Download Tennessee Special Warranty Deed Legal Forms

Tennessee Special Warranty Deed Overview

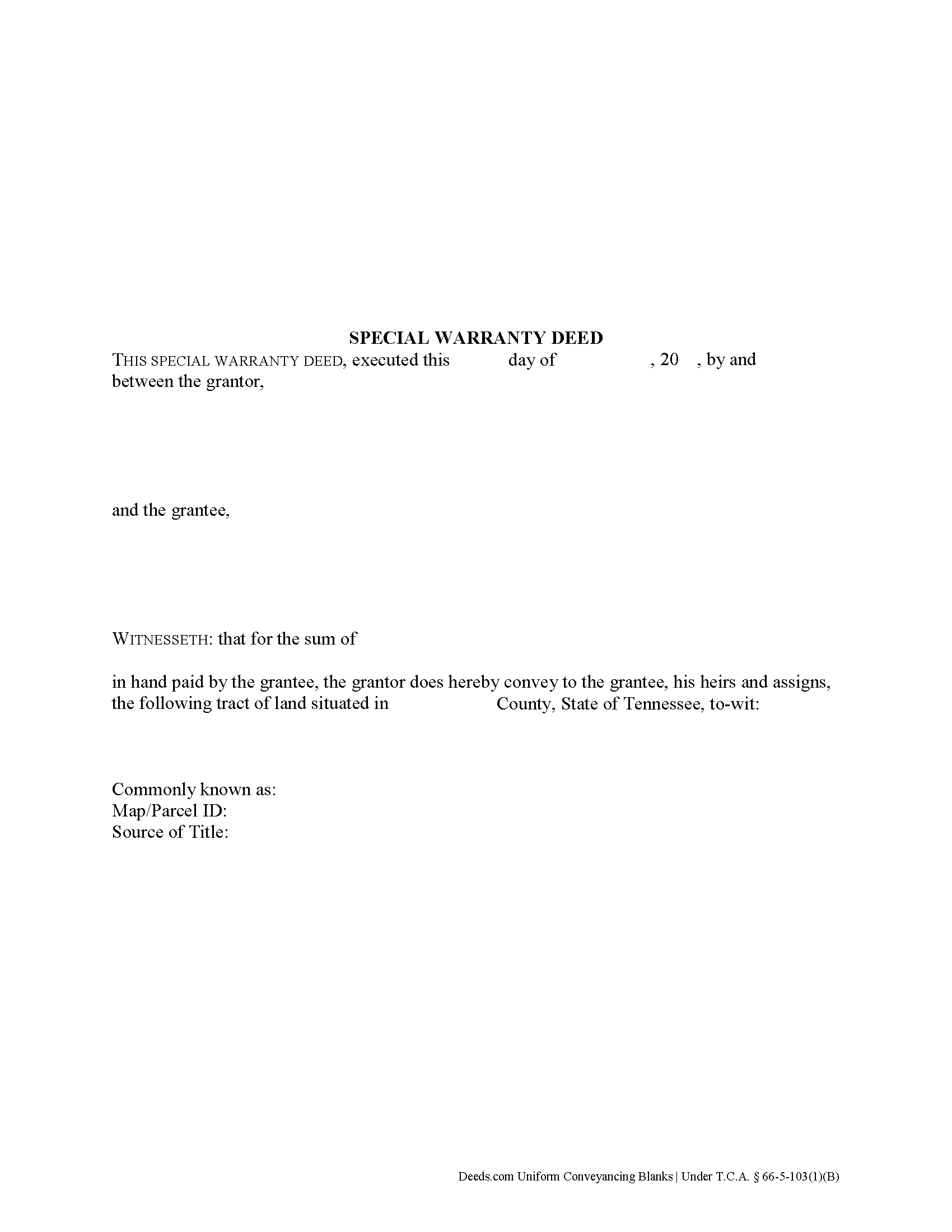

In Tennessee, title to real property can be transferred from one party to another using a special warranty deed. When recorded, a special warranty deed conveys an interest in real property to the named grantee with limited warranties of title.

In Tennessee, special warranty deeds are statutory. They must use the term "convey," as well as contain specific covenant language that the grantor is "seized and possessed of this land, and [has] a right to convey it." The deed warrants "the title against all persons claiming under [him or her]" (T.C.A. 66-5-103(1)(B)). This means that the deed will not protect the grantee against title issues that arose prior to the time the grantor acquired title.

A lawful special warranty deed includes the grantor's full name, mailing address, and marital status, the consideration given for the transfer, and the grantee's full name, marital status, vesting, and mailing address. Vesting describes how the grantee holds title to the property. Generally, real property is owned in either sole ownership or in co-ownership. For Tennessee residential property, the primary methods for holding title are tenancy in common and tenancy by entirety. A conveyance of real estate to two or more persons creates a tenancy in common. Married couples have the option to vests as tenants by entirety. T.C.A. 66-1-107 abolishes survivorship in joint tenancy. Consult a lawyer for questions regarding joint tenancy and/or survivorship rights in Tennessee.

As with any conveyance of realty, a special warranty deed requires a complete legal description of the parcel. Recite the prior deed reference to maintain a clear chain of title, and detail any restrictions associated with the property. The deed must be acknowledged by the grantor (and his or her spouse, if applicable) in the presence of a notary. Finally, the deed must meet all state and local standards for recorded documents.

Record the original completed deed, along with any additional materials, at the recorder's office in the county where the property is located. Recordation taxes are due upon recording. See 67-4-409 for exemptions. Refer to the same statute and contact the appropriate recorder's office for information on up-to-date fees.

This article is provided for informational purposes only and is not a substitute for the advice of an attorney. Contact a Tennessee lawyer with any questions related to the transfer of real property.

(Tennessee SWD Package includes form, guidelines, and completed example)