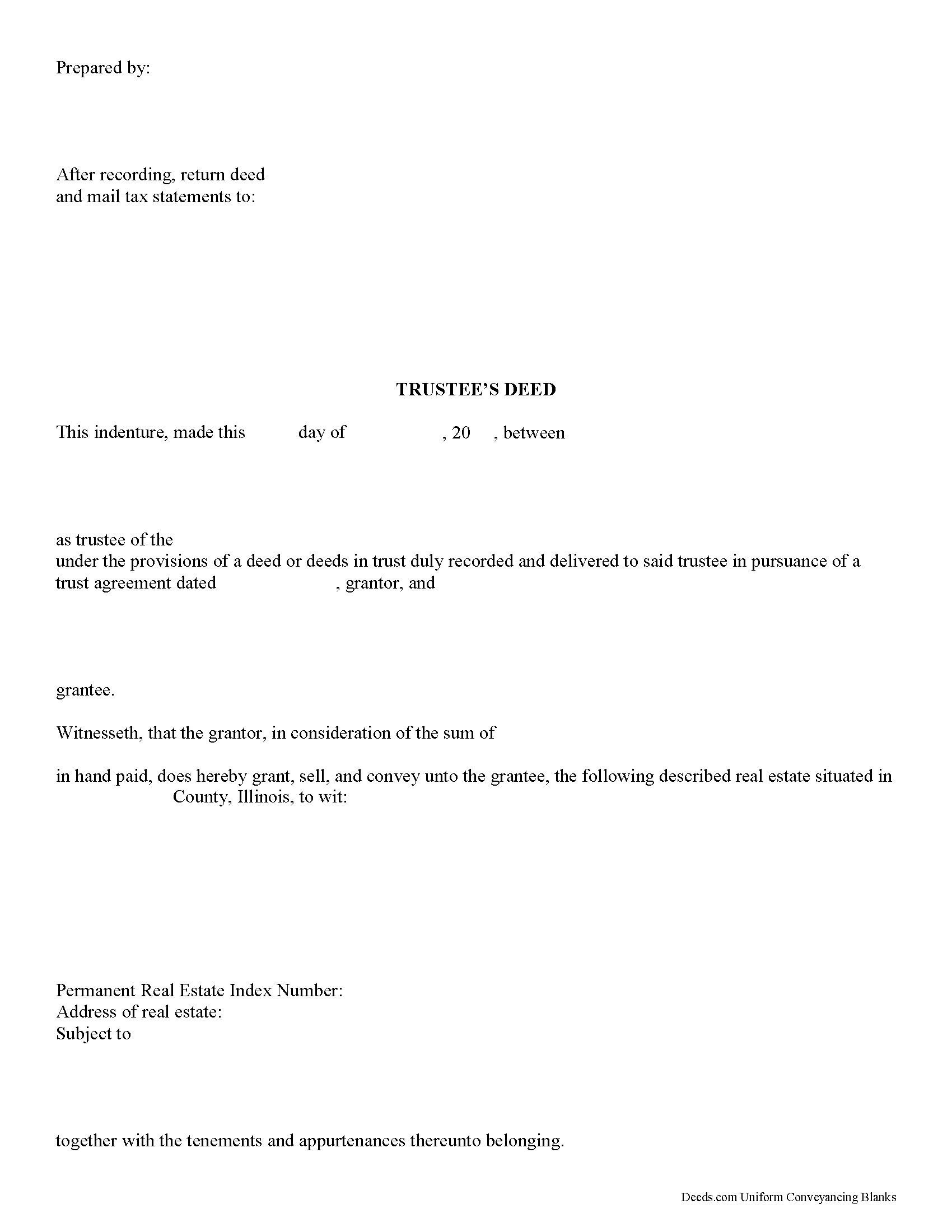

Hardin County Trustee Deed Form

Hardin County Trustee Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

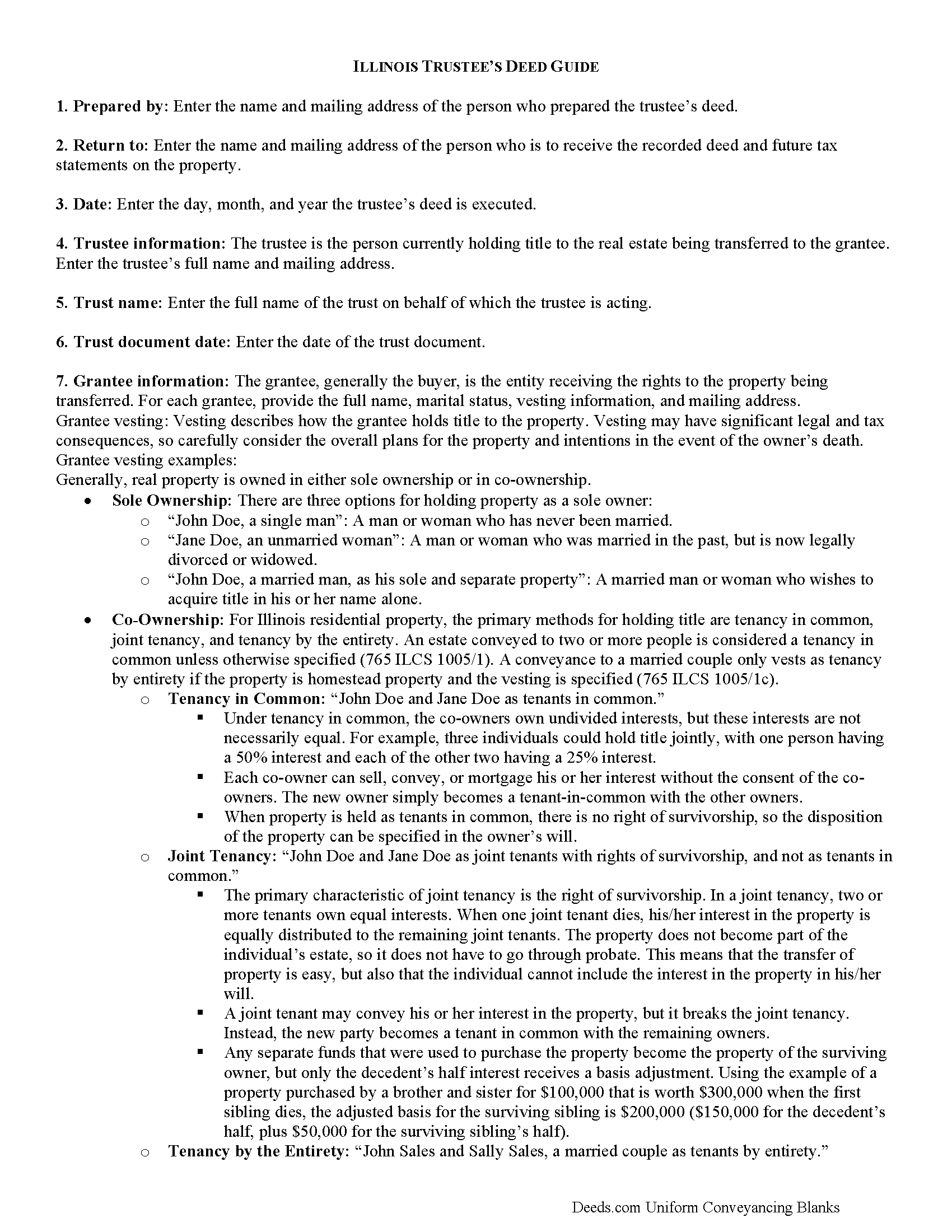

Hardin County Trustee Deed Guide

Line by line guide explaining every blank on the form.

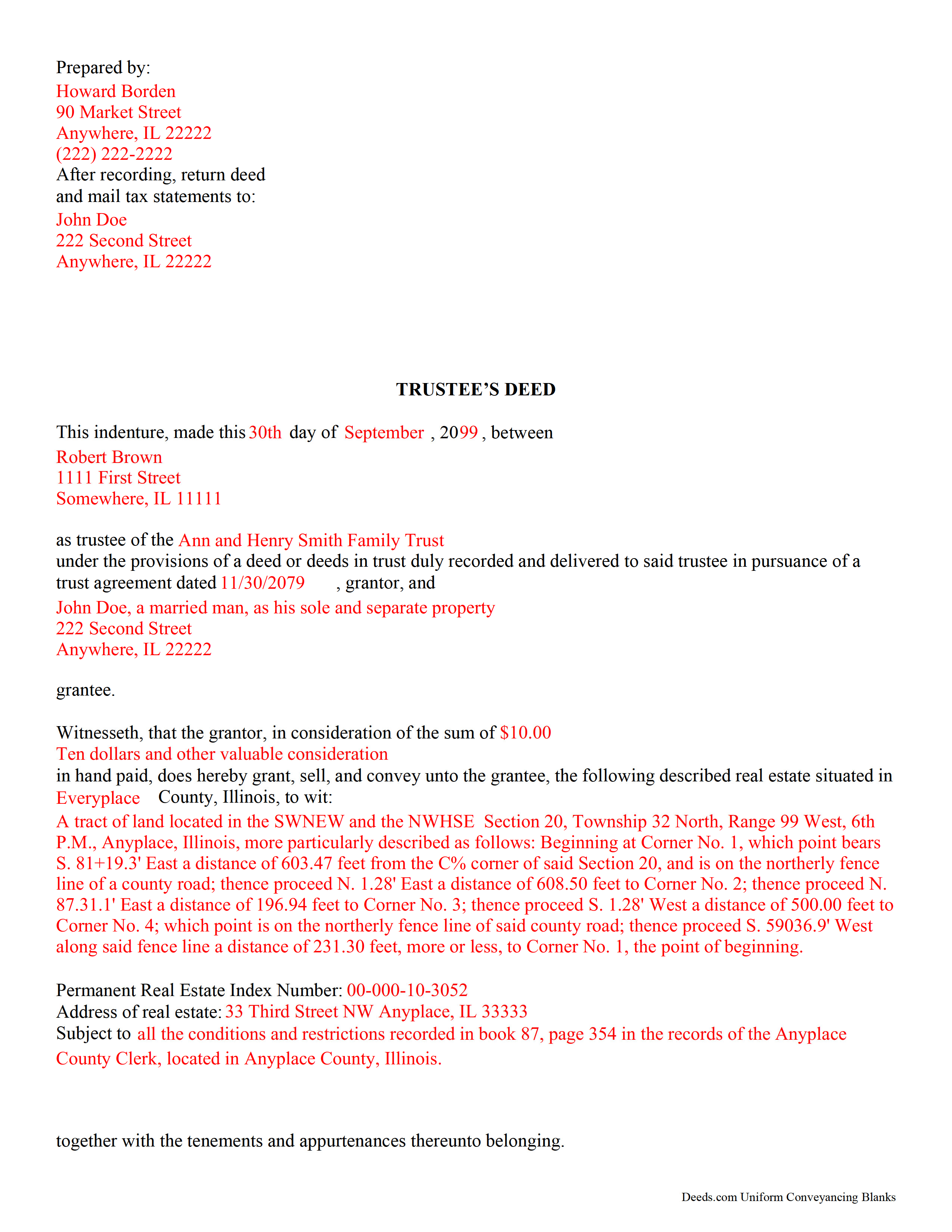

Hardin County Completed Example of the Trustee Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Illinois and Hardin County documents included at no extra charge:

Where to Record Your Documents

Hardin County Clerk/Recorder - Courthouse

Elizabethtown, Illinois 62931

Hours: 8:00 to 4:00 Monday through Friday

Phone: (618) 287-2251

Recording Tips for Hardin County:

- Documents must be on 8.5 x 11 inch white paper

- Verify all names are spelled correctly before recording

- Avoid the last business day of the month when possible

- Bring extra funds - fees can vary by document type and page count

Cities and Jurisdictions in Hardin County

Properties in any of these areas use Hardin County forms:

- Cave In Rock

- Elizabethtown

- Karbers Ridge

- Rosiclare

Hours, fees, requirements, and more for Hardin County

How do I get my forms?

Forms are available for immediate download after payment. The Hardin County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Hardin County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Hardin County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Hardin County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Hardin County?

Recording fees in Hardin County vary. Contact the recorder's office at (618) 287-2251 for current fees.

Questions answered? Let's get started!

In Illinois, a trustee's deed is used to transfer real property out of a trust. The deed is named for the person executing it -- the trustee. According to Black's Law Dictionary, 8th ed., a trustee is someone who, having legal title to property, holds it in trust for the benefit of another and owes a fiduciary duty to that beneficiary. A fiduciary is someone who must exercise a high standard of care in managing another's money or property.

The trustee's deed establishes basic information about the trust, such as the name and date of the trust document. The trustee serves as the grantor in the deed, and transfers the title into the grantee's name. As with all other conveyances of real property, the deed requires a legal description of the property being conveyed, as well as a Property Identification Number (PIN) and commonly known address. For a valid transfer, the trustee must sign the deed in the presence of a notary, who confirms (notarizes) the signature.

(Illinois Trustee Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Hardin County to use these forms. Documents should be recorded at the office below.

This Trustee Deed meets all recording requirements specific to Hardin County.

Our Promise

The documents you receive here will meet, or exceed, the Hardin County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Hardin County Trustee Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4601 Reviews )

Gail W.

September 19th, 2019

Deeds.com had the forms I needed, along with completed examples. Fast download. Easy to use site. Thanks!

Thank you!

Scott K.

July 2nd, 2022

The beneficiary deed was acceptable to the county clerk and my notarized official deed was mailed to me. The Missouri-based deed met with official approval so all is well in the land that time forgot.

Thank you!

John M.

November 18th, 2021

Just finished downloading all of the forms; so far so good

Thank you for your feedback. We really appreciate it. Have a great day!

Michael S.

December 22nd, 2020

I was very impressed. I needed a Grant Deed that would comply with Calif. law. I haven't tried to record it yet, but I think it's spot-on. References to statutes very helpful. I'm a retired Idaho attorney, and my first attempt was politely rejected by the recorder. (documentary transfer fee exemption, etc.)

Thank you!

Nancy E.

April 25th, 2023

Easy to complete. I would suggest, since it is 2 pages, make a bigger space for land descriptions & sources.

Thank you for your feedback. We really appreciate it. Have a great day!

Kim H.

October 17th, 2020

Great site. quick turnaround and communication. I needed an exception that they told me I needed and where to get the info within hours. I returned warranty deed with exception and the deed was recorded the same day! Great turnaround!

Thank you for your feedback. We really appreciate it. Have a great day!

Johnna G.

March 15th, 2021

Fantastic experience. Deeds.com worked with me on any corrections required by the county. Filing was super easy.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jennifer A.

May 20th, 2020

Great site

Thank you!

Ismael I.

April 10th, 2019

The service was fast and outstanding. Thank you.

Thank you!

Karen O.

June 2nd, 2021

I often think I am smarter than I am. Thankfully there are people that know what they are doing so I can focus on my business and the big picture without worrying about the little things.

Thank you!

Alan S.

May 26th, 2020

Quick, easy, and accurate. And if there's ever a problem, the resolution is also quick, easy, and accurate. The service is hard to beat.

Thank you for your feedback. We really appreciate it. Have a great day!

Shabaz W.

June 5th, 2020

Very convenient

Thank you!

Anna L W.

December 19th, 2021

Was insecure about being able to access the information but pleasantly found that the site was easy to use. Seems that I can use it repeatedly to go back and reprint the forms once I paid.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Willie P.

June 15th, 2022

got the forms needed plus all the information needed to fill them out.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Richard G.

March 17th, 2023

Easy to use. I was able to find out what I needed quickly and was able to download the information necessary.

Thank you!