Polk County Specific Power of Attorney for the Sale of Property Form

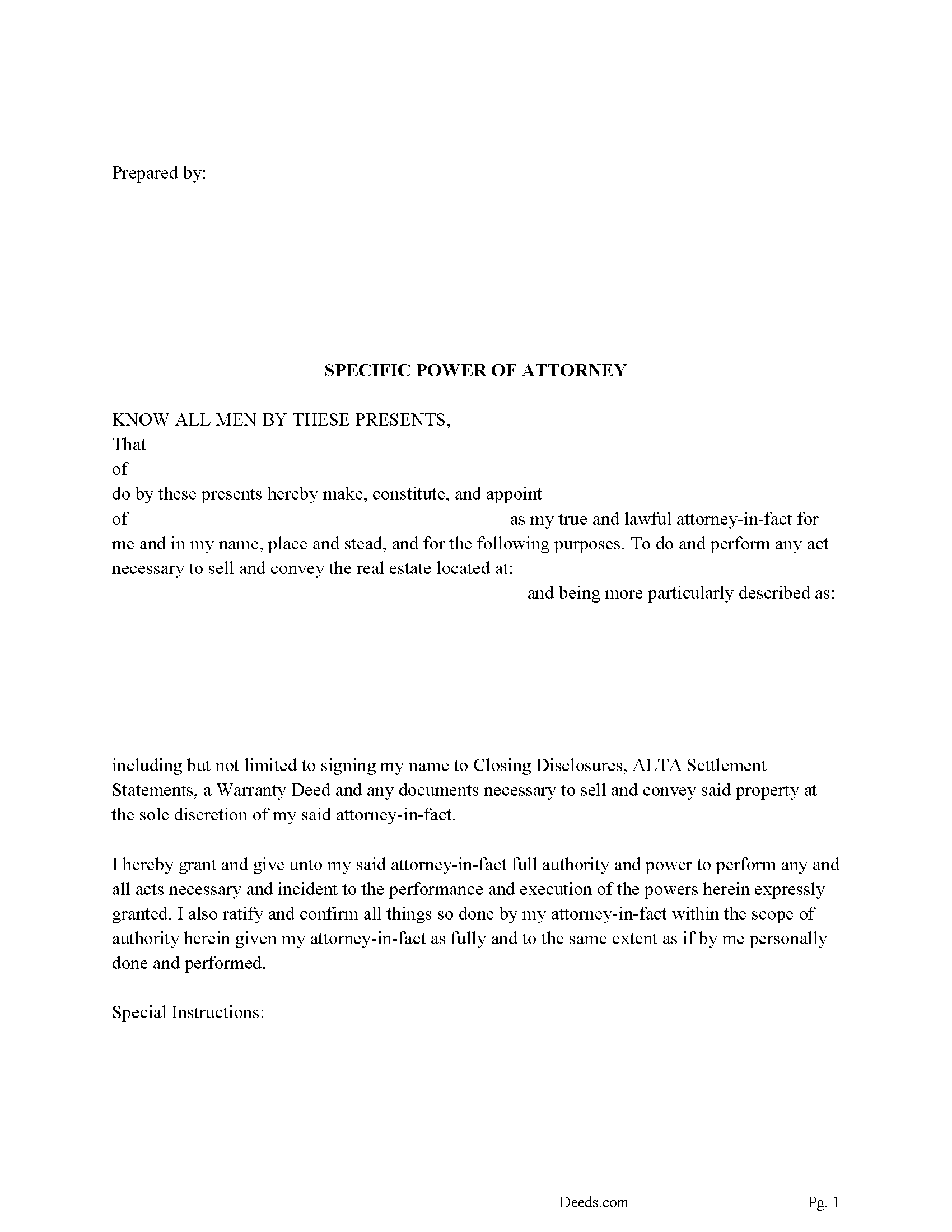

Polk County Specific Power of Attorney Form / Sale of Property

Fill in the blank form formatted to comply with all recording and content requirements.

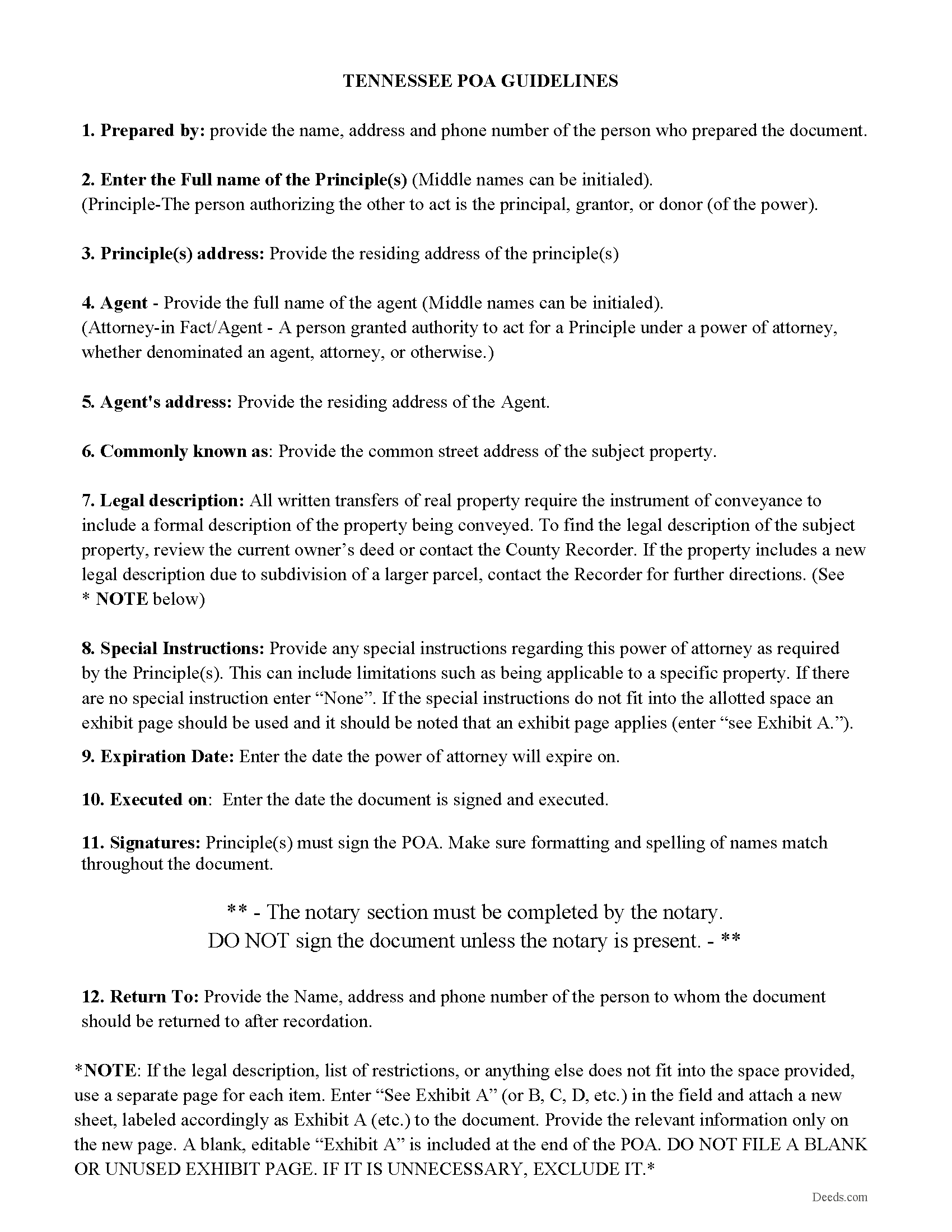

Polk County Specific Power of Attorney Guidelines

Line by line guide explaining every blank on the form.

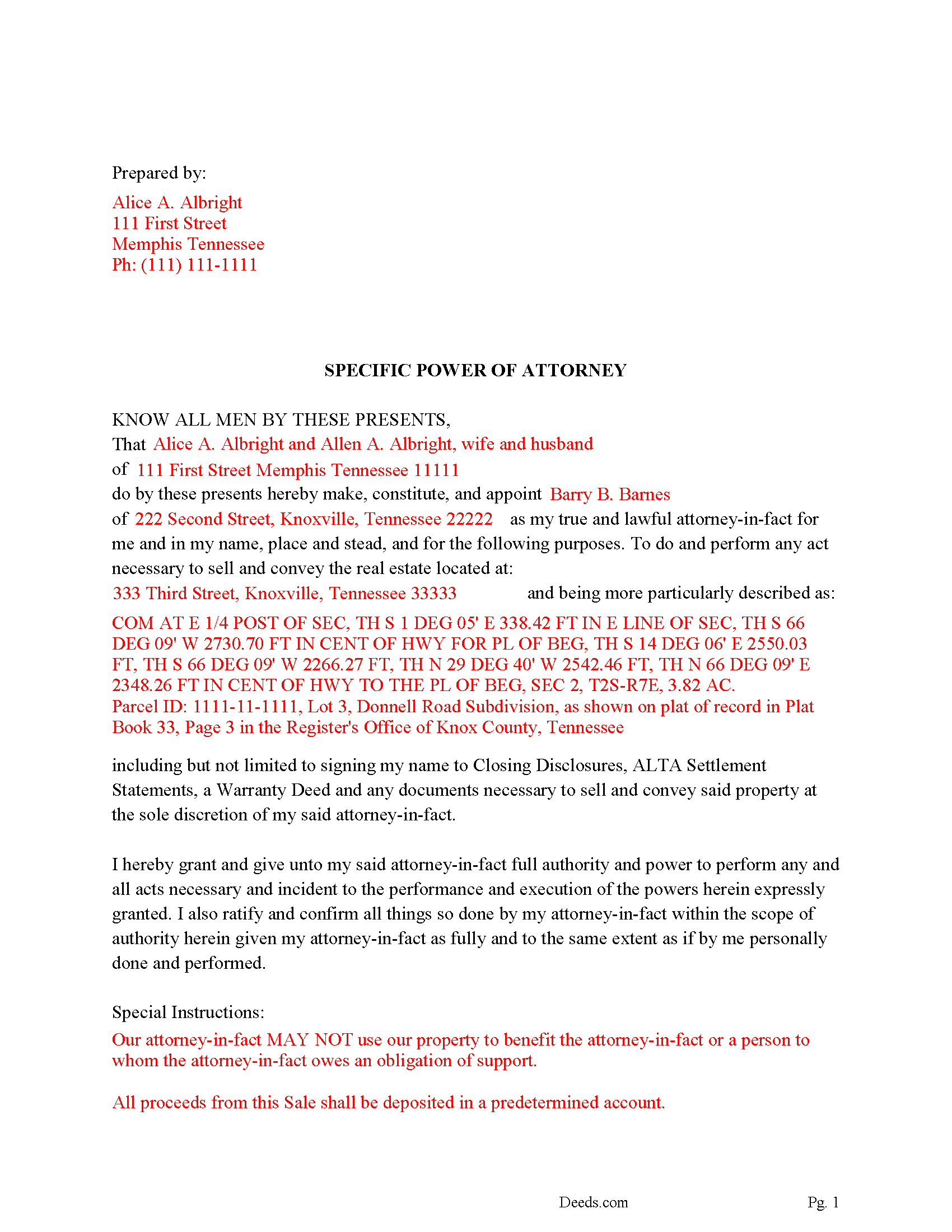

Polk County Completed Example of the Specific POA

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Tennessee and Polk County documents included at no extra charge:

Where to Record Your Documents

Polk County Register of Deeds

Benton, Tennessee 37307

Hours: 8:30am to 4:30pm M-F

Phone: (423) 338-4537

Recording Tips for Polk County:

- Documents must be on 8.5 x 11 inch white paper

- Verify all names are spelled correctly before recording

- Recording fees may differ from what's posted online - verify current rates

- Leave recording info boxes blank - the office fills these

- Make copies of your documents before recording - keep originals safe

Cities and Jurisdictions in Polk County

Properties in any of these areas use Polk County forms:

- Benton

- Conasauga

- Copperhill

- Delano

- Ducktown

- Farner

- Ocoee

- Old Fort

- Reliance

- Turtletown

Hours, fees, requirements, and more for Polk County

How do I get my forms?

Forms are available for immediate download after payment. The Polk County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Polk County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Polk County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Polk County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Polk County?

Recording fees in Polk County vary. Contact the recorder's office at (423) 338-4537 for current fees.

Questions answered? Let's get started!

The Principal(s), owners of the property appoint a second party, attorney-in-fact to sell a specific property. In this form the principal is empowering the attorney-in-fact to do and perform any act necessary to sell and convey the real estate specified. Included is a "Special Instructions" section where the attorney-in-fact's powers can be further limited and/or defined.

This power of attorney shall become effective immediately upon the execution of same and pursuant to Tennessee Code Annotated Section 34-6-101 et seq. and shall be considered a "Durable Power of Attorney."

This power of attorney is formatted for recording in the Tennessee County, where the subject property is located and terminates upon a date provided by the principal. Therefore 60, 90, 120 days, etc. can be allotted for the sale.

(Tennessee SPOA-Sale Package includes form, guidelines, and completed example)

Important: Your property must be located in Polk County to use these forms. Documents should be recorded at the office below.

This Specific Power of Attorney for the Sale of Property meets all recording requirements specific to Polk County.

Our Promise

The documents you receive here will meet, or exceed, the Polk County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Polk County Specific Power of Attorney for the Sale of Property form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4585 Reviews )

David W.

March 10th, 2021

Thanks to all of you. You provide a great service! Dave in Ca.

Thank you for your feedback. We really appreciate it. Have a great day!

srikanth n.

January 14th, 2020

why not word format??

Good question. There are many reasons, we'll touch on a few. For the end user (you) Adobe Reader is free, Word is not. PDF is the portable document standard, Word is a decent word processor. A portable document format (PDF) maintains document formatting such as margins and font size which is very important to legal documents, Word does not. Have a wonderful day.

jennifer e.

September 1st, 2020

EXCELLENT, PROMPT SERVICE. I will definitely use again .HIGHLY RECOMMEND.

Thank you for your feedback. We really appreciate it. Have a great day!

Jennifer D.

March 9th, 2022

I was skeptical; but, so thankful I went with them. They were beyond helpful through the entire process and very patient with me. I could not have done my quit deed form without them. Thank you for all of your help.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Anita M.

March 10th, 2019

This was a very easy process to find the correct documents and download them. The price was also reasonable.

Thank you for your feedback. We really appreciate it. Have a great day!

Christine G.

April 23rd, 2021

. Easy to use.

Thank you for your feedback. We really appreciate it. Have a great day!

Kahn B.

May 2nd, 2019

The Quitclaim deed seems pretty simple However I wonder if I can fll out the paper as easily as it looks I appreciate very much the sample and the direction for filling out the deed. Now I am in the process of gathering document to fill out the deed and I think only when after everything done, I may have a clear idea how good the Quitclaim Deed is. I hope I can follow instruction and will successfully done the paperwork. Thank you very much.

Thank you for your feedback. We really appreciate it. Have a great day!

Steve V.

June 6th, 2025

Quick and easy. Quite the time saver.

Thanks, Steve! We're glad to hear the process was quick and easy—and that it saved you time. That’s exactly what we aim for!

Alex Q.

January 25th, 2022

10 STARS! Deeds.com never fails! Thank you so much!

Thank you!

Michael C.

January 4th, 2023

Overall positive experience; especially liked immediate access to downloaded documents and instructions. My only concern was lack of adequate space in portions of your beneficiary deed blank form which then required me to use 3 exhibits to complete all necessary documents for the county recorders office. Assuming they accept them I will call this a strong win. Thanks.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Karen P.

March 19th, 2021

Very easy to use.

Thank you!

Debbie M.

August 21st, 2019

Everything that I needed was included. I appreciate that there was a sample as well as the step-by-step directions included in the download. I would definitely recommend this site to anyone that needs it.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Joe F.

January 11th, 2021

TOOK ME SEVERAL DAYS TO FIND A SITE THAT DIDNT CHARGE $100 JUST TO USE ONE FORM. THANKS

Thank you for your feedback. We really appreciate it. Have a great day!

Eileen D.

August 5th, 2020

Very easy to use. The example form was a big help in making sure I had the forms filled out correctly.

Thank you!

Carmen R.

November 14th, 2021

I was able to get the form I needed but it would not adjust properly on the page.

Thank you!