Maricopa County Conditional Lien Waiver on Final Payment Form

Last validated November 25, 2025 by our Forms Development Team

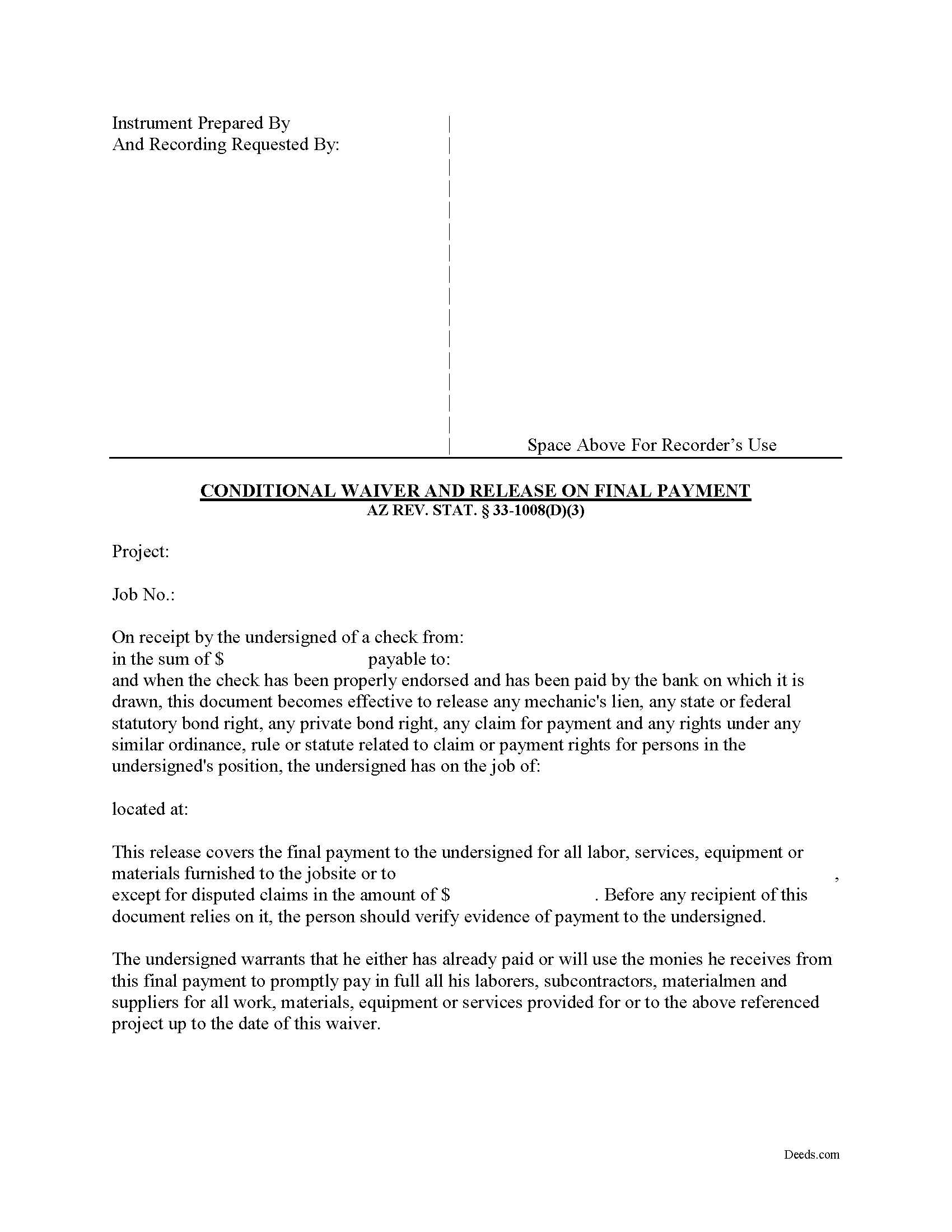

Maricopa County Conditional Lien Waiver on Final Payment Form

Fill in the blank form formatted to comply with all recording and content requirements.

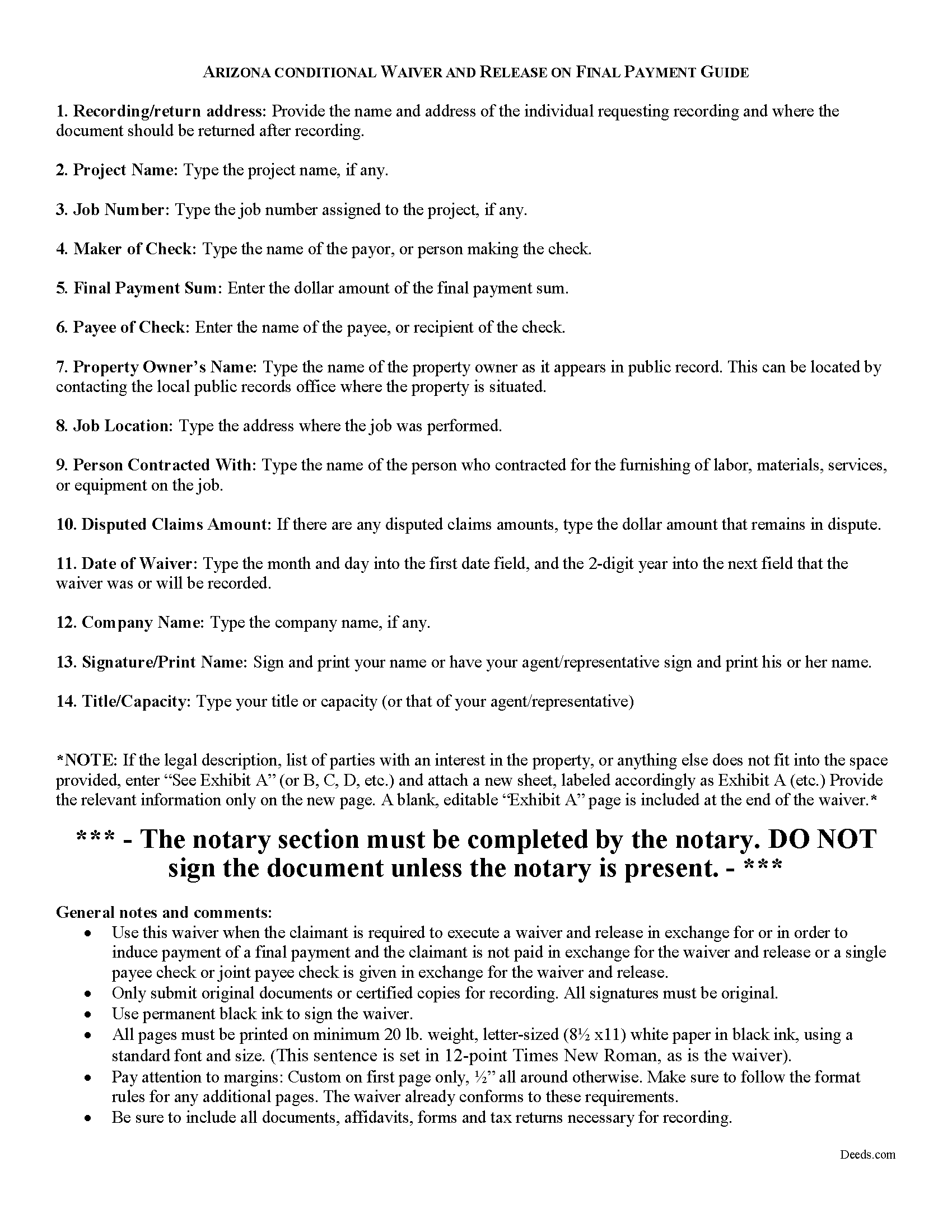

Maricopa County Conditional Lien Waiver on Final Payment Guide

Line by line guide explaining every blank on the form.

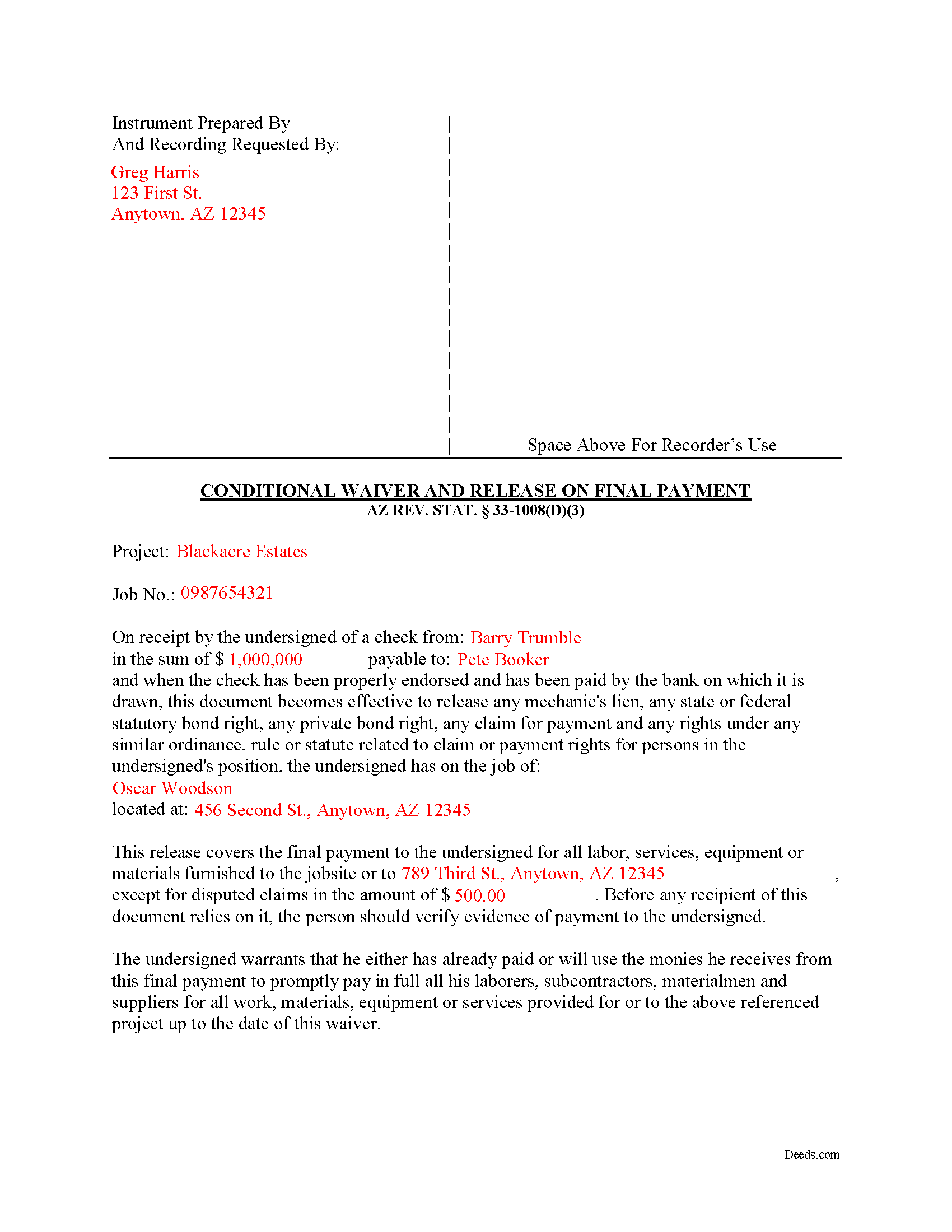

Maricopa County Completed Example of the Conditional Lien Waiver on Final Payment Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Arizona and Maricopa County documents included at no extra charge:

Where to Record Your Documents

Recorder: Main Office

Phoenix, Arizona 85003

Hours: 8:00 A.M. - 5:00 P.M. Monday - Friday

Phone: 602-506-3535

Recording Tips for Maricopa County:

- Leave recording info boxes blank - the office fills these

- Request a receipt showing your recording numbers

- Bring extra funds - fees can vary by document type and page count

Cities and Jurisdictions in Maricopa County

Properties in any of these areas use Maricopa County forms:

- Aguila

- Arlington

- Avondale

- Buckeye

- Carefree

- Cashion

- Cave Creek

- Chandler

- Chandler Heights

- El Mirage

- Fort Mcdowell

- Fountain Hills

- Gila Bend

- Gilbert

- Glendale

- Glendale Luke Afb

- Goodyear

- Higley

- Laveen

- Litchfield Park

- Mesa

- Morristown

- New River

- Palo Verde

- Paradise Valley

- Peoria

- Phoenix

- Queen Creek

- Rio Verde

- Scottsdale

- Sun City

- Sun City West

- Surprise

- Tempe

- Tolleson

- Tonopah

- Tortilla Flat

- Waddell

- Wickenburg

- Wittmann

- Youngtown

Hours, fees, requirements, and more for Maricopa County

How do I get my forms?

Forms are available for immediate download after payment. The Maricopa County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Maricopa County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Maricopa County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Maricopa County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Maricopa County?

Recording fees in Maricopa County vary. Contact the recorder's office at 602-506-3535 for current fees.

Questions answered? Let's get started!

Lien waivers are part of the Arizona mechanic's lien process. The waiver, given by a contractor, subcontractor, materials supplier or other party to the construction project (the claimant) acknowledging receipt of payment and waiving any future lien rights to the owner's property. Lien waivers are governed under Arizona Revised Statute 33-1008.

In Arizona, lien waivers require strict compliance with the statute and any document purported to waive a lien must follow the statutory format. AZ REV. STAT. 33-1008(A). Any contract or other form attempting to waive lien rights is void as a matter of law. Id. Additionally, lien waivers filed in the state require evidence of actual payment when the waiver is conditioned on receipt of payment. Id.

There are two classifications of lien waivers: conditional and unconditional. Within either class, there are subcategories of "partial" and "final" waivers. Unconditional waivers take effect without payment confirmation, but conditional waivers are effective only when payment is received, usually verified by a check clearing the bank. So, a conditional waiver given after the final payment releases the claimant's right to lien, but only after any check used to pay the bill clears the bank.

The waiver must contain details identifying the job/project, the amount and type of payment, including the name of the person who wrote any checks, the property owner, the location and a description of the work, relevant dates, and the claimant's signature. 33-1008(D)(3).

This article is provided for informational purposes only and should not be relied on as a substitute for the advice of an attorney. Please contact an Arizona attorney with questions about mechanic's lien waivers.

Important: Your property must be located in Maricopa County to use these forms. Documents should be recorded at the office below.

This Conditional Lien Waiver on Final Payment meets all recording requirements specific to Maricopa County.

Our Promise

The documents you receive here will meet, or exceed, the Maricopa County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Maricopa County Conditional Lien Waiver on Final Payment form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4614 Reviews )

Griselle M.

February 9th, 2021

This is my third time using Deeds.com and they don't disappoint. Their customer service is outstanding - absolutely excellent - via messages, I communicated with them immediately and 24/7 - on weekends and at night. I would not even try another service as they provide excellence which is so rare these days.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Alexia B.

June 11th, 2020

Excellent service with rapid turn around time!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Debra C.

August 14th, 2019

The website is so easy to use. I was able to purchase and download my documents within seconds!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Albert j.

June 3rd, 2020

Very easy site to use for a simple minded happy howmowner. Very reasonable fee Quick turn around Good communication

Thank you!

Barbara R.

August 26th, 2020

Thank you for your services My first time to ever print anything from your service or print off of a computer like this so I'm praying that it works I'm doing this to my phone. Thank you

Thank you!

Connie E.

December 25th, 2018

Great service! Easy to download and view. Florida should have the Revocable Transfer on Death (TOD)deed, that many other States have. That's the one I really wanted. This one will do in the meantime.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Philip S.

November 30th, 2021

This was our first time using Deeds.Com. We were tremendously impressed. The website works well, but the customer service really makes this organization special. The prompt, professional and knowledgeable responses to inquiries and recording issues was refreshing.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

MARY LACEY M.

May 28th, 2025

Deeds.com has become a great assistant to our firm! The service is of highest quality and consistently helpful to our law firm in its recording needs. It's summer in Arizona and no one I know wants to drive to downtown Phoenix to record a property deed so think I will add "grateful" to my praise.

Thank you, Mary! We appreciate your kind words and are glad to help make recording easier — especially when it means avoiding a summer trip to downtown Phoenix. We’re grateful for your continued trust.

Myron L.

November 29th, 2020

The forms were not identical to the county's version but it met my needs.

Thank you!

MARILYN I.

March 20th, 2023

Very pleased with your user friendly site.

Thank you!

Nancy C.

January 15th, 2021

Simple and easy to download. After reading the instructions/sample pages I did still have some questions regarding the beneficiary deed for the state of MO.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Chanda B.

September 9th, 2025

So easy to use!

Thank you!

William P.

June 11th, 2019

Good timely service. Returned my fee on a document that could not be located.

Thank you!

Donald P.

March 9th, 2021

I wish the quick claim dead would have had letterhead that said, State South Carolina.

Thank you for your feedback. We really appreciate it. Have a great day!

JOSEPH W.

September 17th, 2021

Easy peezy!

Thank you!