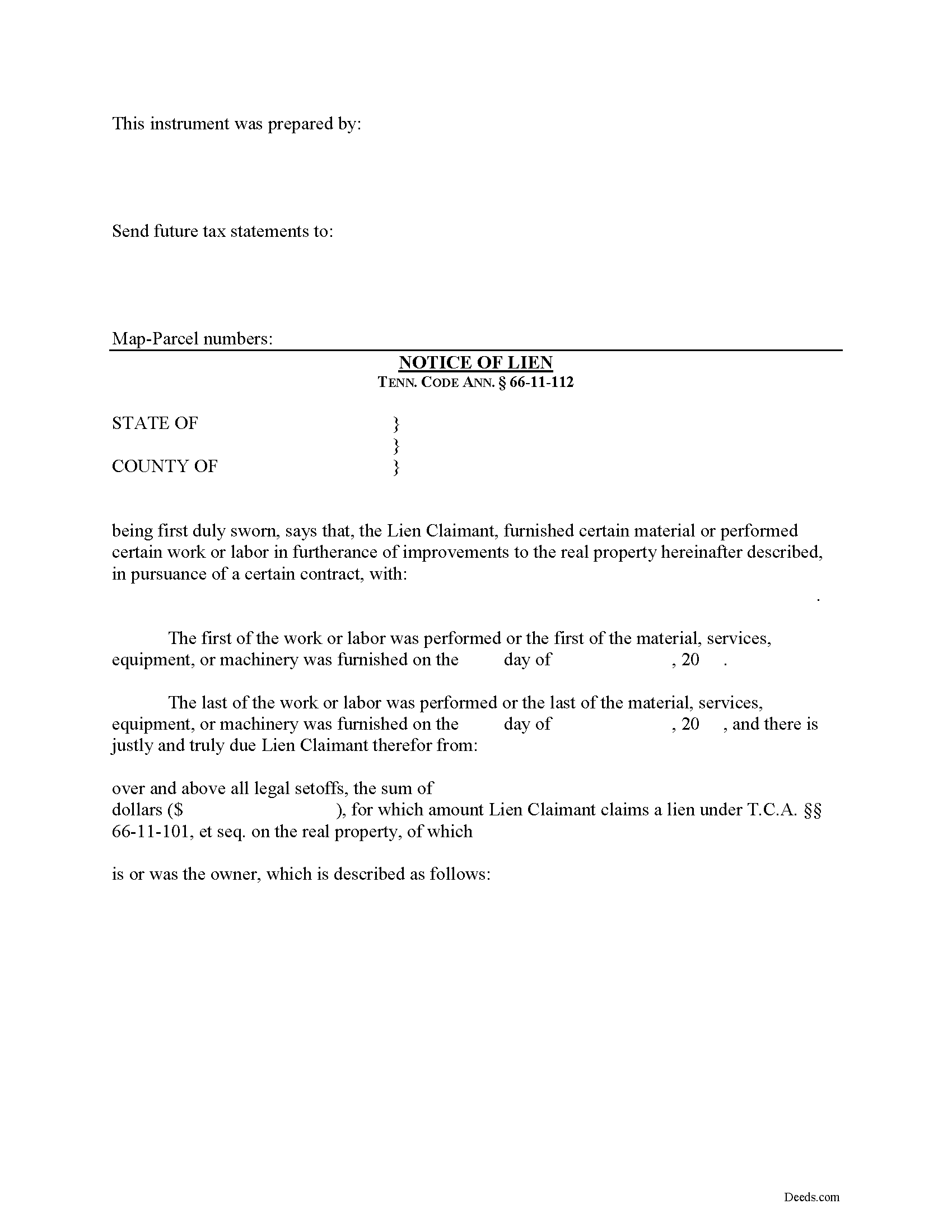

Polk County Notice of Mechanics Lien Form

Polk County Notice of Mechanics Lien Form

Fill in the blank Notice of Mechanics Lien form formatted to comply with all Tennessee recording and content requirements.

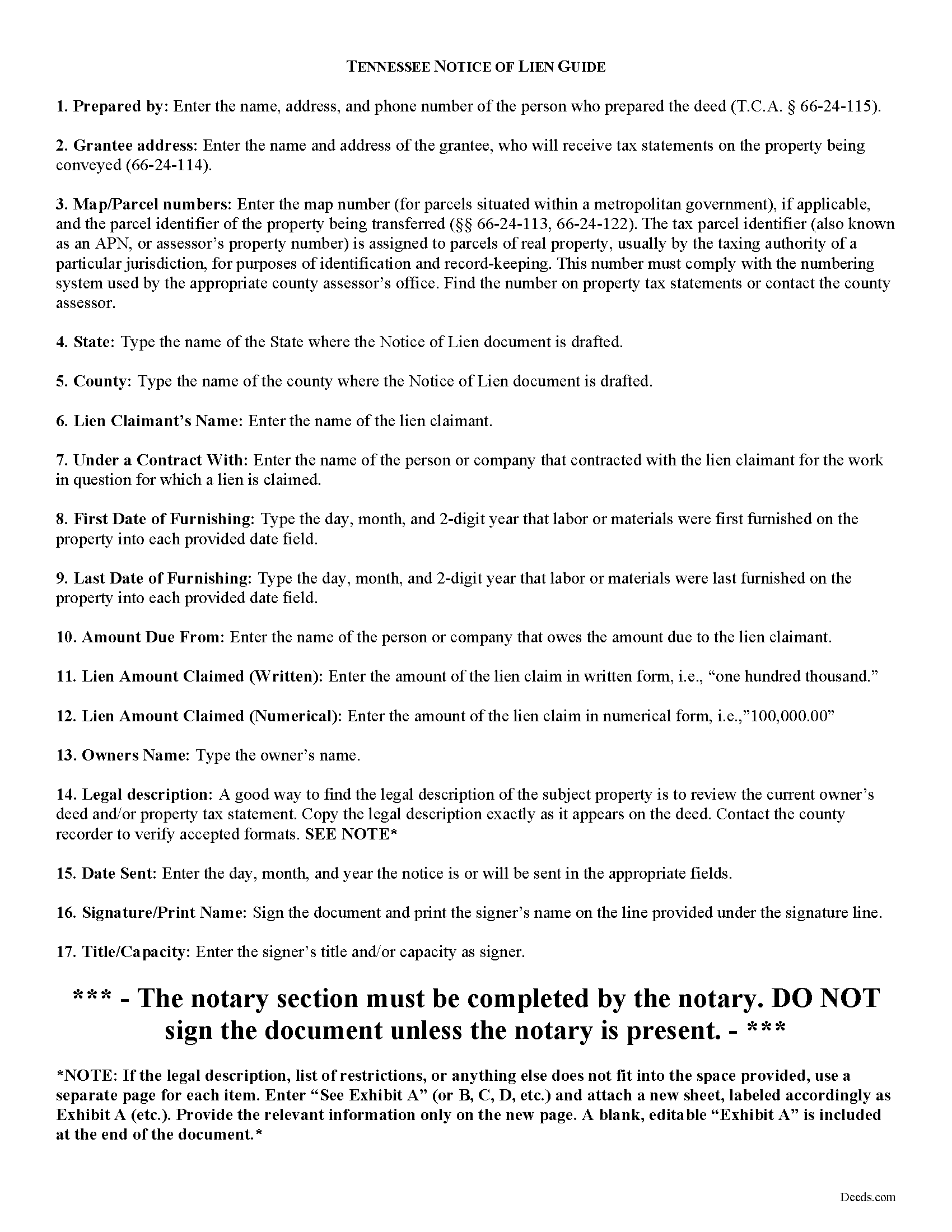

Polk County Notice of Mechanics Lien Guide

Line by line guide explaining every blank on the form.

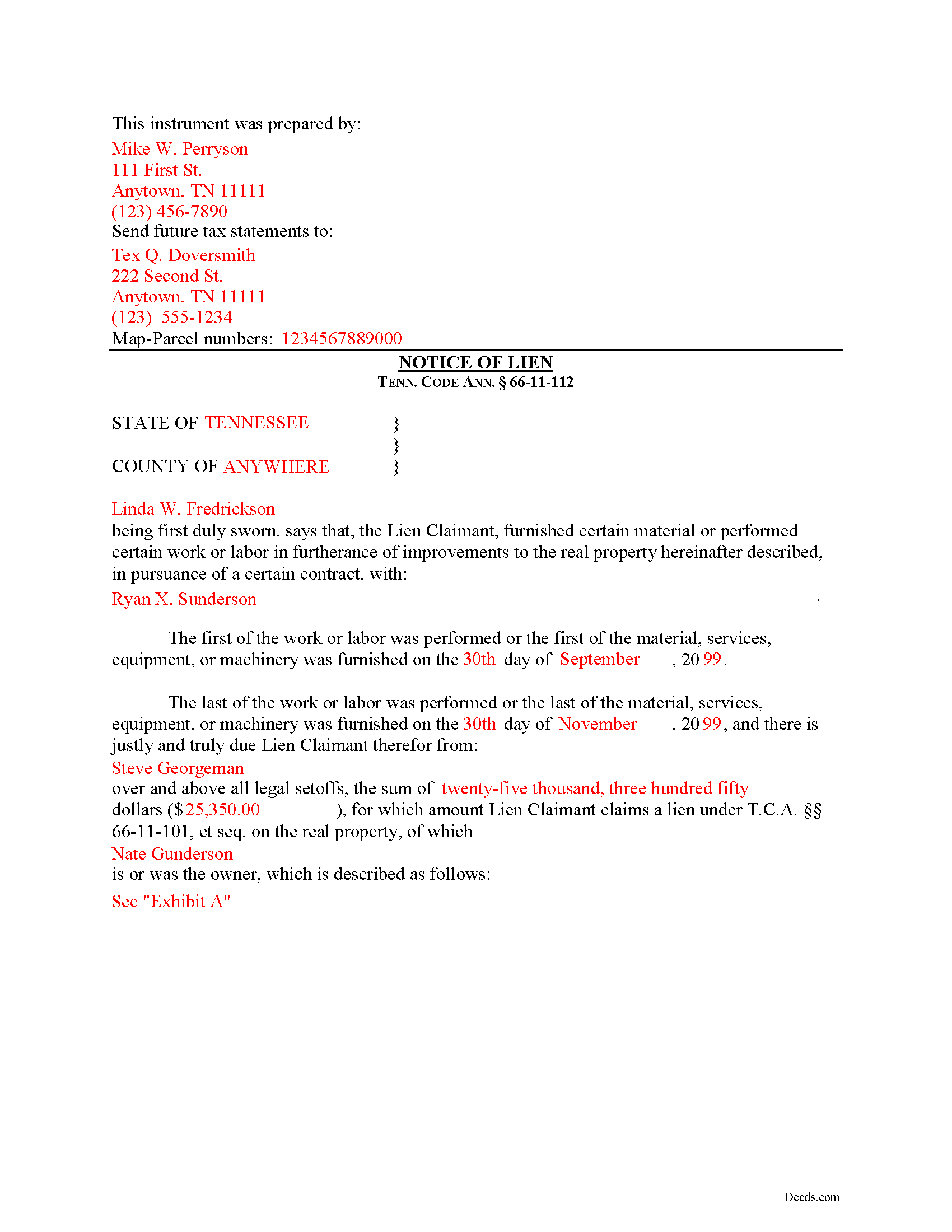

Polk County Completed Example of the Notice of Mechanics Lien Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Tennessee and Polk County documents included at no extra charge:

Where to Record Your Documents

Polk County Register of Deeds

Benton, Tennessee 37307

Hours: 8:30am to 4:30pm M-F

Phone: (423) 338-4537

Recording Tips for Polk County:

- Check that your notary's commission hasn't expired

- Double-check legal descriptions match your existing deed

- Avoid the last business day of the month when possible

- Recording fees may differ from what's posted online - verify current rates

- Bring extra funds - fees can vary by document type and page count

Cities and Jurisdictions in Polk County

Properties in any of these areas use Polk County forms:

- Benton

- Conasauga

- Copperhill

- Delano

- Ducktown

- Farner

- Ocoee

- Old Fort

- Reliance

- Turtletown

Hours, fees, requirements, and more for Polk County

How do I get my forms?

Forms are available for immediate download after payment. The Polk County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Polk County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Polk County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Polk County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Polk County?

Recording fees in Polk County vary. Contact the recorder's office at (423) 338-4537 for current fees.

Questions answered? Let's get started!

Filing a Mechanic's Lien Claim in Tennessee

Mechanic's Liens are used to place a block or burden on a property owner's title when a claimant (such as a contractor or materials supplier) has not been paid for labor, materials, or equipment provided. In Tennessee, mechanic's liens are governed under Chapter 11 of the Tennessee Property Code.

In order to preserve the priority of the lien, as it concerns subsequent purchasers or encumbrancers for a valuable consideration without notice of the lien, the lienor, is required to record in the office of the register of deeds of the county where the real property, or any part affected, lies, a sworn statement of the amount for, and a reasonably certain description of the real property on, which the lien is claimed. Tenn. Prop. Code 66-11-112(a).

The recording party shall pay filing fees, and shall be provided a receipt for the filing fees, which amount shall be part of the lien amount. Id. The recordation must be done no later than ninety (90) days after the date the improvement is complete or is abandoned, prior to which time the lien shall be effective as against the purchasers or encumbrancers without the recordation. Id.

The owner must serve thirty (30) days' notice on prime contractors and on all of those lienors who have served notice in accordance with Tenn. Prop. Code 66-11-145 (the notice of non-payment) prior to the owner's transfer of any interest to a subsequent purchaser or encumbrancer for a valuable consideration. Id.

If the sworn statement is not recorded within that time, the lien's priority as to subsequent purchasers or encumbrancers shall be determined as if it attached as of the time the sworn statement is recorded. Id. Therefore, timely recording is of the utmost importance to protect full lien rights.

According to Tennessee Prop. Code 66-11-112(b), a building, structure or improvement is deemed to have been abandoned for purposes of the lien law when there is a cessation of operation for a period of ninety (90) days and an intent on the part of the owner or prime contractor to cease operations permanently, or at least for an indefinite period. If either of these occur, it is time to file your lien.

This article is provided for informational purposes only and should not be considered legal advice or relied upon as any substitute for speaking with an attorney. Please consult a Tennessee attorney familiar with construction law for any issues regarding mechanic's liens.

Important: Your property must be located in Polk County to use these forms. Documents should be recorded at the office below.

This Notice of Mechanics Lien meets all recording requirements specific to Polk County.

Our Promise

The documents you receive here will meet, or exceed, the Polk County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Polk County Notice of Mechanics Lien form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4580 Reviews )

Dave S.

May 1st, 2019

Easy to use and get forms I needed. Corporate need for an invoice/receipt could be a bit easier - have to print screen to get any info.

Thank you for your feedback Dave, we really appreciate it.

CLAUDE G.

September 18th, 2019

just what I needed Thank You

Thank you!

Randall S.

September 19th, 2021

I have had great success with this so far. The site had the correct forms and I was able complete the documents. It seems like a great resource!

Thank you for your feedback. We really appreciate it. Have a great day!

Christine W.

December 30th, 2020

excellent

Thank you!

Joy R.

August 10th, 2020

Easy and efficient way to get a deed copy.

Thank you!

Debra M.

November 8th, 2021

Easy Peasy. Great experience.

Thank you for your feedback. We really appreciate it. Have a great day!

Timothy C.

January 19th, 2022

Excellent service. Pay your fee, download the form and fill out according to specific instructions. Then, again according to instructions, take it to the county clerk's office and have it recorded. It could not be easier.

Thank you!

Sharon B.

February 19th, 2021

Awesome and so easy Thanks

Thank you!

Ron S.

April 5th, 2019

Fair price and beneficiary deed was recorded without issue. Completion instructions provided were insufficient in some cases.

Thank you!

Greg M.

March 16th, 2020

This is a great site! Very easy to use and has all the documents I required. Thank you!

Thank you!

William M.

February 27th, 2019

I got what I needed and did exactly what I needed. All legal and no hassle. Thanks Deeds.com, you made the job much easier.

Thank you!

Jennifer R.

January 8th, 2022

The recording service has been very easy to use. It is efficient and no hassle.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

gary c.

January 26th, 2022

process was easy and simple to do

Thank you for your feedback. We really appreciate it. Have a great day!

Maura M.

January 15th, 2020

Easy user friendly website

Thank you!

Terri B.

April 5th, 2021

It's worth the money. I would like to have seen a variety of examples showing different scenarios for completing a quitclaim deed.

Thank you!