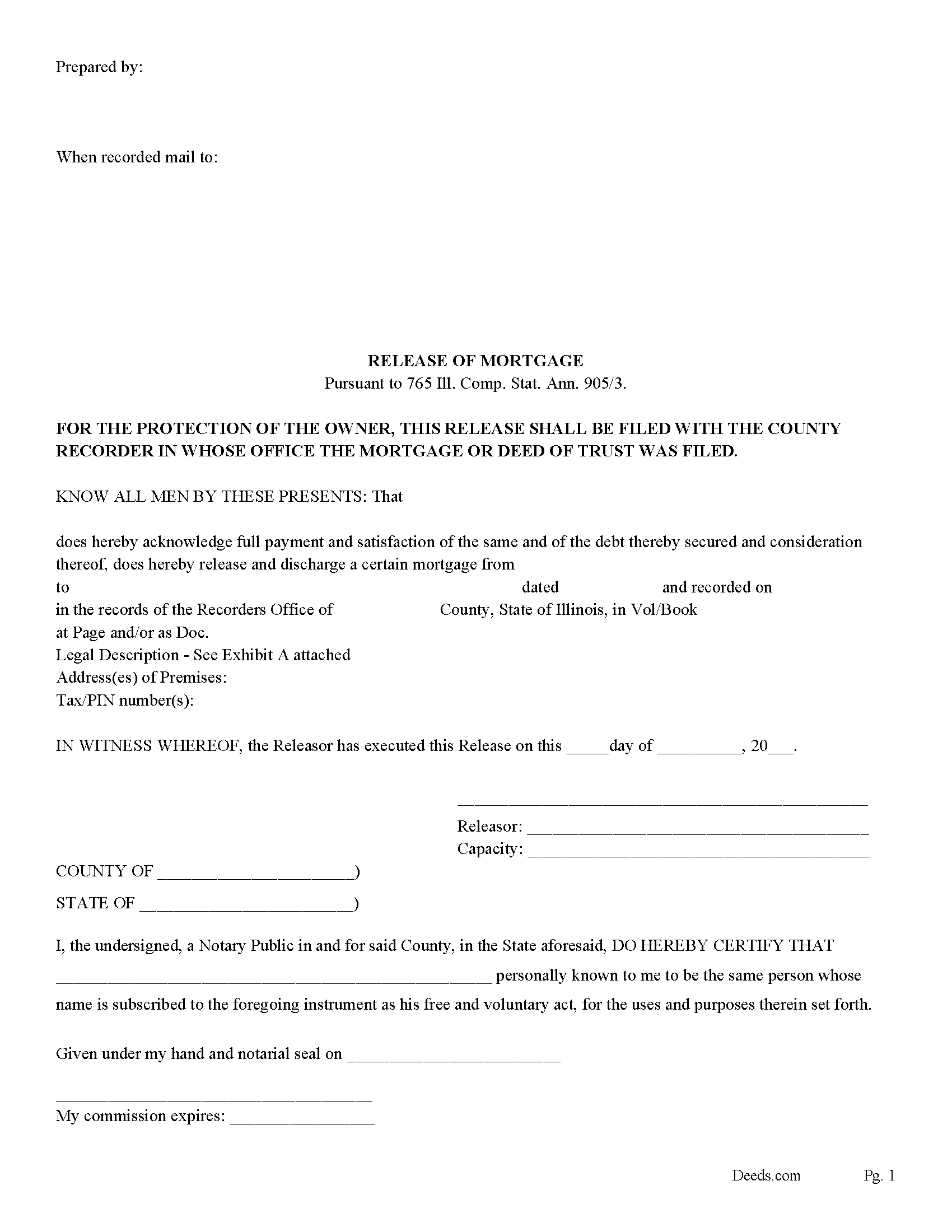

Hardin County Release of Mortgage Form

Hardin County Release of Mortgage Form

Fill in the blank form formatted to comply with all recording and content requirements.

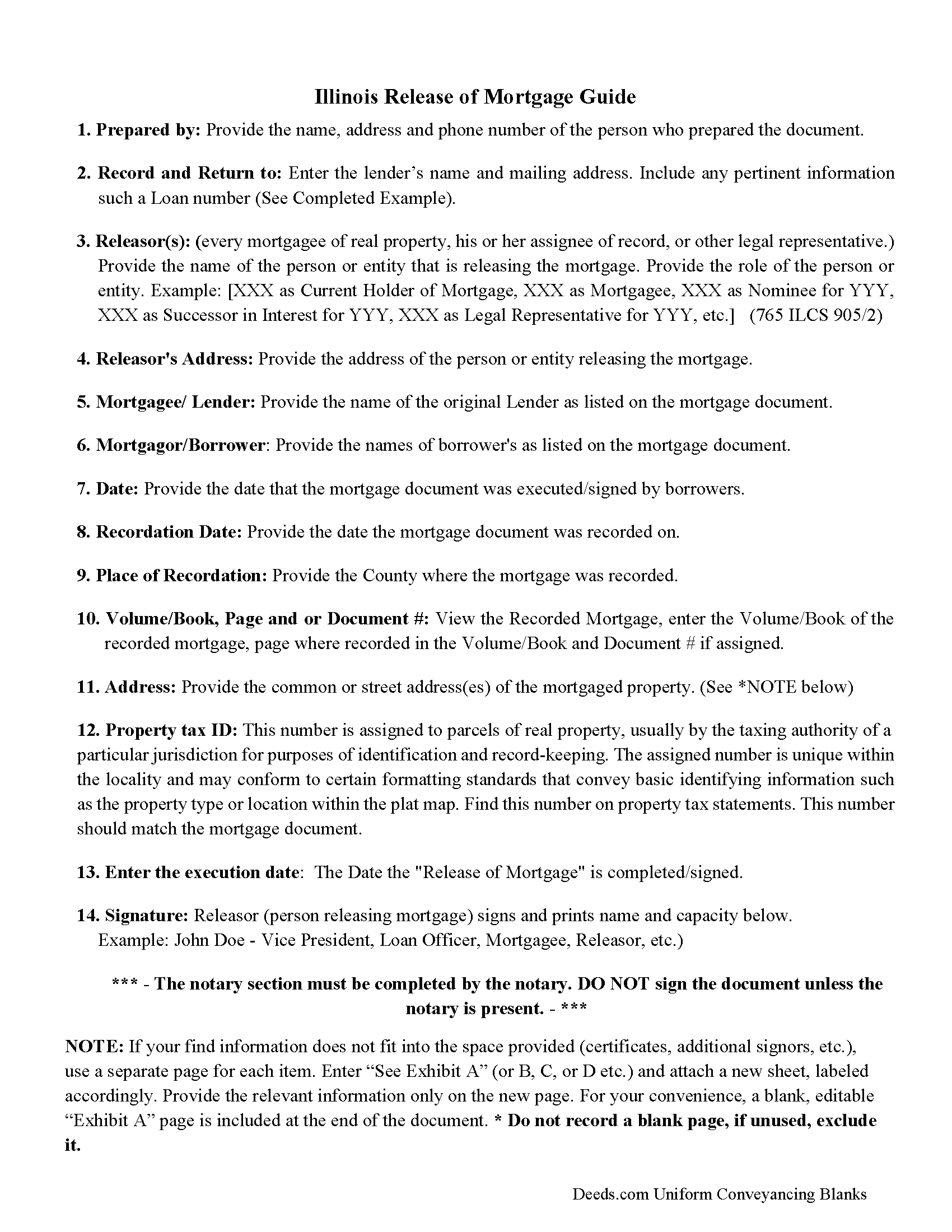

Hardin County Guidelines Release of Mortgage

Line by line guide explaining every blank on the form.

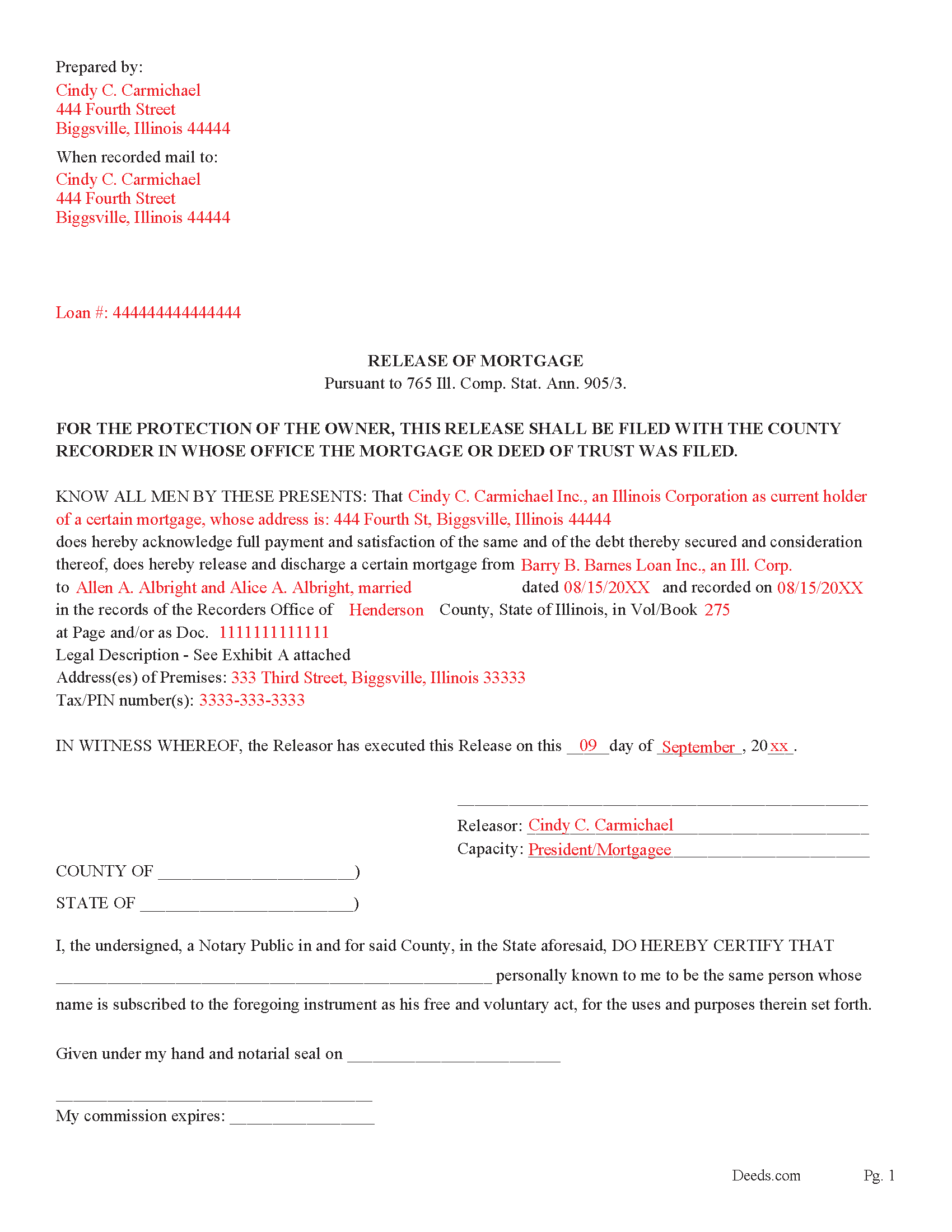

Hardin County Completed Example of the Release of Mortgage Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Illinois and Hardin County documents included at no extra charge:

Where to Record Your Documents

Hardin County Clerk/Recorder - Courthouse

Elizabethtown, Illinois 62931

Hours: 8:00 to 4:00 Monday through Friday

Phone: (618) 287-2251

Recording Tips for Hardin County:

- Bring your driver's license or state-issued photo ID

- Documents must be on 8.5 x 11 inch white paper

- Avoid the last business day of the month when possible

Cities and Jurisdictions in Hardin County

Properties in any of these areas use Hardin County forms:

- Cave In Rock

- Elizabethtown

- Karbers Ridge

- Rosiclare

Hours, fees, requirements, and more for Hardin County

How do I get my forms?

Forms are available for immediate download after payment. The Hardin County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Hardin County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Hardin County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Hardin County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Hardin County?

Recording fees in Hardin County vary. Contact the recorder's office at (618) 287-2251 for current fees.

Questions answered? Let's get started!

This form may be used by the current mortgage holder or representative to release a mortgage that is paid in full.

To avoid penalty the (mortgagee)/lender, (his or her executor or administrator, heirs and assigns), generally has (30 days) to file the release (after the payment of the debt secured by such mortgage) (765 ILCS 905/4)

(765 ILCS 905/3) (from Ch. 95, par. 53)

Sec. 3. An instrument in writing which releases a mortgage or trust deed of real property may be acknowledged or proved in the same manner as deeds for the conveyance of land.

(Source: Laws 1961, 1st Spec.Sess., p. 42.)

If the release is delivered to the mortgagor or grantor, it must have imprinted on its face in bold letters at least 1/4 inch in height the following: "FOR THE PROTECTION OF THE OWNER, THIS RELEASE SHALL BE FILED WITH THE RECORDER OR THE REGISTRAR OF TITLES IN WHOSE OFFICE THE MORTGAGE OR DEED OF TRUST WAS FILED".

(765 ILCS 905/2)

(Illinois Release of Mortgage Package includes form, guidelines, and completed example)

Important: Your property must be located in Hardin County to use these forms. Documents should be recorded at the office below.

This Release of Mortgage meets all recording requirements specific to Hardin County.

Our Promise

The documents you receive here will meet, or exceed, the Hardin County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Hardin County Release of Mortgage form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4578 Reviews )

Juanita G.

February 5th, 2025

Easy and efficient service. The communication is on point. Thank you!

Thank you for your positive words! We’re thrilled to hear about your experience.

Richard R.

November 14th, 2019

Very straightforward, and fair-enough pricing.

Thank you!

Marilyn C.

March 16th, 2021

Fillable documents, after a download, would be helpful. Very good to have all these forms online and accessible for an overall fee.

Thank you!

Diane W.

January 3rd, 2020

The forms were immediately available for download, which was nice. However, I was not impressed by the lack of several features: 1) there was no way to edit set text in the form, such as where it says you should consult an attorney. That is not necessary for recording the deed and I wanted to deleted it, but could not. 2) Also, under the "Notes" section, there is a limited area to write; I tried adding a fuller explanation of something, but the form would not accept or include it when I printed the final document. The form may do the job, but it's not very sophisticated or elegant.

Thank you for your feedback. We really appreciate it. Have a great day!

Nancy E.

May 4th, 2025

Took me awhile to figure out and get the information printed so I can use it later. Thank you.

Your insights are invaluable to us and help us strive for better service. Thank you for taking the time to share your thoughts.

Jennifer L L.

November 19th, 2024

So far this has been a great experience. Very easy to use the deeds.com website and download the forms. Very nice that they give example forms and guides to help you fill out the forms. I just have to wait to make sure that the forms are accepted and recorded with no issues.

Your insights are invaluable to us and help us strive for better service. Thank you for taking the time to share your thoughts.

Brenda K R.

October 1st, 2021

Hello, I like how easy the form is to follow. I'm unsure however of how to proceed as what I am trying to do is have my name added to the deed so in event of death I have ownership.

Thank you for your feedback. We really appreciate it. Have a great day!

henry p v.

March 18th, 2020

The deed easily downloaded. Form fill was smooth. I thought the service was a good value.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Galina K.

June 9th, 2023

Was fast and easy to get the forms with instructions on how to fill them out.

Thank you for the kind words Galina. We appreciate you. Have an amazing day!

Anita M W.

May 17th, 2023

This process is outstanding, and it saved the hassle of going downtown and dealing with traffic.

Thank you for the kinds words Anita. Glad we could be of assistance. Have an amazing day!

Jo A B.

June 18th, 2022

Clean crisp website with helpful information; however. If the site states the following files are included, a single .zip, .rar, , ,download should be available instead of individual.

Thank you for your feedback. We really appreciate it. Have a great day!

Ramona C.

October 28th, 2020

Easy to use and the sample really helped.

Thank you!

Maria W.

July 19th, 2022

Really, the best and easiest service given us to complete a process for recorder office! Thank you!!

Thank you!

Amy L B.

March 12th, 2025

easy to download forms and help is there if you need it!

Thank you, Amy! We appreciate your kind words and are glad you found the forms easy to download. Our team is always here if you ever need assistance. Thanks for choosing us!

ZENOBIA D.

November 11th, 2021

I Love Deeds.com. They have all of the documents you need to take care of your needs. IT is also safe and convenient way to send your documents safely and secure.

Thank you!