Rhea County Correction Deed Form

Last validated November 26, 2025 by our Forms Development Team

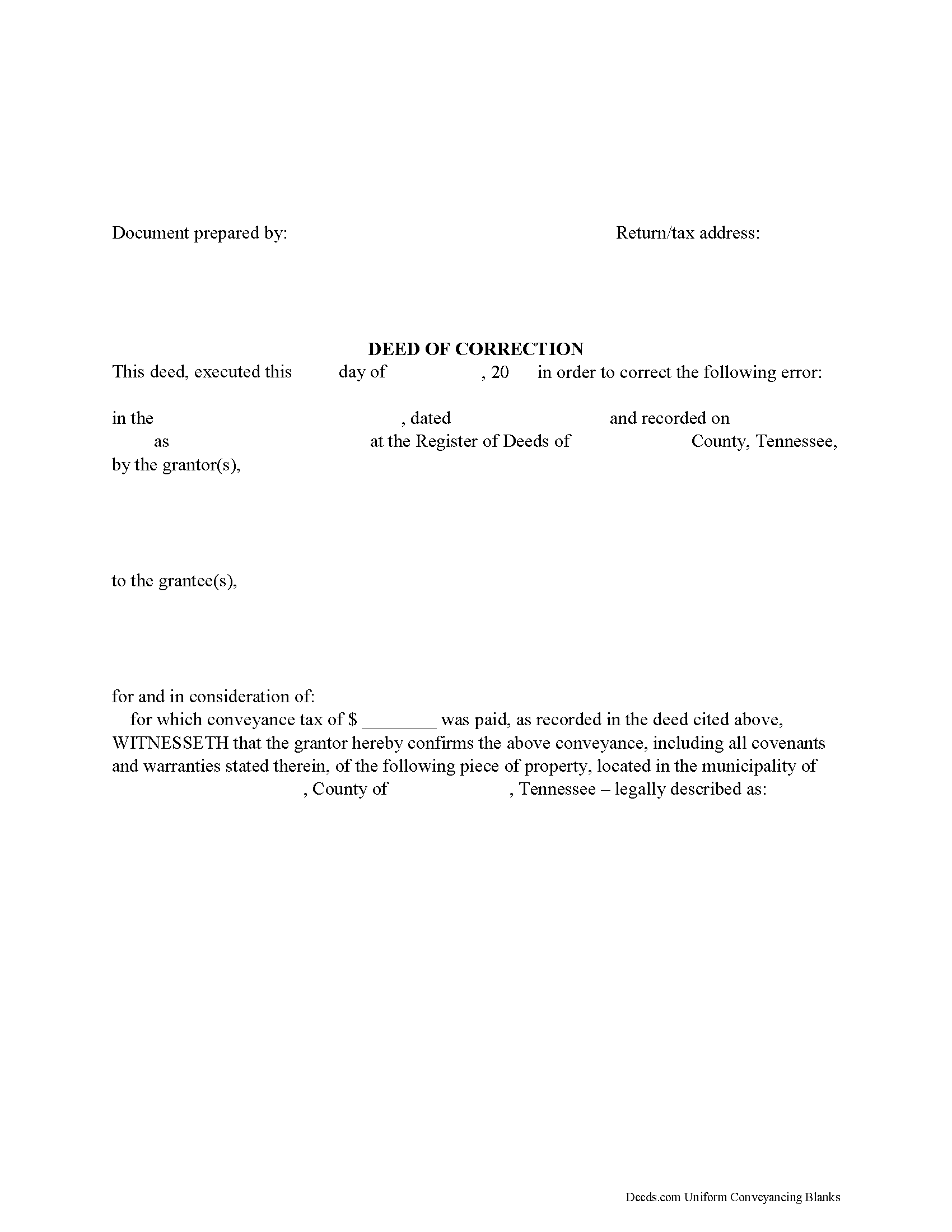

Rhea County Correction Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

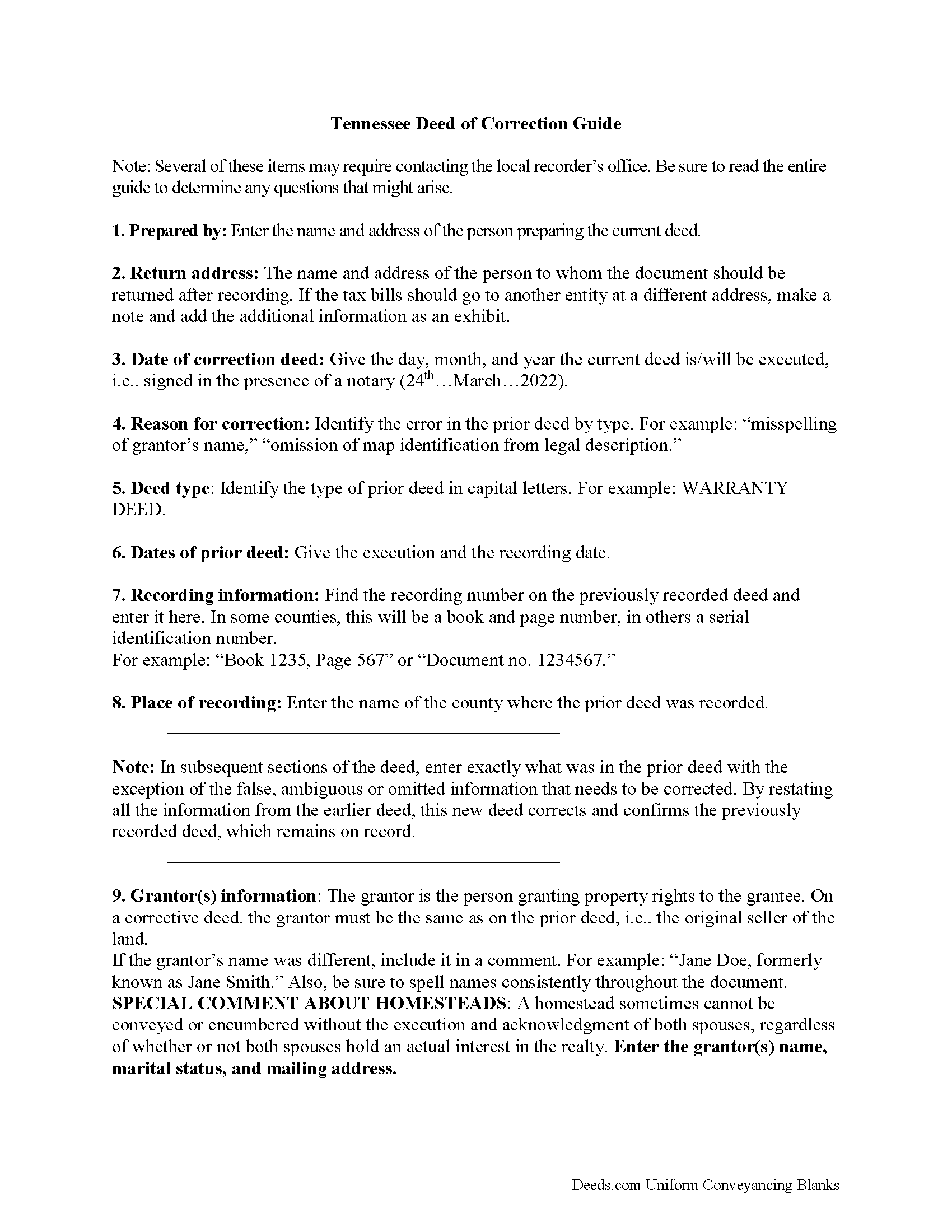

Rhea County Correction Deed Guide

Line by line guide explaining every blank on the form.

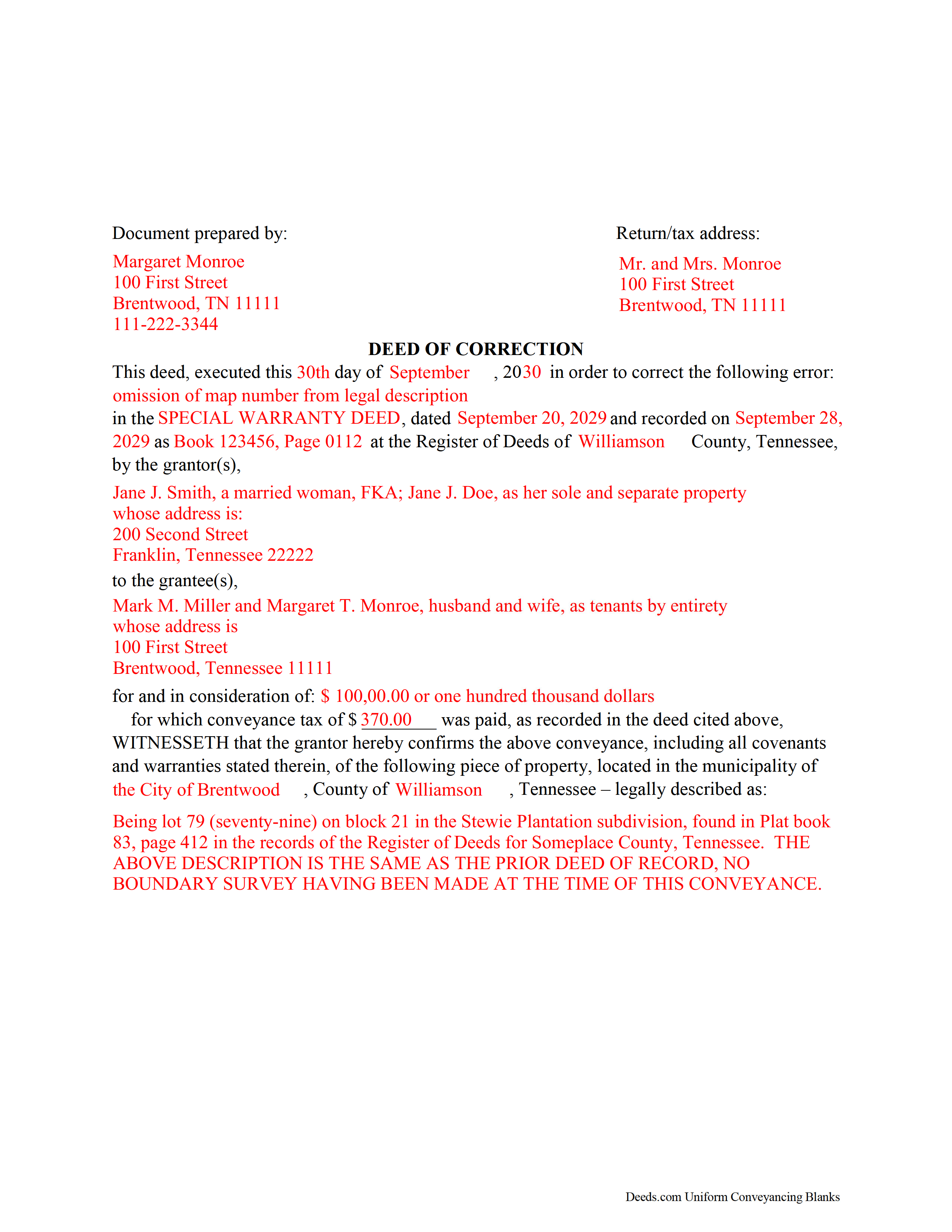

Rhea County Completed Example of a Correction Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Tennessee and Rhea County documents included at no extra charge:

Where to Record Your Documents

Rhea County Register of Deeds

Dayton, Tennessee 37321

Hours: 8:30 to 4:30 M-F

Phone: (423) 775-7841

Recording Tips for Rhea County:

- Verify all names are spelled correctly before recording

- Double-check legal descriptions match your existing deed

- Check margin requirements - usually 1-2 inches at top

- Make copies of your documents before recording - keep originals safe

Cities and Jurisdictions in Rhea County

Properties in any of these areas use Rhea County forms:

- Dayton

- Evensville

- Grandview

- Graysville

- Spring City

Hours, fees, requirements, and more for Rhea County

How do I get my forms?

Forms are available for immediate download after payment. The Rhea County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Rhea County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Rhea County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Rhea County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Rhea County?

Recording fees in Rhea County vary. Contact the recorder's office at (423) 775-7841 for current fees.

Questions answered? Let's get started!

Use the correction deed to correct errors in a warranty, special warranty, or quitclaim deed in Tennessee.

The best option for correcting a deed in Tennessee is to record a correction deed. Other options, such as a scrivener's affidavit and re-recording the original deed, both have some drawbacks. The scrivener's affidavit can serve as a valid alternative when the original grantor is not available. Tennessee law provides that a corrected copy of the original document may be attached to the affidavit as an exhibit (T.C.A. 66-24-101(a)(27)). Such a copy, however, only carries the weight of an exhibit to an affidavit and not that of a recorded document.

Re-recording the original deed with corrections requires a new execution/signing and notary acknowledgement. The reason for correcting, the actual correction and cross-reference to the prior recording must be made on the existing copy or, depending on county requirements, on a title page. This will not only require fees for the additional page(s) when re-recording, but also creates potential problems during the recording if the added information does not stay within the required document margins.

The easiest and cleanest option for correcting a deed is to record a new correction deed, which makes reference to the original document by date and recording number and gives the reason for the correction by indicating the type of error. Except for the corrected or omitted information, it duplicates the text of the prior deed. The original parties must sign in the presence of a notary, who then acknowledges this new instrument prior to recording. In some Tennessee counties, a corrective deed must have a new oath of value, if the original deed is more than 6 months old.

(Tennessee CD Package includes form, guidelines, and completed example)

Important: Your property must be located in Rhea County to use these forms. Documents should be recorded at the office below.

This Correction Deed meets all recording requirements specific to Rhea County.

Our Promise

The documents you receive here will meet, or exceed, the Rhea County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Rhea County Correction Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4614 Reviews )

LETICIA N.

August 23rd, 2022

I AM VERY PLEASED WITH YOUR WEBSITE. EASY AND I WAS GIVEN A SAMPLE OF THE FORM AND INSTRUCTIONS. I AM VERY PLEASED.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

harriet l.

June 21st, 2019

Worked very smoothly and got the job done

Thank you for your feedback. We really appreciate it. Have a great day!

Vince D.

August 6th, 2020

Great product and service, really makes me rethink the value I provide to my customers.

Thank you!

Jesse H.

November 8th, 2021

Good & friendly software, complete & clear instructions & guidance, generates proper forms that were readily accepted @ Clerk & Recorder Office, all of this @ reasonable cost. Five Stars!

Thank you for your feedback. We really appreciate it. Have a great day!

Vertina B.

June 14th, 2022

The website is well established and easy to use. I got everything I was supposed to get. I had no problem downloading the forms. All of the forms printed well.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Robert R.

September 1st, 2019

Just joined. Recommended by a strong source. Looking forward to doing business.

Thank you!

Joanne K.

July 16th, 2021

I haven't used the forms yet, but was at the county recorders office and they looked at it and said it looked fine. The instructions were easy to read and the forms easy to complete and save for a next time, if there is need.

Thank you for your feedback. We really appreciate it. Have a great day!

Richard W.

March 25th, 2019

Very nice web site with available forms. Being out of state we appreciated instruction sheet details. Rick and Jean Weber, Chicago

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Niranjan C.

August 24th, 2021

Whole process was very easy and quick. Forms were easy to fill, examples were quite appropriate. Recommended.

Thank you!

Erika M.

November 13th, 2020

Received the forms I ordered, found them to be easy to complete with the guide and example that was included. Had no issues recording them, smooth as silk from start to finish.

Thank you for your feedback. We really appreciate it. Have a great day!

June G.

May 16th, 2020

AMAZING! Easy to use, reasonable fee - and get MUCH MORE than just a deed form. I ordered a "deed" and received a whole "package," including a guide and the jurisdiction's costs schedule and cover page that would be needed to record the deed - even included a Certificate of Transfer that is not required for a deed but something I needed for a different transaction. The website was extremely easy to use and the cautions about not disclosing personal information were so clear and personal, they made me feel secure in knowing this site was not trying to rip me off. Very professional. Well done.

Thank you for your feedback. We really appreciate it. Have a great day!

Paul W.

March 11th, 2022

Exceptionally easy site to navigate. Forms and related documents downloaded quickly and were helpful in completing the forms, which have already been filed with the County Registrar of Deeds. Many thanks for an extremely useful site!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Tina C.

August 26th, 2021

Quick and easy ordering and download. Appreciated that I could get the form that is used in my county. Would have like to be able to add paragraphs to form.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

kabir r.

May 11th, 2022

Wonderful quitclaim forms, very happy

Thank you!

roger m.

April 2nd, 2019

super clean interface i thank you very much

Thank you!