Bristol County Quitclaim Deed with Covenants Form

Bristol County Quitclaim Deed with Covenants Form

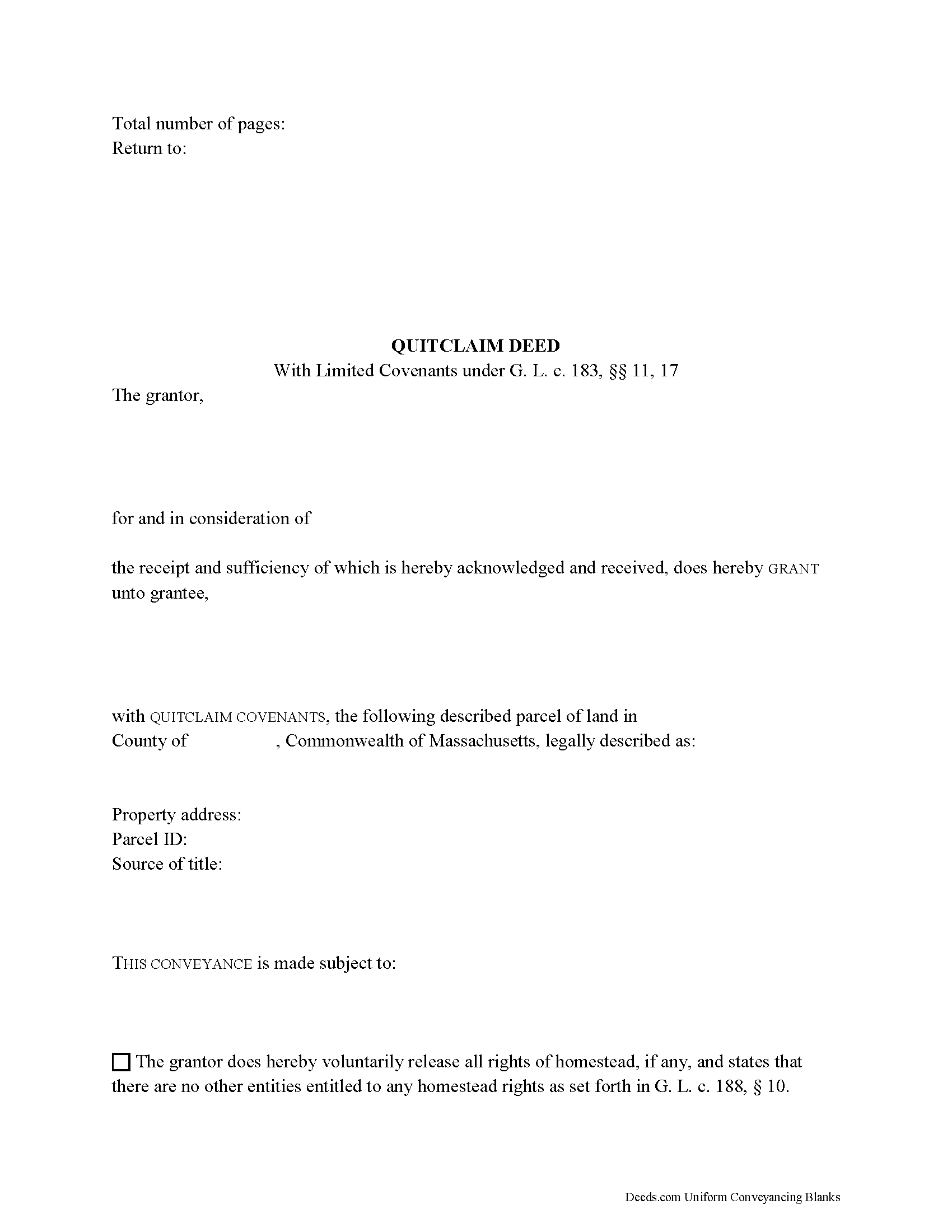

Fill in the blank Quitclaim Deed with Covenants form formatted to comply with all Massachusetts recording and content requirements.

Bristol County Quitclaim Deed with Covenants Guide

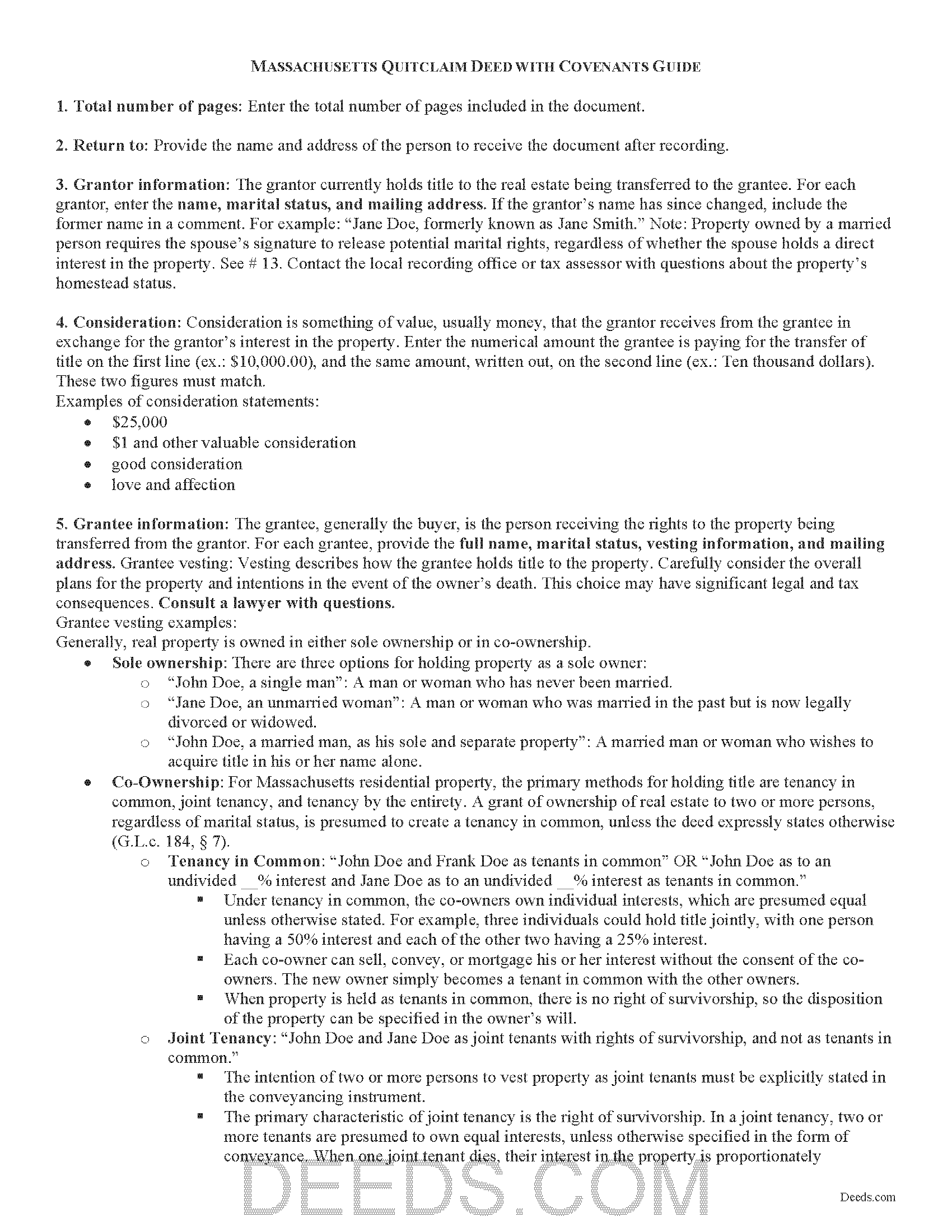

Line by line guide explaining every blank on the Quitclaim Deed with Covenants form.

Bristol County Completed Example of the Quitclaim Deed with Covenants Document

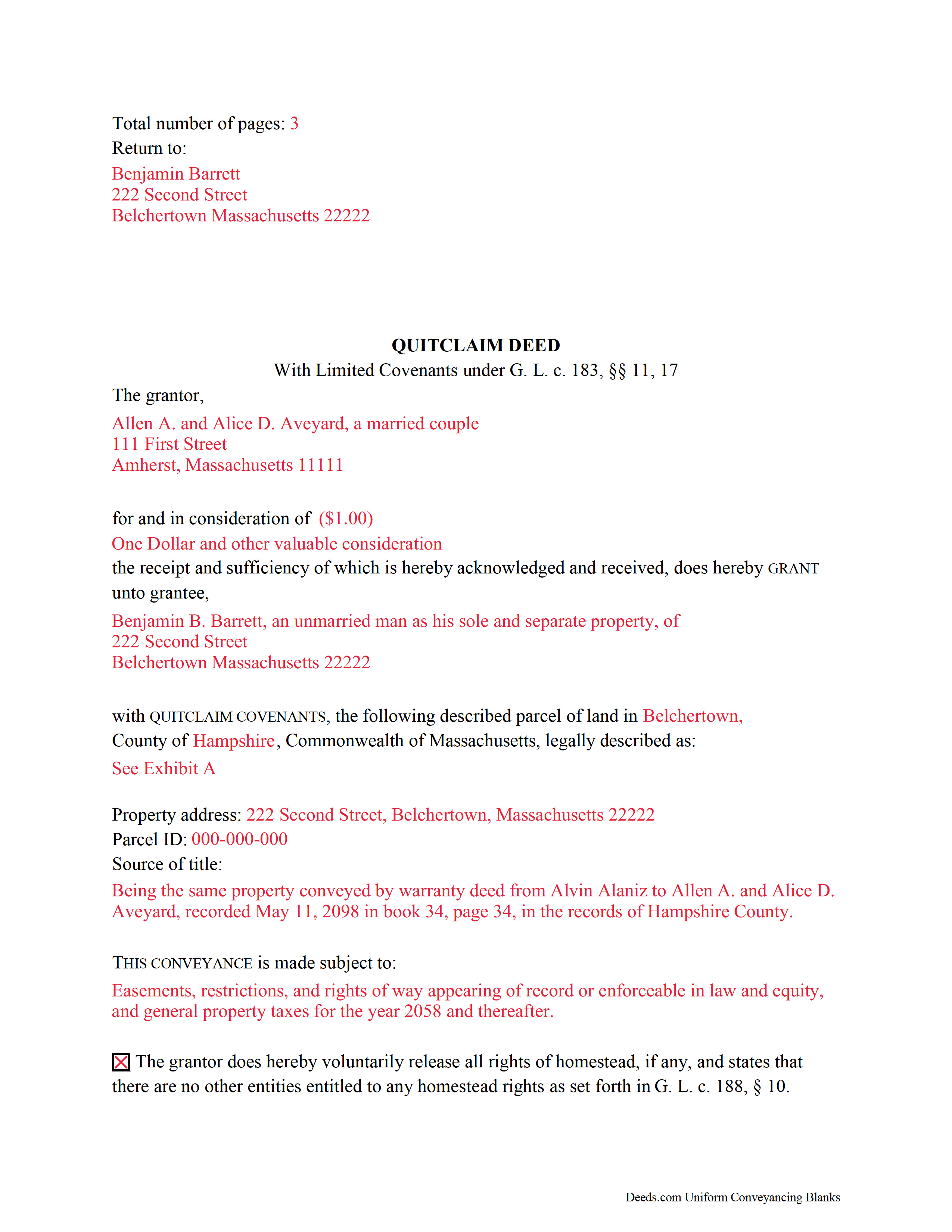

Example of a properly completed Massachusetts Quitclaim Deed with Covenants document for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Massachusetts and Bristol County documents included at no extra charge:

Where to Record Your Documents

Bristol County Registry of Deeds, Fall River District

Fall River, Massachusetts 02722

Hours: 8:00 to 4:30 Mon-Fri / Recording until 4:00

Phone: (508) 673-2910

Bristol County Registry of Deeds, Northern District

Taunton, Massachusetts 02780

Hours: 8:00 to 4:30 Mon-Fri / Recording until 4:00

Phone: (508) 822-0502

Northern District - Attleboro location (no registered land)

Attleboro, Massachusetts 02703

Hours: 9:00 to 4:00 Mon-Fri / Recording until 3:30

Phone: (508) 455-6100

Bristol County Registry of Deeds, Southern District

New Bedford, Massachusetts 02740

Hours: 8:00 to 4:30 Mon-Fri / Recording until 4:00

Phone: (508) 993-2603

Recording Tips for Bristol County:

- Bring your driver's license or state-issued photo ID

- Ask if they accept credit cards - many offices are cash/check only

- Bring extra funds - fees can vary by document type and page count

- Ask about their eRecording option for future transactions

- Recorded documents become public record - avoid including SSNs

Cities and Jurisdictions in Bristol County

Properties in any of these areas use Bristol County forms:

- Acushnet

- Assonet

- Attleboro

- Attleboro Falls

- Berkley

- Chartley

- Dartmouth

- Dighton

- East Freetown

- East Mansfield

- East Taunton

- Easton

- Fairhaven

- Fall River

- Mansfield

- New Bedford

- North Attleboro

- North Dartmouth

- North Dighton

- North Easton

- Norton

- Raynham

- Raynham Center

- Rehoboth

- Seekonk

- Somerset

- South Dartmouth

- South Easton

- Swansea

- Taunton

- Westport

- Westport Point

Hours, fees, requirements, and more for Bristol County

How do I get my forms?

Forms are available for immediate download after payment. The Bristol County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Bristol County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Bristol County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Bristol County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Bristol County?

Recording fees in Bristol County vary. Contact the recorder's office at (508) 673-2910 for current fees.

Questions answered? Let's get started!

Real estate conveyances in Massachusetts are governed under Massachusetts General Laws Chapters 183 and 184.

Quitclaim deeds with limited covenants are used to transfer the rights, title, and interest in real estate, if any, from the grantor (seller) to the grantee (buyer). When using this kind of deed, the grantor "covenants that the property is free from all encumbrances," and that he will "warrant and defend the same to the grantee forever against the lawful claims and demands of all persons claiming by, through or under the grantor, but against none other" (G.L.c. 183 sec. 17). Because of these covenants, this form is valid as-is for use as a special warranty deed in Massachusetts.

In addition to meeting all state and local standards for recorded documents, a lawful deed identifies the name, address, and marital status of each grantor and grantee (G.L.c. 183 sec. 6). State law requires that all land records contain information on how the grantee will hold title (G.L.c. 184 sec. 7). For Massachusetts residential property, the primary methods for holding title are tenancy in common, joint tenancy, and tenancy by the entirety. A grant of ownership of real estate to two or more persons, regardless of marital status, is presumed to create a tenancy in common, unless the deed expressly states otherwise (G.L.c. 184 sec. 7).

As with any conveyance of real estate, a quitclaim deed with limited covenants requires a complete legal description of the parcel. The deed must state the amount of the full consideration, or the total price for the conveyance (G.L.c. 183 sec. 6). Based on the consideration paid, an excise tax (also known as a transfer tax or stamp tax) is collected from the seller (G.L.c. 64D sec. 1,2).

Record the completed deed at the local County Registry of Deeds office. Some counties (Berkshire, Bristol, Essex, Middlesex, Worcester) are split into two or more recording districts. Make sure to record the deed in the correct recording district. If the deed pertains to registered land, submit the deed to the Registry District of the Land Court. Include all relevant affidavits, forms, and fees along with the deed for recording. For guidance related to supplemental documentation, speak with the local Registry of Deeds office.

This article is provided for informational purposes only and is not a substitute for legal advice. Contact a lawyer with questions about quitclaim deeds with limited covenants or transfers of real property in Massachusetts.

(Massachusetts QCD with Covenants Package includes form, guidelines, and completed example)

Important: Your property must be located in Bristol County to use these forms. Documents should be recorded at the office below.

This Quitclaim Deed with Covenants meets all recording requirements specific to Bristol County.

Our Promise

The documents you receive here will meet, or exceed, the Bristol County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Bristol County Quitclaim Deed with Covenants form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4577 Reviews )

Theresa J.

March 27th, 2023

The beginning of the process was very simple. In the middle now waiting for the invoice to move forward.

Thank you for your feedback. We really appreciate it. Have a great day!

Sheilah C.

November 24th, 2020

So far very good. I will know more when I complete the forms and submit them.

Thank you!

Christine B. B.

May 20th, 2019

The Personal Representatives Deed is definitely a helpful document for my files. I find it need just a little tweaking by deeds.com , There should be more space for the legal description. I did see in the FAQ's you recommend putting it in the Exhibit and this is what I did. Also I couldn't get the year to be accepted and had to write it in. These are just some minor suggestions, on the whole I was grateful to find this document. Thank you.

Thank you for your feedback. Sorry to hear that you had trouble with the date field, we will have it reviewed.

Lori M.

March 6th, 2021

So easy to use. The directions are very clear.

Thank you!

Stacie S.

June 26th, 2020

This process was very simple once I got the form right! I would definitely utilize this system in the future if I needed to.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

STANLEY K.

February 3rd, 2022

I AM DELIGHTED TO BE PARTY TO DEEDS.COM. THE PROCESS IS DOWN-TO-EARTH AND VERY USER FRIENDLY. I MUST SAY THAT JUST THE SAVINGS IN TRAVEL TIME AND MONEY IS IN ITSELF VERY REFRESHING. THIS ON LINE PROCESS IS SO CONVENIENT FOR MY OVERALL EFFORT AND OF COURSE FOR OUR CLIENTS AS WELL. I GOT BACKED UP IN RECORDING WHEN THE VIRUS BEGAN RAGING AND PERSONAL VISITS TO LAND RECORDS BECAME A THING OF THE PAST.I FOUND THE SITE WITH A SUGGESTION FROM DC LAND RECORDS' ASSISTANT BY PHONE. I ONLY WISH I'D KNOWN ABOUT THIS AWESOME SERVICE BEFORE 2020. HATS OFF TO DEEDS.COM!

Thank you for your feedback. We really appreciate it. Have a great day!

LIsa B.

January 27th, 2023

Deeds.com made this process of electronic document recording so easy! The communication was quick, friendly, helpful and efficient. I am out of state and have administrative items to handle for my father who has Alzheimer's. Deeds.com is a great service. I highly recommend them, and will use them again when the time comes.

Thank you!

Kelly L.

April 15th, 2019

So far so good. Please make the payment method easier after the information has been uploaded and submitted.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Gayela C.

September 13th, 2019

Easy to use and I really like having the guides that come along with the forms.

Thank you!

David C.

March 16th, 2022

I was able to use your website for the purpose I was looking for. I was able to conclude the transactions I needed without having to use an attorney.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Gina M.

August 25th, 2021

Wow, great forms. They do have some protections in place to keep you from doing something stupid but if you use the forms as intended they will work perfectly for you.

Thank you for your feedback. We really appreciate it. Have a great day!

Gregory B.

May 30th, 2020

I believe you need more instruction on the use of the web site. I would type and nothing would appear on the form. When I tried to save a completed form I ended with a blank form with no detail.

Thank you!

Blanche S.

March 25th, 2022

Thank you I hope I've done it all right!!

Thank you!

Rick M.

February 1st, 2023

Sign up process was fine. The search could be refined a bit to make it easier. Rather than being presented with a large number of fields and trying to figure out, it say street suffice (Drive, Street, Lane) are needed and with what spelled out, what abbreviated it would be nice to have them presented as questions with examples. The $30 price point of r a deed is way too high for me as an appraiser. This is why I didn't complete the transaction.

Thank you for your feedback. We really appreciate it. Have a great day!

Sharon C.

October 29th, 2022

Easy process considering not too technical savvy!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!