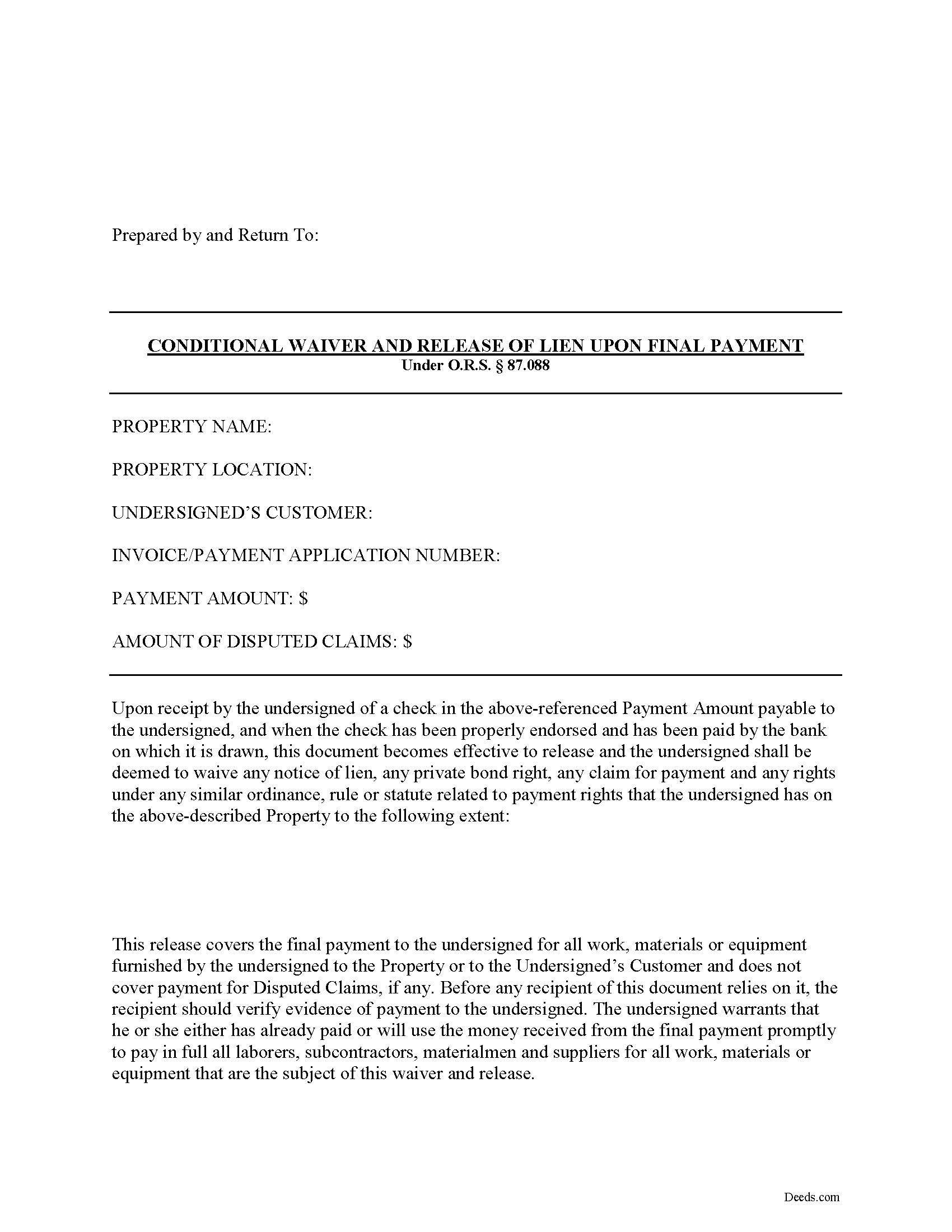

Yamhill County Conditional Lien Waiver on Final Payment Form

Yamhill County Conditional Lien Waiver on Final Payment Form

Fill in the blank Conditional Lien Waiver on Final Payment form formatted to comply with all Oregon recording and content requirements.

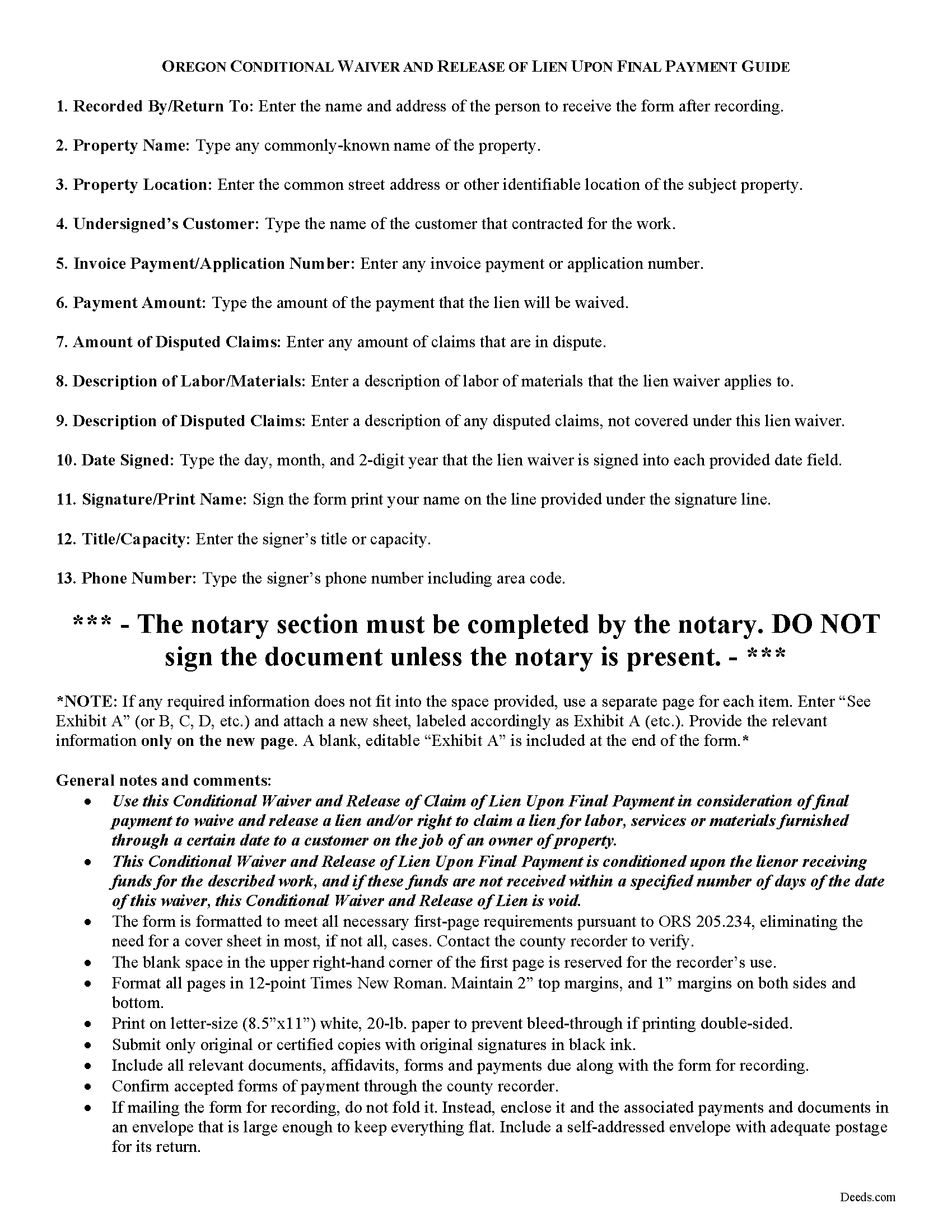

Yamhill County Conditional Lien Waiver on Final Payment Guide

Line by line guide explaining every blank on the form.

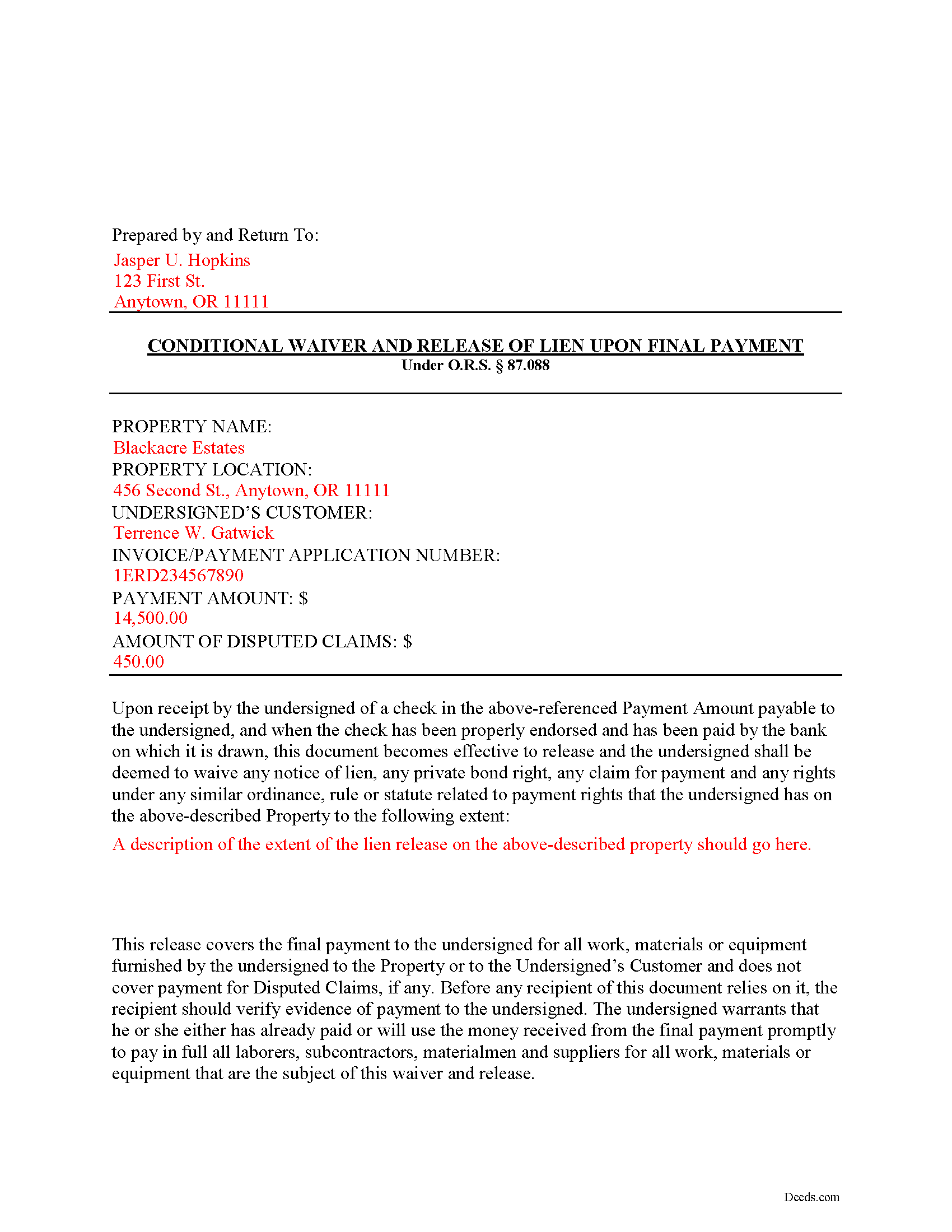

Yamhill County Completed Example of the Conditional Lien Waiver on Final Payment Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Oregon and Yamhill County documents included at no extra charge:

Where to Record Your Documents

Yamhill County Clerk

McMinnville, Oregon 97128-4607

Hours: 9:00 to 5:00 M-F / Recording until 4:30

Phone: (503) 434-7518

Recording Tips for Yamhill County:

- Both spouses typically need to sign if property is jointly owned

- Avoid the last business day of the month when possible

- Request a receipt showing your recording numbers

- Bring extra funds - fees can vary by document type and page count

Cities and Jurisdictions in Yamhill County

Properties in any of these areas use Yamhill County forms:

- Amity

- Carlton

- Dayton

- Dundee

- Lafayette

- Mcminnville

- Newberg

- Sheridan

- Willamina

- Yamhill

Hours, fees, requirements, and more for Yamhill County

How do I get my forms?

Forms are available for immediate download after payment. The Yamhill County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Yamhill County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Yamhill County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Yamhill County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Yamhill County?

Recording fees in Yamhill County vary. Contact the recorder's office at (503) 434-7518 for current fees.

Questions answered? Let's get started!

Oregon's Construction Lien Law is codified at ORS 87.001 to 87.060 and 87.075 to 87.093.

Liens are instruments, recorded with the land records for the locality where the relevant real property is situated, that document the agreement between the owner/customer and the contractor. They identify the primary parties and generally include a description of the work requested, a tentative schedule, and an information about charges and payments.

Contractors and other authorized parties (claimants) use construction liens to protect their interests while improving someone else's property. To encourage payment, the contractor may offer to waive lien rights.

Altogether, there are four separate lien waivers: partial conditional, partial unconditional, final conditional, and final unconditional. A conditional waiver offers more protection to the lien claimant, and depends on the payment clearing the bank, meaning that there are no bounced checks or other complications. An unconditional waiver offers more protection to the owner and is effective regardless of payment receipt.

For example, let's say a customer pays the total balance due. After the payment clears the bank, the claimant completes and records a conditional waiver on final payment form, which identifies the parties, the nature of improvement, the property, and the relevant dates and payments applied. By recording, the claimant releases all rights reserved by the earlier lien.

This article is provided for informational purposes only and should not be relied upon as a substitute for the advice of an attorney. Please contact an Oregon lawyer with any questions about waivers or other issues related to construction liens.

Important: Your property must be located in Yamhill County to use these forms. Documents should be recorded at the office below.

This Conditional Lien Waiver on Final Payment meets all recording requirements specific to Yamhill County.

Our Promise

The documents you receive here will meet, or exceed, the Yamhill County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Yamhill County Conditional Lien Waiver on Final Payment form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4580 Reviews )

Charles G.

August 14th, 2022

Easy to request. Fast response

Thank you!

Dan P.

June 25th, 2020

Great service and well done forms thank you

Thank you!

Kerrin S.

April 11th, 2020

Wow, this was so easy & helpful. I didn't get it finished in time for recording, so I'm still waiting on that part, but the rest was simple and straight-forward. Thanks!

Thank you!

Teri B.

January 7th, 2019

Glad to have all of the helpful extra information, even though they don't answer all questions for all situations. So, I accessed public records and asked questions at the auditor's office. Also, on my Mac computer, filling out the actual deed form is a challenge because the screen jumps to the last page everytime I try to type a few letters or hit the return key, so I'm rollling back up to the first 2 pages after most keystrokes. A bit annoying. Overall, happy to have these form options are available! There is really no need to wait and pay for an attorney when all the information needed is available via public records. Fill in the blanks!

Thanks so much for the feedback Teri. There are known issues between Adobe and Mac, we try to work around them as much as possible. Have a wonderful day!

Wilfrid J.

June 7th, 2021

It was fast and easy but it's really official

Thank you!

Tawnya B.

December 28th, 2018

The document I needed and easy instructions!

Thank you!

Elizabeth W.

February 9th, 2023

would have been smart to give each pdf a name instead of unintelligible numbers...

Thank you for your feedback. We really appreciate it. Have a great day!

Jose S.

February 7th, 2021

Thank you so very much I live in Texas but I Owned a home in Indiana with your help I could never get those paper that I need to change the ownership in Indiana. You have a great site.

Thank you!

Michele S.

February 10th, 2019

This is a great service if you know what youre looking for. Unfortunately it just wasnt right for me and my situation.

Thank you!

James H.

January 14th, 2020

Very satisfied. Download was easy, completing the form was easy, got our signatures notarized and submitted it to the register of deeds. The only item was that the register of deeds did not immediately recognize the TOD deed form as the usual form they receive. After carefully reviewing all the information and wording on the deed she accepted it.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Tim T.

June 8th, 2023

Very easy to find forms and good examples for filling out forms!

Thank you for your feedback. We really appreciate it. Have a great day!

Conrad R.

January 28th, 2023

Easy to obtain form, easy to use. Came with instrucions and references to state statutes. Very Helpful.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jesse H.

November 8th, 2021

Good & friendly software, complete & clear instructions & guidance, generates proper forms that were readily accepted @ Clerk & Recorder Office, all of this @ reasonable cost. Five Stars!

Thank you for your feedback. We really appreciate it. Have a great day!

Tim T.

September 3rd, 2019

Although I am sure that the Quit Claim form was acceptable for my county, I felt that it was not formatted in the manor that I have seen while viewing the other deeds recorded. So that forms that I received were not useful to me.

Thank you for your feedback. We really appreciate it. Have a great day!

Lucinda L.

December 29th, 2021

mostly good; however, you need to update the annual exclusion gift amount from $14,000 to $15,000 (where it has ben for several years), and you need to make your Gift Deed final paragraph be gender neutral like "they" or "he or she" rather than just"he". We women lawyers and our women clients appreciate that.

Thank you for your feedback. We really appreciate it. Have a great day!