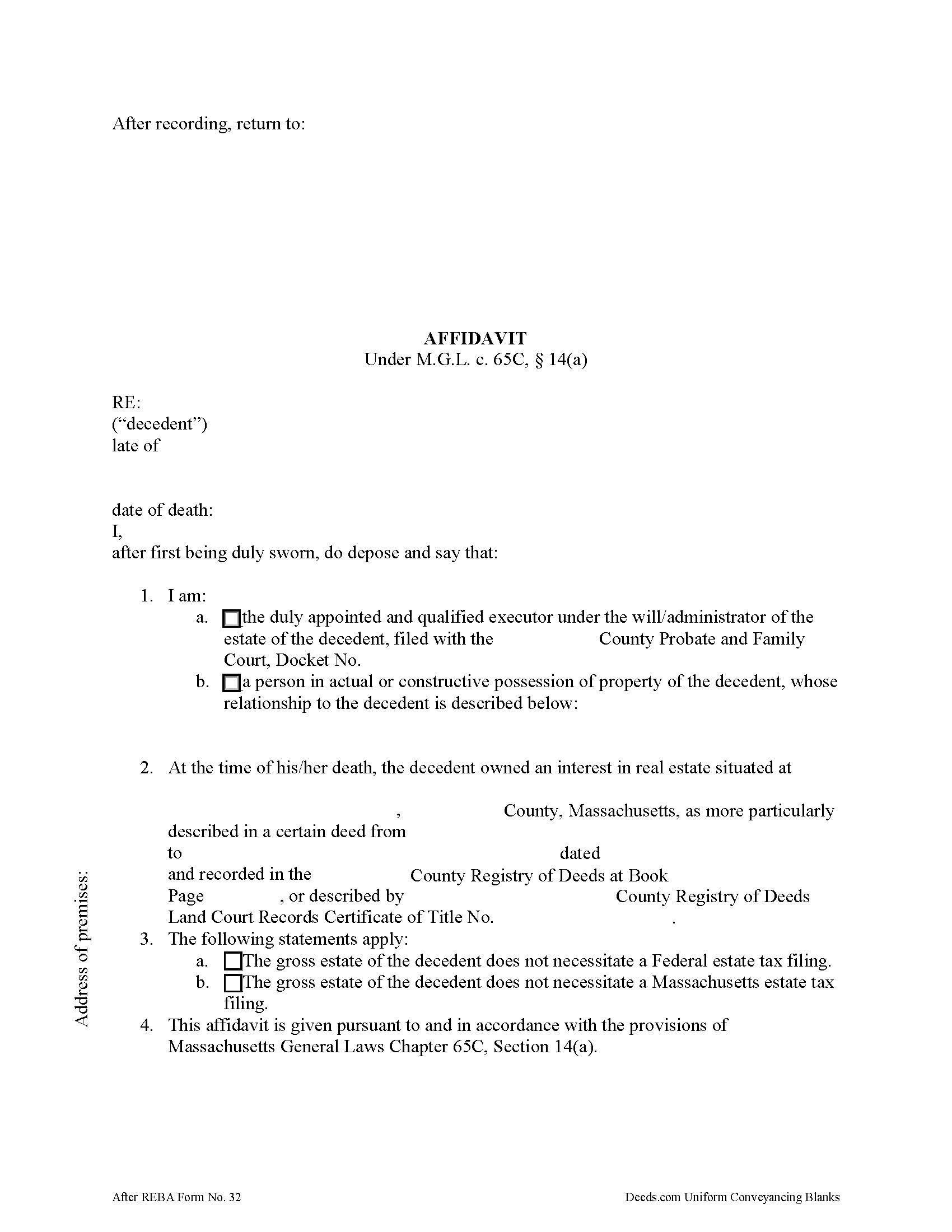

Hampshire County Estate Tax Affidavit Form

Hampshire County Estate Tax Affidavit Form

Fill in the blank form formatted to comply with all recording and content requirements.

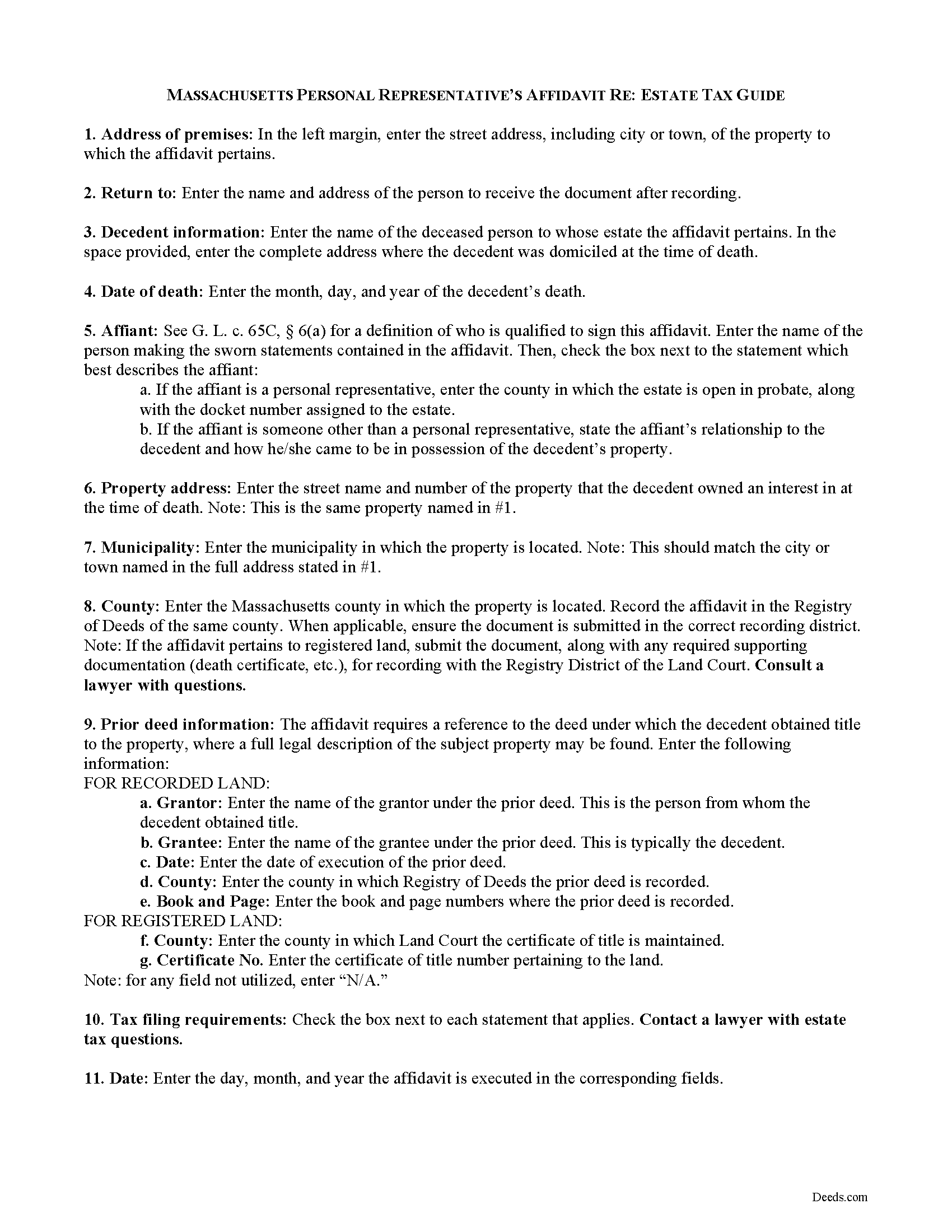

Hampshire County Estate Tax Affidavit Guide

Line by line guide explaining every blank on the form.

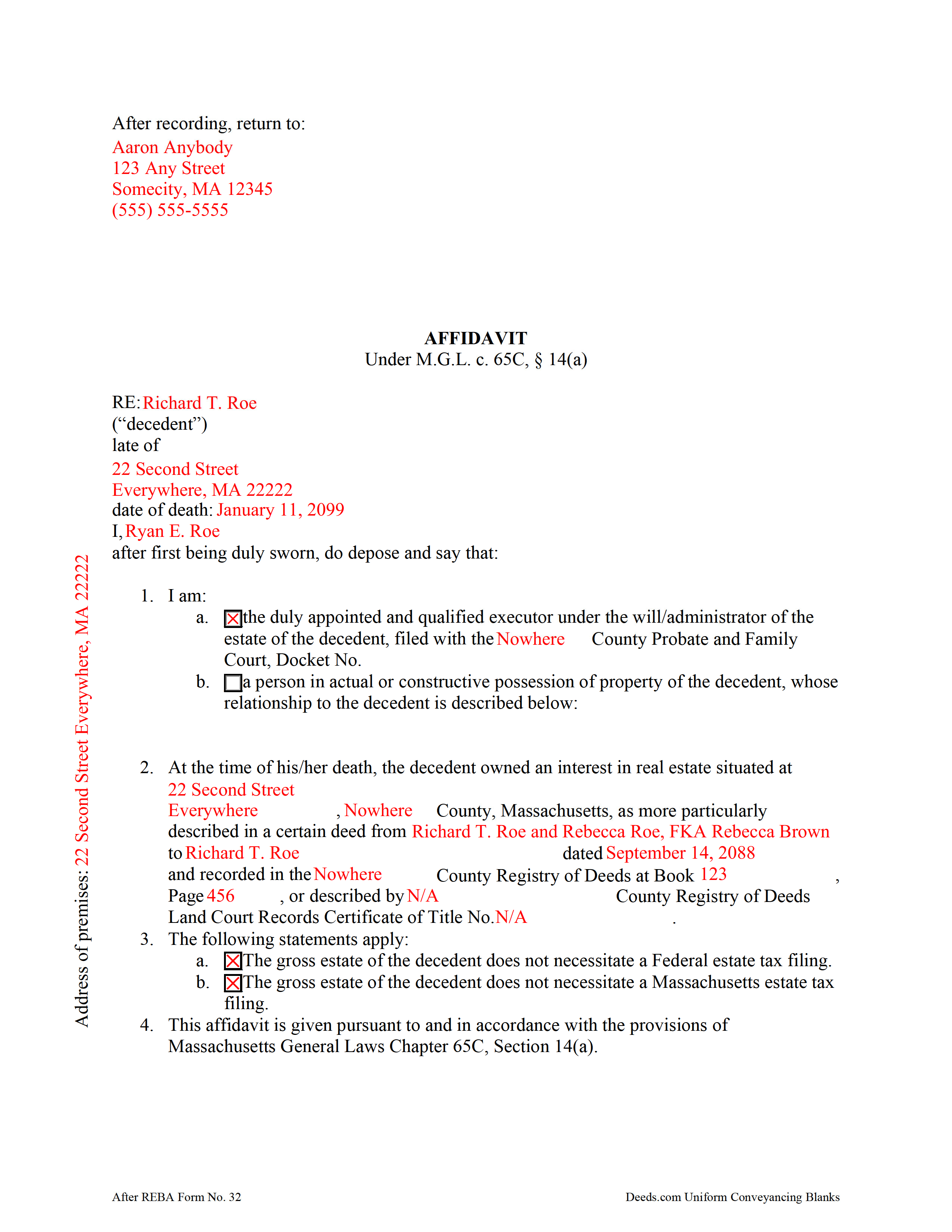

Hampshire County Completed Example of the Estate Tax Affidavit Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Massachusetts and Hampshire County documents included at no extra charge:

Where to Record Your Documents

Hampshire Registry of Deeds

Northampton, Massachusetts 01060

Hours: Mon-Fri 8:30 to 4:30 / Recording until 4:00

Phone: (413) 584-3637

Recording Tips for Hampshire County:

- Ensure all signatures are in blue or black ink

- White-out or correction fluid may cause rejection

- Request a receipt showing your recording numbers

- Recorded documents become public record - avoid including SSNs

Cities and Jurisdictions in Hampshire County

Properties in any of these areas use Hampshire County forms:

- Amherst

- Belchertown

- Chesterfield

- Cummington

- Easthampton

- Florence

- Goshen

- Granby

- Hadley

- Hatfield

- Haydenville

- Huntington

- Leeds

- Middlefield

- North Amherst

- North Hatfield

- Northampton

- Plainfield

- South Hadley

- Southampton

- Ware

- West Chesterfield

- West Hatfield

- Williamsburg

- Worthington

Hours, fees, requirements, and more for Hampshire County

How do I get my forms?

Forms are available for immediate download after payment. The Hampshire County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Hampshire County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Hampshire County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Hampshire County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Hampshire County?

Recording fees in Hampshire County vary. Contact the recorder's office at (413) 584-3637 for current fees.

Questions answered? Let's get started!

In Massachusetts, upon death, a lien attaches to a decedent's real property for ten years, or until the estate tax is paid, or an affidavit showing that the decedent's gross estate does not require an estate tax filing is recorded by a personal representative (or other qualified person under G. L. c. 65C, 6(a)) in the Registry of Deeds.

Use the affidavit of estate tax under M.G.L. c. 65C, 14(a) to release the lien on the decedent's property. The affidavit should include the name, address, and date of death of the decedent. The affiant shall indicate whether he/she is the personal representative of the decedent's probated estate, or, if the property is not subject to probate, then the affiant's relationship to the decedent.

The document's recitals also include the address of the premises affected and the prior instrument containing a legal description of the property. All statements contained within the affidavit are made by the affiant on penalty of perjury and sworn to before a notary public.

Contact a lawyer with questions about the Massachusetts estate tax and affidavits relating to decedents' estates in the Commonwealth of Massachusetts.

(Massachusetts ETA Package includes form, guidelines, and completed example)

Important: Your property must be located in Hampshire County to use these forms. Documents should be recorded at the office below.

This Estate Tax Affidavit meets all recording requirements specific to Hampshire County.

Our Promise

The documents you receive here will meet, or exceed, the Hampshire County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Hampshire County Estate Tax Affidavit form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4574 Reviews )

Lloyd T.

September 13th, 2023

Example deed given did not apply to married couples as joint owners with both being grantors. The example and directions also did not show how to write more than one grantee as equal grantees. Both would have been helpful when husband and wife are granting their property to their children equally. Also when attaching the exhibit A with the property description the example did not say "see exhibit A"in the property description area, so I didn't write that. Luckily the recorder of deeds allowed me to write it in. I think directions and examples for multiple scenarios would be helpful.

Thank you for your feedback. We really appreciate it. Have a great day!

Denise B.

September 3rd, 2020

Quick and easy!

Thank you Denise. We appreciate you.

Rosemary W.

February 27th, 2021

considering the current epidemic your fees save me time and parking fees. with help from DC recorder of deeds I was directed to the correct link to process my deed

Thank you for your feedback. We really appreciate it. Have a great day!

Don R.

January 26th, 2022

From Pennsylvania here. Documents are great and easy to fill out however you are lacking a couple of things. You only provide the option for a Grant Deed when you purchase by your county which is Mercer County for me. Why not give the ability to get a Warranty Deed that better protects the Grantee? Also, being from Pennsylvania and in a county that mined Buituminous Coal we are required to include the Coal Severance Notice and Bituminous Mine Subsidence and Land Conservation Act Notice. You can check the box on your Deed form that they are required and attached but you do not provide the verbiage or form for this. You state that you know what each county requires and include everything required but you do not include these two required Notices. This has been a requirement for years and the wording never changes. I had to look for these Notices and hand type this information and include it on another seperate page after the Notary section on the Deed. The Grantor has to sign the Coal Severance Notice and be witnessed by a Notary so I had to add another place for the Notary and will have to pay twice for witnessed signatures when it could have been included in your document. My Deed from 2003 was done that way and then the Notary statement after that so it was only one notarized witness of signature.

Thank you for your feedback. We really appreciate it. Have a great day!

Roy B.

January 30th, 2021

Convenient yes, expensive "big YES" and with what I paid to record a lien it cost me close to $50. That seems quite exorbitant in my estimation!!

Thank you for your feedback. We really appreciate it. Have a great day!

Marci C.

November 6th, 2024

Excellent Service! Quick and easy! Will definitely be using again!

Knowing our customers are happy is our top priority. Thank you for the wonderful feedback!

Jim B.

December 22nd, 2021

Would be great if you would just put all of these documents into ONE .pdf.

Thank you for your feedback. We really appreciate it. Have a great day!

Richard R.

November 14th, 2019

Very straightforward, and fair-enough pricing.

Thank you!

Nina F.

September 23rd, 2020

My experience could not have been better. Easy to communicate with, even though I'm largely ignorant of technical problem-solving. I may be addle-minded with 83 years on earth, but I think they actually cared about solving my problem and were sorry it was beyond their territory. Truly extra nice.

Thank you for your feedback. We really appreciate it. Have a great day!

Rysta W.

June 29th, 2021

Very easy to use and great price.

Thank you for your feedback. We really appreciate it. Have a great day!

irene a.

February 8th, 2019

good forms thanks, irene

Thank you Irene.

Samuel T.

June 26th, 2021

So far, so good. explanations provided for the forms and instructions on how I should proceed were clear as a bell, and it was nice to get immediate delivery of the forms. I'll be looking for other ways to take advantage of this site, for sure.

Thank you!

Katherine H.

March 30th, 2023

extremely thorough by covering all bases, easy to understand, direct access, fair price with no strings attached. I recommend the service to everyone.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Christopher G.

August 12th, 2019

couldn't find what I was looking for.

Thank you for your feedback Christopher, sorry to hear that you couldn't find what you were looking for. Have a wonderful day.

Kevin E.

May 15th, 2019

Great app works very well thank you very much

Thank you!