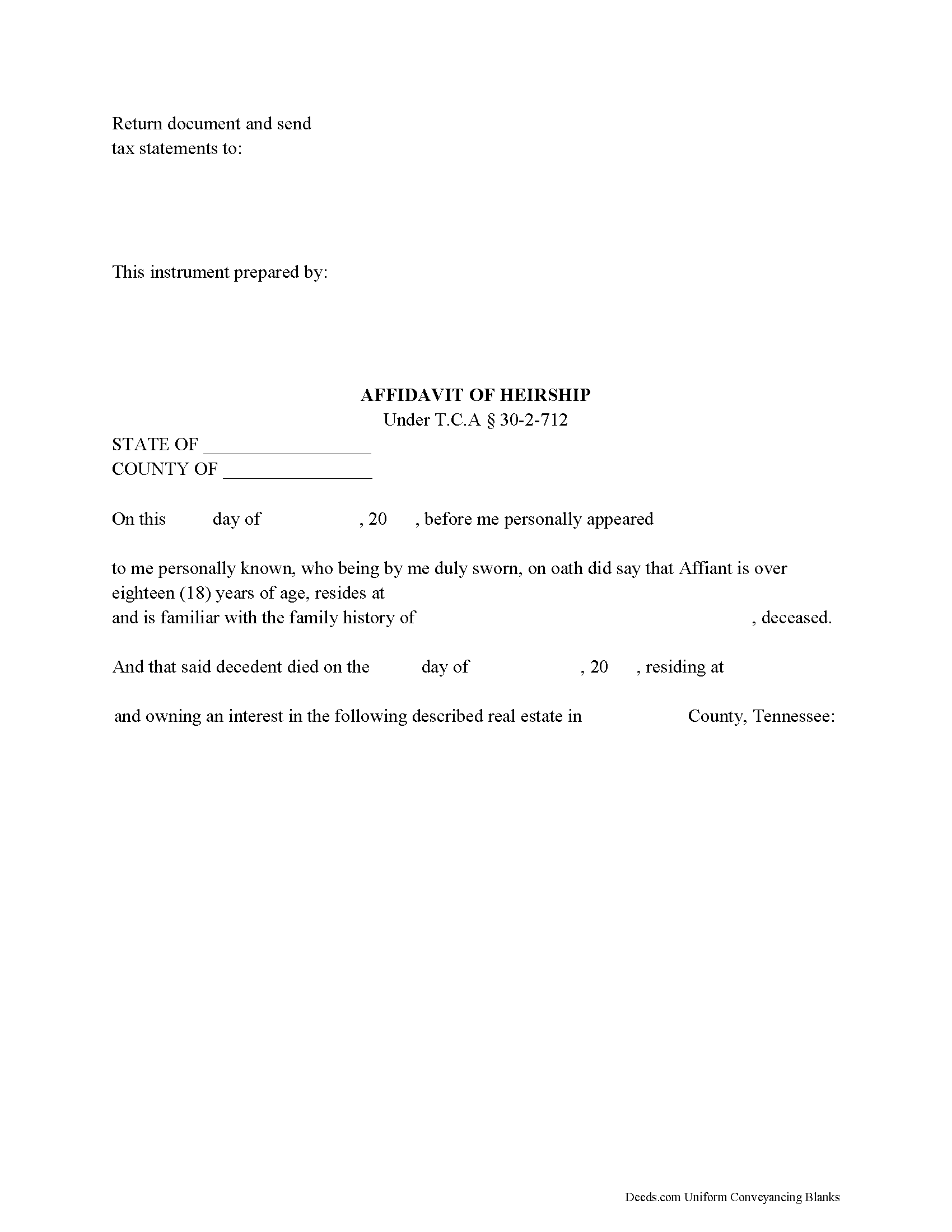

Stewart County Affidavit of Heirship Form

Stewart County Affidavit of Heirship Form

Fill in the blank form formatted to comply with all recording and content requirements.

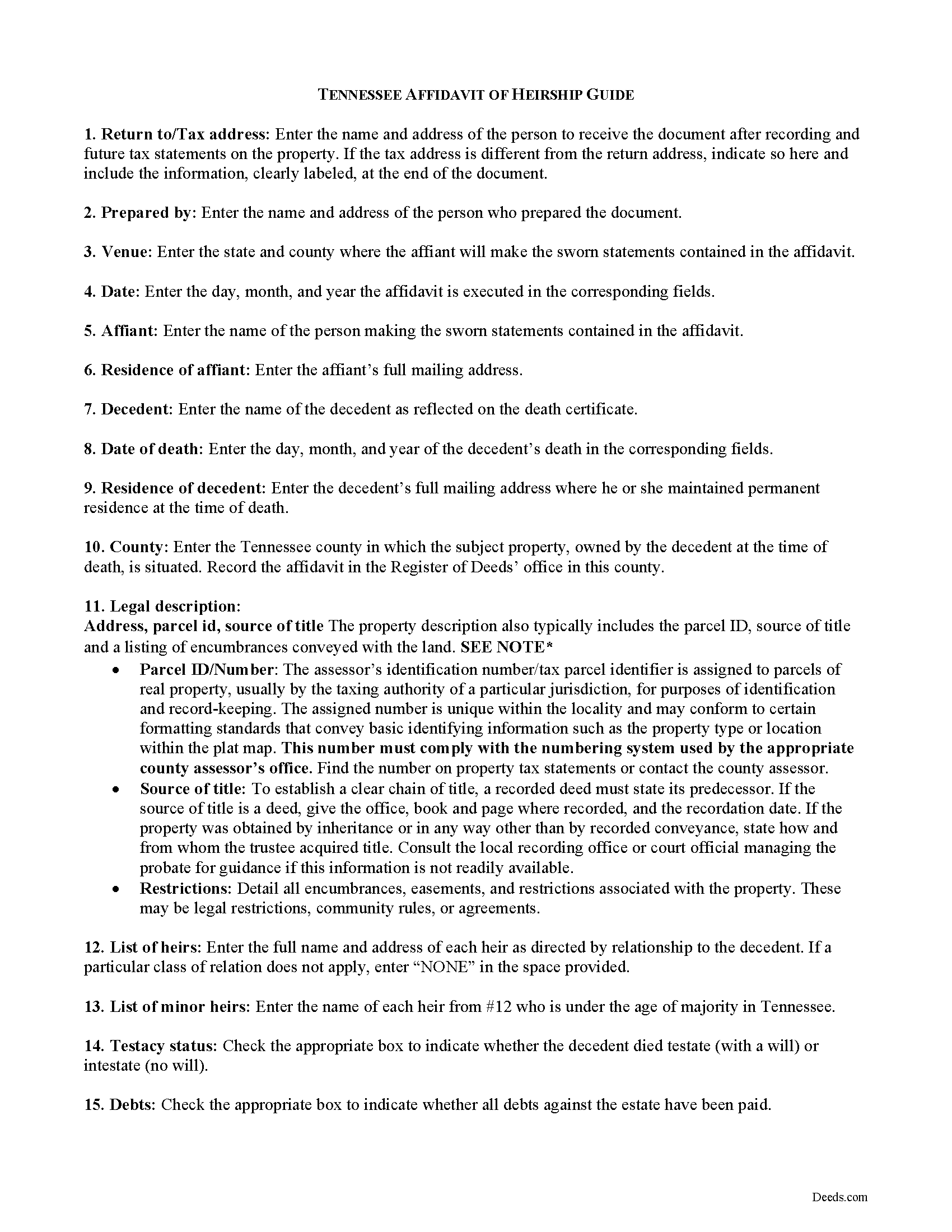

Stewart County Affidavit of Heirship Guide

Line by line guide explaining every blank on the form.

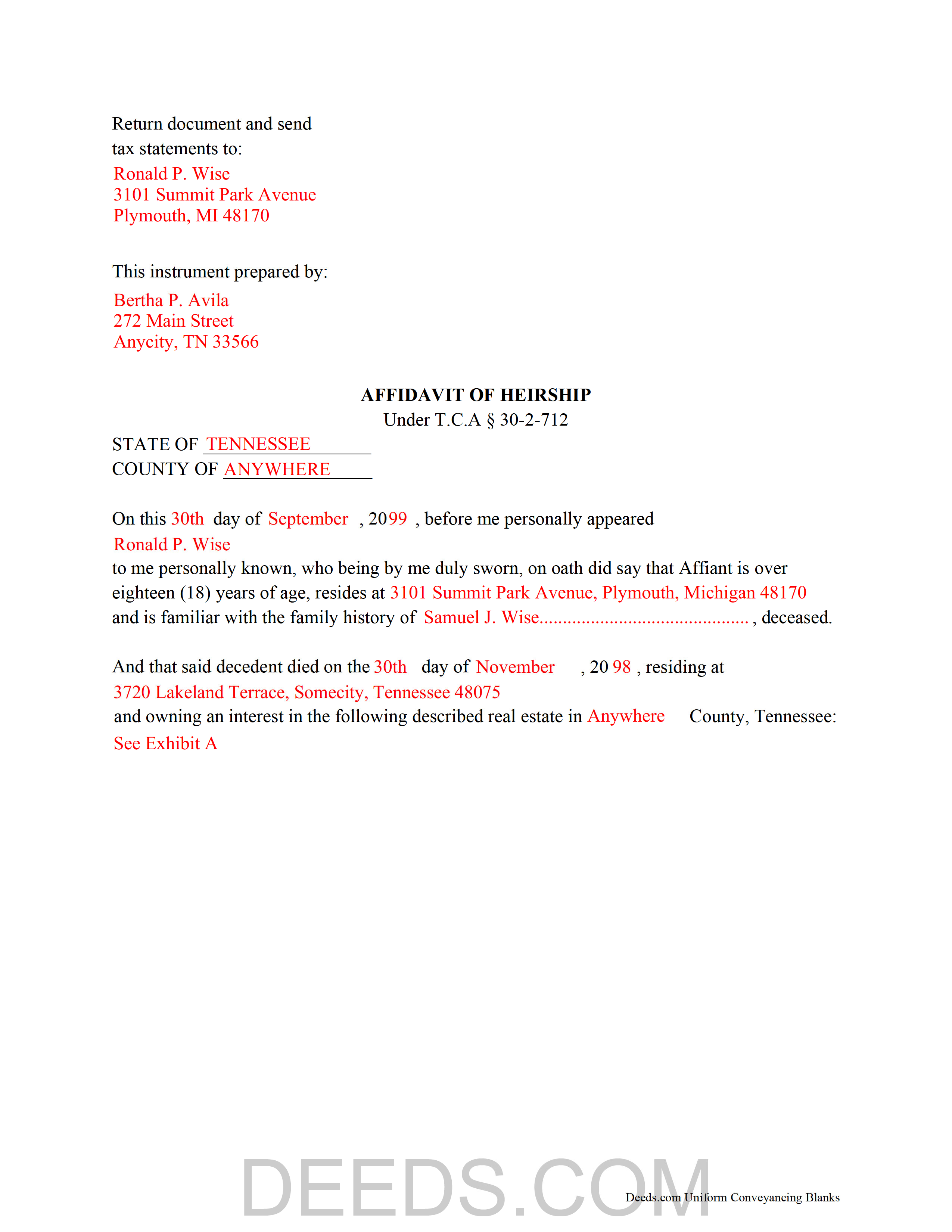

Stewart County Completed Example of a Affidavit of Heirship Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Tennessee and Stewart County documents included at no extra charge:

Where to Record Your Documents

Stewart County Register of Deeds

Dover, Tennessee 37058

Hours: 8:00am to 4:30pm M-F

Phone: (931) 232-5990

Recording Tips for Stewart County:

- Double-check legal descriptions match your existing deed

- Bring extra funds - fees can vary by document type and page count

- Both spouses typically need to sign if property is jointly owned

- Recording fees may differ from what's posted online - verify current rates

- Recorded documents become public record - avoid including SSNs

Cities and Jurisdictions in Stewart County

Properties in any of these areas use Stewart County forms:

- Big Rock

- Bumpus Mills

- Cumberland City

- Dover

- Indian Mound

Hours, fees, requirements, and more for Stewart County

How do I get my forms?

Forms are available for immediate download after payment. The Stewart County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Stewart County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Stewart County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Stewart County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Stewart County?

Recording fees in Stewart County vary. Contact the recorder's office at (931) 232-5990 for current fees.

Questions answered? Let's get started!

The affidavit of heirship, sometimes called an affidavit of inheritance, is a statutory form under T.C.A. 30-2-712.

An affidavit of heirship, when recorded, gives notice of a change in title following the death of a real property owner. It is typically recorded when the decedent has died intestate, or without a last will and testament. The affidavit names the decedent and the heirs who, by operation of law, are the current owners of the property.

The affiant, or person making the sworn statements contained in the affidavit, is anyone having knowledge of the facts contained within. A standard affidavit of heirship contains the legal description and map parcel number of the realty and lists the heirs by name, address, and relation to the decedent.

In addition, if not followed by a recorded deed from one or all heirs, the affidavit requires the tax bill address for tax statements on the property and a prior title reference stating the type of document and book, page, and recording date of the instrument granting title to the decedent.

This is a general affidavit of heirship. Your situation may require more specific information. Consult a lawyer when preparing the affidavit to ensure all necessary information is included and to understand the legal implications of the document.

(Tennessee AOH Package includes form, guidelines, and completed example)

Important: Your property must be located in Stewart County to use these forms. Documents should be recorded at the office below.

This Affidavit of Heirship meets all recording requirements specific to Stewart County.

Our Promise

The documents you receive here will meet, or exceed, the Stewart County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Stewart County Affidavit of Heirship form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4585 Reviews )

Arnie M.

August 11th, 2025

I found this to be a great experience, it was Fairley easy to upload my documents and your customer service was awsome.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jerry K G.

August 23rd, 2022

I got what I asked for, almost instantly.

Thank you!

Christine G.

April 23rd, 2021

. Easy to use.

Thank you for your feedback. We really appreciate it. Have a great day!

Rocio S.

March 4th, 2019

Great Help - very satisfied with the service - would recomend 100%

Thank you for the kind words Rocio. Have a wonderful day!

Sandra K.

April 29th, 2019

Seems fairly simple with forms and instructions

Thank you for your feedback. We really appreciate it. Have a great day!

Alma S.

May 6th, 2020

I like the service very much, it's easy and fast, I'm really happy with the service.

Thank you!

Kathleen H.

August 10th, 2019

EASY!!

Thank you!

Ralph S.

June 30th, 2023

Excellent deed correction experience and guidance!!! Thank you! R. Scott.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Patricia W.

January 29th, 2019

The "Trustee's Deed" should have been labeled a Deed of Trust because that's what it really is. So now I just wasted $19.97 getting something I can't use.

Thank you for your feedback. Sorry to hear of your confusion. We have canceled your order and payment for the trustee's deed document.

Ariel S.

June 3rd, 2020

Awesome....love the ease of use and response.

Thank you for the kinds words Ariel, we appreciate you! Have a fantastic day!

Andrew S.

October 14th, 2020

This is fast and easy.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Paul S.

January 27th, 2022

Worked very well

Thank you!

Filomena G.

March 8th, 2025

very helpful

Thank you!

Sandra H.

February 26th, 2019

I am a retired attorney. I chanced upon this website while looking for a Florida Lady Bird Deed Form. It conforms to Florida Law and was exactly what I needed. The forms are easy to obtain and even easier to use and print out.

Thank you so much Sandra, we really appreciate your feedback.

David R A.

April 18th, 2023

Way overpriced But serves the Purpose.

Thank you for your feedback. We really appreciate it. Have a great day!