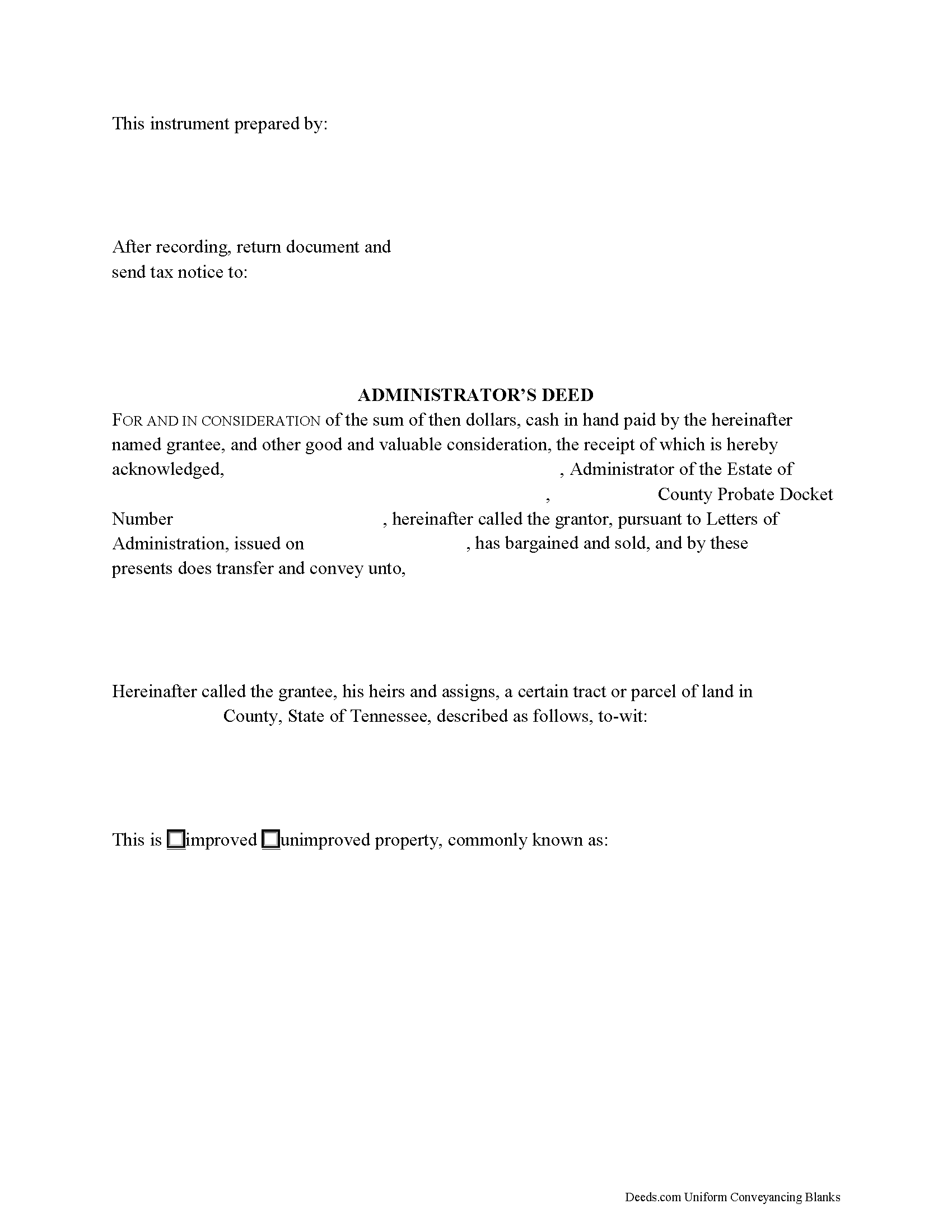

Shelby County Administrator Deed Form

Shelby County Administrator Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

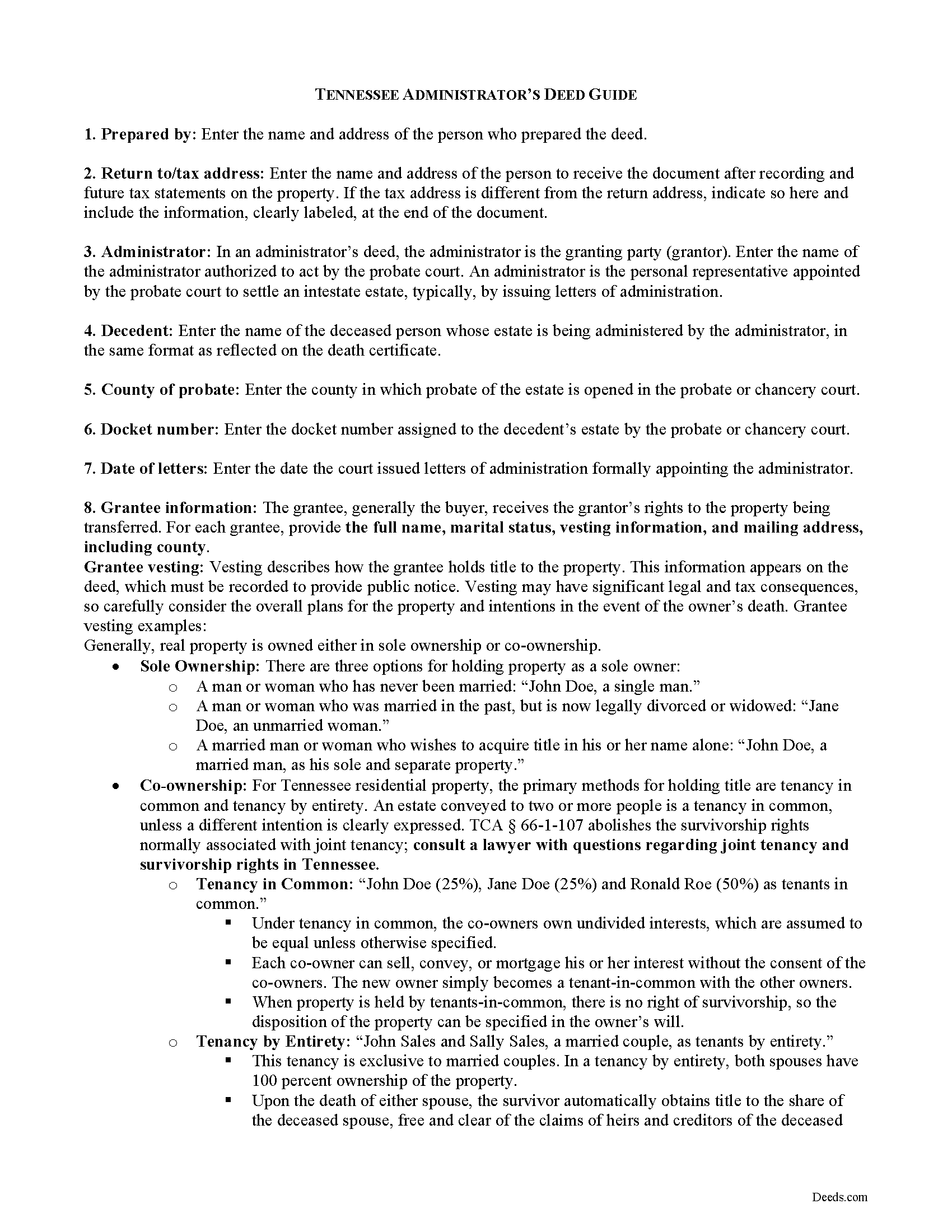

Shelby County Administrator Deed Guide

Line by line guide explaining every blank on the form.

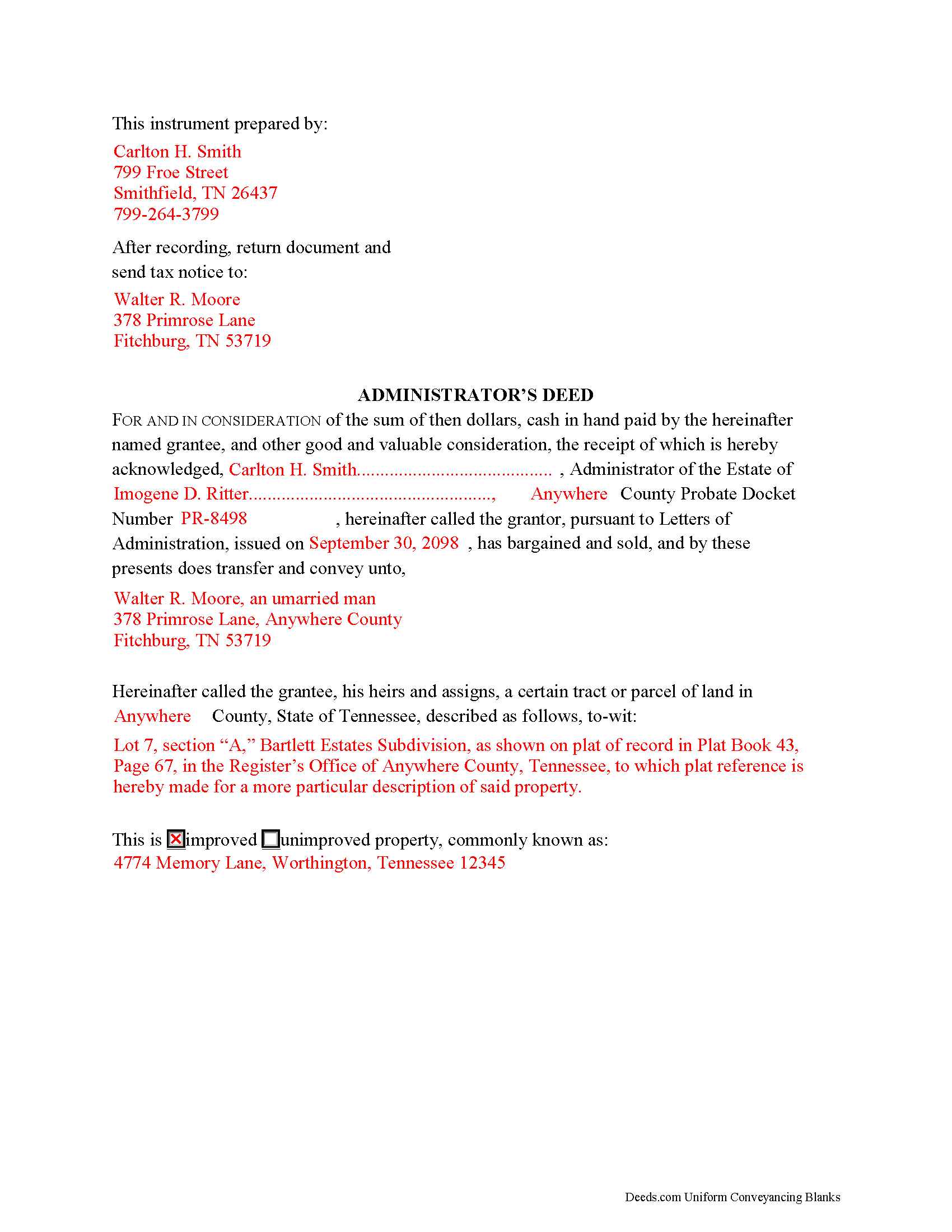

Shelby County Completed Example of the Administrator Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Tennessee and Shelby County documents included at no extra charge:

Where to Record Your Documents

Shelby County Register of Deeds

Memphis, Tennessee 38134

Hours: 8:00 to 4:30 M-F

Phone: (901) 222-8100

Recording Tips for Shelby County:

- Verify all names are spelled correctly before recording

- Both spouses typically need to sign if property is jointly owned

- Avoid the last business day of the month when possible

- Ask for certified copies if you need them for other transactions

Cities and Jurisdictions in Shelby County

Properties in any of these areas use Shelby County forms:

- Arlington

- Brunswick

- Collierville

- Cordova

- Eads

- Ellendale

- Germantown

- Memphis

- Millington

Hours, fees, requirements, and more for Shelby County

How do I get my forms?

Forms are available for immediate download after payment. The Shelby County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Shelby County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Shelby County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Shelby County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Shelby County?

Recording fees in Shelby County vary. Contact the recorder's office at (901) 222-8100 for current fees.

Questions answered? Let's get started!

Use an administrator's deed to transfer title to a decedent's real property to a purchaser following a sale. An administrator's deed names the duly authorized and acting administrator of the estate of the deceased as the granting party. This is the person to whom the probate court has issued letters of administration.

Typically, administrators' deeds contain fiduciary covenants akin to those found in a special warranty deed, and the deed may even be indexed as a special warranty deed in the county land records. The warranty of title in a special (limited) warranty deed only covers the period that the grantor held title to the property, along with covenants that the grantor is lawfully seized and possessed of the property in fee simple and has a good right to convey it, and that the property is unencumbered, unless noted on the face of the deed.

A sale of realty from the decedent's estate may be required when the decedent's personal property is insufficient to pay the estate's debts. A petition of the court for a decree of sale is required before an administrator can make a sale (T.C.A. 30-2-402). The court may order a sale if there is sufficient evidence, upon hearing, that the land should be sold.

Fiduciary deeds follow the same formalities as any deed affecting title to real property, which include a legal description of the subject parcel, the parcel and map numbers assigned by the taxing authority, and a recitation of the grantor's source of title. In addition, the deed notes whether the subject parcel is improved or unimproved property. Any restrictions on the property should be noted on the face of the deed.

Instruments in Tennessee also require an oath of value (T.C.A. 67-4-409(a)). On any type of warranty deed, the oath reflects the consideration made for the transfer or what was given for the transfer, or the value of the property, whichever is greater. This oath is made and signed by the grantee or the grantee's buyer or agent, typically at the time of recording, as directed by the document's preparer. Conveyance tax is levied based on the amount reflected in the oath of consideration and is due upon recording.

Record deeds and instruments relating to real property in the Register of Deeds' office of the county where the subject land is situated. Instruments affecting interests in real property must meet state and county requirements for form and content, and should reflect the preparer's name and address, the property tax address, and signature of the granting party, made in the presence of a notary public. Include any requisite documentation with the deed, which may include a certificate of probate, certified copies of a will, and/or related probate orders.

The information provided here is not a substitute for legal advice and does not address specific probate situations. Consult an attorney licensed in the State of Tennessee with questions regarding administrators' deeds and probate procedures in that state, as each situation is unique.

(Tennessee AD Package includes form, guidelines, and completed example)

Important: Your property must be located in Shelby County to use these forms. Documents should be recorded at the office below.

This Administrator Deed meets all recording requirements specific to Shelby County.

Our Promise

The documents you receive here will meet, or exceed, the Shelby County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Shelby County Administrator Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4581 Reviews )

Douglas N.

September 13th, 2021

Great!

Thank you!

Shelly D.

March 13th, 2020

Excellent

Thank you!

Resa J.

April 11th, 2019

Seamless. Excellent.

Thank you for your feedback Resa. Have a wonderful day!

Xochitl B.

November 30th, 2021

Excellent website, thanks so much.

Thank you!

Mikel R.

February 16th, 2021

Definitely recommend. Superb customer service. Well worth the money! Thanks again!

Thank you for your feedback. We really appreciate it. Have a great day!

John G.

July 25th, 2022

I was actually quite pleased with the ease of use of this site. I really, really liked the step by step instructions and examples of the finished product !!

Thank you!

Susan H.

November 10th, 2024

I used the quitclaim deed form, it was easy to fill out, had notarized and was accepted by the county's recorders office. Having a example form made it so much easier to fill out.

Thank you for your positive words! We’re thrilled to hear about your experience.

Donald W.

December 8th, 2019

Could not have been any easier to download the quit claim forms. The provided instructions and samples look to be helpful. Only have to set aside the time to fill out. Thanks

Thank you!

Craig H.

February 26th, 2022

Worked exactly like it was supposed to. No glitches

Thank you for your feedback. We really appreciate it. Have a great day!

Rick L.

May 26th, 2022

I love it! Very convenience.

Thank you!

Barbara E.

April 4th, 2019

Fast efficient, just what I needed.

Thank you so much Barbara. We appreciate your feedback.

Armando R.

February 17th, 2021

Great service, quick and affordable. Thank you!

Thank you!

Matthew G.

February 19th, 2019

Second time using Deeds.com. Easy and professional

Thank you Matthew. Have a great day!

June G.

May 16th, 2020

AMAZING! Easy to use, reasonable fee - and get MUCH MORE than just a deed form. I ordered a "deed" and received a whole "package," including a guide and the jurisdiction's costs schedule and cover page that would be needed to record the deed - even included a Certificate of Transfer that is not required for a deed but something I needed for a different transaction. The website was extremely easy to use and the cautions about not disclosing personal information were so clear and personal, they made me feel secure in knowing this site was not trying to rip me off. Very professional. Well done.

Thank you for your feedback. We really appreciate it. Have a great day!

Mary Z.

December 2nd, 2021

Awesome forms, easy to complete and print.

Thank you!