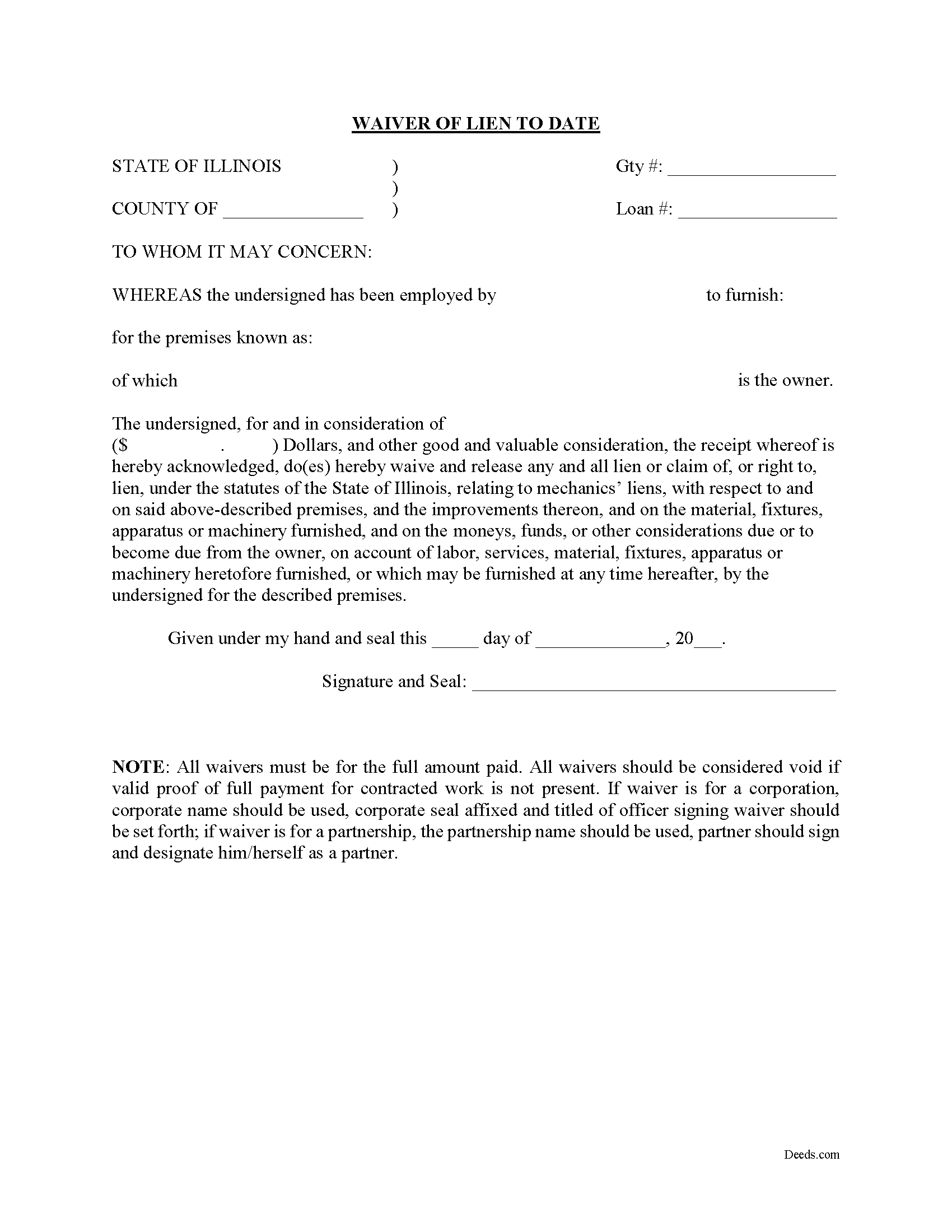

Hardin County Waiver of Lien to Date Form

Hardin County Waiver of Lien to Date Form

Fill in the blank Waiver of Lien to Date form formatted to comply with all Illinois recording and content requirements.

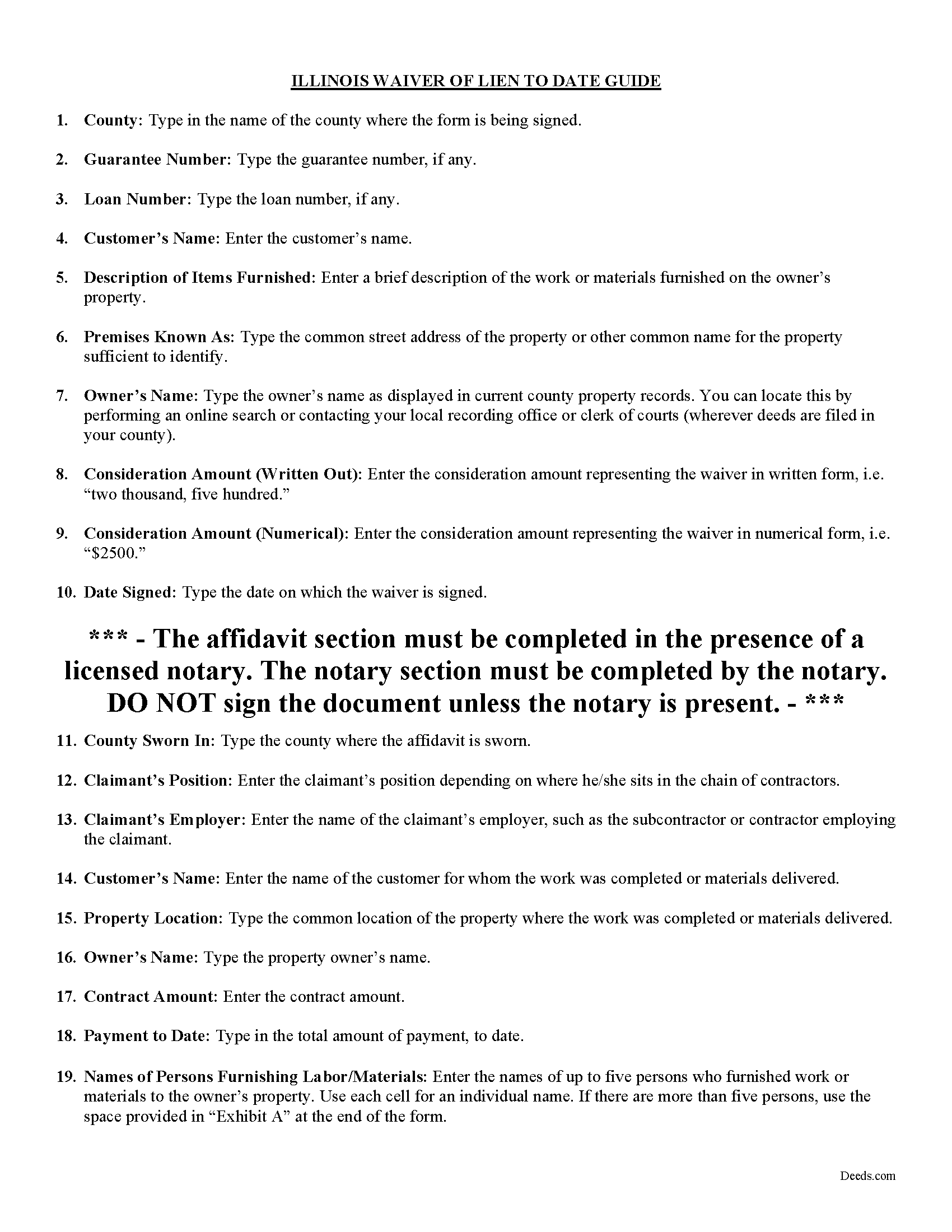

Hardin County Waiver of Lien to Date Guide

Line by line guide explaining every blank on the form.

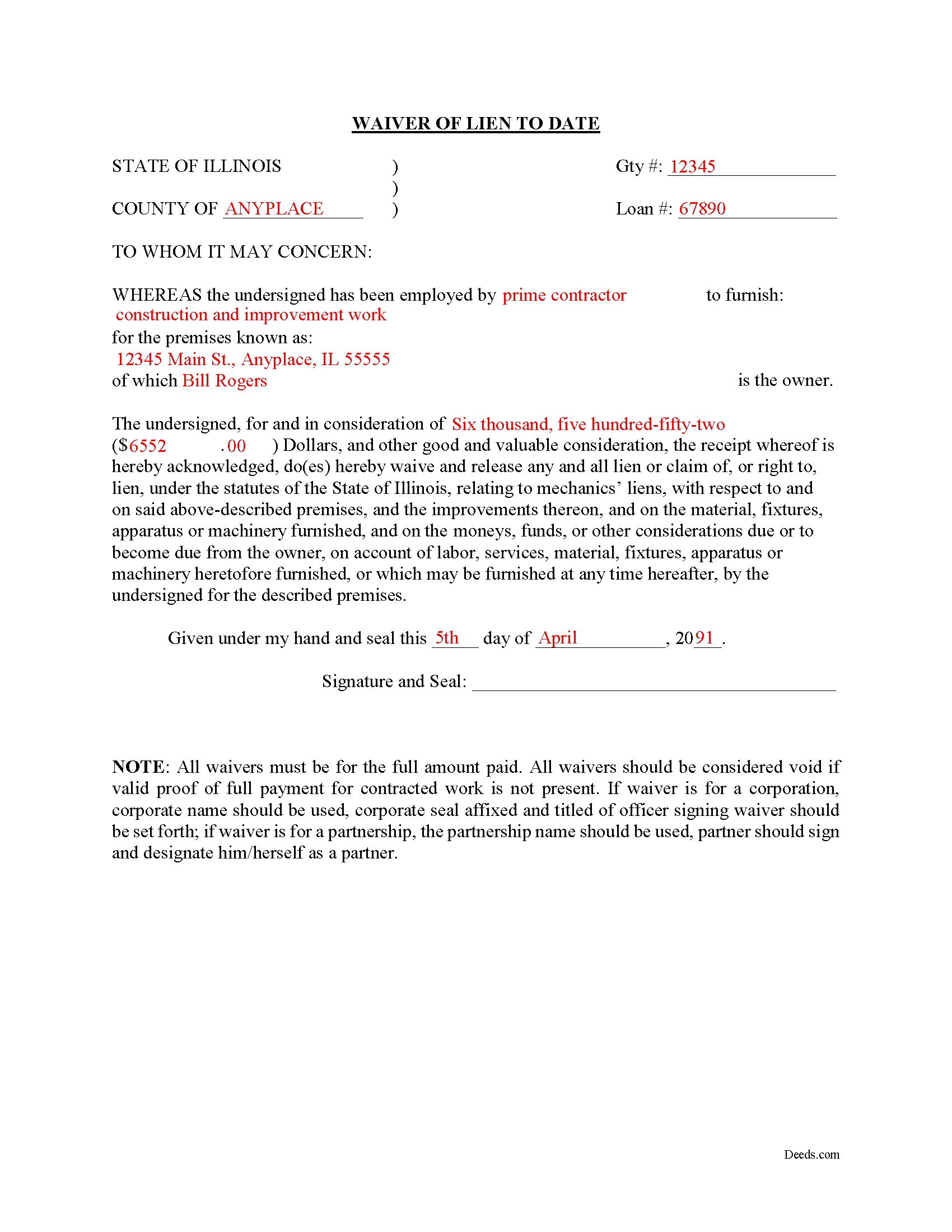

Hardin County Completed Example of the Waiver of Lien to Date Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Illinois and Hardin County documents included at no extra charge:

Where to Record Your Documents

Hardin County Clerk/Recorder - Courthouse

Elizabethtown, Illinois 62931

Hours: 8:00 to 4:00 Monday through Friday

Phone: (618) 287-2251

Recording Tips for Hardin County:

- Recorded documents become public record - avoid including SSNs

- Make copies of your documents before recording - keep originals safe

- Both spouses typically need to sign if property is jointly owned

- Avoid the last business day of the month when possible

- If mailing documents, use certified mail with return receipt

Cities and Jurisdictions in Hardin County

Properties in any of these areas use Hardin County forms:

- Cave In Rock

- Elizabethtown

- Karbers Ridge

- Rosiclare

Hours, fees, requirements, and more for Hardin County

How do I get my forms?

Forms are available for immediate download after payment. The Hardin County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Hardin County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Hardin County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Hardin County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Hardin County?

Recording fees in Hardin County vary. Contact the recorder's office at (618) 287-2251 for current fees.

Questions answered? Let's get started!

Under 770 ILCS 60, Illinois' Mechanic's Lien Act, lien waivers are a type of document used between a contractor (including a sub or general) and a property owner to induce or encourage final or partial payments in exchange for forfeiting the claimant's right to a mechanic's lien.

A lien waiver is useful for property owners because it assures them that a lien will not be placed on their property, and for contractors because presenting the waiver can encourage the owner to pay. Therefore, a waiver offers a quid pro quo arrangement with benefits for both sides. Waivers can be conditional, meaning they go into effect based upon actual receipt of payment as a triggering event, or unconditional, meaning the waiver takes effect upon being sent to the owner or prime contractor.

The Waiver of Lien to Date is for a subcontractor and contractor to sign upon receipt of a partial payment from the customer. The parties should ensure the payment has been made (meaning any check has been deposited and cleared) before signing the waiver. The Waiver of Lien to Date includes an affidavit to be completed by the contractor listing all parties contracted with, the contract amounts, payment amounts, and balance remaining due. Finally, sign the completed lien waiver in front of a notary public.

Contact an attorney for more information about lien waivers, or any other issues related to mechanic's liens in Illinois.

Important: Your property must be located in Hardin County to use these forms. Documents should be recorded at the office below.

This Waiver of Lien to Date meets all recording requirements specific to Hardin County.

Our Promise

The documents you receive here will meet, or exceed, the Hardin County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Hardin County Waiver of Lien to Date form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4578 Reviews )

Marlin M.

March 10th, 2025

all round GREAT!

Always great to hear kind words from such a long time customer Marlin, thank you.

Arthur M.

December 8th, 2020

A good service that saves a lot of time and precludes making a trip to the County Assessors Office. Valuable service.

Thank you!

Ken S.

March 14th, 2019

Easy to downloand. Instructions were helpful and easy to follow. Made the process a lot easier for me.

Thanks Ken.

John G.

August 6th, 2019

Great on line help with the recording process!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Christina H.

April 15th, 2021

The process was straightforward, quick and reasonably priced. The agents provided updates every step of the way.

Thank you!

david t.

January 15th, 2019

No review provided.

Thank you!

Joan L. W.

June 9th, 2021

Excellent Service

Thank you!

Michael B.

May 25th, 2021

Download was easy to complete, but difficult to revisit site to review purchased forms on line. Suggest you download everything at one sitting to make sure you get everything you need from your purchase.

Thank you!

CARRIE T.

March 10th, 2022

Thought it was pretty simple to use.

Thank you!

Gene J.

September 6th, 2019

Easy to pay for, hard to download. A zip file containing all the forms would be a great addition. Your warning under the Review box needs help: see Your review may displayed publicly so please do not include any personal information.

Thank you for your feedback. We really appreciate it. Have a great day!

JOHN H.

July 20th, 2022

It was simple and fast thanks so much.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

David H.

August 21st, 2019

Rapid, excellent service. This definitely beats the old way of trying to obtain public documents from LA County. Great improvement!

Thank you!

James M.

August 30th, 2022

Just what I needed to help clear ownership of what has been deeded to be by inheritance

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Nancy H.

December 31st, 2018

Site was excellent and saved a trip to the County office to pick up forms.

Thank you Nancy. Glad we could help. Have a great day!

donald h.

January 26th, 2019

very informative and thank everyone involved,my deed needed to be changed and will adjusted.

Thank you!