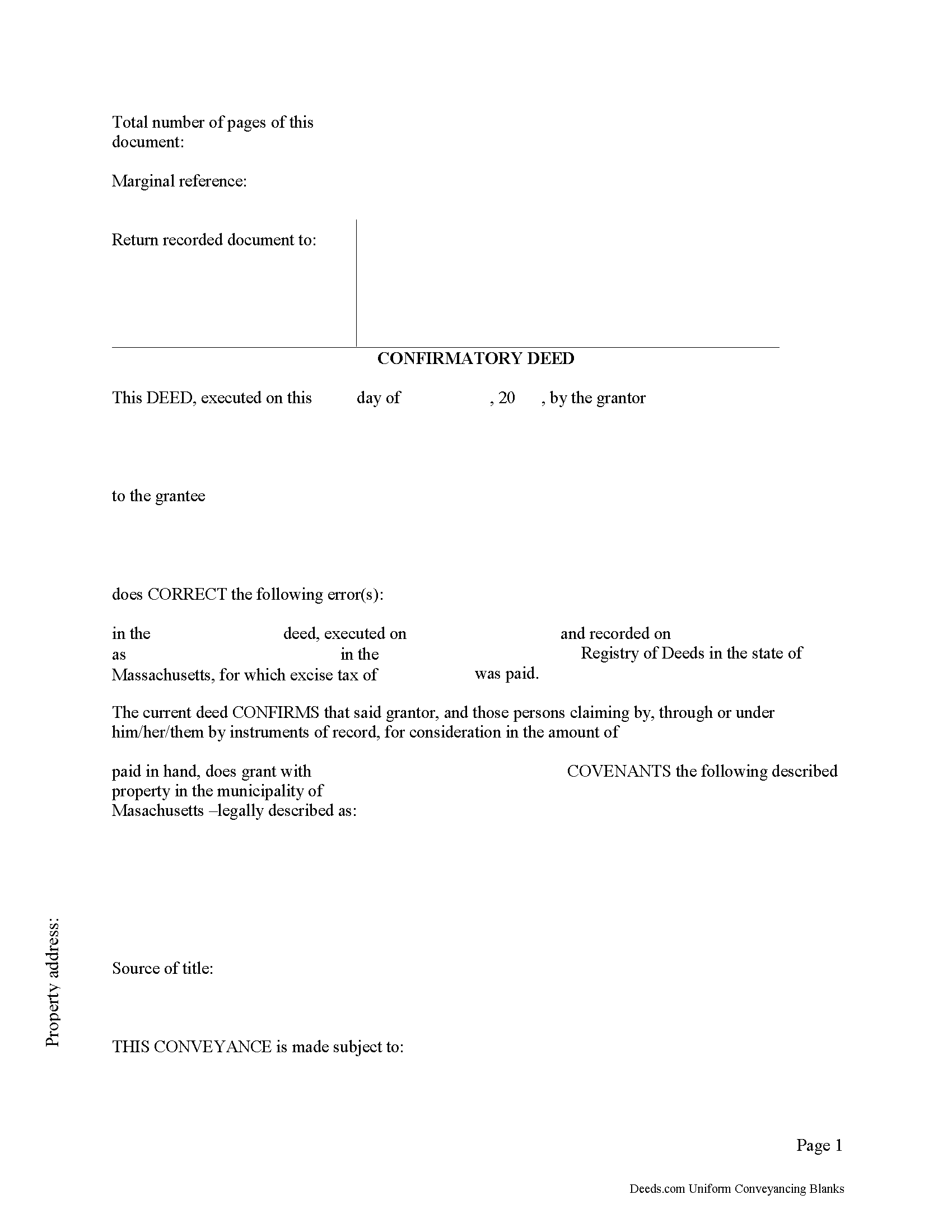

Plymouth County Correction Deed Form

Plymouth County Correction Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

Plymouth County Correction Deed Guide

Line by line guide explaining every blank on the form.

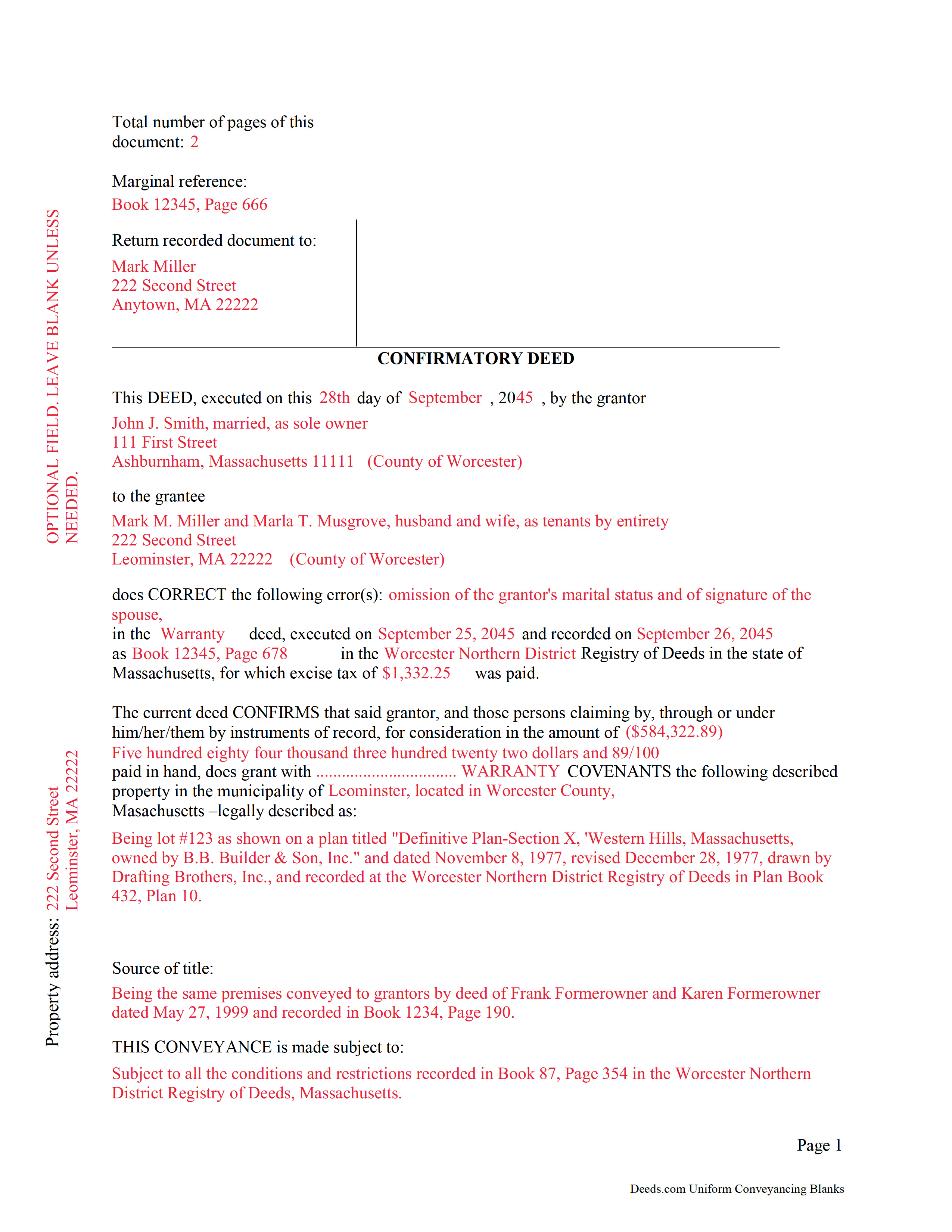

Plymouth County Completed Example of a Correction Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Massachusetts and Plymouth County documents included at no extra charge:

Where to Record Your Documents

Plymouth - Main Office with Land Court

Plymouth, Massachusetts 02360

Hours: 8:15 to 4:30 M-F / Recording until 4:00

Phone: (508) 830-9200

Brockton Satellite Office

Brockton, Massachusetts 02301

Hours: 8:30 to 12:00 & 12:45 to 4:15 M-F / Recording until 4:00

Phone: (508) 830-9200

Rockland Satellite Office

Rockland, Massachusetts 02370

Hours: 8:30 to 12:00 & 12:45 to 4:15 M-F / Recording until 4:00

Phone: (508) 830-9200

Recording Tips for Plymouth County:

- Ask if they accept credit cards - many offices are cash/check only

- Both spouses typically need to sign if property is jointly owned

- Leave recording info boxes blank - the office fills these

Cities and Jurisdictions in Plymouth County

Properties in any of these areas use Plymouth County forms:

- Abington

- Accord

- Brant Rock

- Bridgewater

- Brockton

- Bryantville

- Carver

- Duxbury

- East Bridgewater

- East Wareham

- Elmwood

- Green Harbor

- Greenbush

- Halifax

- Hanover

- Hanson

- Hingham

- Hull

- Humarock

- Kingston

- Lakeville

- Manomet

- Marion

- Marshfield

- Marshfield Hills

- Mattapoisett

- Middleboro

- Minot

- Monponsett

- North Carver

- North Marshfield

- North Pembroke

- North Scituate

- Norwell

- Ocean Bluff

- Onset

- Pembroke

- Plymouth

- Plympton

- Rochester

- Rockland

- Scituate

- South Carver

- Wareham

- West Bridgewater

- West Wareham

- White Horse Beach

- Whitman

Hours, fees, requirements, and more for Plymouth County

How do I get my forms?

Forms are available for immediate download after payment. The Plymouth County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Plymouth County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Plymouth County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Plymouth County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Plymouth County?

Recording fees in Plymouth County vary. Contact the recorder's office at (508) 830-9200 for current fees.

Questions answered? Let's get started!

Use the confirmatory deed to correct an error in a warranty or quitclaim deed in Massachusetts.

A corrective or confirmatory deed is in effect an explanation and correction of an error in a prior instrument and passes no title. It should be executed from the original grantor to the original grantee, and it needs to be recorded, which in Massachusetts constitutes delivery of the deed. The date of the conveyance will remain unchanged, and the correction has retroactive effect, that is, it is valid as of the date of the original instrument even though it has a different execution date.

The confirmatory deed must reference the original conveyance it is correcting by type of error, date of execution and recording, and recording number and location. Beyond that, it restates the information given in the prior deed, thus reiterating and confirming it. No additional excise tax is required for such a deed, but the tax paid on the prior conveyance should be indicated.

Deeds of confirmation are most appropriate for minor errors and omissions in the original deed, such as misspelled names, omission of marital status, or typos in the legal description. More substantial changes, such as adding a name to the title, changing the vesting information or the legal description of the property, require a new deed of conveyance instead of a confirmatory deed.

(Massachusetts CD Package includes form, guidelines, and completed example)

Important: Your property must be located in Plymouth County to use these forms. Documents should be recorded at the office below.

This Correction Deed meets all recording requirements specific to Plymouth County.

Our Promise

The documents you receive here will meet, or exceed, the Plymouth County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Plymouth County Correction Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4577 Reviews )

Linda W.

April 21st, 2020

The Quitclaim deed form was fine. Unfortunately, all I wanted to accomplish was to transfer property held in my name into my trust, but I could not any wording on the information you provided on how to accomplish this. It was not a sale, just a transfer from me to me as trustee.

Thank you for your feedback. We really appreciate it. Have a great day!

EVE A.

October 31st, 2022

Site was easy to navigate. I found the lien discharge form I was looking for immediately and the download and completion was simple. Thank you for having a great site.

Thank you for your feedback. We really appreciate it. Have a great day!

Nancy R.

June 5th, 2022

I AM NOT TOO SMART WHEN IT COMES TO COMPUTER STUFF, BUT THIS WEBSITE MADE IT SO VERY EASY & SIMPLE TO ACCOMPLISH THE TASK THAT WAS NEEDED. I FOUND MY STATE, FOUND THE TYPE OF DEED I NEEDED, FILLED IN THE BLANKS, PRINTED IT OUT & THEN GOT THE REQUIRED SIGNATURES WITNESSED & NOTARIZED -- EASY-PEASY! I WILL BE USING DEEDS.COM IN THE FUTURE & WILL CERTAINLY RECOMMEND IT TO FRIENDS & FAMILY. I REALLY APPRECIATED ALL THE OTHER FORMS OF EXPLANATION THEY GIVE YOU AS WELL AS AN EXAMPLE OF HOW YOUR COMPLETED DOCUMENT SHOULD LOOK ONCE YOU'RE FINISHED.

Thank you for your feedback. We really appreciate it. Have a great day!

Candy A.

June 27th, 2020

Super simple to download all necessary forms. BIG thank you for this service.

Thank you!

John D.

September 30th, 2020

I was quite impressed by the quality of your documents and the ease of the download.

Thank you for your feedback. We really appreciate it. Have a great day!

Tarik W.

July 20th, 2021

Excellent customer service!!!!!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Vanessa G.

January 9th, 2024

Quick, painless, and they communicated with me during the entire process. I will certainly be suing them again.

We are delighted to have been of service. Thank you for the positive review!

Barbara W.

June 9th, 2021

Easy website to navigate. Found the form I needed within seconds. Thank you

Thank you for your feedback. We really appreciate it. Have a great day!

Janice S.

February 28th, 2019

Really easy downloading the forms the directions everything was really easy thanks!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Bill M.

March 10th, 2021

PROS: Quick communication. Completed the task expediently. CONS: Deciphering what was being referred to on the website when needing the proper classification wasn't clear. Had to delve through your unfamiliar territory. But managed. OVERALL: Got the job done swiftly and the end result was satisfactory. Will use again.

Thank you!

Hanne R.

November 17th, 2020

excellent

Thank you!

Susan G.

January 11th, 2025

Very easy to use!

We are thankful for your continued support and feedback, which inspire us to continuously improve. Thank you..

Rhobe M.

May 8th, 2023

Very user friendly site. I was able to get the information I needed fast.

Thank you!

Jubal T.

November 27th, 2024

This is the most comprehensive, helpful real estate tool I have seen. I was at first worried because the 330# didn’t have live operators but I received messages in my account as quickly as a conversation had by text and was able to download a deed and record it the same day in a county 1,300 miles away. Highly recommended!

We are sincerely grateful for your feedback and are committed to providing the highest quality service. Thank you for your trust in us.

Rosanne E.

October 8th, 2020

Excellent response and all went well with downloading documents. Thank you for offering this important service.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!