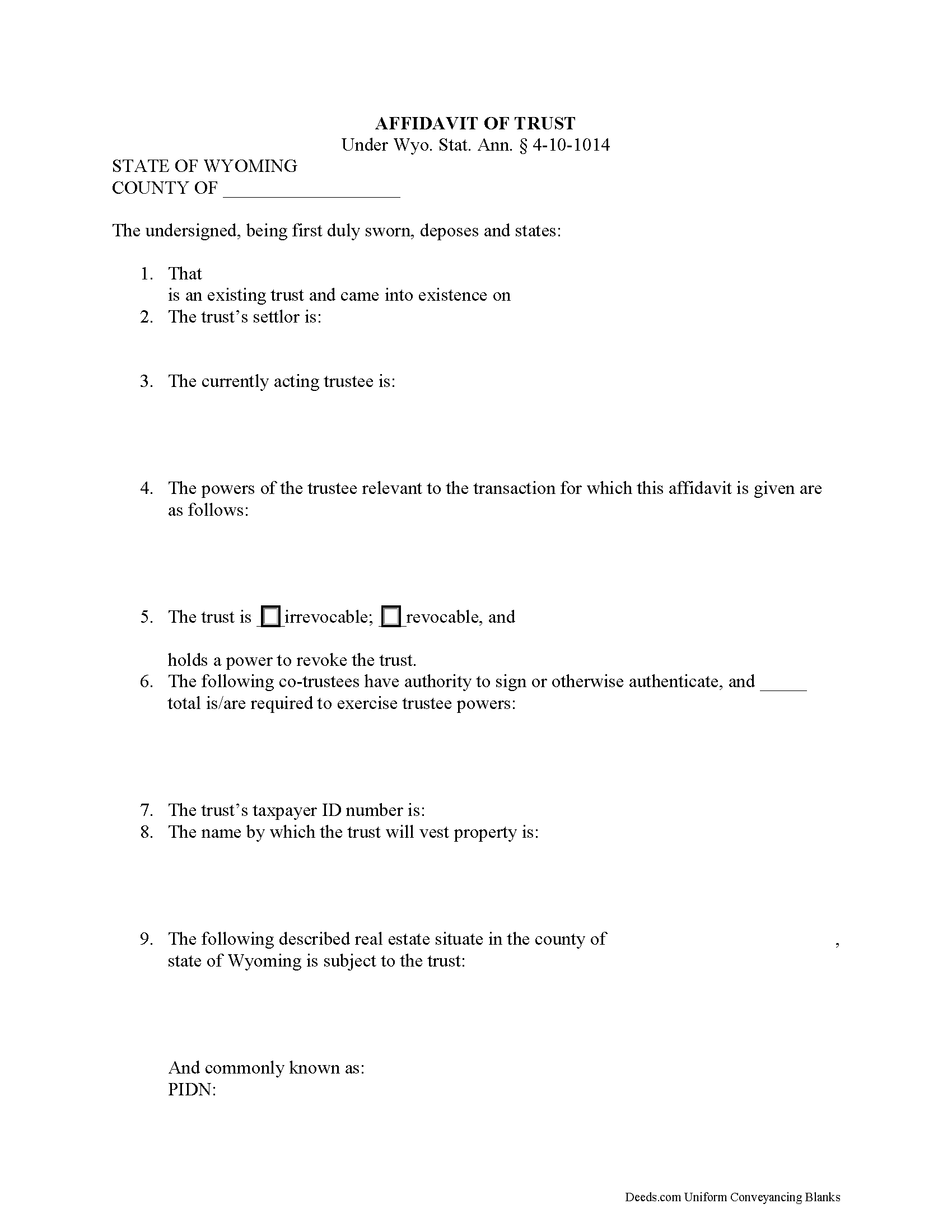

Sheridan County Affidavit of Trust Form

Sheridan County Affidavit of Trust Form

Fill in the blank form formatted to comply with all recording and content requirements.

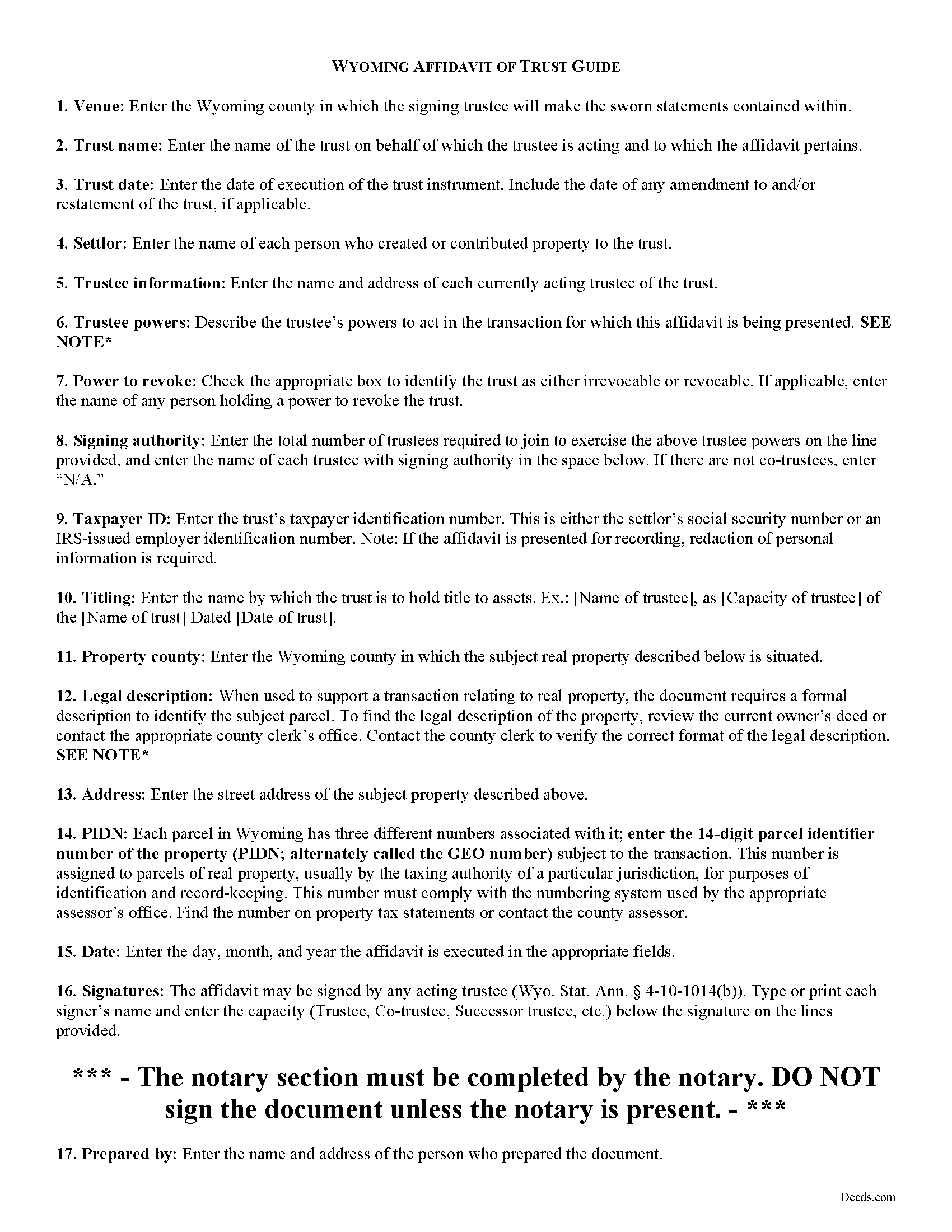

Sheridan County Affidavit of Trust Guide

Line by line guide explaining every blank on the form.

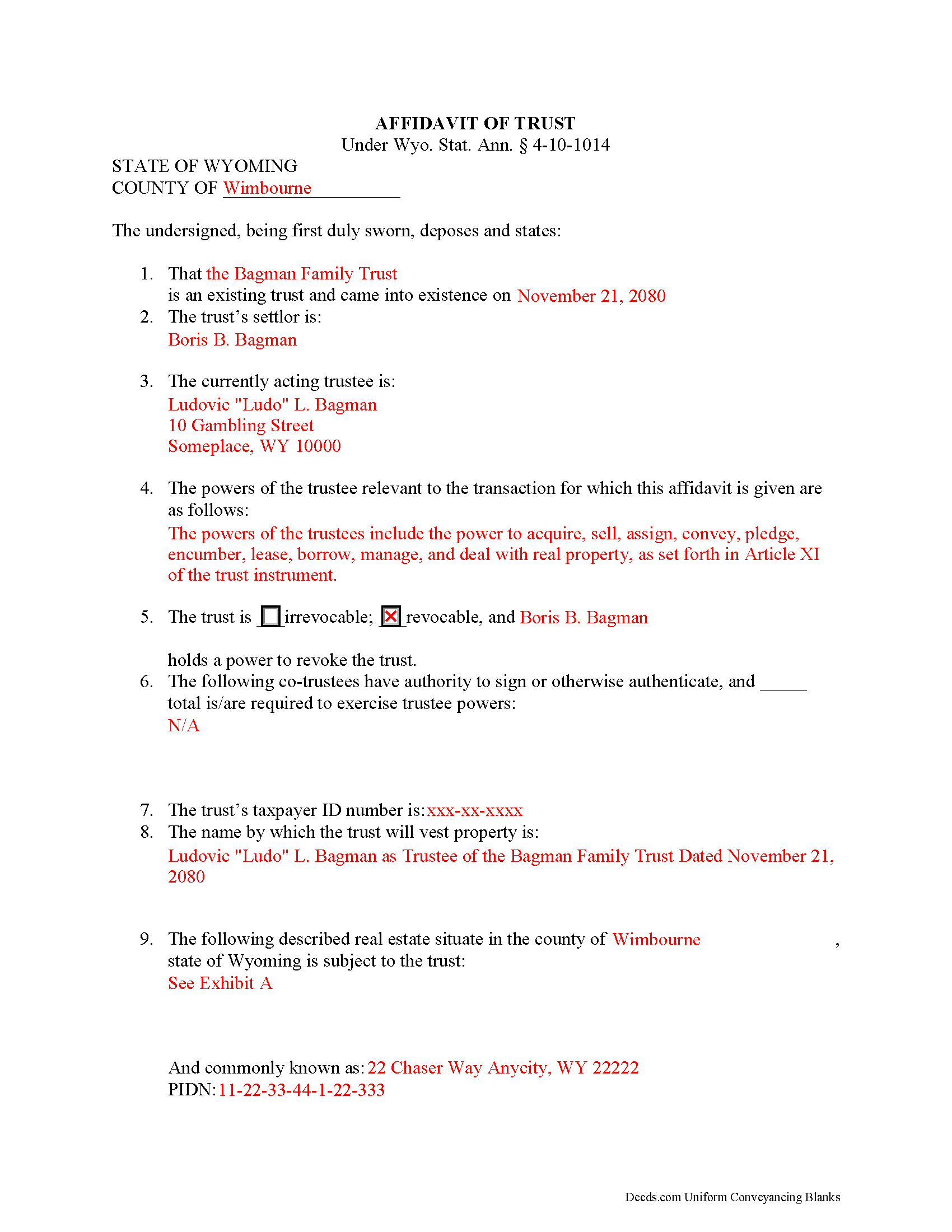

Sheridan County Completed Example of the Affidavit of Trust Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Wyoming and Sheridan County documents included at no extra charge:

Where to Record Your Documents

Sheridan County Clerk & Recorder

Sheridan, Wyoming 82801

Hours: Monday - Friday 8:00am - 5:00pm

Phone: (307) 674-2500

Recording Tips for Sheridan County:

- Bring your driver's license or state-issued photo ID

- White-out or correction fluid may cause rejection

- Check margin requirements - usually 1-2 inches at top

- Both spouses typically need to sign if property is jointly owned

- Avoid the last business day of the month when possible

Cities and Jurisdictions in Sheridan County

Properties in any of these areas use Sheridan County forms:

- Arvada

- Banner

- Big Horn

- Clearmont

- Dayton

- Leiter

- Parkman

- Ranchester

- Sheridan

- Story

- Wolf

- Wyarno

Hours, fees, requirements, and more for Sheridan County

How do I get my forms?

Forms are available for immediate download after payment. The Sheridan County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Sheridan County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Sheridan County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Sheridan County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Sheridan County?

Recording fees in Sheridan County vary. Contact the recorder's office at (307) 674-2500 for current fees.

Questions answered? Let's get started!

In a trust relationship, a settlor transfers one or more assets to another (the trustee), who holds and manages them for the benefit of a third (the beneficiary). In a living trust, the settlor indicates the intent to create a trust by executing a document called the trust instrument. This document sets out the trust's provisions and allows the settlor to plan how his assets will be distributed upon his death, without the requirement that his estate go through probate.

In the place of the entire trust document, a trustee in Wyoming may present an affidavit of trust to any person who is not a trust beneficiary. Codified as part of the Uniform Trust Code at Wyo. Stat. Ann. 4-10-1014, the document certifies that a trust exists and that the trustee has the authority to engage in the business at-hand with the recipient on behalf of said trust. Instead of summarizing the entire trust agreement, the affidavit contains only the information relevant to the current transaction, allowing the settlor to maintain the privacy of his/her estate plans (including the identity of trust beneficiaries).

As specified by statute, the affidavit is signed and sworn to before an appropriate official. Other requirements include the name and date of trust; the name of the settlor; the name and address of the current trustee; and a description of the relevant powers of the trustee. In addition, the document identifies any person who holds a power to revoke the trust, if applicable, and, if there are multiple trustees, it stipulates which trustees have signing authority and how many, if fewer than all, are required to act jointly to perform the powers listed. Wyoming also requires the trust's taxpayer identification number.

The form includes the name by which the trust vests title to property, and, when used in transactions pertaining to real property interests, may include a legal description of the subject property held in trust. Further, the trustee certifies that the trust has not been amended, modified, or revoked in a manner that invalidates any of the statements contained within the certificate. Persons dealing with trustees are protected by the provisions of 4-10-1014.

Consult a lawyer with questions regarding affidavits of trust or other issues relating to trust property in Wyoming.

(Wyoming AOT Package includes form, guidelines, and completed example)

Important: Your property must be located in Sheridan County to use these forms. Documents should be recorded at the office below.

This Affidavit of Trust meets all recording requirements specific to Sheridan County.

Our Promise

The documents you receive here will meet, or exceed, the Sheridan County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Sheridan County Affidavit of Trust form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4588 Reviews )

Deborah G.

July 23rd, 2021

Absolutely wonderful customer service. I am very pleased with the service I received and highly recommend this to everyone.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Mark & Linda W.

December 18th, 2020

Quite simple and easy. Only one critique: It would be easier if the names of the PDF would reflect the name of the deed/form such as 'Controlling tax return' rather than '1579101185SF56863.pdf'. However I love downloading forms rather than mail.

Thank you for your feedback. We really appreciate it. Have a great day!

Sally S.

May 3rd, 2022

it would be nice to have explanation of all the forms required. For a first time estate DPOA, I feel a bit insecure with the forms and would like a paragraph explaining specifics for each link and what to complete for the ladybird deed. Otherwise, I love the ease of purchase with immediate links available.

Thank you for your feedback. We really appreciate it. Have a great day!

Susan J.

June 29th, 2020

very fast service. immediate response and kept me informed along the way. the county was not cooperating and this was communicated to me and my fee was refunded, just like that. will definitely use this company again

Thank you!

Jacquelyn W.

February 4th, 2022

Great site with great info. Almost made the job seamless but form would not adjust to my longer than usual legal description -- I ended up having to recreate the form in word processing software (Libre). But could not have done it without the guidelines.

Thank you!

Stephen D.

January 15th, 2019

Very good hope to use in the future.

Thank you for your feedback. We really appreciate it. Have a great day!

Lowell P.

May 26th, 2020

Exceptionally helpful instruments that are compliant with State law and anticipate various contingencies. Very pleased.

Thank you for your feedback. We really appreciate it. Have a great day!

Julie S.

May 2nd, 2020

I am really impressed by this website. Not only is it affordable, but they give a detailed description, instructions, and an example to follow. Also there are additional forms included. And it's State, even county, specific. They do not require a subscription either as you can just order what you want. Thank you!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Eppie G.

October 19th, 2021

Perfect

Thank you!

Evaristo R.

October 6th, 2020

I was very excited to use the website but unfortunately they had a problem retrieving my Deed but thank you for the opportunity.

Thank you for your feedback. We really appreciate it. Have a great day!

Ann K.

March 4th, 2020

I ordered a Quit Claim Deed for my county. Once I read the detailed instructions and filled it out I submitted it to the local Register of Deeds and it was filed on the spot while I waited! Thank you, you made a difficult and expensive task easy (for a laymen with no knowledge) at little expense. Highly recommend your site!!!

Thank you for your feedback. We really appreciate it. Have a great day!

Dean P.

October 6th, 2021

Very fast, efficient, and convenient - thanks Deeds.com! I would recommend this service to everyone needing to record documents, especially out-of-state customers such as myself.

Thank you for your feedback. We really appreciate it. Have a great day!

Michael H.

April 8th, 2022

another exact match with what i needed, thank you! the recorded of deeds accepted it with no problem.

Thank you for your feedback. We really appreciate it. Have a great day!

Larry C.

July 7th, 2021

Very easy and convenient, thank you so much.

Thank you!

Bruce J.

November 8th, 2019

Fast results

Thank you!