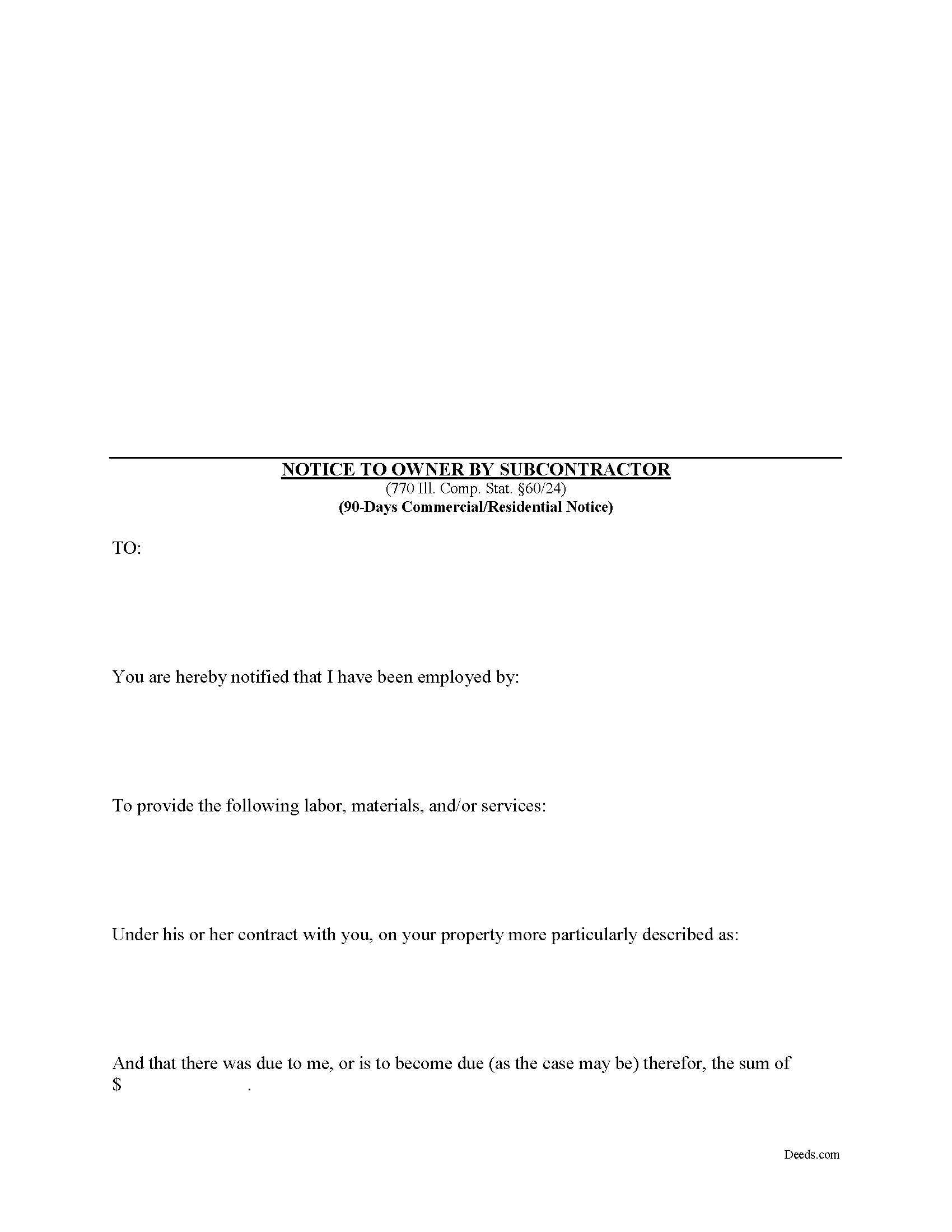

Jersey County Mechanics Lien Preliminary 90 Day Notice Form

Jersey County Mechanics Lien Preliminary 90 Day Notice Form

Fill in the blank Mechanics Lien Preliminary 90 Day Notice form formatted to comply with all Illinois recording and content requirements.

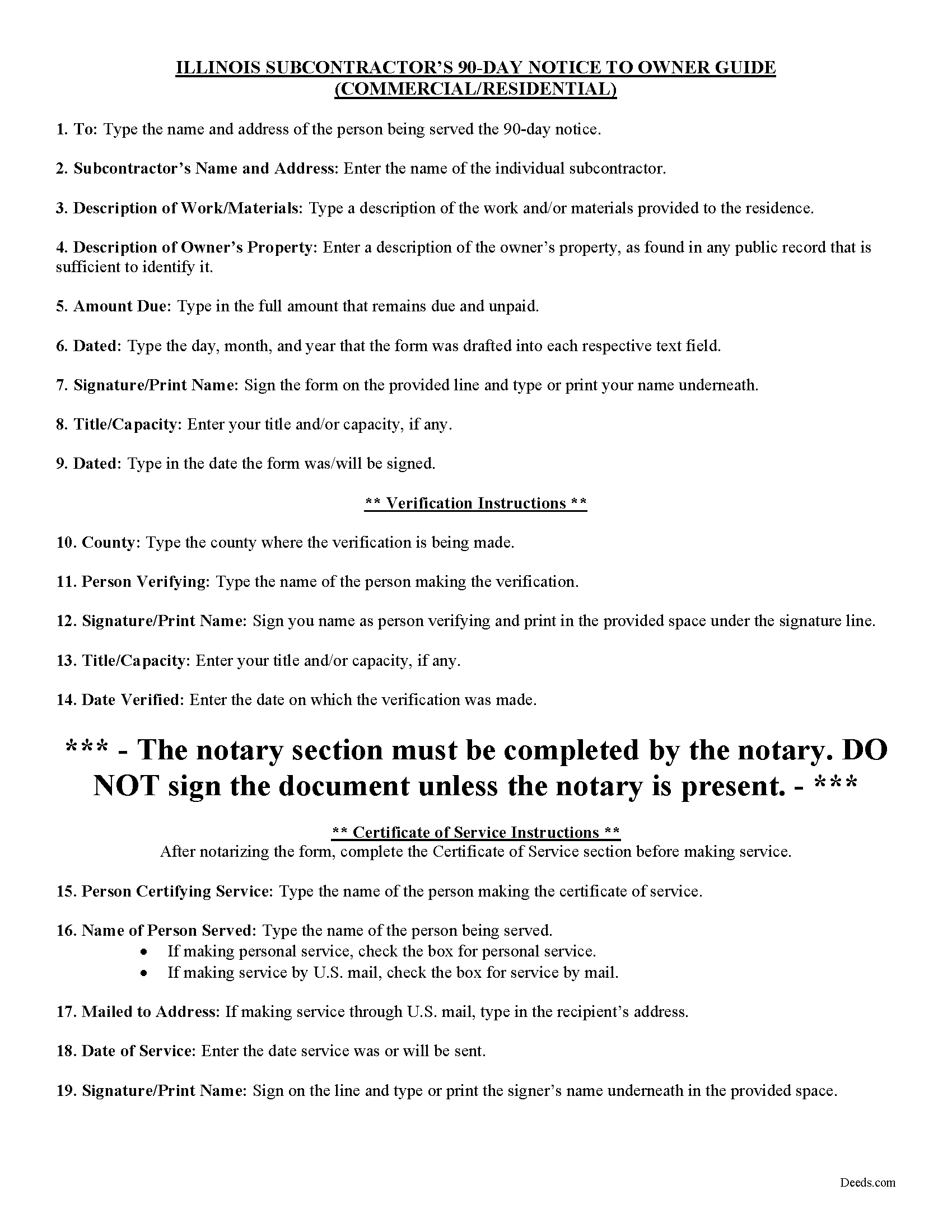

Jersey County Preliminary 90 Day Notice Guide

Line by line guide explaining every blank on the form.

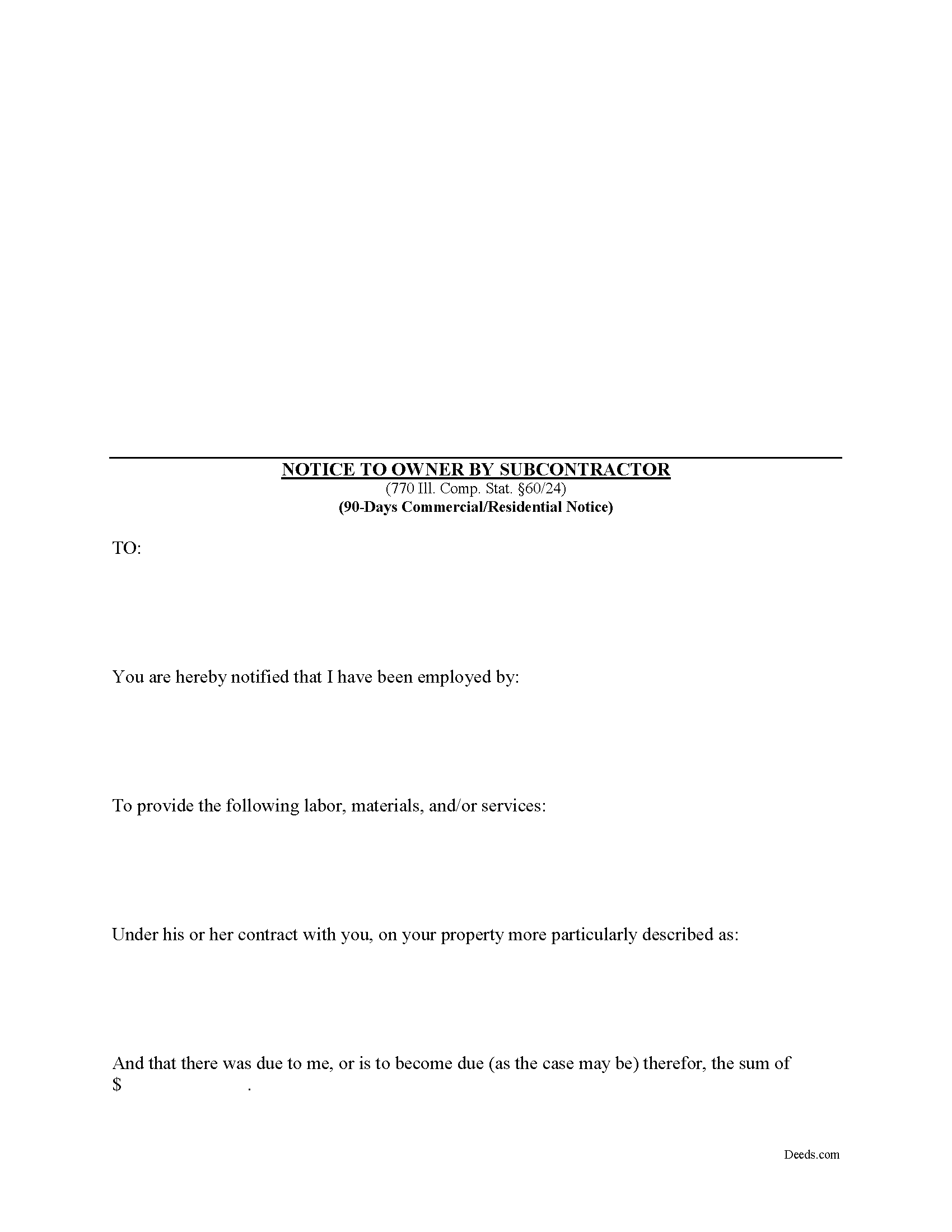

Jersey County Completed Example of the Preliminary 90 Day Notice Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Illinois and Jersey County documents included at no extra charge:

Where to Record Your Documents

Jersey County Clerk/Recorder

Jerseyville, Illinois 62052

Hours: 8:00 am to 4:00pm Monday through Thursday, and 8:00am to 12 Noon on Fridays

Phone: (618) 498-5571 Ext 117 & 118

Recording Tips for Jersey County:

- Documents must be on 8.5 x 11 inch white paper

- Bring extra funds - fees can vary by document type and page count

- Recorded documents become public record - avoid including SSNs

Cities and Jurisdictions in Jersey County

Properties in any of these areas use Jersey County forms:

- Dow

- Elsah

- Fidelity

- Fieldon

- Grafton

- Jerseyville

- Medora

Hours, fees, requirements, and more for Jersey County

How do I get my forms?

Forms are available for immediate download after payment. The Jersey County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Jersey County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Jersey County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Jersey County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Jersey County?

Recording fees in Jersey County vary. Contact the recorder's office at (618) 498-5571 Ext 117 & 118 for current fees.

Questions answered? Let's get started!

This statutory form is meant for use by subcontractors or others who are not directly contracted for work with the property owner.

For residential, owner-occupied projects, the 90-day notice form is the second preliminary notice sent in anticipation of filing a lien (the 60-day notice must be served beforehand sent via certified mail within 60 days from the first furnishing). For a commercial project, the 90-day form is the first notice sent to the owner. Either way, both commercial and residential jobs require the 90-day notice prior to filing a lien. 770 Ill. Comp. Stat. 60/24(a).

The 90-day notice is a demand for payment that must be sent by all contractors, subcontractors, laborers, and material/equipment suppliers who have not directly contracted with the owner or the owner's agent. Note that all eligible workers must send the notice within 90 days after the final furnishing of work or delivery of materials to the jobsite. Id. Any substantial additional or extra work can enlarge the time, but mere corrections of previously completed work will not affect the end date. Be aware the time is 90 days, not three months, so count 90 days from the date labor or materials were last furnished.

Serve the notice either through personal service by using a process server, or use the easier and less expensive option of certified mail. The notice does not have to be recorded but keep track of all dates and confirmations of receipt of service to help create a paper trail if a lien becomes necessary. If the deadlines are near, consider a process server. If mailing, serve the notice by certified mail, return receipt requested on the owner, the mortgage lenders, and the general contractor.

The 90-day notice must be verified which means the contractor's signature represents the contents of the notice are accurate and true. The notice must also be notarized by signing it in front of a licensed Notary Public who affixes his or her seal to the document.

This article is provided for informational purposes only and does not constitute legal advice. If you have any questions about mechanic's liens, including the preliminary notices, please consult an attorney.

Important: Your property must be located in Jersey County to use these forms. Documents should be recorded at the office below.

This Mechanics Lien Preliminary 90 Day Notice meets all recording requirements specific to Jersey County.

Our Promise

The documents you receive here will meet, or exceed, the Jersey County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Jersey County Mechanics Lien Preliminary 90 Day Notice form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4583 Reviews )

Norman K.

March 2nd, 2021

It wasn't really what I needed I read and read and read and read and I thought I was to do with for filing for probate or probate executor but instead it was for the property if you are executor and but it wasn't very clear on that so it didn't work for me so I was kind of wasted money

Sorry to hear that Norman. We've gone ahead and canceled your order and payment.

Blaine G.

February 4th, 2022

Pretty good promissory note...but unable to delete some of the not needed stuff. Fill in blanks are fine but not all the template language is appropriate in my situation

Thank you for your feedback. We really appreciate it. Have a great day!

James B.

June 9th, 2019

Reliable and fast. A great assest.

Thank you!

Barbara D.

October 9th, 2019

Appreciate this service!

Thank you!

Michael G. S.

January 3rd, 2019

The process was quite easy, following the instructional guide. I have yet to find out if the deed was accepted, but your site was very user friendly.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Shonda S.

January 21st, 2023

This is the best thing I have ever done with this being my first time doing a quick claim. This has save me and my family money instead of paying a lawyer. Thanks again.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Glenella J.

February 21st, 2019

I wish you had the older deeds online to look at. Other than that, I was very satisfied with my experience.

Thank you for your feedback. We really appreciate it. Have a great day!

Jerry W.

March 16th, 2020

Great program and easy to follow instructions.

Thank you for your feedback. We really appreciate it. Have a great day!

Yvette B.

December 2nd, 2020

Rude customer service. Will not be using deeds.com again. Thanks

Thank you for your feedback Yvette, we do hope that you find something more suitable to your needs elsewhere. Have a wonderful day.

Dubelsa T.

July 13th, 2020

Loved it!!!!! Beats going downtown!!!! Super easy and fast!!!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Noelle V.

December 31st, 2024

I requested a copy of some documents and within the hour, they were waiting for me in PDF form. It was easy and helped a great deal to have this service available.

Your feedback is valuable to us and helps us improve. Thank you for sharing your thoughts!

David N.

January 9th, 2025

Thank you fine Deeds Company. I hope all goes well for you and all your team!

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

Gene J.

September 6th, 2019

Easy to pay for, hard to download. A zip file containing all the forms would be a great addition. Your warning under the Review box needs help: see Your review may displayed publicly so please do not include any personal information.

Thank you for your feedback. We really appreciate it. Have a great day!

James H.

December 7th, 2020

Clear and easy instructions. Prompt processing and confirmation. I am still in the middle of submitting my document for recording, but I am confident that the Deeds.com service will deliver as promised. Definitely a valuable tool with important legal doucments.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Rebecca M.

December 28th, 2023

Great service! fast turnaround! I’ve used Deeds.com multiple times, and the software interface is easy to use. I was able to get Deeds for Nevada re-recorded (errors on my lawyers part), quickly with Deeds.com support. Thanks Deeds.com!!

It was a pleasure serving you. Thank you for the positive feedback!