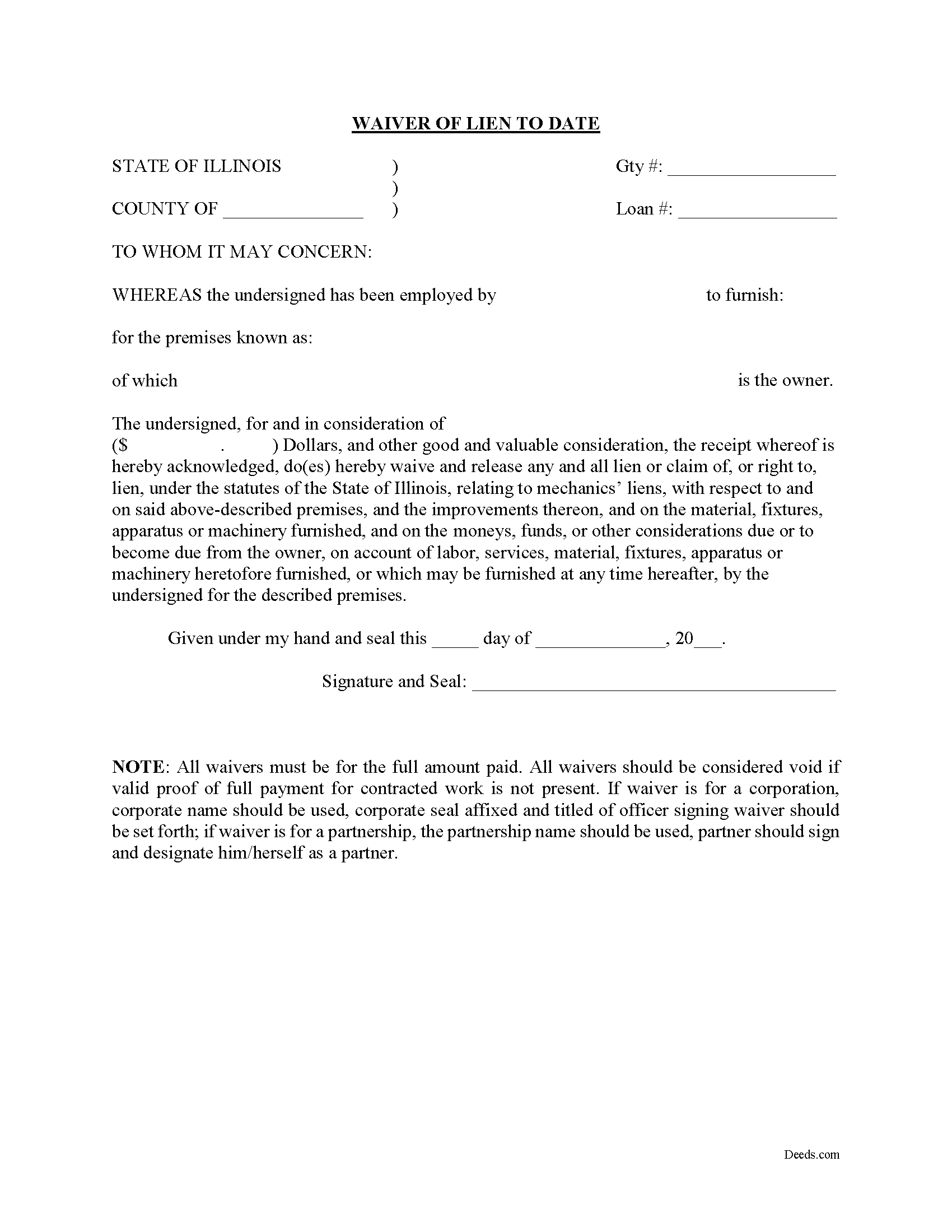

Jersey County Waiver of Lien to Date Form

Jersey County Waiver of Lien to Date Form

Fill in the blank Waiver of Lien to Date form formatted to comply with all Illinois recording and content requirements.

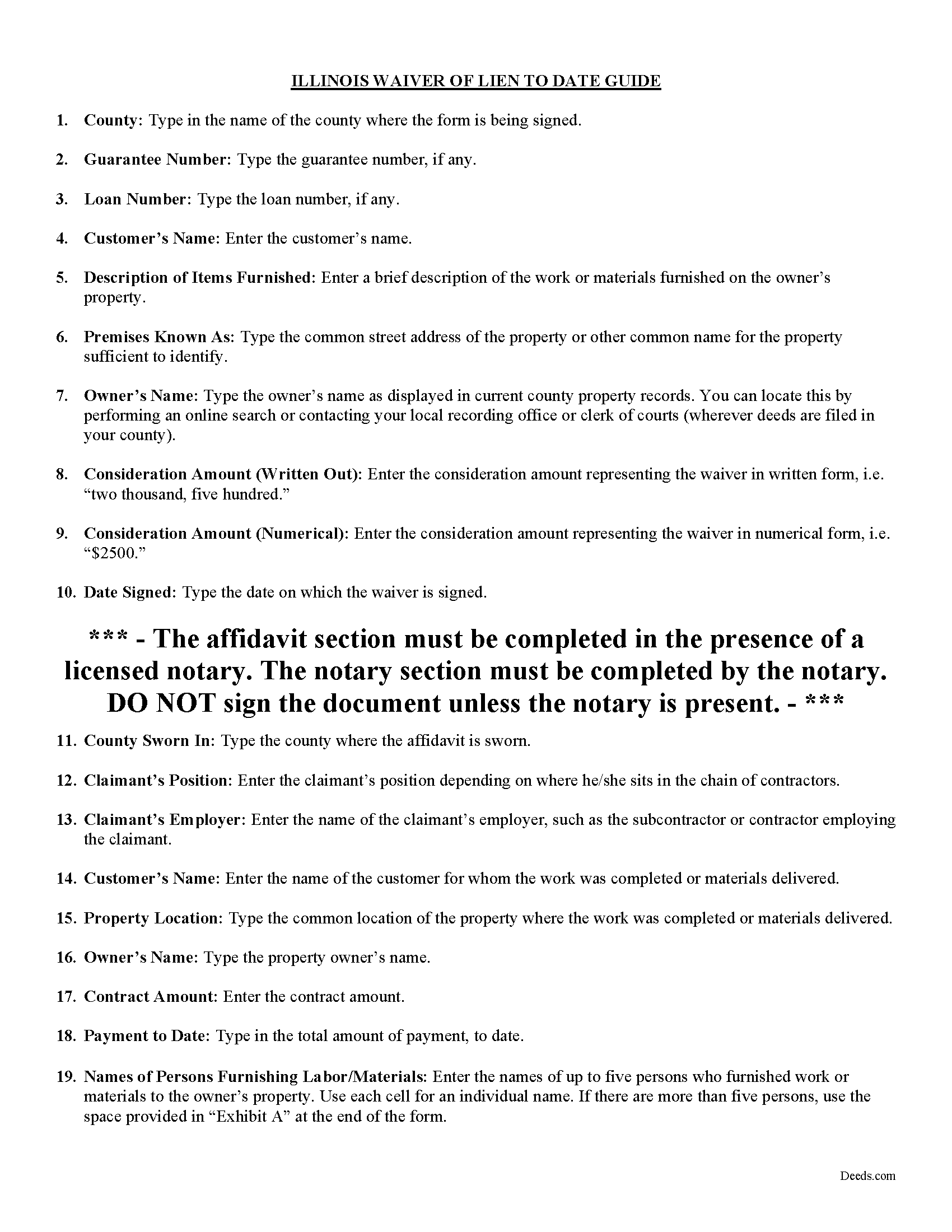

Jersey County Waiver of Lien to Date Guide

Line by line guide explaining every blank on the form.

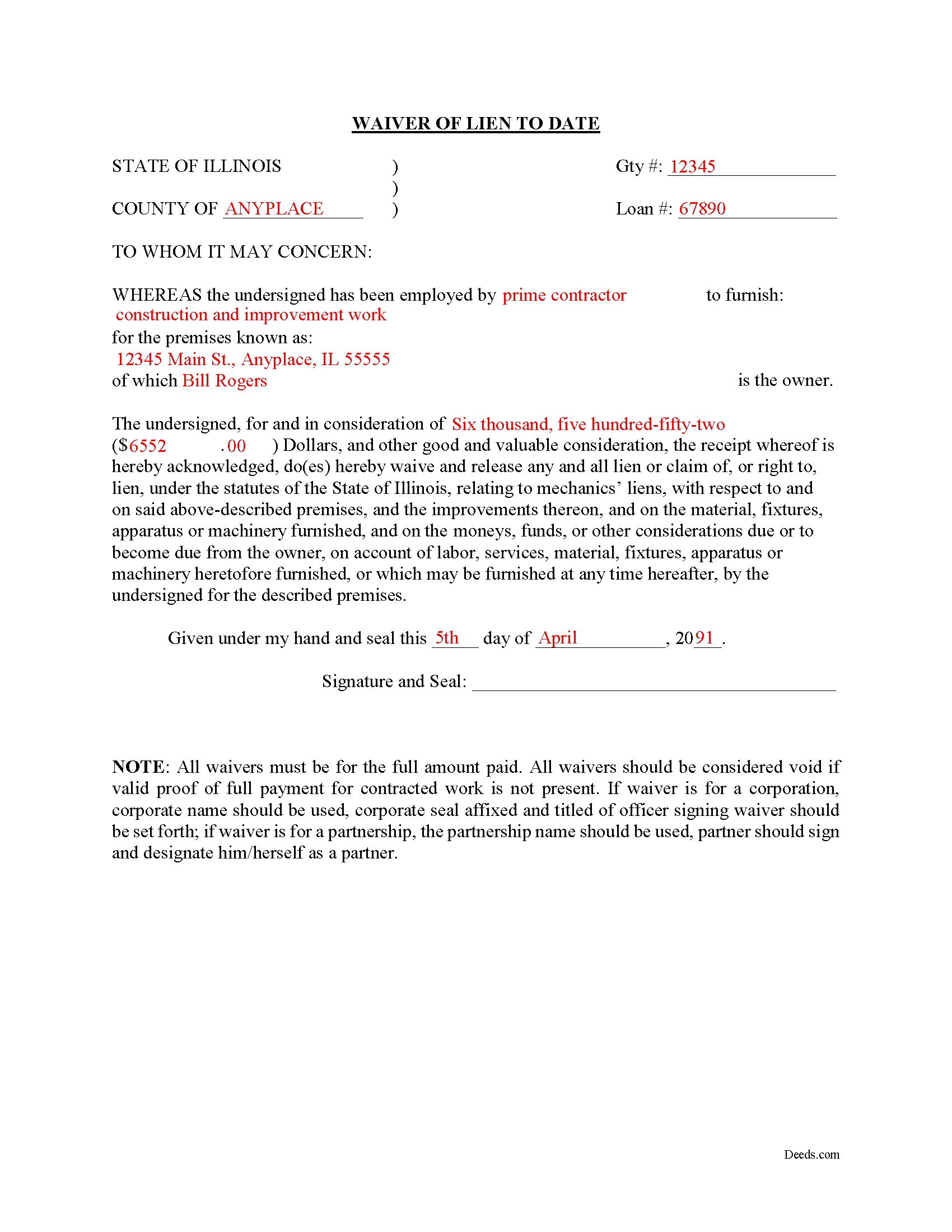

Jersey County Completed Example of the Waiver of Lien to Date Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Illinois and Jersey County documents included at no extra charge:

Where to Record Your Documents

Jersey County Clerk/Recorder

Jerseyville, Illinois 62052

Hours: 8:00 am to 4:00pm Monday through Thursday, and 8:00am to 12 Noon on Fridays

Phone: (618) 498-5571 Ext 117 & 118

Recording Tips for Jersey County:

- White-out or correction fluid may cause rejection

- Check that your notary's commission hasn't expired

- Documents must be on 8.5 x 11 inch white paper

- Verify all names are spelled correctly before recording

- Bring extra funds - fees can vary by document type and page count

Cities and Jurisdictions in Jersey County

Properties in any of these areas use Jersey County forms:

- Dow

- Elsah

- Fidelity

- Fieldon

- Grafton

- Jerseyville

- Medora

Hours, fees, requirements, and more for Jersey County

How do I get my forms?

Forms are available for immediate download after payment. The Jersey County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Jersey County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Jersey County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Jersey County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Jersey County?

Recording fees in Jersey County vary. Contact the recorder's office at (618) 498-5571 Ext 117 & 118 for current fees.

Questions answered? Let's get started!

Under 770 ILCS 60, Illinois' Mechanic's Lien Act, lien waivers are a type of document used between a contractor (including a sub or general) and a property owner to induce or encourage final or partial payments in exchange for forfeiting the claimant's right to a mechanic's lien.

A lien waiver is useful for property owners because it assures them that a lien will not be placed on their property, and for contractors because presenting the waiver can encourage the owner to pay. Therefore, a waiver offers a quid pro quo arrangement with benefits for both sides. Waivers can be conditional, meaning they go into effect based upon actual receipt of payment as a triggering event, or unconditional, meaning the waiver takes effect upon being sent to the owner or prime contractor.

The Waiver of Lien to Date is for a subcontractor and contractor to sign upon receipt of a partial payment from the customer. The parties should ensure the payment has been made (meaning any check has been deposited and cleared) before signing the waiver. The Waiver of Lien to Date includes an affidavit to be completed by the contractor listing all parties contracted with, the contract amounts, payment amounts, and balance remaining due. Finally, sign the completed lien waiver in front of a notary public.

Contact an attorney for more information about lien waivers, or any other issues related to mechanic's liens in Illinois.

Important: Your property must be located in Jersey County to use these forms. Documents should be recorded at the office below.

This Waiver of Lien to Date meets all recording requirements specific to Jersey County.

Our Promise

The documents you receive here will meet, or exceed, the Jersey County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Jersey County Waiver of Lien to Date form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4583 Reviews )

Larry T.

May 19th, 2023

Excellent service!!!!! A 5STAR

Thanks Larry! We appreciate you.

michele d.

July 31st, 2022

It was easy to download, received it quickly, the sample really helped. I would like if some of the text was editable. for instance - the addresses were defaulted with the state of filing while we lived in another one.

Thank you for your feedback. We really appreciate it. Have a great day!

Kristina H.

January 23rd, 2020

Everything I needed to complete my release of lien was easy to obtain from Deed.com - and the example and instructions were helpful as well. The website is simple and efficient. Thanks!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Joseph B.

September 8th, 2022

All very good

Thank you!

David M.

January 13th, 2023

Outstanding products and interface. DCM, IL Attorney

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Suhila C.

August 23rd, 2020

This site is awesome. It has everything I need to purchase and sell (transfer deed ownership) land and property. I cannot wait to get our new land and building for business. Thanks, Suhila

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Charlotte K.

August 31st, 2022

Really a simple, quick, professional experience!

Thank you!

Dianne J.

January 23rd, 2021

Thought we would just do a quit claim to remove a name on a deed but after read your instruction and all that is needed we decided to meet with a lawyer. Appreciate all the info that you supplied.

Glad to hear that Dianne. We always recommend seeking the advice of a professional if you are not completely sure of what you are doing. Have a great day!

Barbara G.

May 12th, 2021

High rating, great site and forms were exactly what I needed. Thanks for being there for me.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Debra W.

January 13th, 2021

I was trying to get a lien released for the last 3 month with Maricopa County and once I utilized your system it was complete within 24 hours of my filing. Great company and customer service, thank you!

Thank you for your feedback. We really appreciate it. Have a great day!

Bobbie N.

February 24th, 2022

Thank you so much for making the site so easy to use.

Thank you for your feedback. We really appreciate it. Have a great day!

DOUGLAS H.

December 16th, 2020

Just as promised My quitclaim deed went through the county recorders office with no problem.

Thank you for your feedback. We really appreciate it. Have a great day!

David M.

July 30th, 2022

Very easy to use and modify if necessary. Spot on with each county requirement for recording and Notarizing

Thank you for your feedback. We really appreciate it. Have a great day!

Cynthia M.

July 5th, 2019

I wanted the Lady Bird Deed for my estate, and it was very easy to download, fill out and file. My county records department accepted it with no issue. Thank you Deeds.com! You saved me over $500.00!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Ronney O.

December 16th, 2021

Great Experience

We appreciate your business and value your feedback. Thank you. Have a wonderful day!