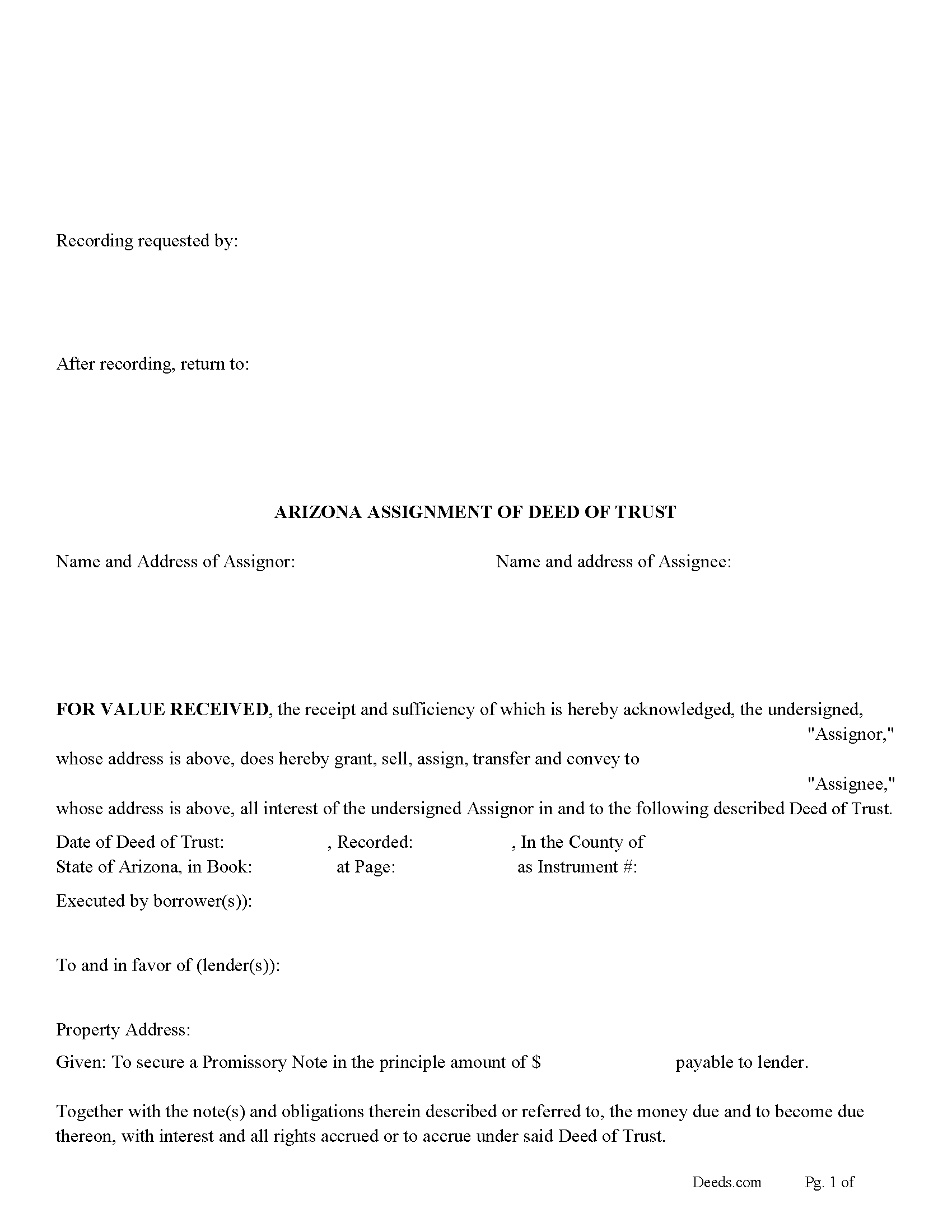

Maricopa County Assignment of Deed of Trust Form

Maricopa County Assignment of Deed of Trust Form

Fill in the blank form formatted to comply with all recording and content requirements.

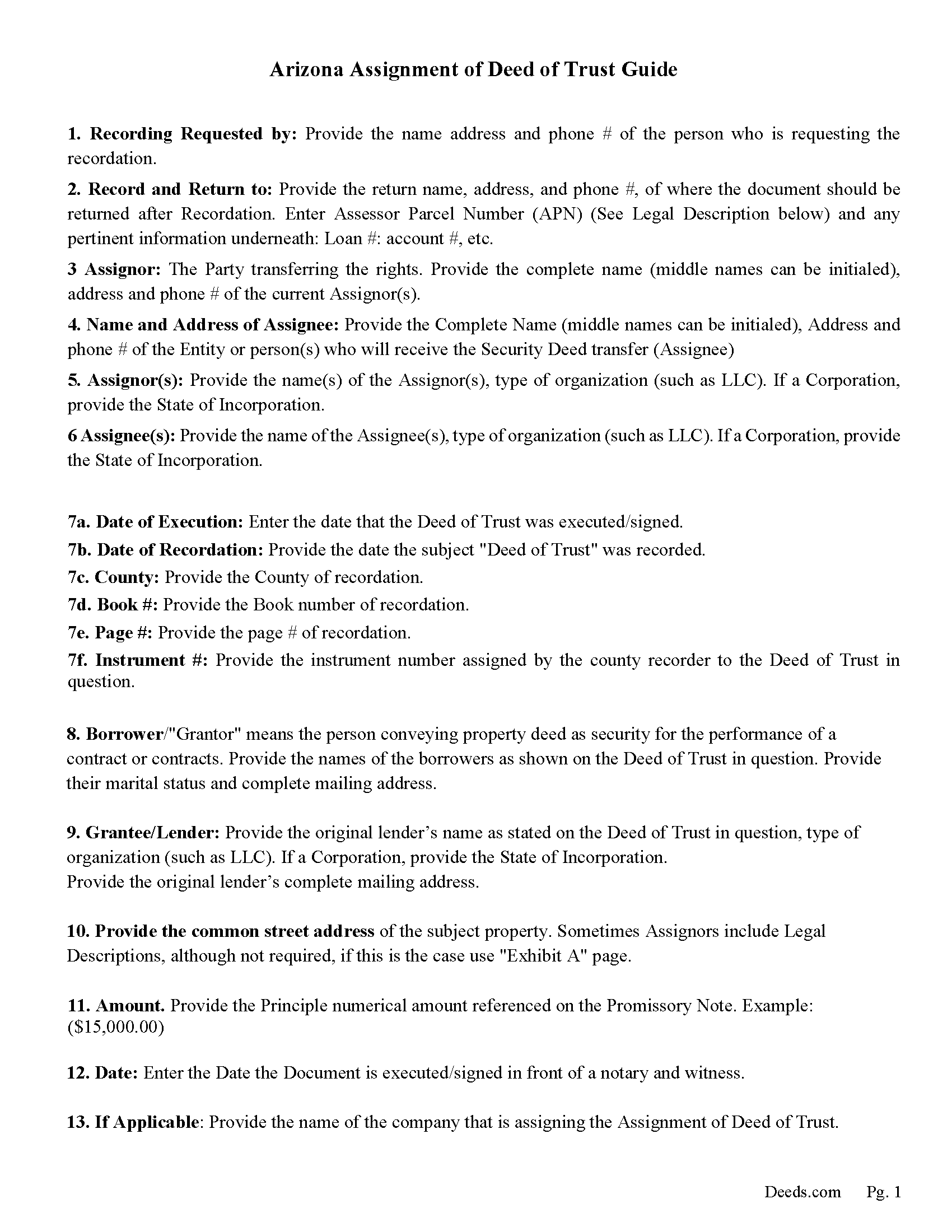

Maricopa County Guidelines for Assignment of Deed of Trust

Line by line guide explaining every blank on the form.

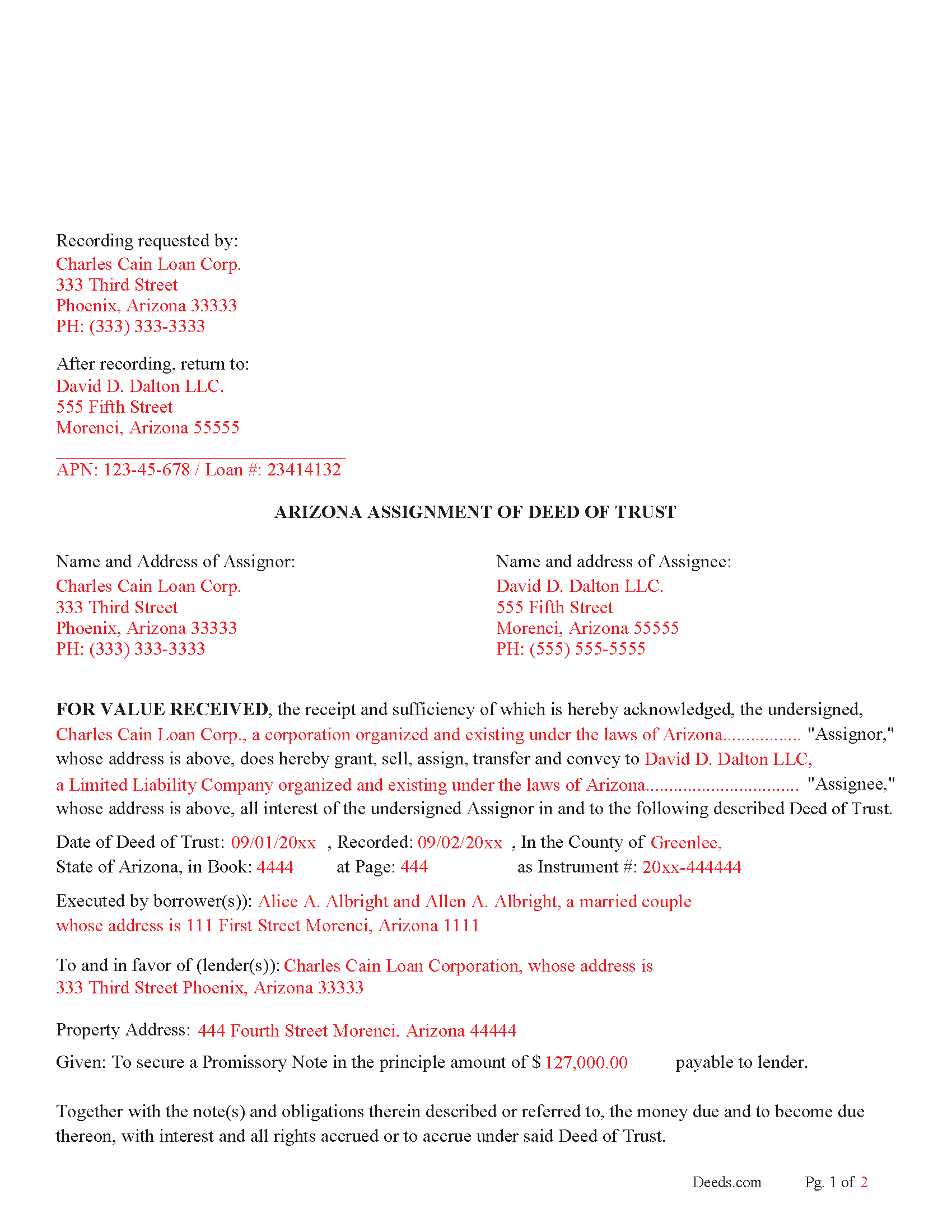

Maricopa County Completed Example of the Assignment of Deed of Trust Document

Example of a properly completed form for reference.

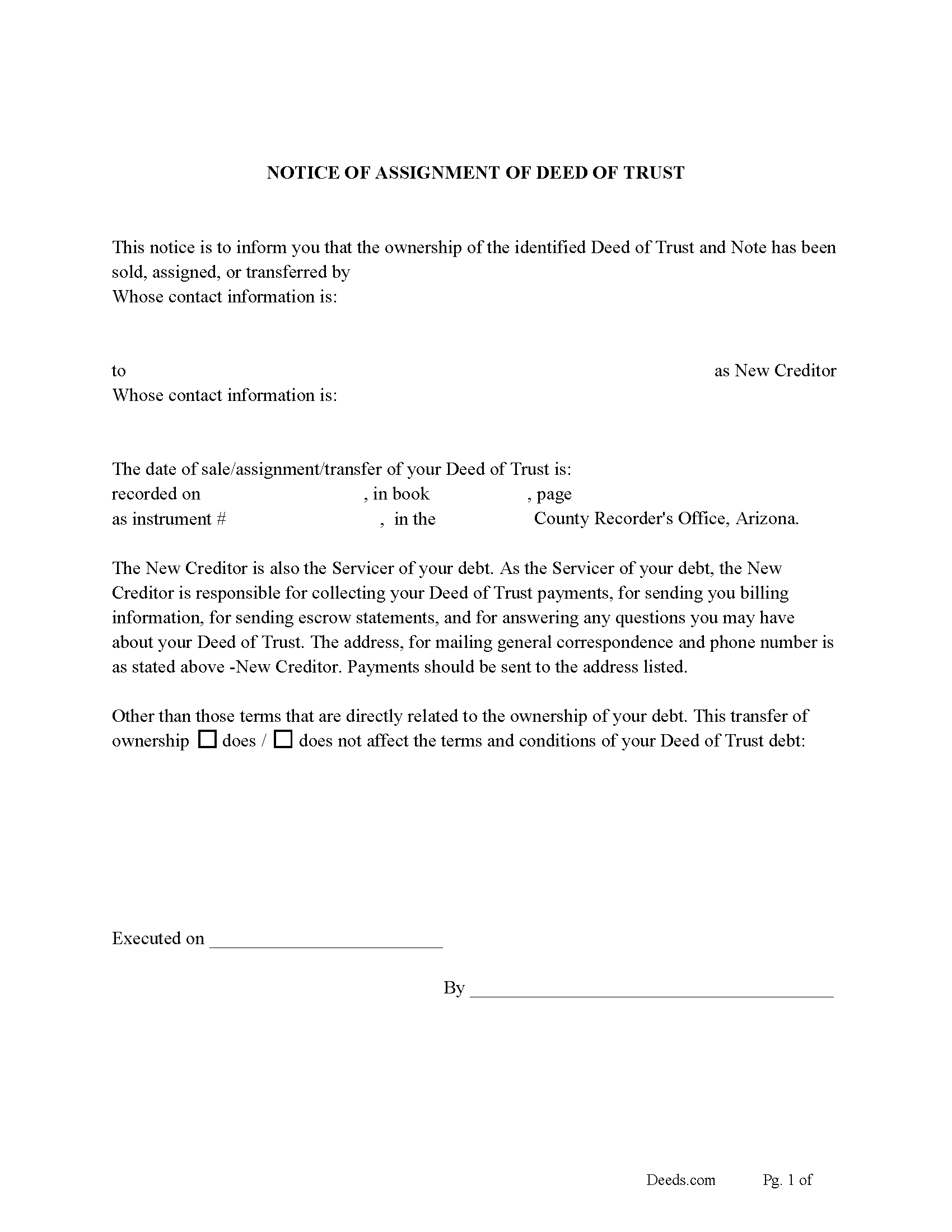

Maricopa County Notice of Assignment of Deed of Trust Form

Fill in the blank form formatted to comply with content requirements.

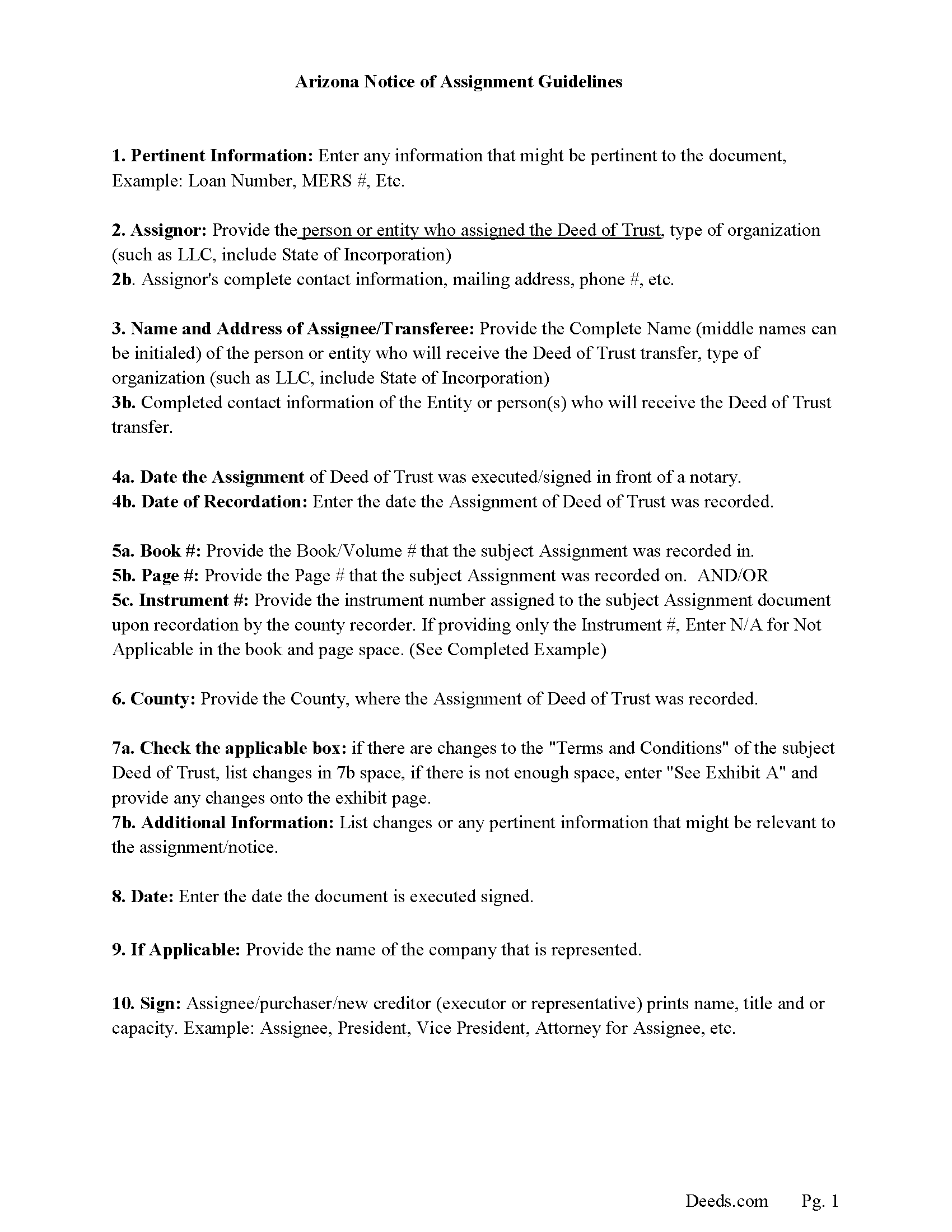

Maricopa County Notice of Assignment Guidelines

Line by line guide explaining every blank on the form.

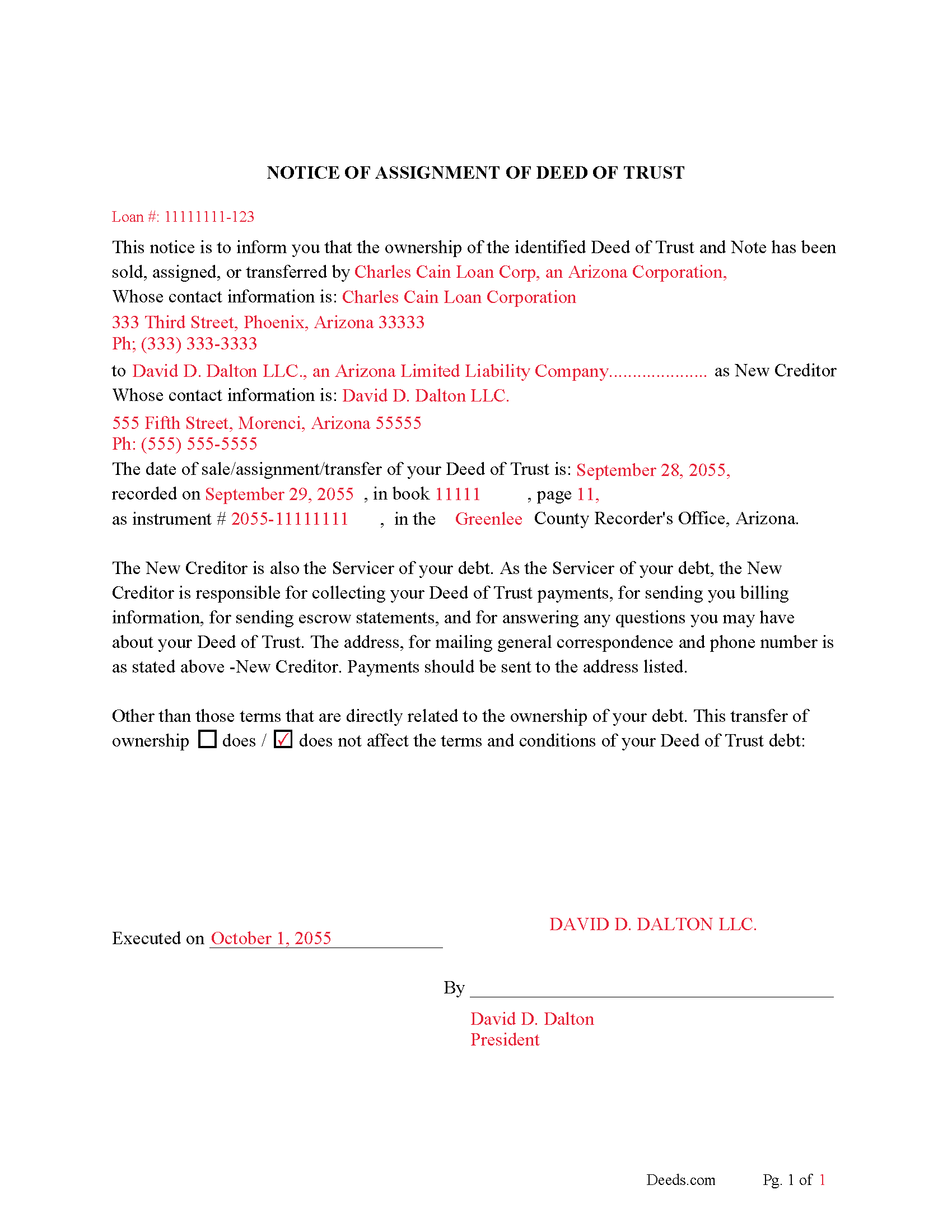

Maricopa County Completed Example of Notice of Assignment Document

Example of a properly completed form for reference.

All 6 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Arizona and Maricopa County documents included at no extra charge:

Where to Record Your Documents

Recorder: Main Office

Phoenix, Arizona 85003

Hours: 8:00 A.M. - 5:00 P.M. Monday - Friday

Phone: 602-506-3535

Southeast Office (Mesa)

Mesa , Arizona 85210

Hours: 8:00 A.M. - 5:00 P.M. Monday - Friday

Phone: 602-506-3535

Recording Tips for Maricopa County:

- Recording fees may differ from what's posted online - verify current rates

- Leave recording info boxes blank - the office fills these

- Mornings typically have shorter wait times than afternoons

Cities and Jurisdictions in Maricopa County

Properties in any of these areas use Maricopa County forms:

- Aguila

- Arlington

- Avondale

- Buckeye

- Carefree

- Cashion

- Cave Creek

- Chandler

- Chandler Heights

- El Mirage

- Fort Mcdowell

- Fountain Hills

- Gila Bend

- Gilbert

- Glendale

- Glendale Luke Afb

- Goodyear

- Higley

- Laveen

- Litchfield Park

- Mesa

- Morristown

- New River

- Palo Verde

- Paradise Valley

- Peoria

- Phoenix

- Queen Creek

- Rio Verde

- Scottsdale

- Sun City

- Sun City West

- Surprise

- Tempe

- Tolleson

- Tonopah

- Tortilla Flat

- Waddell

- Wickenburg

- Wittmann

- Youngtown

Hours, fees, requirements, and more for Maricopa County

How do I get my forms?

Forms are available for immediate download after payment. The Maricopa County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Maricopa County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Maricopa County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Maricopa County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Maricopa County?

Recording fees in Maricopa County vary. Contact the recorder's office at 602-506-3535 for current fees.

Questions answered? Let's get started!

This form is used by the current holder of a Deed of Trust to transfer rights to another party, usually when a note or deed of trust is sold. (If acknowledged as provided by law, shall from the time of being recorded impart notice of the content to all persons, including subsequent purchasers and encumbrancers for value.) ARS 33-818

Current Borrowers must be notified of the assignment. Notification consists of contact information of the new creditor, recording dates, recording instrument numbers, changes in loan, etc. Included are "Notice of Assignment of Deed of Trust" forms.

The Truth and lending act requires that borrowers be notified when their deed of trust debt has been sold, transferred, or assigned to a new creditor. Generally, within 30 days to avoid up to $2,000.00 in statutory damages, plus reasonable attorney's fees. Systematic violations can reach up $500,000.00.

(Arizona Assignment of Deed of Trust Package includes form, guidelines, completed example, and notice of assignment forms) For use in Arizona only.

Important: Your property must be located in Maricopa County to use these forms. Documents should be recorded at the office below.

This Assignment of Deed of Trust meets all recording requirements specific to Maricopa County.

Our Promise

The documents you receive here will meet, or exceed, the Maricopa County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Maricopa County Assignment of Deed of Trust form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4581 Reviews )

Margo W.

June 11th, 2022

Very easy to understand and complete the process. This is the third attempt to download a Quit Claim Deed and the only one we had success with. Thank you.

Thank you for your feedback. We really appreciate it. Have a great day!

PETER A.

May 15th, 2025

Got the forms I needed after getting forms for the wrong county and paying twice. My bad!

Thanks for your feedback! Just to clarify—when an order is placed for the wrong county, we’re happy to help. In this case, we canceled the original order and refunded the payment so there was no duplicate charge. Glad you got the correct forms in the end!

Jeffrey G.

March 9th, 2023

Transaction went smoothly. The forms in the package were just what was needed.

Thank you for your feedback. We really appreciate it. Have a great day!

Glenda T.

November 11th, 2020

you made this so easy,user friendly

Thank you for your feedback. We really appreciate it. Have a great day!

Beverly R.

February 2nd, 2022

This was a wonderful experience, easy fast and convenient. Thank you for all your help.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Carolyn G.

September 1st, 2021

I was extremely pleased with this experience, which literally took a minimum amount of time. One recommendation: make certain that when documents are uploaded that they have been received in the appropriate file. The lack of clarity caused me to upload twice or three times. Thank you.

Thank you for your feedback. We really appreciate it. Have a great day!

Susan N.

August 28th, 2022

Easy to use.

Thank you!

Pegi B.

January 24th, 2022

This service is fast and easy to use. We will definitely use this service again. Thank you.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Cheryl W.

August 10th, 2019

Have yet to use. Appears over whelming, we will see.

Thank you for your feedback. We really appreciate it. Have a great day!

Melissa S.

April 13th, 2020

Not what I can use.

Thank you!

FELISA J.

December 18th, 2019

I liked the ease of locating the document I needed and the sample document was extremely helpful. I would have liked the acknowledgement to be on the same page as the rest of the document. It costs for each page recorded.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Woody P.

August 28th, 2021

I was informed that a quit Claim Deed that I had submitted, did not meet county requirements. I ordered the correct form and was surprised that the form included instructions and a sample "completed" form for me to follow. I found it al very helpful. Thank you !!!

Thank you!

Colleen B.

September 20th, 2020

Looks good. We will see how it goes.

Thank you!

Robert K.

June 13th, 2021

Very user friendly - I found the affidavit I needed right away together with the guide to filling it out.

Thank you!

Charles E. M.

December 17th, 2020

5 stars...thanks for your fast and professional assistance. Charles

Thank you!